MINISO begins "upgrading" | Dolphin Research

在成立的第十年,名创优品要迈向 “超级品牌”。

名创优品 8.9 元一支的眉笔在 “国货价格刺客” 的衬托下火了一把。30 元出头的香薰、8.9 一支的眉笔,成了年轻人最新标配。

归功于年轻人对精致生活的追求,同时省钱最大化的诉求,名创优品以其低价策略在全球经济下行周期中高速增长。最新财报数据显示,截至 6 月 30 日的第四财季,名创优品集团营收首次达 32.5 亿元,同比增长 40%,整体业绩表现再创新高。

然而,名创优品并不满足于低价定位,他们同样焦虑低价流量带来的可持续性。创始人叶国富认为,在复杂的商业世界中,只有超级平台企业、超级技术企业和超级品牌企业才能做到长青。

为了从 “低价品牌” 跨越到 “超级品牌”,名创优品采取了一系列品牌升级和扩张的举措,他们积极与知名 IP 联名,开设超级大店,在海外加速扩张。

所有的一切都是为了摆脱过去 “强零售” 的基因,不被单纯当做渠道,而是真正拥有定价权的品牌。

当名创优品不再便宜,消费者还会继续买单吗?

名创优品的 “超级品牌梦”

在过去十年间,名创优品之所以能做到如此低价,主要还是得益于供应链的优势。

据招股书披露,在供应链上游有数千人负责产品选购,下游也有数千人负责门店拓展,这使得销售对产品的反馈非常快速有力。

畅销产品很快反馈到总部,经研究和分析后增加订购,巨大采购量也获得上游厂商的大力支持。

强大的供应链让名创优品获得了成本领先优势,也使其销售形成了快速的正反馈循环,规模越做越大。

2023 年,名创优品实现了公司历史上最好的业绩,收入与利润端皆超出市场预期。并且消费热还在持续,7-8 月名创优品销售额持续强劲增长,多家门店创单店销售新高。

具体来看,7 月近三分之一门店创历史销售记录,1-7 月国内单店 GMV 持平 2019 年疫前水平及 2021 年同期。

8 月中国区线下销售额突破 13 亿元,同比增 47.8%,3000 多家门店中有 792 家创历史最高纪录。

但是,这并非名创优品的终极目标。在成立的第十年,名创优品终于喊出它的 “超级品牌梦”。

然而一直以 “极致供应链、强零售属性” 作为核心基因的名创优品,要转型至超级品牌,并不是件容易事。

尽管强大品牌力意味着更强议价能力和品牌溢价,但也对品牌塑造能力提出更高要求。

所谓品牌力,来源于产品从设计、选择、销售、售后到广告推广各个环节的积累,消费者在每个环节都会根据体验给出积极或消极的印象分,最终才决定了品牌的品牌力水平。任何环节的不足,都可能影响品牌塑造。

“开超级大店、疯狂联名 IP、海外加速扩张”,名创优品正在以它的方式摆脱过去 “低价品牌” 的标签,打造一个 “超级品牌”。

“超级大店” 打开单店业绩天花板

开设超级大店是名创优品品牌升级的举措之一。

根据名创优品的说法,只有超大店才能在消费者心目中建立起品牌强大的印象,提升单店业绩天花板。

但超大店往往代表更优质的购物环境、更丰富的 SKU 选择、更高的客单价,当定位平价的名创优品走起高端路线,消费者还会认可吗?

高租金是否会拉高成本影响单店盈利模型?

对于市场上的疑虑,名创优品表示,虽然大店的投入是普通门店的 2 倍左右,但超级大店开业后人表现出色,广州北京路旗舰店月销售额可以做到 500 万人民币,美国旗舰店 130-140 万美金。

超级门店的客单价更高,人流量大,单店店销反而更好,存货转的更快,投资回收期也更短。

见智研究认为,名创优品正着手于改变原先的低价定位,提升单价,扩张品类,超级大店模式的跑通在一定程度上验证了这一战略的有效性。

显而易见的是,名创优品并不会在各品类上直接涨价,仍会保证低毛利引流商品的合理配比。

但毋庸置疑,他们会从溢价空间大的品类入手,往高端化方向突破,这样既能提升毛利,也能提高品牌格调。

据其在业绩会上透露,未来毛利率更高的 IP 和兴趣类品类将扩大至销售的 30% 左右,成为提升毛利的关键所在。

典型例子就是原来卖 39.9 元的香薰,[大师创香室] 定价为 79.9 元起,虽然客单价翻子但横向对比同类竞品,大师系列香薰的价格依然有优势。

销售额也超过了名创优品的预期,自去年年底上线以来,大师花艺香薰累积营收近 3000 万,大师创香室系列累积营收近 7000W。

(资料来源:各品牌天猫官方旗舰店,财通证券研究所)

从联名三丽鸥到成为三丽鸥

IP 联名也是吸引年轻群体的有效手段,三丽鸥、hello kitty、迪士尼等久经不衰的经典 IP,为品牌提供了持续不断的流量和销量。

并且 IP 产品往往具有更高的附加值,有助摆脱同质化严重的低价产品标签。

当年为争取漫威 IP,名创优品死磕半年,叶总亲赴美国迪士尼总部讲 PPT 提案,后来更是下死命令,拿不到漫威 IP 不能回国。

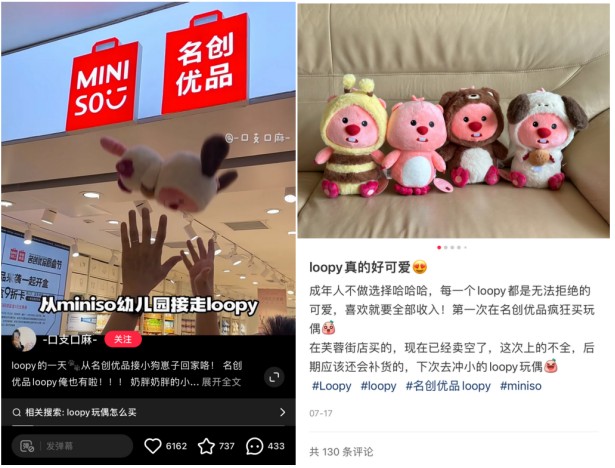

今年 7 月芭比联名上新仅 5 天接近一半的品类全网售罄。Loopy 线上发售当天,名创优品小程序被挤到崩溃。史努比联名也在社交媒体上品牌声量持续走高。

显然,名创优品正从重视成本转向重视产品品质和差异化。

上半年,名创优品 IP 产品销售占比约 25%,较去年提升 1 个百分点,较 2019 年提升 10 个百分点。随着与芭比、Loopy、史努比等知名 IP 的合作,8 月 IP 产品销售已突破 30%。

联名成熟 IP 拥有稳定客户群和回报率,但过度依赖外部 IP 也存在被视为 “代工品牌” 的风险。值得注意的是,名创优品目前仅有 DUNDUN 鸡、PENPEN 企鹅两个自有 IP 系列。

对此,名创优品回答见智研究,自有 IP 仍在初期孵化阶段,未来会增加自有 IP 的供给量。

但不会像迪士尼做很重的内容,而是类似于三丽鸥,从早期一个礼品零售店,靠不断推出新形象,变成有旺盛生命力的长期 IP。

从联名三丽鸥到成为三丽鸥,这就是名创优品想要做的事。

在海外比想象中过得好

也有分析师认为,“拼多多”“名创优品” 代表的并非 “消费降级”,而是中国供应链优势的外化。名创优品也用实际数据证明了其在海外过得比人们想象中都要好。

4 个月前,名创优品在寸土寸金的美国时代广场开出首家中国品牌店,单日销售高达 55 万元人民币,创全球门店单日销售记录。

这只是名创优品出海一角。

今年海外 GMV 增长率迅猛,贡献超过 40%(上季度为 25%)营业利润,堪称最亮眼业绩表现。其中 40% 来自亚洲,包括东南亚、印度。30% 是在北美。欧洲和中东占比大概 10%~15%。

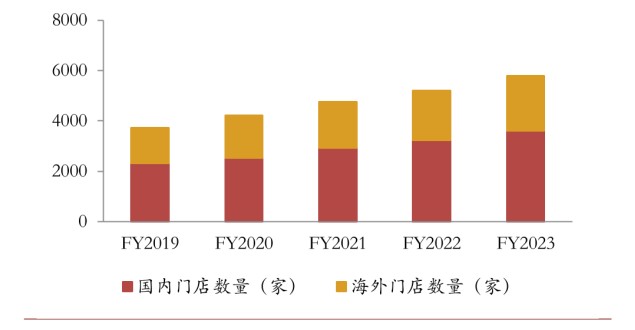

要做一个长青的品牌,肯定绕不开出海。海外的利润空间更大,毛利率更高。名创优品目标是在 2027 年开中国门店 5000 家,海外门店 4000 家。

(门店数量稳定攀升,占比保持稳定,资料来源:公司招股书,公司公告,财通证券研究)

和市场想象中的不同,名创优品在海外市场的成功并不依赖于补贴,而是其供应链优势和国内管理红利。

以美国为例,只要把上货、理货之类的基本动作做好,就能带动百分之十几的销售。去年年底,美国单店的月平均销售额就超过了百万元,今年一季度已成为收入贡献排名第一的海外国家。

(名创优品各国收入贡献&GMV 贡献排名,资料来源:名创优品业绩演示材料)

名创优品向见智研究直言,北美直营市场毛利率高达 60%-70%,是未来最大的发展重点。目前名创优品有约 80 家美国门店,渗透率低,目标在美国单一市场开到 1500 家门店。下半年开店高峰,海外市场全年可以新增 350-450 个门店。

美国市场的另一个重要意义,是成为向其他海外市场示范和辐射的示范市场。如果名创优品能把中国的经营模式和管理经验复制到美国,无疑可以辐射推广到欧洲等地,提高全球市场的知名度和美誉度。

总结

“消费平替” 的热潮为名创优品带来了飞速增长,但公司很清楚品牌长青不能仅靠低价优势。于是在成立的第十年,名创优品喊出了它的 “超级品牌梦”。

开设超级大店扩张品类、提高客单价,联名 IP 提升产品附加值,发力毛利率更高的海外市场,在转型过程中新的增长空间被打开。真正拥有产品定价权的 “超级品牌”,将获得更高的利润空间。

名创优品正在朝这个方向努力着。