Persistent Low Inflation in the U.S.: Can Chinese Concept Stocks Still Be Pursued for Gains?

Hello everyone, here is a summary of this week's strategy weekly report by Dolphin Jun:

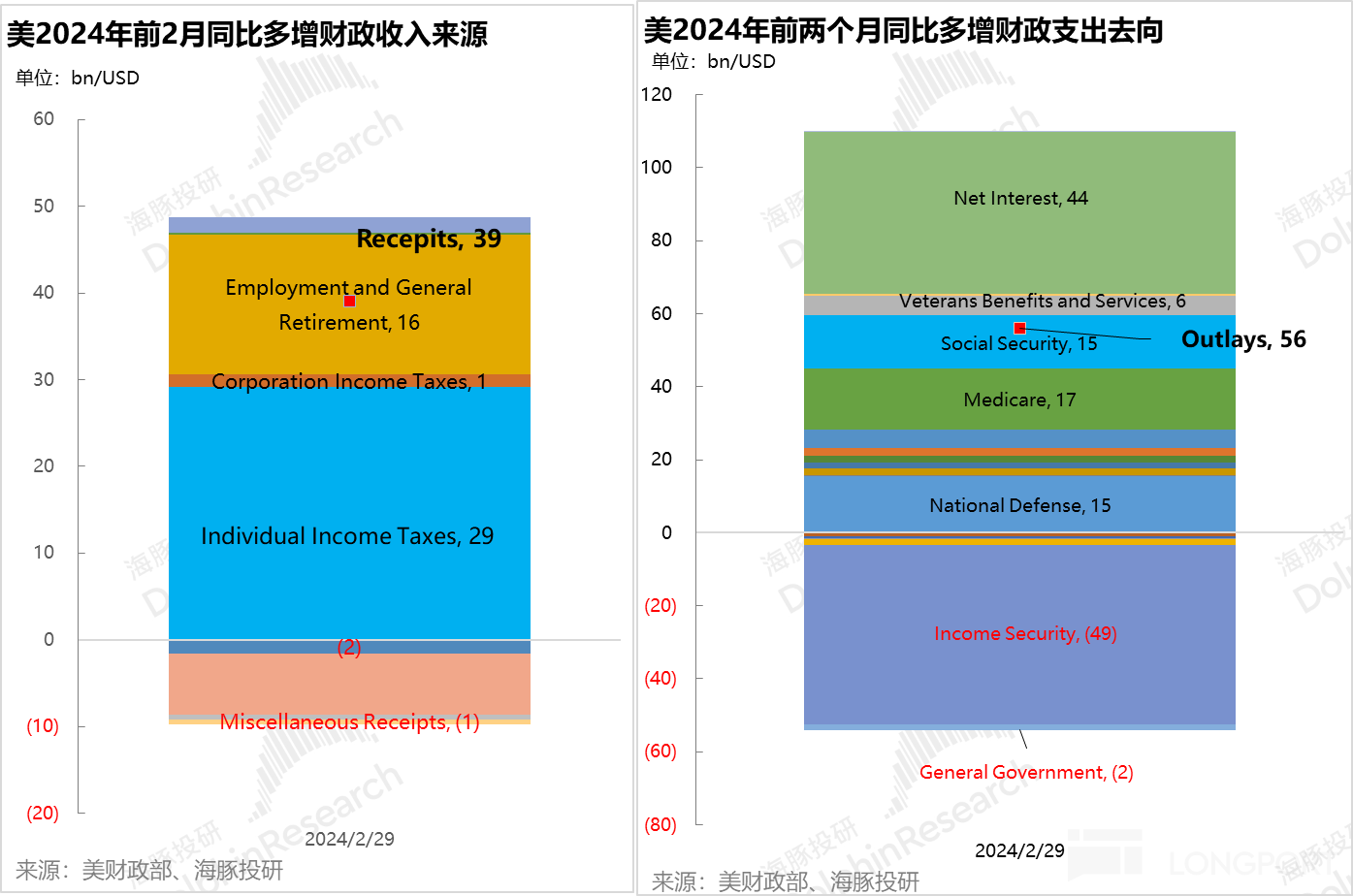

The U.S. deficit soared in February: Looking at January and February together, the deficit for the first two months of this year was $183 billion, a decrease of less than $30 billion compared to the same period last year. With a total deficit of over $800 billion in the first five months of the 2024 fiscal year, achieving a deficit of $1.5 trillion for the whole year still poses certain difficulties.

The inflation data for the first two months of 2024 is concerning, with prices continuing to rise. Dolphin Jun will focus on how the Federal Reserve views this year's policy rates and inflation expectations in its latest forecast on March 20th.

February's social zero: Excluding motorcycle parts, gas stations, building materials, and dining, core retail sales showed zero growth month-on-month, indicating that the recovery of goods sales in February was not good. Since social zero mainly focuses on goods, and dining falls under the category of service expenditure in household spending statistics, with service consumption accounting for 65% of household consumption, the weak social zero cannot directly lead to the conclusion of weak household consumption in February.

After the Spring Festival, due to the Federal Reserve slowing down the pace of bond sales, both reverse repurchase agreements and TGA accounts released balances, market liquidity has been marginally increasing on a monthly basis, making liquidity relatively abundant. With overflowing liquidity and the recovery of domestic consumption in January and February, it is worth continuing to focus on the rebound opportunities of Chinese consumer assets.

Here are the detailed contents:

Last week, U.S. stocks entered a period of intensive release of macroeconomic data for March, with the release of February CPI, PPI, retail sales, and U.S. federal fiscal data.

Overall, when looking at prices, social zero, and fiscal data together, the U.S. in February still exhibits a trend of "re-inflation" in prices, weak social zero, and a deficit economy, leading to a "double slow" trend of declining inflation and slowing economic growth.

I. U.S. fiscal deficit soared in January and February

After the narrow deficit turned positive in January due to high revenue driving interest payments, a high deficit returned in February: in addition to continued high interest payments, expenditures related to aging such as social security, healthcare, and health continued to rise, and defense spending also increased significantly, with overall expenditures still in a state of rigid growth.

Although individual income tax revenue, corporate income tax, and revenue from employment and pensions increased, estate and gift taxes decreased significantly.

As a result of this gap, the U.S. federal fiscal deficit in February reached $229 billion. Looking at January and February together, the deficit for the first two months of this year was $183 billion, a decrease of less than $30 billion compared to the same period last year.

By the end of February in the 2024 fiscal year, the federal government had accumulated a deficit of over $800 billion, requiring additional efforts to control the actual deficit for the entire fiscal year within the estimated $1.5 trillion by the U.S. Congressional Budget Office. Moreover, based on the trend this month, the possibility of cutting expenditures is very small, and achieving the estimated year-end deficit can only be done through increased fiscal revenue2. Prices: Is there a backlash in commodity prices?

Basically, in the past year, prices in the United States have mostly seen deflation in goods and inflation in services. Due to the higher proportion of services, overall prices tend to lean towards inflation.

In February, the core CPI inflation index remained high at over 0.35%. One important reason is that after eight consecutive months of negative growth in core goods inflation, it returned to a positive growth of 0.1% month-on-month in February.

If we exclude high-weight but persistently difficult to sustain items like used cars, other items such as clothing, healthcare goods, and tobacco have shown positive or accelerated growth month-on-month. Against the backdrop of basic bottoming out of commodity channel inventories and continuous expansion of the manufacturing PMI price index, it is necessary to pay attention to whether commodity deflation is coming to an end.

In terms of service inflation, apart from the slowing but still high housing cost inflation, other areas such as transportation with high volatility and education, entertainment, and communication services have also seen accelerated growth month-on-month.

The main services prices that have declined month-on-month are medical services and other personal services, but overall core service inflation still remains high at a 0.5% month-on-month increase.

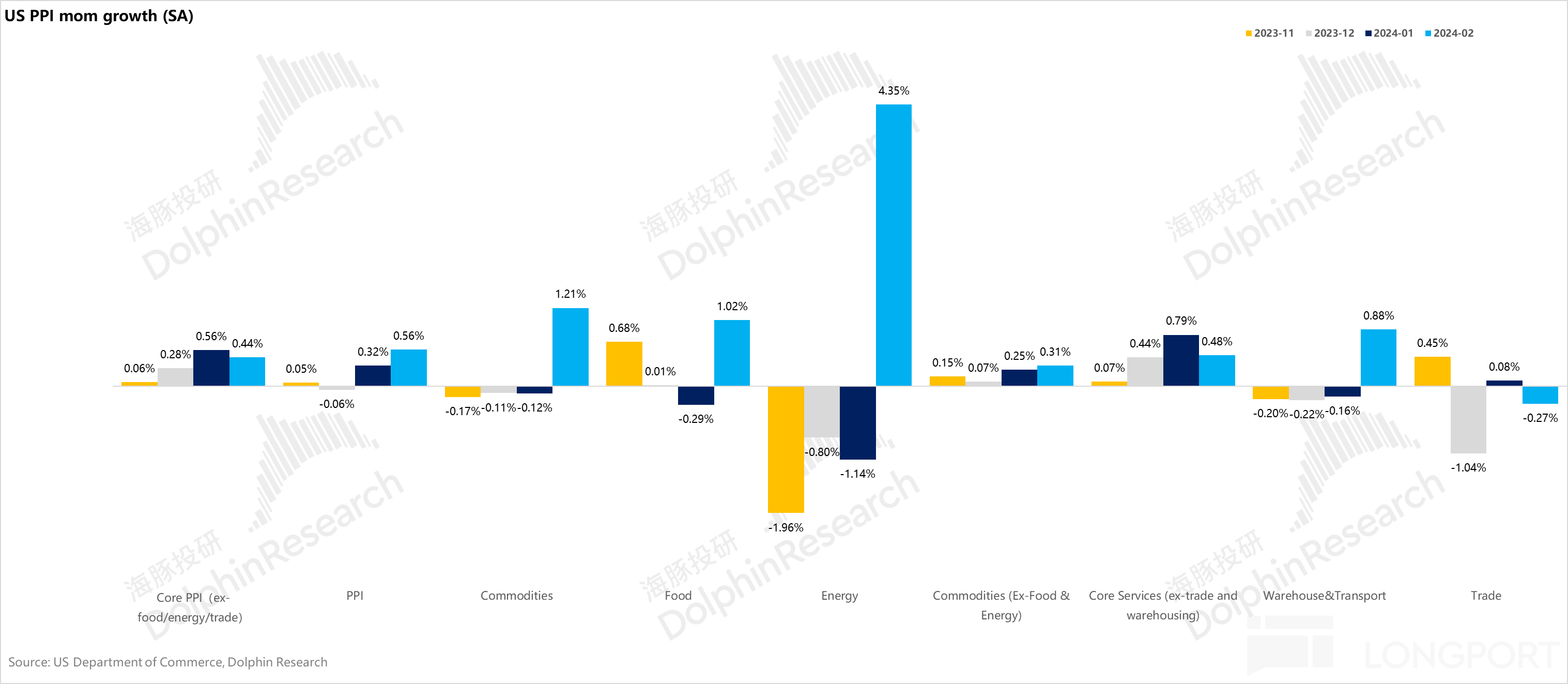

In addition to the less-than-expected deflation described by the CPI, in February, the inflation in PPI excluding food and energy commodities increased, while the core service industry excluding trade and warehousing remained high, leading to an overall core PPI growth of 0.44% month-on-month, remaining at a relatively high level.

The price data for the first two months of 2024 is not reassuring, with prices continuing to soar. In this situation, Dolphin will focus on how the Federal Reserve views policy rates and inflation expectations for this year in its latest forecast on March 20.

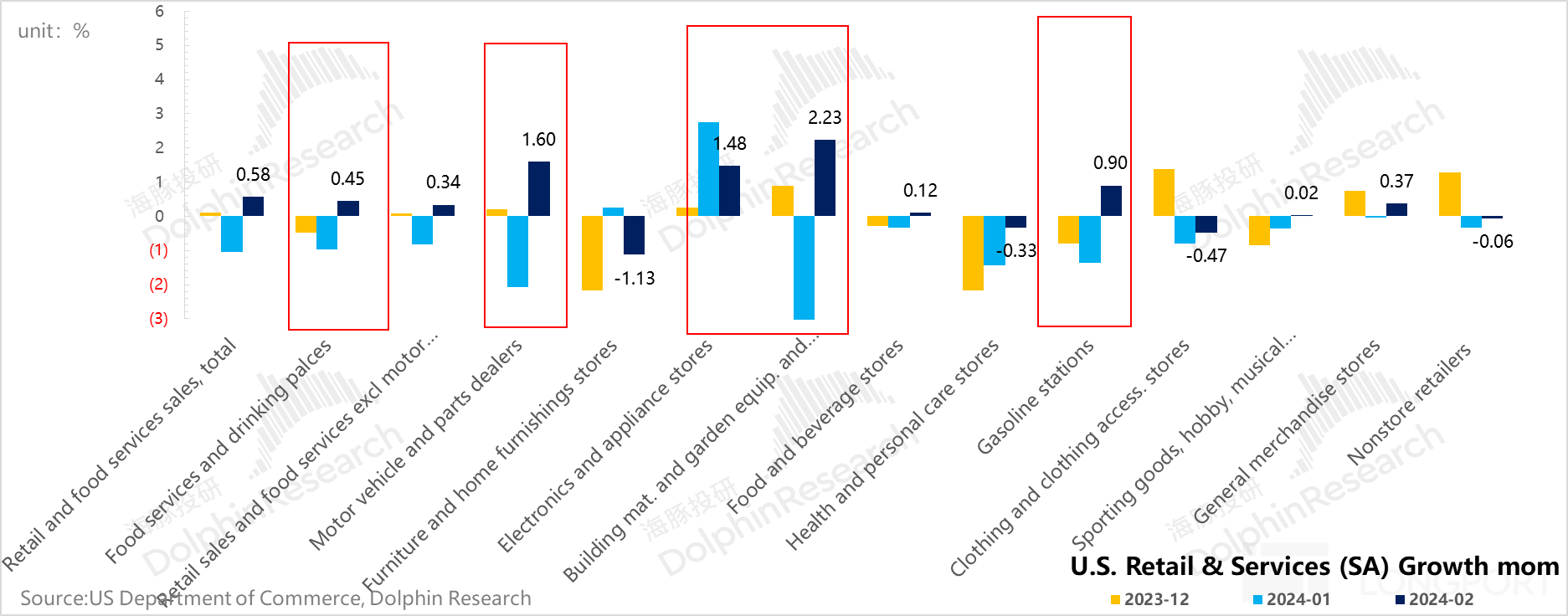

3. Weak rebound in February's social retail

Due to significant seasonal effects in January, the seasonally adjusted month-on-month decline in social retail was large. The market was expecting a good growth in February, but looking at core retail, the situation is not satisfactory:

Industries with high growth in February are mostly those that experienced high declines in January, such as automobiles and parts, building materials and gardening, and gas stations highly related to oil prices.

Excluding motorcycle parts, gas stations, building materials, and dining, core retail directly saw zero growth month-on-month, implying that the recovery in commodity sales in February was not good. Since social retail is mainly goods-oriented, the major category of dining, which has good sales performance, falls under the category of service expenditure in household spending statistics, and service consumption accounts for 65% of household consumptionWeak social consumption cannot directly lead to the conclusion of weak consumer spending in February.

Currently, the US economy remains resilient in terms of fiscal policy, with high household income, high employment, price rebound, and the relative ability of residents to save compared to their debt repayment capacity before the epidemic. Therefore, Dolphin still tends to believe that the US economic growth may exceed market expectations, and the downward pressure on inflation may not be smooth.

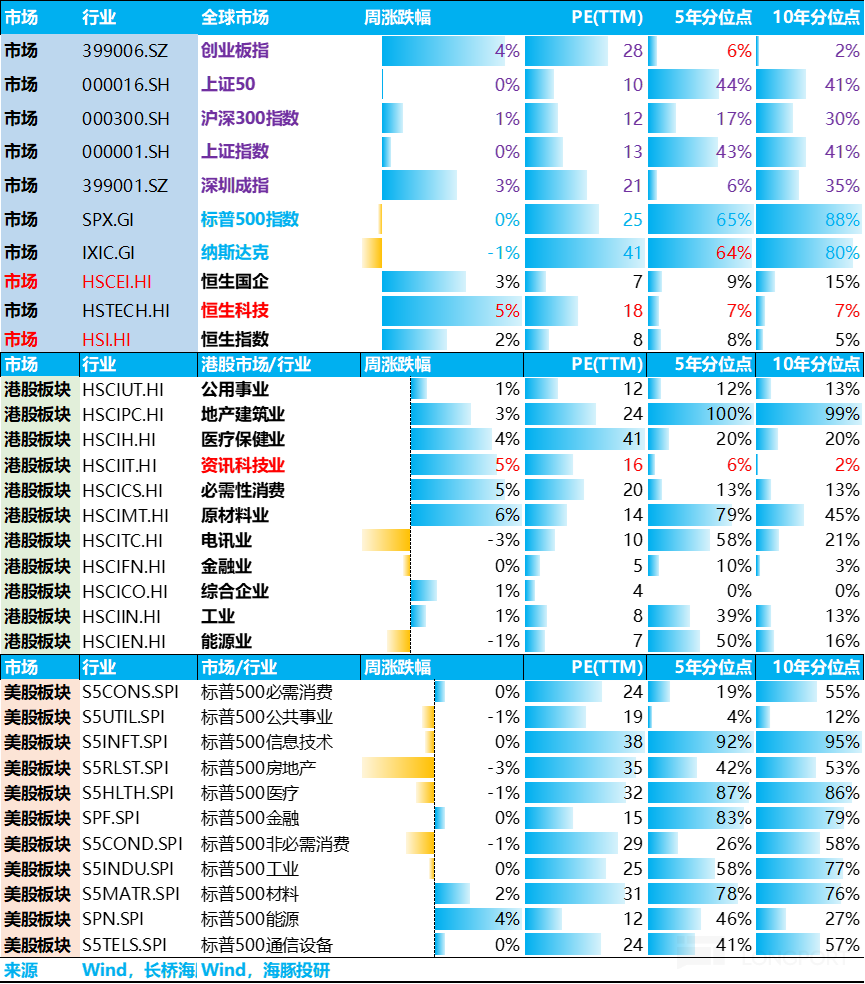

IV. Inflation rebounds while liquidity remains ample, funds continue to seek undervalued stocks

After the Spring Festival, due to the Federal Reserve slowing down the pace of bond sales, both reverse repurchase agreements and the TGA account have released balances, leading to a marginal increase in market liquidity on a monthly basis, making market liquidity relatively abundant.

From points one to four, the data released in February still shows that the US economy is in a state of high growth under a large fiscal policy, with inflation leaning towards being overheated.

In the short term, high-growth stocks that can outperform inflation are relatively overvalued, and in a situation of abundant liquidity, funds continue to seek undervalued assets.

V. Portfolio rebalancing and returns

On March 15th, Alpha Dolphin's virtual portfolio added the KWeb index, for the following reasons:

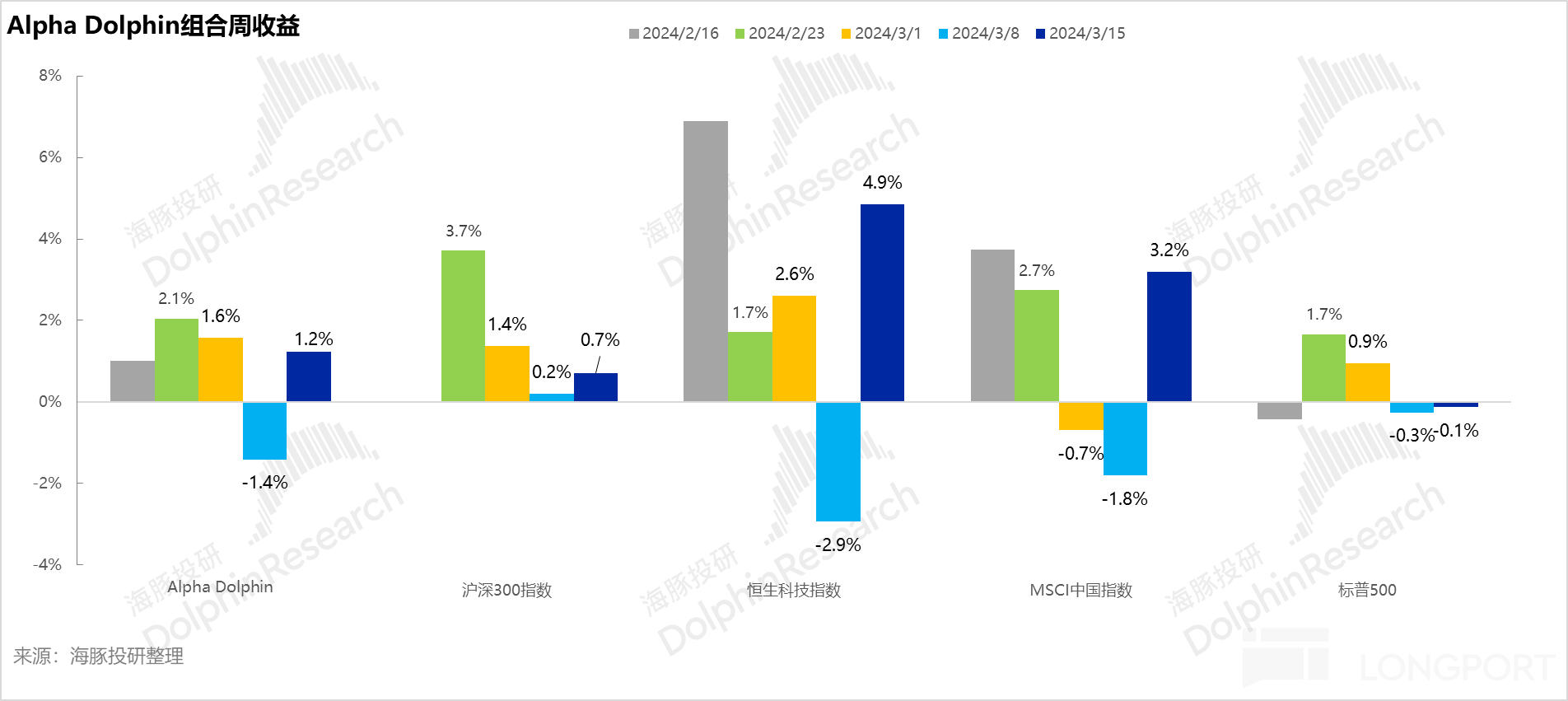

By the end of the week, the portfolio's return increased by 1.2%, weaker than Hang Seng Tech Index (+4.9%) and MSCI China (+3.2%), but stronger than the CSI 300 Index (+0.7%) and S&P 500 (-0.1%).

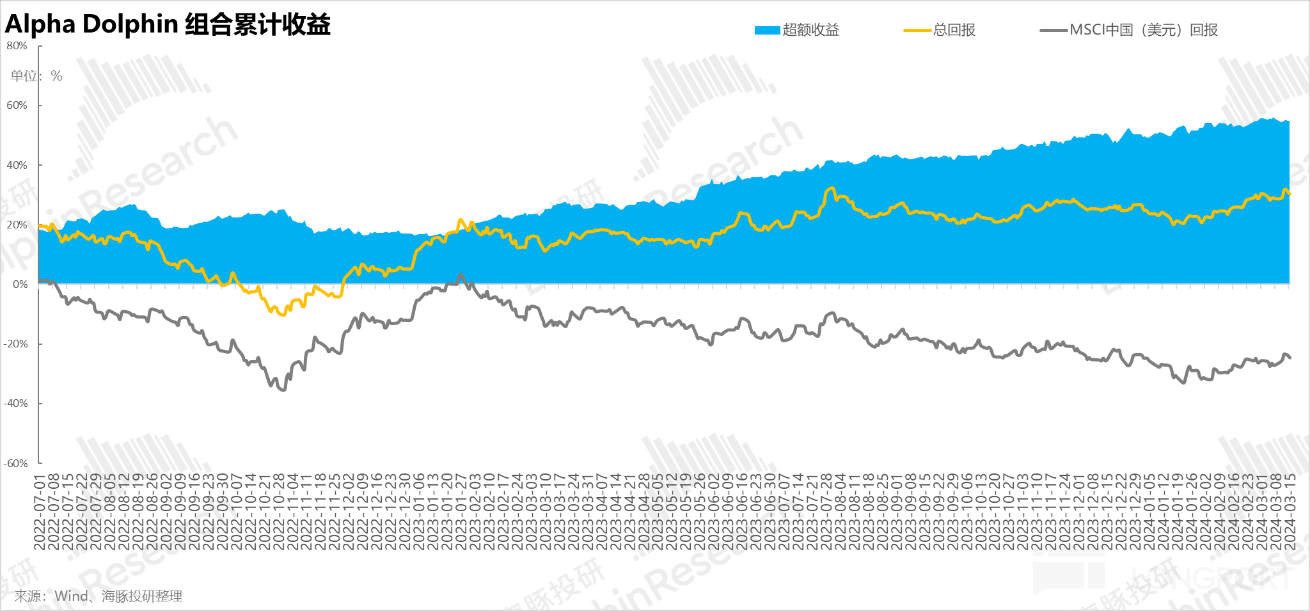

From the start of the portfolio testing to the end of last week, the absolute return of the portfolio was 30%, with an excess return compared to MSCI China of 55%. From the perspective of asset net value, Dolphin's initial virtual assets of $100 million have now risen to $133 million.

Six. Contribution of Individual Stock Gains and Losses

Six. Contribution of Individual Stock Gains and Losses

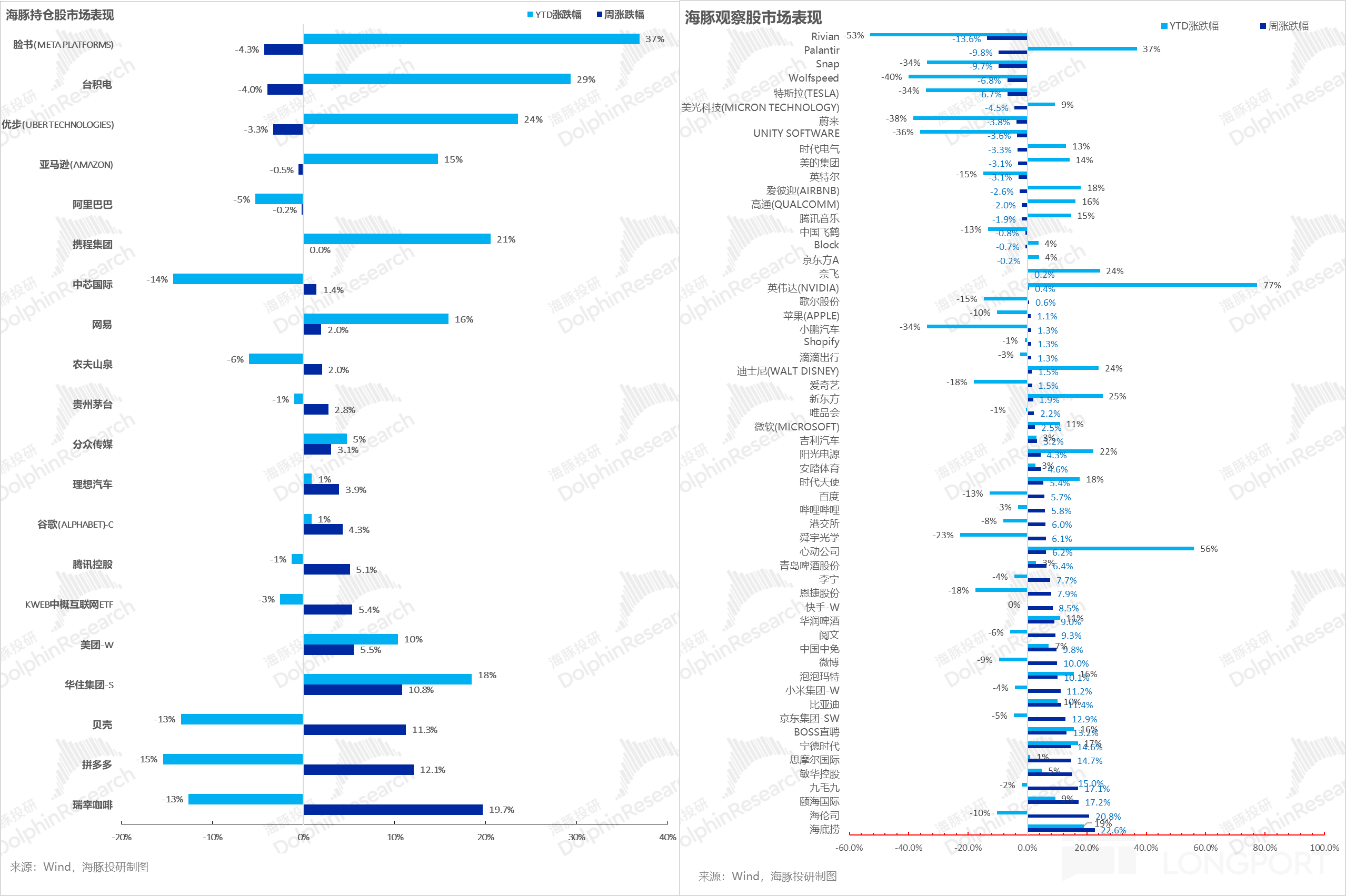

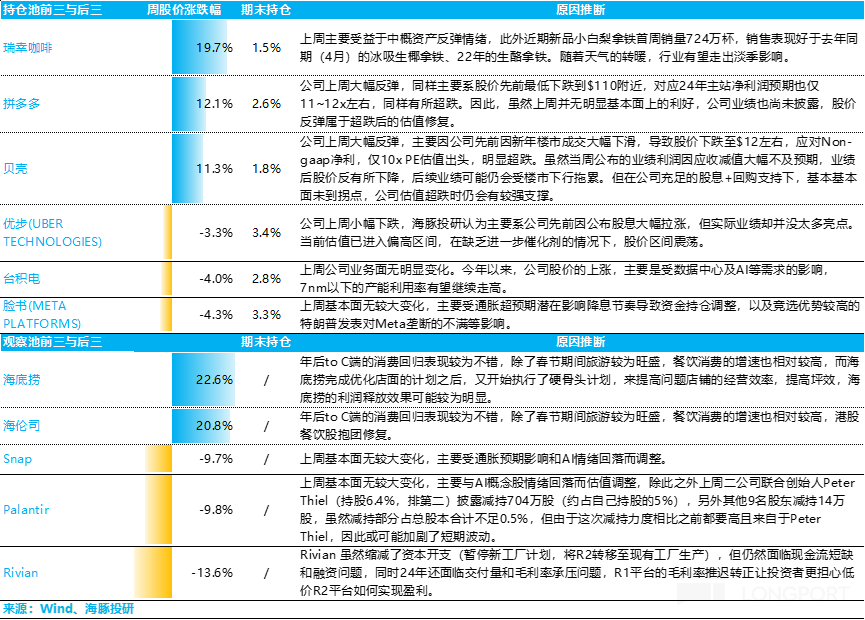

Last week, the major declines were in US stock assets such as Facebook, Uber, TSMC, etc., while the top gainers were mainly offline dining and contact consumer assets in Chinese concept stocks, as well as companies in the internet sector that had previously seen small gains and are now catching up.

Alpha Dolphin analyzed the companies with significant increases and decreases in the holding pool and watchlist last week, along with possible reasons, as shown below:

Seven. Asset Allocation of the Portfolio

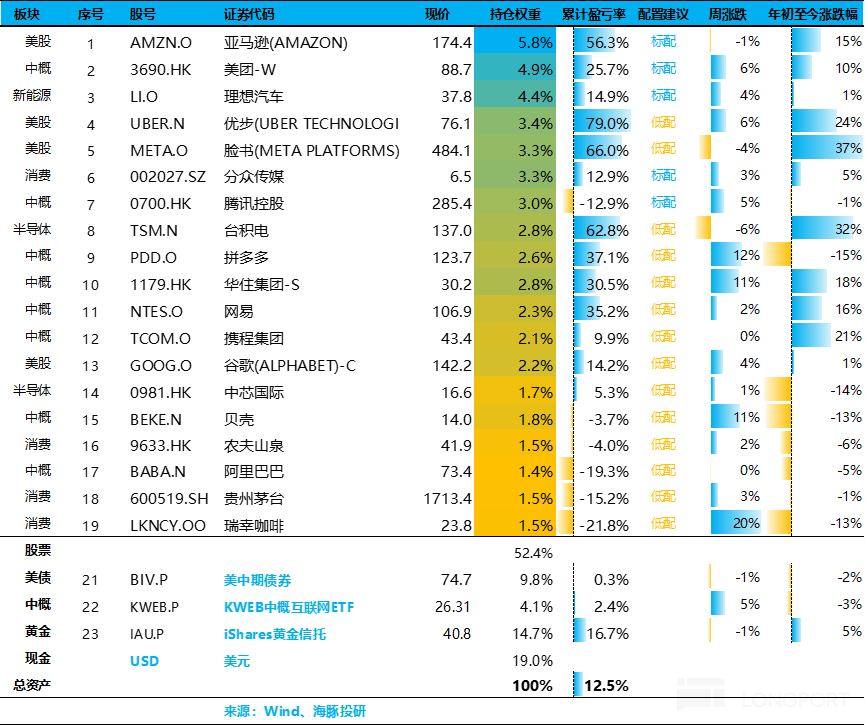

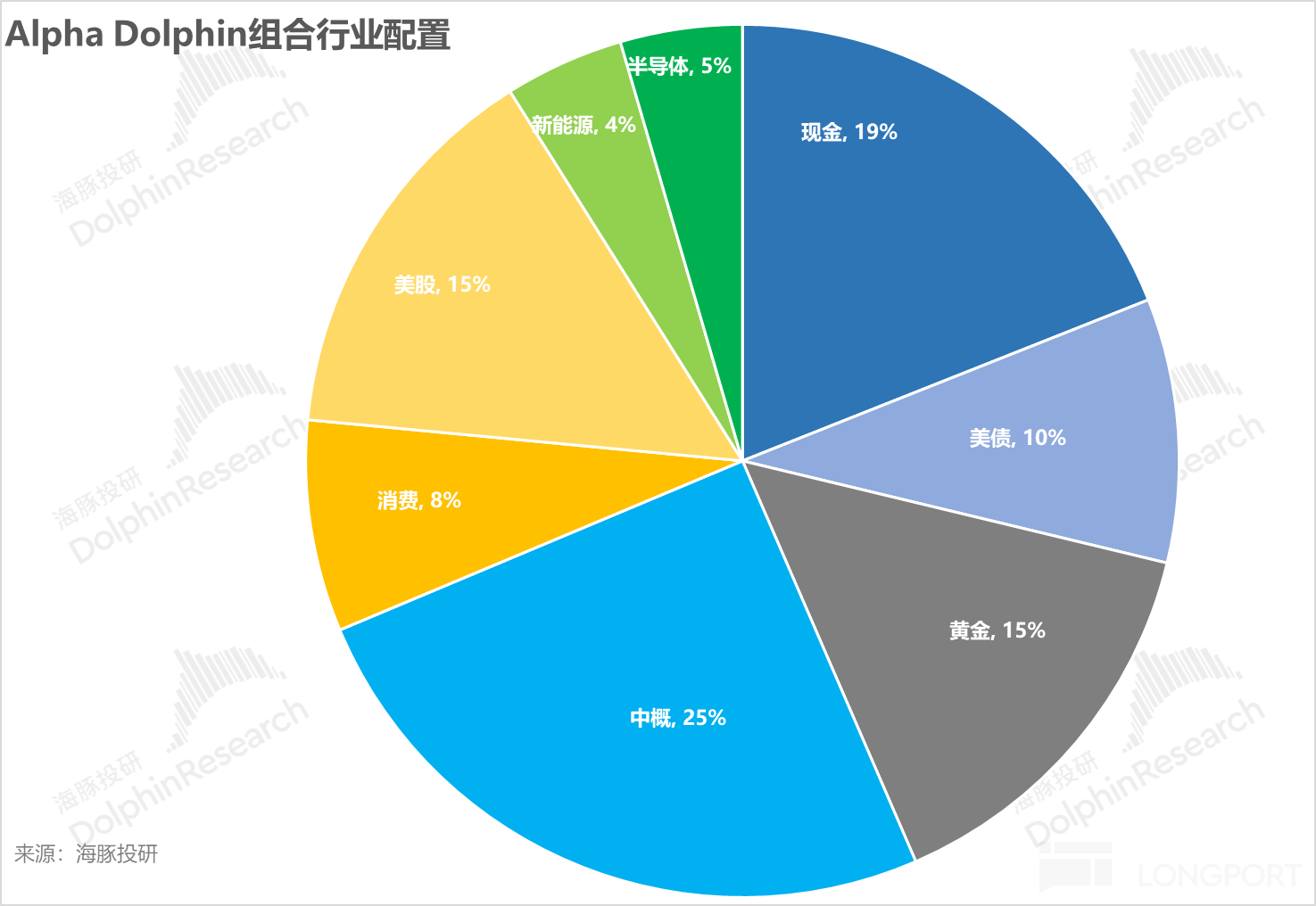

The Alpha Dolphin virtual portfolio holds a total of 20 individual stocks and equity ETFs, with 6 core holdings and the rest being underweighted equity assets, along with gold, US bonds, and US dollar cash.

As of the end of last week, the asset allocation and equity asset weights of Alpha Dolphin are as follows:

Eight. Key Events of the Week

This week, a wave of Chinese concept stock financial reports is coming, with high-profile companies such as Pinduoduo, Meituan, Tencent, Xiaomi, Kuaishou, XPeng, etc., all releasing their performance. The Dolphin will cover and review these companies. The Dolphin has summarized the key areas of focus for each company. Users who are interested can follow the Dolphin's frontline analysis.

Risk Disclosure and Disclaimer of this Article: Dolphin Research Disclaimer and General Disclosure

For recent articles from the Dolphin Research Portfolio Weekly Report, please refer to:

《Not Daring to Chase the Seven Sisters of Technology? Chinese Concept Stocks Unexpectedly Benefited》《Enterprise Relay Residents Support the Economy, the United States Will Not Cut Interest Rates Quickly》

《Giants Stagnate, Chinese Concepts Rise, Return to Light or Style Switch》

《2024, Will the U.S. Economy Avoid Landing?》

《Another Critical Moment! Will Powell Bail Out Yellen, the Prodigal?》

《Seeing Mud and Sand Together Again, How Much Faith Can Withstand the Test?》

《Unstoppable Deficit, Supporting the Dignity of U.S. Stocks》

[《2024 United States: Good Economy, Quick Interest Rate Cuts? Too Beautiful, Will Suffer Losses》](https://longportapp.cn/zh-CN/topics/10979739?《2023 American Suicide Rebirth》

《Fed Makes a U-turn, Can Powell Resist Yellen?》

《Year-end US Stocks: Small Rise is Pleasant, Big Rise is Harmful》

《Consumer Cooling Off, Is the US Fed Really Just a "Hard-mouthed" Fed Away from Rate Cuts?》

《US Stocks Overdrawn Again, Finally the Opportunity for Chinese Concepts》

《The Faith in US Stocks "Never Sets" is Back, Is it Reliable this Time?》 "High interest pours into consumer spending, is the United States really thriving or just a flash in the pan?"

"In the second half of the Fed's tightening, neither stocks nor bonds can escape!"

"This is the most down-to-earth, the Dolphin Investment Portfolio is launched"