Share ratio of 50%! "Zero-day options" make a comeback

2018 年的市场灾难即将重现?

被称为 “末日期权” 的零日期权(0DTEs)势头再起,或使本就不平静的股市加剧波动,五年前的市场崩盘或将重现。

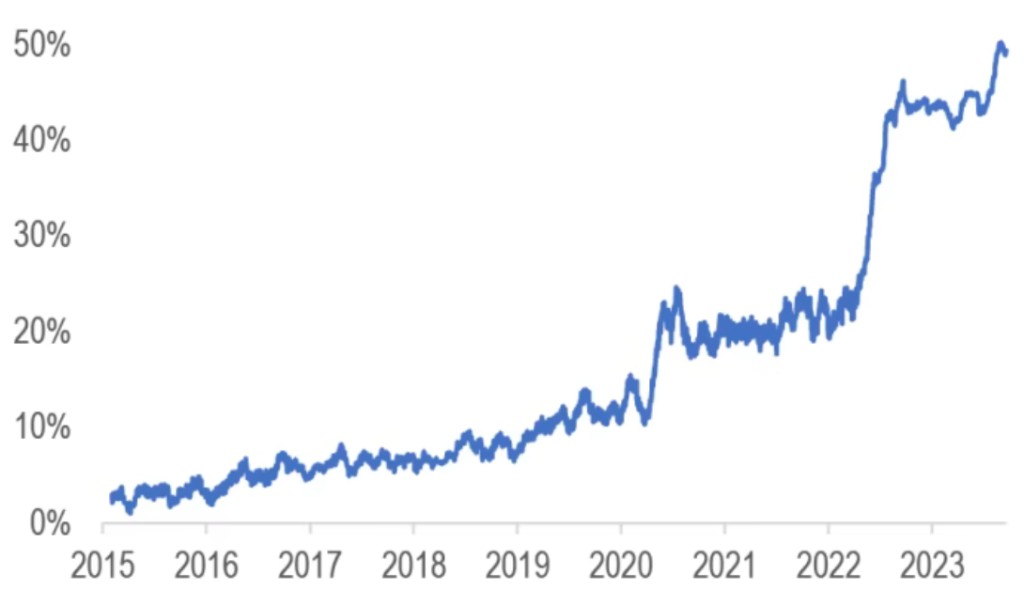

据摩根大通称,零日期权交易量不断创下历史新高,并且最近已占所有标普 500 指数期权交易量的一半。

摩根大通周一公布的报告指出,零日期权的 “繁荣” 似乎是它自己的事情,其特殊的用户群主要是高频交易者和散户投资者。 因此,它并没有真正影响其他期权领域的交易量(SPDR 标普 500 ETF 的短期期权除外)。

末日期权是在交易当天到期并失效的期权合约,这意味着期权的到期时间只剩下最多 24 个小时,投资者对这类期权进行快速的买入、卖出操作。由于到期时间极其有限,这类期权的价格比到期日更长的期权更便宜,杠杆也更高,大约每 1 美元,就可以撬动起 1000 美元的市值。

巨大的杠杆带来巨大的利润,引诱散户投资者蜂拥而至投机,使 “末日期权” 去年在华尔街大行其道;然而,巨大的杠杆也意味着巨大的风险,很快市场上出现了剧烈的讨论声。

据华尔街见闻稍早前文章,摩根大通首席市场策略师兼全球研究联席主管 Marko Kolanovic 曾警告称,零日期权交易正在呈爆炸式增长,并可能造成与 2018 年初同一级别的市场灾难。这个相对不透明的金融角落是一颗潜伏在市场中的定时炸弹,可能引发 “Volmageddon 2.0” 式的市场崩盘。

2018 年 2 月,一个追踪波动率的基金因为市场下跌至接近赎回线而遭到抛售。这场危机导致道琼斯工业指数和标普 500 指数大跌,被市场称为 “波动性末日”(Volmageddon)。

相较于摩根大通,美国银行的态度更加乐观。美银股票衍生品策略师 Nitin Saksena 和 Benjamin Bowler 站出来反驳称,零日期权不会导致所谓的 “Volmageddon 2.0”,该期权背后的现实情况远比 “Volmageddon 2.0” 微妙得多。

8 月上旬美股大跌期间,高盛和瑞银发现,零日期权看跌期权交易激增,导致投资者大举抛售,加剧了美股的跌势。此外,野村和花旗均表示出对零日期权看跌期权骤增的担忧。

根据摩根大通最新的报告,最近推出的首批基于零日期权的 ETF 可能会进一步加剧市场崩盘的风险。

近日,基金公司 Defiance 推出了两只积极管理的基金,这两只基金通过卖出每日标普 500 和纳斯达克 100 指数期权的看跌期权,以实现收益。

这种策略借鉴了近期非常流行的基于期权收益的 ETF 策略,其中最典型的代表就是推出约 3 年的 JPMorgan Equity Premium Income ETF(JEPI),它已募集了近 300 亿美元的资产。

值得一提的是,Defiance 为其 S&P 500 0DTE 基金选择的交易代码为 JEPY,试图碰瓷 JEPI。这些新 ETF 的资产目前只有约 1500 万美元,其影响微不足道,但如果募集了大量的资产,可能会加剧 0DTE 期权带来的尾部风险。