Posts

Posts Likes Received

Likes ReceivedMorgan Stanley replaced Ford Motor with $Tesla(TSLA.US) as its top pick in the U.S. auto industry, citing a potential 40% upside in the stock price.

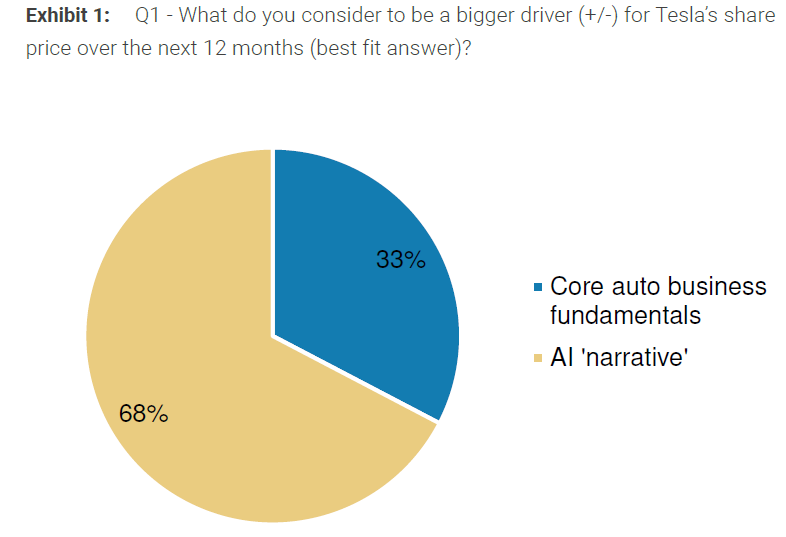

From the DOJO hype in the second half of last year, to the recent energy storage push, to the 68% of investors in recent surveys believing that the AI narrative is the key to Tesla's stock price over the next 12 months, and now back to the auto business. Some CEOs paint rosy pictures, while others put valuations on those pictures—it's a perfect closed loop.

Delaying the Robotaxi launch event from August to October suggests that preparations may not be fully ready. Of course, looking slightly further ahead to next year, 2024’s lowest point for Tesla seems to be gradually fading, with the affordable model set to launch in 2025, a more favorable macro interest rate environment, and Tesla’s position as a leader in large-scale hardware-side AI still offering plenty of narrative potential.

But Dolphin Research always prefers to "watch what they do, not what they say." While the company’s grand vision is important, what matters more is how much of it can be executed now and how much the market has already priced in.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.