Posts

Posts Likes Received

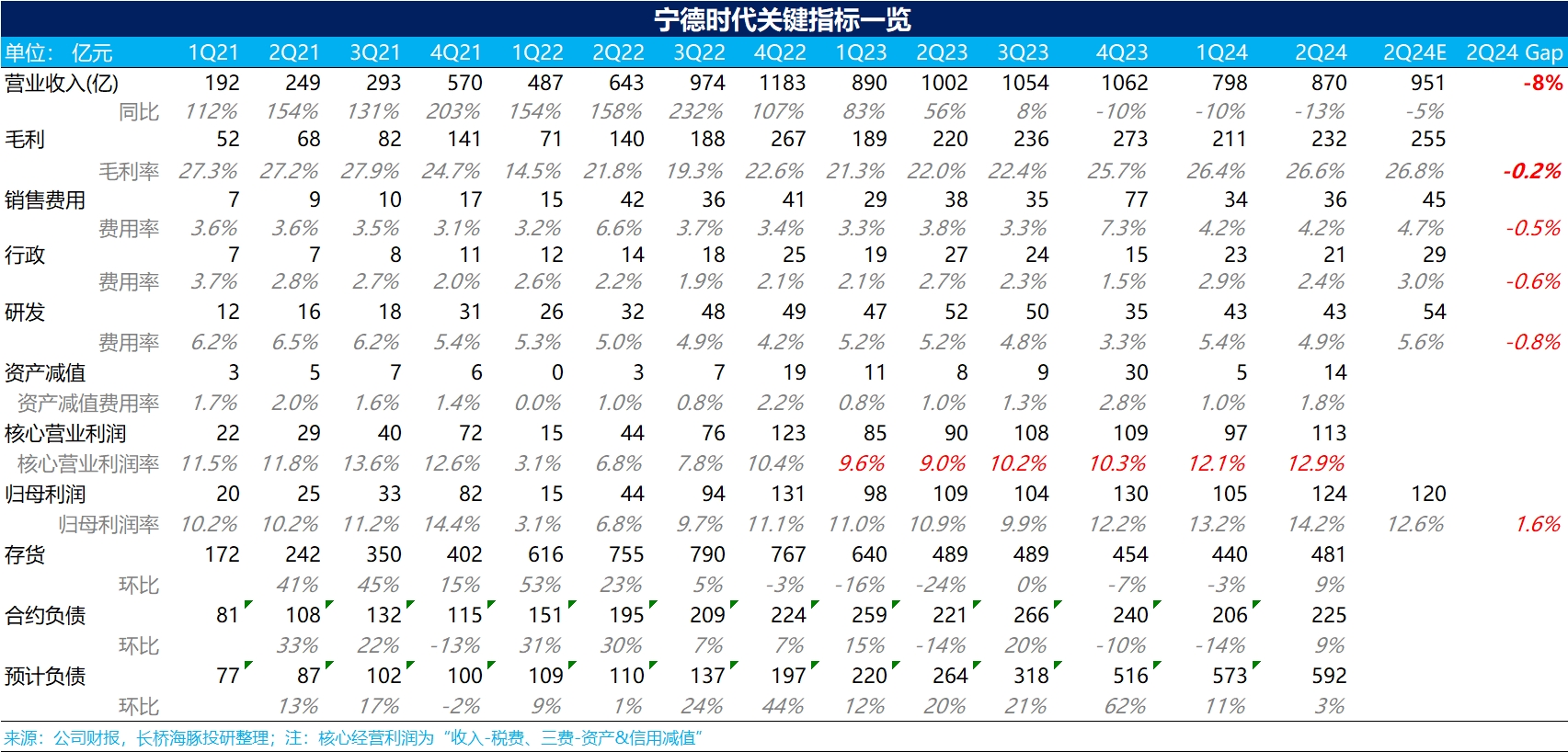

Likes Received$CATL(300750.SZ) In terms of Q2 performance, revenue significantly missed market expectations, while gross margin was basically in line with market expectations.

The revenue miss was mainly due to a severe decline in battery unit prices. Market expectations for Q2 battery shipments were around 110-120Gwh, implying a battery unit price range of 0.58-0.63 yuan/wh, down 16%-23% QoQ from 0.76 yuan/wh in Q1. The market had expected battery unit prices to stabilize around 0.72 yuan/wh with the stabilization of lithium carbonate prices, but this quarter's prices were significantly lower than expected.

The severe price decline led to increased impairment losses on finished goods inventory, with asset impairment losses rising from 500 million yuan last quarter to 1.4 billion yuan this quarter. Dolphin Research attributes the price decline to:

1) A drop in CATL's overseas shipments. Overseas revenue share fell from 35% in H1 2023 to 30% in H1 2024, partly due to slowing EV demand in Europe (subsidy cuts) and overall slower growth in overseas power battery shipments.

2) Tesla's U.S. Model 3 regaining IRA subsidies, which shifted its battery supply from CATL to Panasonic, impacting CATL's overseas shipments.

3) CATL's slower annual price negotiation pace compared to second- and third-tier battery makers. Most key clients finalize price cuts after Chinese New Year, affecting Q2 battery prices. Domestic battery prices have already fallen to around 0.5 yuan/wh for ternary batteries and 0.4 yuan/wh for LFP, forcing CATL to cut prices amid the price war.

4) A higher proportion of lower-priced LFP batteries in CATL's shipments. Domestically, ongoing price wars have increased demand for cheaper LFP batteries, raising their share in CATL's shipments (LFP share in domestic power battery installations rose from 51% in Q1 to 61% in Q2). Overseas, LFP battery shipments have grown faster than ternary batteries, likely due to subsidy cuts (e.g., in Europe) and stricter cost controls driving demand for cheaper LFP.

The issue is that the severe price drop wasn't accompanied by expected operational improvements from CATL, as seen in two key metrics:

1) Inventory continued to rise, from 44 billion yuan last quarter to 48.1 billion yuan, mainly due to a surge in finished goods inventory while shipped goods declined.

2) Battery capacity utilization dropped from 70% in 2023 to around 65% in H1 2024.

On the bright side:

1) CATL's gross margin remained stable at 26.6% in Q2, nearly matching market expectations of 26.8%, with both domestic and overseas margins improving QoQ since H2 2023.

2) Operating expenses were well-controlled and below expectations, leading to net profit exceeding market expectations despite the revenue miss.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.