US stock market loses its biggest momentum! Under the pressure of interest rates, technology stocks have already pulled back by 10%.

人们担心,随着大型科技股的崩溃,市场可能会出现逆转。

隔夜,美股三大股指均跌超 1%,大型科技股全线下跌,美债收益率上升和美元走强继续令市场承压,最新的房屋销售和消费者信心数据引发了投资者对美国经济状况的担忧。

大型科技股是今年上半年推动美股上涨的主要力量,然而进入 9 月,这一支撑一直在动摇。

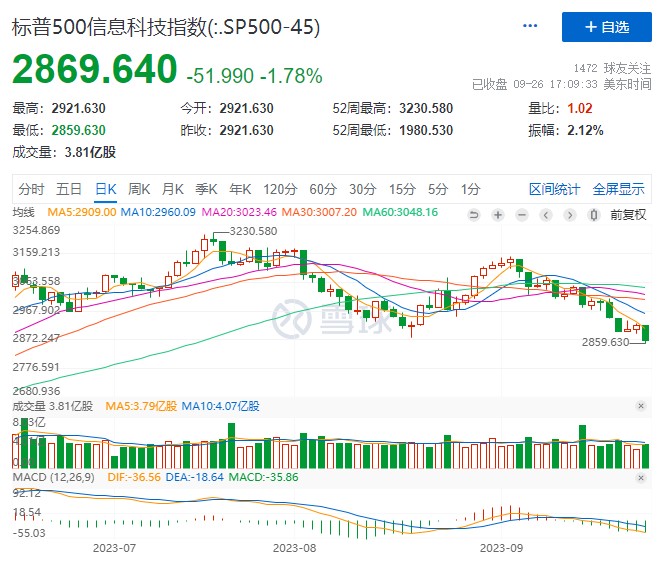

更集中于大型科技股的标普 500 信息科技指数,已从 7 月份的高点下跌了超 10%。该指数也在过去 5 个交易日中,第三次下跌 1%。

今年大部分时间里,美联储的鹰派立场并未对股市构成问题,但随着官员们继续暗示利率可能需要在比投资者预期更长的时间内保持在较高水平,市场情绪正在恶化。

人们担心,美联储抑制通胀的热情可能会破坏经济,再加上消费者趋于谨慎,随着大型科技股的崩溃,市场可能会出现逆转。

美国最大独立经纪交易商 LPL Financial 的首席全球策略师 Quincy Krosby 表示:

“对收益率上升的担忧尚未消散,甚至变得更加严重了,尽管科技股可能能够坚持下去,但你开始看到裂缝。”

“市场的一个非常重要的因素——美国消费者,正变得越来越担心,这不是市场希望看到的。”

利率将长时间高企的预期带崩了消费者信心

周二,标普 500 信息科技指数周二下跌 1.8%,跌幅从 7 月高点扩大至 11%,10 年期美债收益率徘徊在 2007 年以来的最高水平附近。标普 500 指数下跌 1.5%。

明尼阿波利斯联储主席卡什卡里 (Neel Kashkari) 表示,如果经济强于预期,他支持今年再加息一次,打击了市场人气。

此前摩根大通首席执行官杰米•戴蒙 (Jamie Dimon) 警告称,最坏的情况仍然有可能发生,即美联储基准利率触及 7% 并出现滞胀。

一度热情高涨的消费者已经明白了这一点,美国谘商会消费者信心指数的大幅下滑就是明证。与此同时,该指数中反映消费者对未来六个月展望的预期指标跌至 73.7,低于 80 的水平,从历史上看,80 是未来一年经济衰退的标志。

投资者怀疑科技股能否恢复上涨势头

虽然科技公司的全球化性质在一定程度上使它们免受国内增长困境的影响,但它们也无法完全置身事外。

知名投资机构 Miller Tabak 的首席市场策略师 Matt Maley 说,随着人们对利率长期高企的担忧加剧,抛售今年大部分时间表现最好的大型成长型股票,正日益成为投资者的一个资金来源。

Maley 还表示:

“现在终于意识到利率确实会在更长时间内保持在高位,(投资者) 很快开始担心这些大型科技股的估值水平。”

即便自 7 月以来下跌了 10%,标普 500 信息科技指数年内仍上涨了 32%,而同期标普 500 指数的涨幅为 11%。

但投资者怀疑大型科技股能否很快恢复上半年的上涨势头。

花旗集团策略师表示,以科技股为主的纳斯达克 100 指数目前单边净空头头寸为 81 亿美元,所有多头头寸均已平仓。

对此有分析称,部分原因是获利了结,部分原因是股市的焦虑情绪,因长期利率走高的基调确实确实已然开始扎根。