Weight loss pills impact food demand, Walmart: "Drug users" eat less and may impact the food industry.

诺和诺德和礼来推出的新型减肥药可能引起美国食品业发生重大变革,沃尔玛公布数据显示,使用减肥药的人食物摄入下降,最先受到冲击的就是快餐业。周五,几大快餐连锁和食品公司的股票均下挫,表现不及大盘,麦当劳跌超 1.2%,沃尔玛跌近 2.6%,Costco 跌 2.3%。

风靡全球的减肥药,牵动着诸多患者的健康,还令几家药厂今年在金融市场大放异彩,其影响的波及面比这些还要广。最新市场意识到,食品业连带沃尔玛等也中招,因为减肥药冲击食品需求,“嗑药” 顾客吃的越来越少。

诺和诺德 (NVO) 和礼来 (LLY) 推出称为 GLP-1 受体激动剂的 Ozempic、Wegovy 两款新型减肥药,据称有望帮助患者减重 20%,还可以降低患者心脏病发作或中风的风险,被认为是有史以来最有效、最安全的减肥药,使用者越来越多。然而,减肥药的风靡无疑会导致食物摄入减少,尤其危及食物热量较高的快餐业。

财经博客 ZeroHedge 分析,这两款药可能在美国引起餐饮革命,指出躺在舒适区内的美国食品业已经懒于求变,认定美国人迷恋快餐、汉堡等碳水垃圾食品的情况不会改变。目前美国食品业总值近 1 万亿美元,任何一点小变化就都会引起行业的巨大震动。

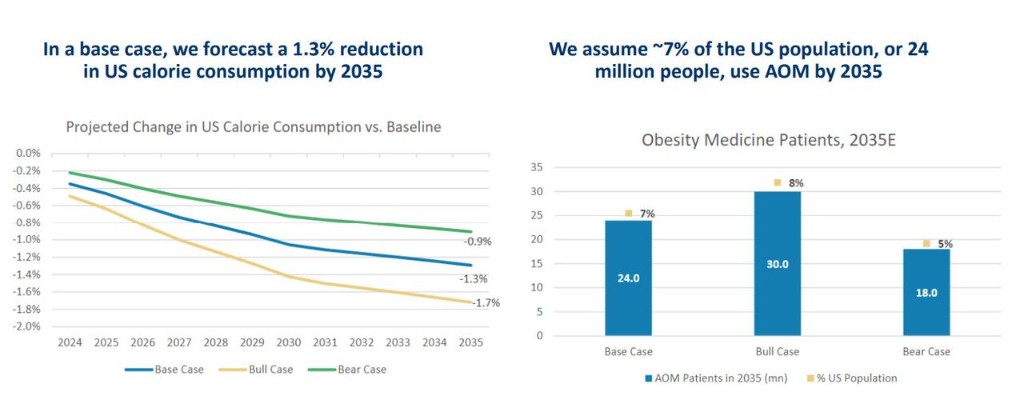

摩根士坦利就预计,两款减肥药可能导致美国未来 11 年的卡路里消耗减少最多 1.7%,届时全美将有最多 8% 的人口服用减肥药。

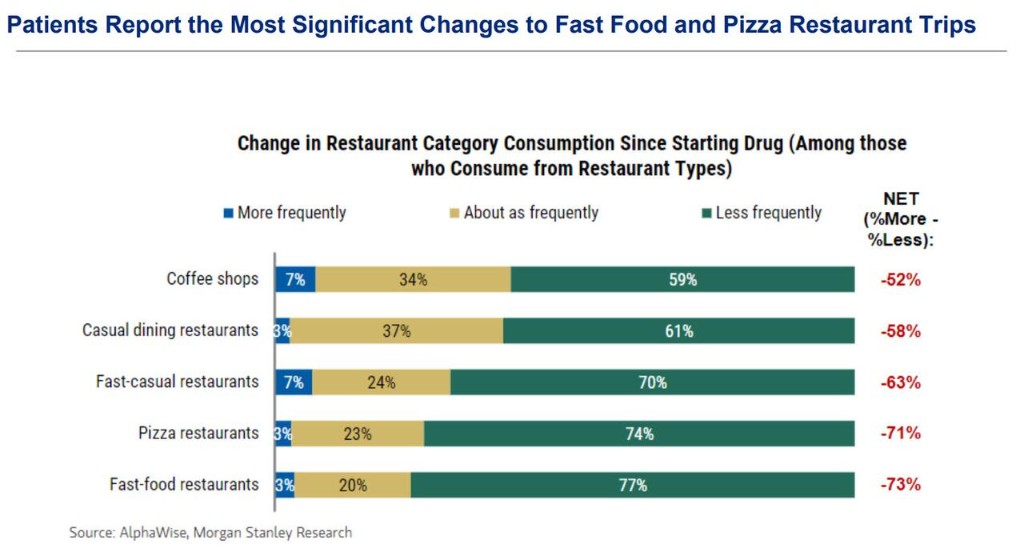

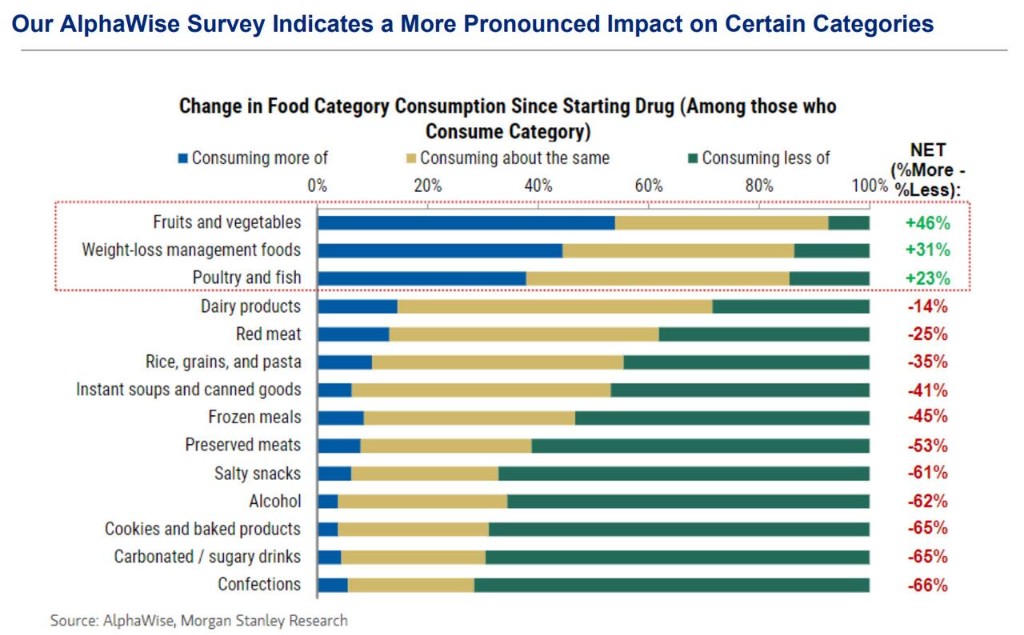

毫不令人意外的是,大摩发现,快餐、披萨等高碳水食物,以及糖果、点心、咸味零食、高糖饮料和零食,受减肥药影响最大。

而且,零售巨头沃尔玛不久前也发出警告,称那些正在服用 Ozempic、Wegovy 和其他减肥药的消费者,购物需求有所降低。沃尔玛美国首席执行官 John Furner 表示,“我们确认,相比总体人群,那些正在服药的消费者确实购物稍微减少,购物数量略微减少,热量消耗也稍稍减少。”

沃尔玛还对那些在其药房购买上述药品的消费者,与并不在其药房拿药的消费者进行比较,发现前者的食物购买量减少。

Ozempic、Wegovy 在沃尔玛药房有售。数据显示,这两款药的销售额从 2020 年至 2022 年增长 300%。沃尔玛首席执行官 Doug McMilon 今年 8 月表示,诺和诺德和礼来减肥药的热销,对沃尔玛营收有助益,但显然不利于高热量快餐消费。他预计,食品等日常消耗品,以及受减肥药风靡而带动的保健产品,销售额在下半年仍可增长 1%。

几大快餐连锁和食品公司的股票当地时间 6 日盘中有所下滑,其中麦当劳(MCD)跌超 1.2%,百盛集团(YUM)跌超 1.5%,家乐氏(K)跌超 2.5%;几大零售业者,沃尔玛(WMT)跌近 2.6%,Costco(COST)跌 2.3%,Walgreens(WBA)跌超 1.4%。相比之下,减肥药制造厂商大涨,诺和诺德(NVO)涨超 2.7%,礼来(LLY)则涨超 3.3%。

尽管越来越多的公司高层和投资者开始讨论减肥药的风靡将如何改变美国的经济与商业环境,但也有不少 CEO 仍对美国肥胖人群消费垃圾食品的前景抱有期待。

本周早些时候,从家乐氏拆分而出的零食公司 Kellanova 首席执行官 Steve Cahullane 表示,该公司正在对饮食习惯改变的潜在影响进行研究;他说,减肥药的使用目前仍然处于非常早期的阶段,“但和所有其他对业务的影响因素一样,我们会关注并研究,如果可能,也会尽量降低影响。”

他还表示,对于 Kellanova 来说,务实的做法可能是同时增加美国和其他市场的穿透程度,找到那些对零食产品有消费兴趣并能够建立一定品牌忠诚度的消费者。