Hong Kong stocks fell on the first day after the holiday: Hang Seng Index and Hang Seng Technology Index both dropped more than 2%. Technology, energy, and real estate sectors all declined, while Evergrande's resumption of trading saw an increase of approximately 28%.

I'm PortAI, I can summarize articles.

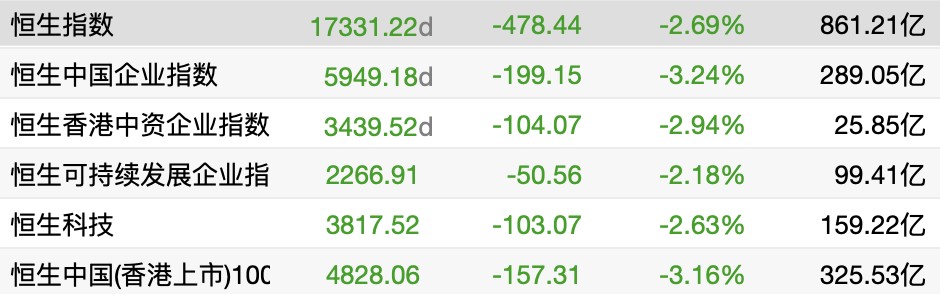

恒生指数收盘跌 2.69%,刷新去年 11 月以来新低, 恒生科技指数跌 2.63%,能源、生物医药、地产、汽车等板块跌幅居前。

10 月 3 日周二,港股节后首日走弱,恒生指数收盘跌 2.69%,刷新去年 11 月以来新低, 恒生科技指数跌 2.63%,国企指数跌 3.24%。

市场焦点是恒大系两股复牌,中国恒大逆市走强,一度飙涨超 40%。盘面上,各板块普跌,能源、生物医药、地产、汽车等板块跌幅居前。

大市全日成交 861 亿港元,较上一交易日 677 亿港元显著放量。

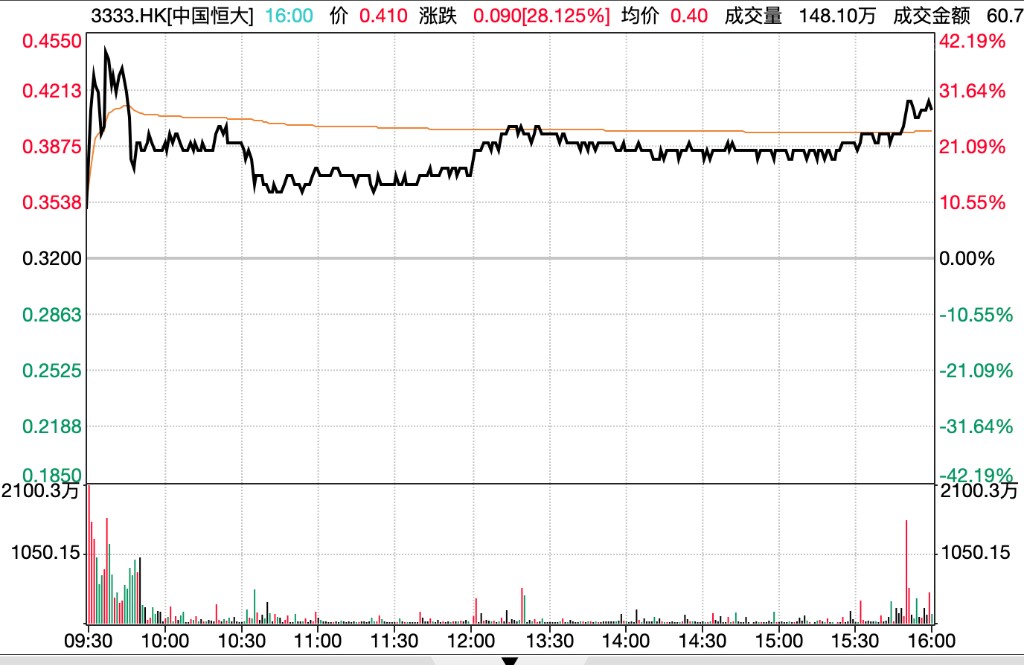

中国恒大复牌逆势走高

恒大系今日复牌,截至发稿,中国恒大开盘涨 9%,随后持续拉升,涨幅一度扩大至逾 40%,收盘回落至 28%,该股上周累计跌超 40%,恒大物业跌超 3%。

消息面上,中国恒大、恒大物业公告称已向联交所申请于 10 月 3 日上午 9:00 时正起恢复买卖。值得注意的是,同为 “恒大系” 三驾马车之一的恒大汽车暂时还尚未发布复牌公告。

地产股下挫

地产股和物业管理服务股下跌,融创中国跌近 7%,碧桂园跌超 7%,龙湖集团跌超 6%,中国海外发展跌 3%,正荣地产跌约 9%。

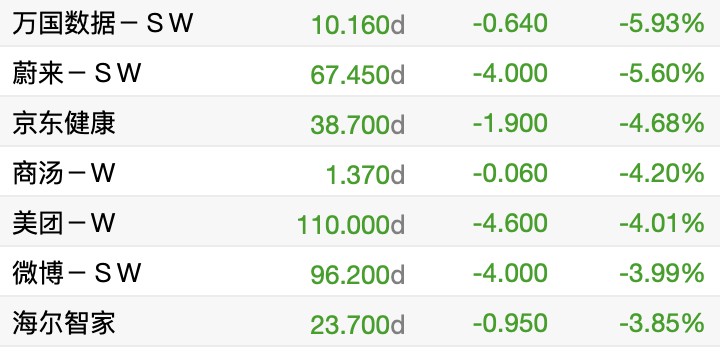

科技、汽车股多数下跌

科技股多数下跌,美团、京东健康跌超 4%,京东、百度、携程等跟跌。

汽车股集体下挫,比亚迪 9 月销量同比增长 43%,股价不升一度跌 3%,长城汽车跌超 5%,蔚来跌超 5%,小鹏汽车跌 0.64%。

能源股跌幅居前

受国际油价走低影响,能源股走低,“三桶油” 集体下跌,中国石油股份跌约 5%,中国石油化工股份跌超 5%,中国海洋石油跌超 3%,赣锋锂业跌超 7%。