Total Assets

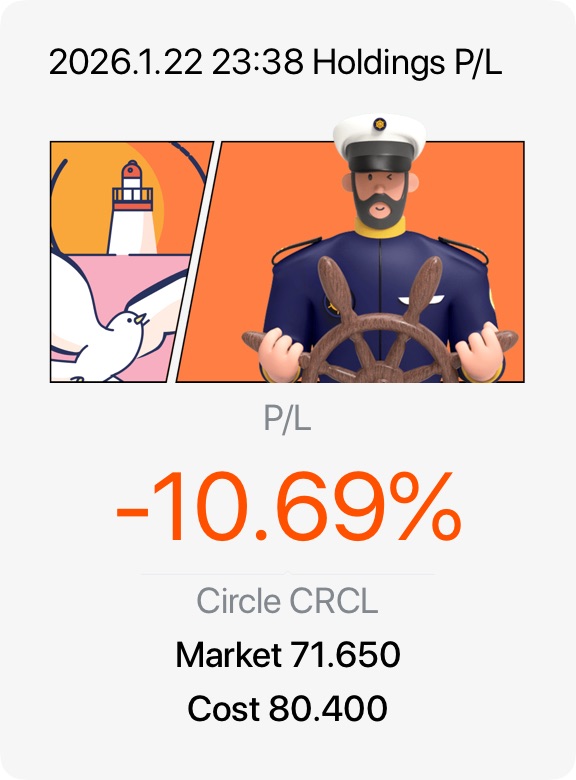

Total Assets$Circle(CRCL.US)I’m currently down on Circle, but I’m still bullish because I see it as a long-term “infrastructure” play rather than a short-term hype stock — if stablecoins keep expanding globally, Circle stands to benefit from growing USDC usage, more partnerships, and deeper integration into payments, trading, and on-chain finance. The price action can be brutal and sentiment-driven, but as long as Circle continues proving trust, compliance strength, and real adoption, I’m willing to hold through the volatility because I believe the market will eventually re-rate it when growth becomes impossible to ignore.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.