Year-end US stock market: Small Gains Bring Joy, Big Gains Bring Harm.

Hello everyone, here is Dolphin Research's summary of the core information on this week's portfolio strategy:

1) As a heavyweight economic data, the November employment situation in the United States seems to be an endless scene. But the real situation behind it should be what Dolphin Research mentioned before, compared to the not-so-bad October, November actually had a slight marginal deterioration. The main disturbance came from the resumption of work in the automotive and Hollywood industries after the strikes, which added more than 40,000 employment data.

2) The overall employment picture depicted by the November employment data in the United States is as follows: a) Return of the strikes, employment rebound, wage increase; b) Small businesses decline, temporary workers decrease; blue-collar workers gradually lose confidence; c) AI starts a new technological cycle, white-collar employment rebounds; d) Construction and manufacturing industries, under the policy of industrial return, remain stable despite high interest rates; e) The actual employment situation in November actually deteriorated marginally.

3) However, for companies, generally speaking, EPS needs to decrease by at least 10% YoY to see significant layoffs. The evolution of employment itself indicates that most companies in the United States still have little pressure on EPS. The employment picture in November still depicts a soft landing economic outlook, so it is still a real piece of good news.

4) Under the comparison of the relative strength and weakness of the November data between China and the United States, with China's MoM CPI turning negative again and the strong employment data in the United States, a possible situation is that the recent appreciation momentum of the RMB may weaken. This is a direct negative for RMB assets, and under the competition of stock assets, the cost of failure may be particularly high. When bottom fishing, one should give oneself a sufficient safety margin.

At this time, although the fundamentals of the US stock market are not under much pressure, the overall valuation is still high. After the excess reverse repo funds are exhausted after the first quarter of 2024, the pressure of the Federal Reserve's selling will still be exerted on the real economy. In this case, if you must look at the US stock market, Dolphin Research believes that stock selection is still necessary. In terms of the overall index, a small rise is pleasing, while a big rise is a state of exerting too much force and causing harm.

5) From the perspective of EPS based on employment data, currently, companies in the transportation industry (with reduced layoffs) in the broad sense may have greater opportunities. In terms of segmentation, the aviation and local transportation (similar to Uber) are still expanding their workforce. Another area to focus on is SaaS companies related to AI, to see how AI's implementation reflects in improving profit margins and increasing revenue growth.

Here are the details:

I. US Employment "Never Ending"? Actually, Marginal Deterioration Again

Starting from last Friday, the United States has entered a new wave of macroeconomic data month. And the opening is the most important employment data:

After the rapid contraction of job openings in October, nearly 199,000 new jobs were added in November, once again significantly higher than the previous month's 150,000. The employment cycle in the United States seems to be a never-ending story:

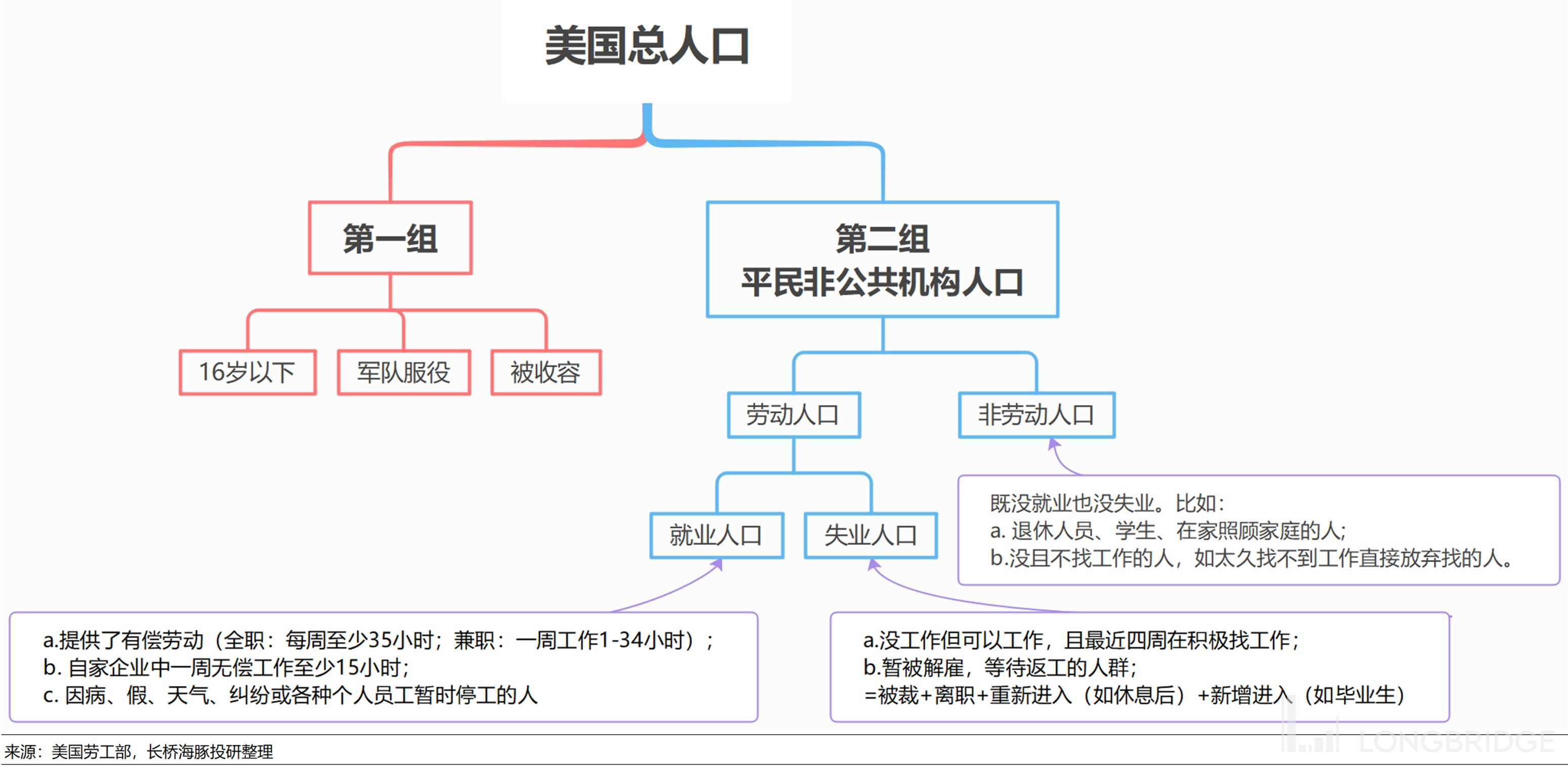

As a country that supplements its labor force with external immigrants rather than relying on internal self-sufficiency, in November, the United States added 180,000 people to the second group of potential labor force, and this increase in labor force participation rate should be significantly higher than the average. In November, the addition of 200,000 jobs is likely to lower the unemployment rate, as the potential labor force of 180,000 cannot fill the gap. The unemployment rate in November did indeed decrease from 3.9% in October to 3.7%.

It seems that the employment data for this cycle in the US stock market is far from over.

However, in Dolphin Research's view, the so-called improvement in November's employment data is not significant when we consider the real situation behind it, as Dolphin Research mentioned before, October was not bad to begin with, and the change in November is not substantial when we exclude these factors.

The disturbance here is mainly due to strikes:

1) The strike in the automotive manufacturing industry resulted in a net job loss of 32,000 in October and a net job gain of 300,000 in November. Therefore, excluding this impact, there were 180,000 jobs created in October and 170,000 jobs created in November.

2) The Hollywood actors' strike lasted for about 100 days and ended in early November, which also had a certain impact on employment. The combined net job loss in the film and recording industry and the publishing industry in October was 25,000, which turned into a net job gain of 12,000 in November. If we exclude the impact of this factor, there should have been more than 190,000 new jobs in October and less than 160,000 new jobs in November.

Moreover, due to the return of the strikers, wages have increased. Coupled with the recovery of white-collar employment and the decline in blue-collar employment, there has been a structural improvement in wage employment, and the hourly wage growth rate in the United States has accelerated again, reaching a MoM growth rate of 0.35%.

4) Excluding the impact of the return of the strikers, most other industries have either maintained or worsened their job growth compared to October:

The most significant decline is in the retail industry - whether it is department stores, discount stores, or supercenters, layoffs are very evident, indicating that offline retail is still under great pressure.

The second largest decline is in temporary employment services - with a net job loss of 14,000, overall blue-collar employment continues to cool down.

5) Strong employment growth in the healthcare industry: If there is one industry that has shown strong employment growth in this cycle, it is the healthcare industry. Whether it is various specialized doctors, hospitals themselves, or caregivers, home healthcare, and even social assistance, the concentrated retirement of the baby boomer generation in the United States has brought about sustained and robust employment in the healthcare sector.

Currently, healthcare services, professional and business services, and accommodation and food services are still the three industries with the largest job gaps. There have been changes in white-collar employment: the demand for IT and computer-related jobs has increased again, as well as the demand for third-party consulting, research services, and other manpower related to intellectual property.

It can be seen that the US technology industry, driven by AI, has entered a phase of job expansion once again.

The overall employment landscape depicted by the November US employment data is as follows:

a) return of strikes, employment recovery, and wage increases;

b) decline in small businesses and temporary workers; blue-collar workers gradually losing ground;

c) the beginning of a new technological cycle driven by AI, white-collar employment rebounding;

d) the construction and manufacturing industries, under the policy of industrial return, are still resilient;

e) the actual employment situation in November has marginally worsened.

However, for companies, generally, EPS needs to decrease by at least 10% YoY before significant layoffs are seen. The evolution of employment itself indicates that most US companies still face little pressure on EPS, and the employment landscape depicted in November still suggests a soft landing for the economy.

2. Behind strong employment, the government continues to bear the burden

Behind strong employment is the fact that companies have good EPS and residents have sufficient income. However, behind this feast lies the burden that the US federal government continues to bear. Looking at the latest macro debt situation in the third quarter:

Under the robust economy in the third quarter, the macro debt ratios of both companies and residents have decreased, and these two sectors have further resolved part of their debt through normal economic success.

However, the US federal government's macro debt ratio has increased during the third quarter when the real GDP growth rate was 5% and the nominal GDP growth rate was over 8%. It is evident that the growth in the second half of this year is suspected to be supported by fiscal stimulus.

From the changes in the Federal Reserve's balance sheet, we can still see the pressure that the government has brought upon itself through the Federal Reserve's asset sales:

The Federal Reserve continues to sell Treasury bonds, and by the end of December, the loan guarantees related to deposit insurance brought about by the crisis in small and medium-sized banks in the first half of the year have been completely cleared. Currently, only the loan amount from the Federal Reserve's previous tool remains, which is 12 million USD.

As a result, the balance of the TGA account was rapidly reduced last week, with only 670 billion USD remaining, which is lower than the Treasury Department's year-end target of 750 billion USD. At the same time, the reverse repurchase funds are also being rapidly consumed, with a remaining balance of 1.2 trillion USD. According to the current issuance scale of short-term debt of over 200 billion USD per month, by the end of the first quarter, it is feared that the use of short-term debt to finance and extend the life of the government will be close to its end.

If the Federal Reserve continues to reduce its balance sheet at the same pace next year, and the Treasury Department turns to rely on long-term debt for borrowing and financing, Dolphin Research still tends to believe that the downward speed of short-term debt will be higher than that of long-term debt in the coming year.

3 Is the US stock market going to rise again? A small rise brings joy, a big rise harms the body

The employment and wage data in November still depict a "soft landing" situation. In contrast to the relative strength and weakness of the November data between China and the US, with China's CPI turning negative again on a month-on-month basis while US employment data remains strong, a likely scenario is that the recent momentum of the renminbi's appreciation will weaken.

This is a direct negative for renminbi assets, and coupled with the fact that internet companies in the fourth quarter, both in terms of guidance and macro data, seem to be facing a challenging quarter, and with the emergence of a "hundred flowers blooming, a hundred schools of thought contending" situation in the domestic e-commerce sector, it means that most e-commerce platforms are facing a macroeconomic downturn and even more intense competition.

Under this situation of existing competition, the cost for the losers may be particularly high. When bottom-fishing, it is important to give oneself a sufficient margin of safety.

As for the US stock market at this time, although the fundamental pressure is not great, the overall valuation is still high. After the excess reverse repurchase funds are exhausted in the first quarter, the pressure from the Federal Reserve to unload assets will still weigh on the real economy. In this situation, if one must look at the US stock market, Dolphin Research believes that stock selection is still necessary.

From the perspective of EPS based on employment data, companies in the transportation industry (with reduced layoffs) may have better performance opportunities. Specifically, in the aviation and local transportation sectors (similar to Uber), personnel expansion is still ongoing. Another area to focus on is SaaS companies related to AI, to see how the progress of AI implementation in improving profit margins and increasing revenue growth is reflected.

4, Portfolio adjustment

Starting from last week, Dolphin Research has gradually reduced positions based on the end-of-year market situation, but because the overall equity position is not heavy, it is still in a slow reduction state. Last week, Xiaopeng Motors was mainly adjusted out, with the specific reasons as follows:

5, Portfolio returns

On December 8th, Alpha Dolphin's virtual portfolio returns declined by 1.3% last week, outperforming Chinese asset indices such as the CSI 300 (-2.4%), Hang Seng Tech (-3.3%), and MSCI China (-3.6%), but not as good as the S&P 500 (+0.2%).

From the start of the self-combination test to last weekend, the absolute return of the portfolio was 25%, with an excess return of 50.5% compared to MSCI China. From the perspective of net asset value, Dolphin Research initially had virtual assets of $100 million and currently has $127 million.

6. Individual Stock Profit and Loss Contribution

With the improvement of US employment data and the re-entry of domestic CPI into deflation, Hong Kong stocks remain the most affected. Hong Kong stocks in the consumer sector are weak, and those with slightly higher valuations, such as Luckin Coffee and Pinduoduo, are facing obvious valuation pressure.

On the other hand, US stocks remain relatively strong, especially after the earnings season, entering the event-driven phase. Stocks related to AI progress have shown good gains. The specific rise and fall are as follows:

Regarding the major companies with significant gains and losses in Dolphin Research's portfolio and watchlist last week, Dolphin Research provides the following analysis:

VII. Portfolio Asset Allocation

After removing Xiaopeng from the Alpha Dolphin virtual portfolio this week, a total of 26 stocks are held, including three standard stocks, with the remaining equity assets being underweighted, and the rest being gold and US dollars.

As of last weekend, the asset allocation and equity asset weightings of Alpha Dolphin are as follows:

Risk Disclosure and Statement for this article: Dolphin Research Disclaimer and General Disclosure

For recent weekly reports from Dolphin Research, please refer to:

"Consumer Cooling, Is the US Fed Just One Step Away from Rate Cuts?" Article: It's time for Chinese concept stocks to shine again as the US stock market reaches its overdraft moment

Article: The return of the "sun never sets" belief in the US stock market, is it reliable this time?

Article: High interest rates can't extinguish consumption, is the US really booming or just hype?

Article: The second half of the Federal Reserve's tightening, stocks and bonds can't escape!

Article: Chinese concept stocks waiting for the second half of the year in the US stock market Don't Panic, the Bottom of Chinese Concept Stocks May Have Arrived

US Unemployment Rate Rises, Hope for Chinese Concept Stocks

Inflation vs. Siphoning, Tough Times Ahead in the Second Half of the Year

US Fiscal Spending Like Water? The Backlash Has Arrived

The "Brotherhood" Behind NVIDIA and Tesla, Can It Continue in the Second Half of the Year?

Is There Redemption for the Hong Kong Stock Market?

Fitch Ratings is Just a "Paper Tiger," Chinese Concept Stocks Still Have Hope

After the Violent Rebound, Should We Stay or Leave the Hong Kong Stock Market?

With US Interest Rates Peaking, Is There Hope for the Hong Kong Stock Market? Reality Strikes, How Far Can the Rebound of Chinese Stocks Go?

Look Further, Will US Interest Rate Hikes Amplify Stagnation?

Decoding the Mystery of Low Savings in the US, Is It Sustainable?

US Housing Market: Subprime Sins, Why Is It Resilient This Time?

Unraveling the Recession: Where Did It Go After Being Predicted, Can It Come Again?

Can a Short Essay Influence the Market? Extreme Pessimism Leads to Overcorrection

US Stock Market Frenzy Continues? Economic Schizophrenia, Beware of Joy Turning to Sorrow

Purgatory vs. Revelry, What Are US and Hong Kong Stocks Really Trading?

US Stocks Pulling Valuations, Hong Kong Stocks Killing Beta? Don't Despair, Reversal Is Imminent Here are some articles you might be interested in:

High interest rates put into another bank? The chances of a soft landing are even greater

ChatGPT vs. Performance release, can the giants support the US stock market?

Is the "US recession, China's recovery" plan going to fail?

The direction of the US recession is set, it's just a minor setback

US service consumption collapses, but the US stock market celebrates?

US interest rate cuts: Just waiting for a moment for the US version of Yu'ebao to strike?

Silicon Valley Bank's run on deposits: Is the US recession about to arrive?

After giving back gains, global markets can finally breathe Inflation Rising: Is It a Confirmation? Or an Opportunity in Disguise?

Putting Inflation Aside: The Signals from Alibaba and Baidu Are More Important

Weakness in Hong Kong and the US: Is the Wolf Coming Back?

The Puppeteer of High-Frequency Macro: Is the US Stock Market a Puppet?

A Single Candlestick Changes Beliefs: Is Tesla Leading the US Stock Market's Comeback?

How Far is the US Stock Market from the "Danger" and "Crisis" Situation?

Uncovering the Root Cause of the US Stock Market's Stagnation

CPI Has Fallen, Why Is the Fed Still So Stubborn?

Is It Really That Easy to Eliminate Service Inflation? Beware of Market Overcorrection

Finally, Hong Kong Stocks Have Some Backbone: Can Independent Trends Continue?

The Darkest Hour Before Dawn: Is the Key in the Darkness or the Dawn? "Reality hits the US stock market, how long can emerging markets continue to bounce?" "Global valuation recovery? Still facing the challenge of performance verification" "China's assets surge, why is there a stark contrast between China and the US?" "Amazon, Google, Microsoft, are the giants falling? The 'meteor shower' in the US stock market continues" "The policy shift behind the expectation: Is the 'strong dollar' GDP growth unreliable?" "The moment of testing 'determination' again: Southbound investors taking over vs Northbound investors running away" "The dream of slowing down interest rate hikes shattered once again" "Getting to know the 'iron-blooded' Federal Reserve again" "A tragic second quarter: The 'hawkish' voices are loud, and collective challenges are difficult" "Falling to the point of doubting life, is there still hope for a reversal?" "The Federal Reserve aggressively fights inflation, but domestic consumption opportunities arise?" Global markets plummet again, labor shortage is the root cause

The Federal Reserve becomes the number one bear, global markets collapse

A bloodbath triggered by a rumor: risks are not yet eliminated, searching for sugar in broken glass

The US leans left, China leans right, and the cost-effectiveness of US assets returns

Layoffs are too slow, the US must continue to "decline"

US stocks celebrate "funerals": recession is a good thing, the most aggressive rate hike is bearish

The second half of rate hikes, the opening of "earnings thunderstorms"

Current Chinese assets: "No news is good news" for US stocks

Growth is already in a frenzy, but does it mean the US is definitely in decline?

In 2023, will the US experience a decline or stagnation? 《US Oil Inflation, Can China's New Energy Vehicles Grow Strong?》

《Fed's Rate Hike Accelerates, China's Asset Opportunities Arise》

《US Stock Market Inflation Soaring Again, How Far Can the Rebound Go?》

《This is the Most Down-to-Earth, Dolphin Research Portfolio is Launched》