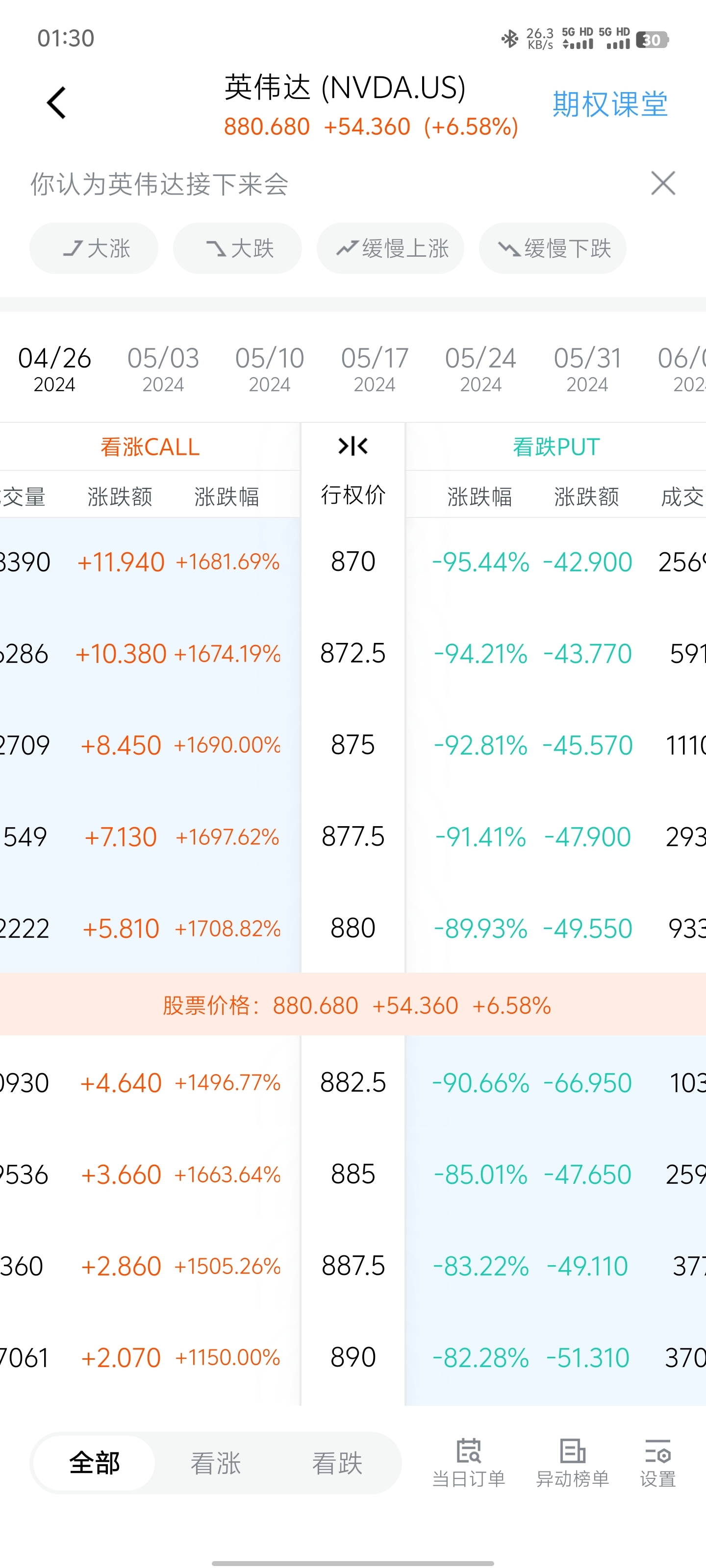

If you plan to construct a strategy by simultaneously buying call options and put options with different strike prices, this is actually a variant of straddle or strangle strategies, also known as a form of "multi-leg strategy" or "spread strategy." The approach of selecting multiple price ranges can be considered as establishing an "option band," attempting to capture broader market volatility. Compared to a single straddle strategy, this approach is more complex and offers different risk and return characteristics.

Considerations for strategy adjustments:

1. Risk and opportunity diversification: By positioning at different strike prices, you can diversify the single-point risk of market judgment. Theoretically, if the market's volatility direction aligns with expectations but the magnitude is uncertain, this method may increase profit opportunities.

2. Cost control: Each additional price range increases costs, so you need to weigh the relationship between increasing potential profit opportunities and additional capital requirements. Typically, wider ranges mean higher costs but may also imply higher potential profit margins.

3. Principles for selecting ranges: When choosing strike price ranges, you can base them on key support and resistance levels determined by technical analysis or on expectations of market volatility. Closer strike price ranges may yield profits with smaller market movements, while more distant ranges require larger fluctuations but may offer higher returns.

4. Construction logic: Before deciding to add more price ranges, clarify your market view (extreme volatility, moderate volatility, or movement in a specific direction) and your willingness to take risks. For example, if you believe the market will experience significant but directionless volatility, you might set closely connected strike prices; if you predict large but uncertain directional movements, you could choose broader ranges.

5. Risk management: Ensure you allocate funds reasonably to each range, avoiding over-concentration in one or a few ranges, which could lead to imbalances in capital management and risk control.

6. Dynamic adjustments: When market conditions change, adjust your strike price ranges in a timely manner, even considering whether to close some positions or roll them to new strike prices to adapt to the latest market dynamics.

Adding multiple price ranges requires meticulous planning and continuous monitoring, as well as a deep understanding of market conditions. It is a more complex options strategy suitable for experienced investors who can tolerate higher risks.

Follow @多空游戏 to double your returns%

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.