Posts

Posts Likes Received

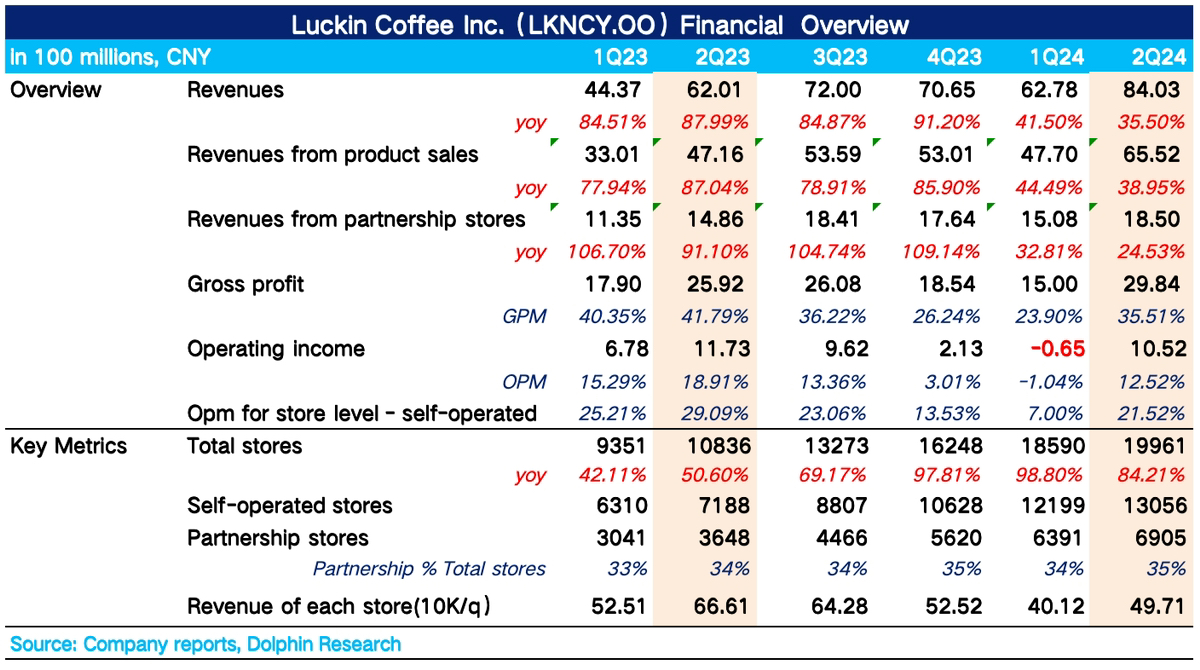

Likes Received$Luckin Coffee(LKNCY.US)first take: Benefiting from seasonal effects, new products, and reduced 9.9 RMB promotions, Q2 performance rebounded as expected. The most criticized profitability in Q1 recovered quickly, and the number of paying users, which Dolphin Research was concerned about, returned to growth, slightly exceeding our overall expectations.

However, same-store sales growth for directly operated stores still declined by 21%. Dolphin Research estimates that same-store sales per store fell by 45%, accelerating compared to the 40% year-on-year decline in Q1. This implies that the peak season and popular new products did not mitigate the impact of new stores cannibalizing old ones.

In fact, Luckin's store expansion pace slowed significantly in Q2 (net increase of 1,371 stores in Q2 vs. 2,342 in Q1). Combined with the launch of light coffee series like fruit tea in Q2, these moves clearly indicate saturation in the pure coffee market, while Luckin is attempting to expand its product offerings to attract new users.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.