Double-click on 'dollar and high interest', will gold price 'hold on now, win the future'?

摩根大通指出,金价与美债实际收益率的负相关关系在降息周期更为明显,随着美债实际收益率和美元在明年晚些时候走势出现逆转,将推动金价突破 2000 美元/盎司,并在 2025 年进一步上涨。

自去年以来,受美债实际收益率走高和美元走强的压制,国际黄金价格经历了多番动荡。

在经历持续上涨后,黄金价格近期回调。COMEX 黄金期货合约 9 月下旬以来连跌九日,累计跌幅达 5.43%。但就中期而言,金价整体保持弹性,即便经历回调,COMEX 黄金期货合约自去年 11 月低位的累计涨幅依然有 12.47%。

摩根大通认为,自 2022 年以来,从各国央行增加购金到地缘政治因素(如周一巴以冲突推动避险买盘涌入黄金),各种催化剂帮助金价保持在较高水平。

而展望未来,小摩依旧看涨金价,认为美债实际收益率和美元在明年晚些时候的最终逆转,将推动金价突破 2000 美元/盎司。

该行分析师 Gregory C. Shearer 在近日的一份报告中预计,金价将在 2024 年下半年达到新的高点(2024 年第四季度平均价格为 2175 美元/盎司),并在 2025 年进一步上涨。

摩根大通:金价与美债实际收益率的负相关关系并不对称

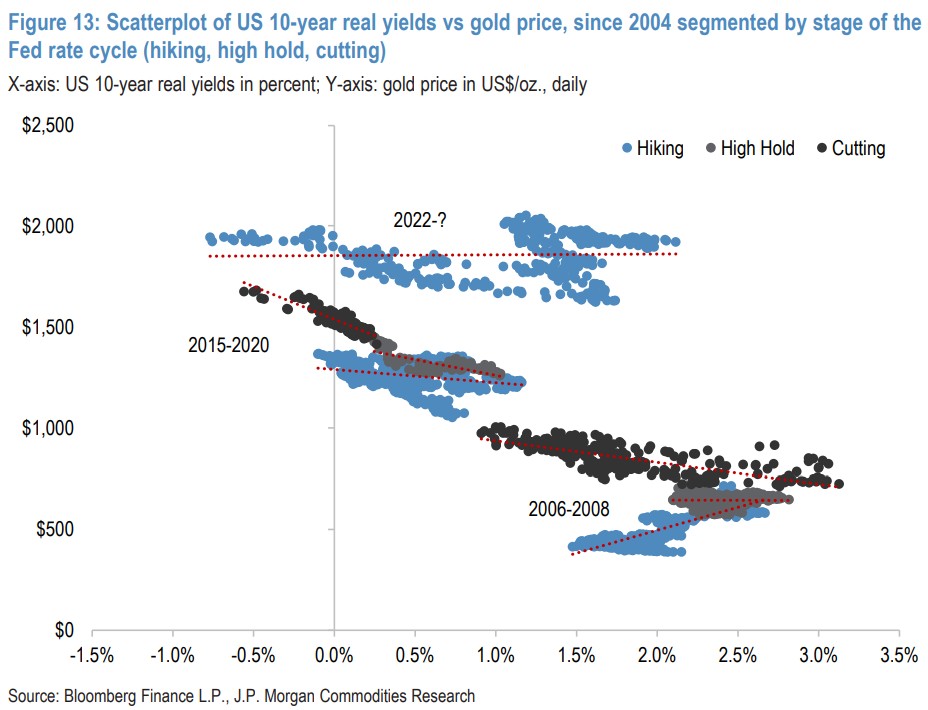

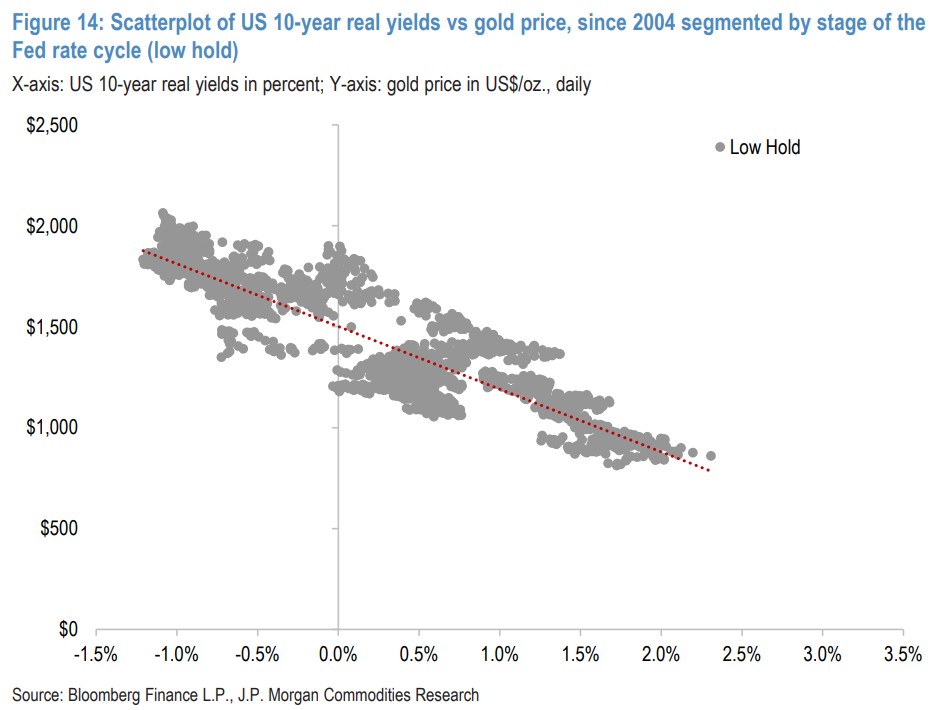

长期以来,黄金和 10 年期美债实际收益率之间保持着完美的负相关关系。

但近几个月这种负相关关系并不明显。自 7 月底以来,美国 10 年期国债实际收益率上升了 87 个基点(升幅 54%),上周达到了 2009 年以来的最高水平,而金价仅下跌了 5%。

小摩认为,黄金和 10 年期美债实际收益率并没有完全脱钩。

该行表示,从历史上看,在美联储加息周期中,金价与实际收益率的负相关关系一直较弱,而在美联储暂停加息、降息并将利率维持在低水平时,美债收益率会下降,金价会再次走强。

报告写道:

“在过去的三个美联储降息周期中,金价在美联储首次降息前的六个月内平均上涨了 4%,而在首次降息后的六个月内又上涨了 15%。

在后两个降息周期(从 2007 年和 2019 年开始),当黄金与实际收益率的关系建立得很好时,在美联储开始降息之前(平均上涨 8%)和之后的六个月里(平均上涨 22%),金价一直看涨。”

摩根大通认为,黄金与美债实际收益率负相关关系的不对称,在一定程度上解释了金价自 2022 年初以来的弹性。

预计美债收益率在更长时间内走高,但到 2024 年年中仍会出现逆转

小摩在报告中表示,即使美联储 9 月发布的利率点阵图更为鹰派,该行经济学家仍然预计美联储的加息周期已经结束,并预计美联储将在 2024 年降息 50 个基点(利率峰值将在 2024 年初出现,2024 年夏天会暗示降息 25 个基点)。

该行认为,市场可能会继续讨论美联储在 2023 年剩余时间内再次加息的可能性,因此,该行策略师预计美债收益率将在年底前保持高位。尽管如此,该行策略师仍然预测,随着美债收益率在美联储降息周期之前开始走低,这种情况将在 2024 年下半年开始改变。

摩根大通对美元的预测与美债收益率的观点相似,即美元的强势预计将持续到年底,然后在 2024 年上半年达到拐点。

小摩展望:金价短期保持弹性,之后将大幅走高

摩根大通认为,美债实际收益率在更长时间内走高,美元受到支撑,可能会继续抑制金价,但预计美联储将维持利率不变,而由于金价与高收益率和美元走强的负相关性降低,因此金价在未来一个季度将基本保持弹性:

金价将在最近的 1880-1950 美元/盎司区间波动,在今年第四季度平均价格为 1920 美元/盎司。

换句话说,在美联储加息周期曲折步入尾声,金价预计将继续原地踏步,直到 2024 年晚些时候出现拐点。

该行预计,随着美联储降息周期临近,金价预计将最终走高,在 2024 年下半年达到新的高点(2024 年第四季度平均价格为 2175 美元/盎司),到 2025 年甚至更高,达到年平均价格 2250 美元/盎司。

报告表示:

“展望明年,由于我们预计美联储将接近并经历降息周期,我们认为这将再次确立实际收益率走低作为黄金看涨的关键驱动因素,推动金价从保持弹性走向突破新高。”

预测准不准?还要看美国经济和通胀

金价看涨风险:美国经济硬着陆和美联储更快转鸽

就基本预测而言,摩根大通并不认为,美国经济会出现衰退,而是认为会温和增长,增速低于平均水平,最终导致从 2024 年第三季度开始降息。

然而,该行认为,未来一年美国经济衰退的风险仍然很高,如果紧缩政策的滞后效应比预期更快或更有力地发挥作用,可能会对宏观市场造成严重冲击。

该行的全球市场策略师指出:

“在美联储过去 12 次紧缩周期中,有 7 次紧随或伴随着经济衰退。在这七个周期中,美国经济衰退平均开始于美联储最后一次加息后的 5-6 个月。

如果我们的经济学家是正确的,假如 7 月标志着美联储的最后一次加息,那么与历史平均水平相似的时间点将在今年年底左右。

如果美联储在经济进一步放缓的情况下做出更迅速的鸽派反应,将给我们对 2024 年黄金的预测增加更多直接的上行风险。”

金价看跌风险:更顽固的通胀要求进一步收紧政策

通胀回归目标水平的最后阶段可能会很困难。

摩根大通预计,自年中以来油价近 30% 的反弹不会持续或反映到核心通胀。然而,该行表示,美国顽固的核心通胀和经济韧性可能促使美联储进一步收紧政策,并将结束紧缩周期的辩论延长至 2024 年。

虽然小摩仍然认为,在这种情况下,金价不会大幅回落至 2022 年底的低点,但这将继续稳步压低金价,使其低于该行的预期,并进一步推迟任何持续的反弹。