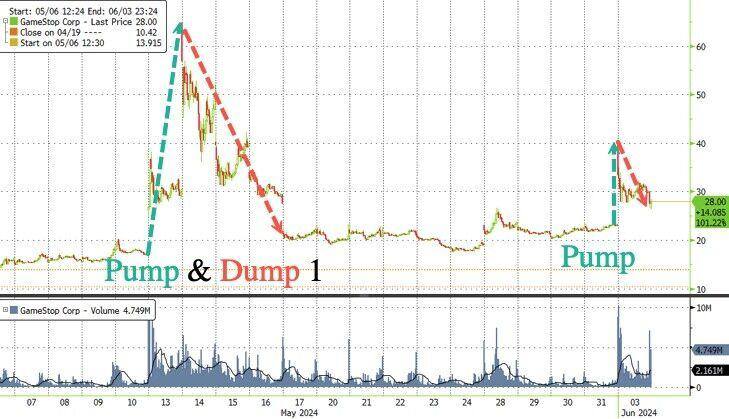

$GameStop(GME.US)Is the "leader of the pack" trying to replay the GME drama? But facing suppression from all sides

GME, the stock that became famous in 2021 when retail investors battled short sellers and naive investors turned the tables, surged 75% at the opening on Monday. The reason was that "retail investor leader" Keith Gill (nicknamed Roaring Kitty on YouTube and X) posted a screenshot of a trade confirmation on his Reddit account on Sunday.

However, two pieces of news caused GME's intraday gains to narrow significantly: First, E-Trade, a brokerage under Morgan Stanley, is considering banning "retail investor leader" Keith Gill from using its platform for trading, citing concerns about potential market manipulation. Second, the U.S. Securities and Exchange Commission is investigating certain bullish option trades in the company.

Additionally, Andrew Left, founder of Citron Research, has returned to the showdown stage after suffering heavy losses in the 2021 short squeeze. Prominent investor Richard Yu also posted trades shorting GME's call options, a strategy much safer than directly shorting the stock. (Richard Yu prefers playing with options.)

As a result, GME's intraday gains narrowed to 14%, closing up 21% at $28.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.