Low-priced global domination! Faced with Temu and Shein, Amazon also smells danger.

通胀之下,美国人也爱廉价商品,这正是新玩家们的机会。

事实证明,百亿补贴不管到哪都好使。

已经登陆美国许久的 Shein 和 Temu 正打得难解难分,在美国消费者中的人气也旗鼓相当。就连电商巨头亚马逊,也感受到了危机。正如在中国,拼多多的低价策略同样威胁到了阿里和京东的地位。

通胀之下,美国人也爱廉价商品

Shein 和 Temu 采用超低价策略来吸引美国消费者,但方式有所不同。

相比 Shein,Temu 的品种更加丰富,不仅有服装,也包括家居用品、汽车配件、电子产品和乐器等多种产品。而 Shein 主要销售时尚女装。

两家公司的目标消费人群都是 Z 世代消费者。

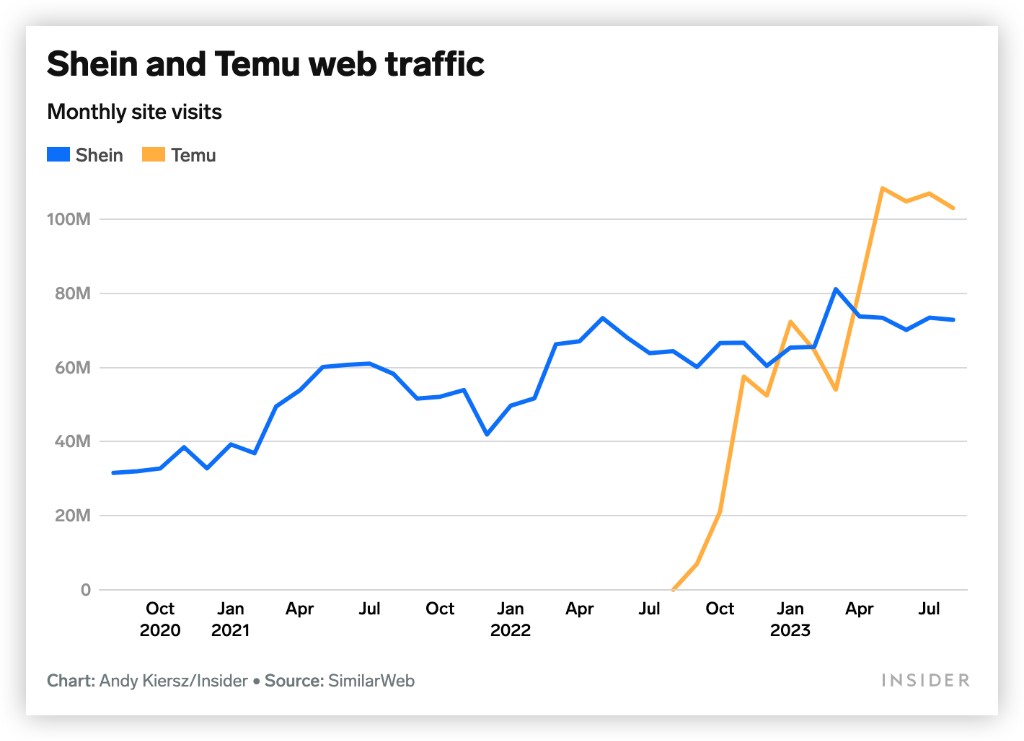

尽管 Temu 在 2022 年 9 月才在登陆美国市场,但根据 Similarweb 数据,它在美国的网络流量和购买量已经超过了 Shein。

根据瑞银分析师的估计,Temu 每个财季在广告上的支出接近 5 亿美元,这也解释了它流量增长的原因。

同时,对于备受通胀困扰的美国消费者来说,他们也越来越愿意尝试 Temu 和 Shein。

根据分析公司 Comscore 的估计,自 2022 年 9 月以来,Temu 在美国的访问量增长了 10 倍,达到约 7050 万次。而 Shein 的美国月独立访客数也翻了一番,达到约 4100 万,这些用户许多都来自亚马逊。

分析公司 GWS 收集的数据显示,近几个月来,亚马逊用户数量出现了 “显著下降”,今年 4-7 月份,亚马逊美国的日用户数量从 5400 万降至 4600 万。

另据研究公司 Insider Intelligence 数据,亚马逊在美国电商市场份额约为 38%,且已经保持这一水平多年。

巨头停滞不前,正是新玩家们的机会。

现在还很难超越亚马逊

亚马逊前高管、加州大学伯克利分校经济学教授 SteveTadelis 认为,和亚马逊不同的是,Temu 和 Shein 并不追求两天送达或更好的客户服务。它们似乎专注于低端市场,即那些愿意等待廉价商品的消费者。

Temu、Shein 两家电商平台和亚马逊有着显著的差异。最大的差异就是它们不需要像亚马逊那样囤货。因为所有的商品都是从中国发出的,需要至少一周或更长时间,才能送到美国消费者手里。

而扎根于美国的亚马逊,则花费了大量成本组建了遍布全美的物流和仓储系统,以确保配送效率。平价电商平台 Temu 和 Shein 基本不可能效仿,也无法效仿,它们唯一的武器就是低价。

但低价已经有足够的杀伤力。据媒体报道,亚马逊内部的高管们一直在紧张地研究对抗 Temu、Shein 的策略。目前,亚马逊网站上提供的比价工具,是不包含这两家平价电商的,可见巨头的一点儿小心思。

不过,尽管增长迅速,Temu 的转化率(即访问网店的用户实际完成购买的比率)仍然低于亚马逊。

Temu 和 Shein 要想在电商领域超越亚马逊,还有很长的路要走。根据 Similarweb 的数据,访问 Temu 的用户中有 93% 也使用亚马逊,而在亚马逊用户中,中有 8% 同时使用 Temu。亚马逊的转化率接近 12%,相比之下,Shein 和 Temu 的转化率只有 5% 左右。

京东、阿里求变 纷纷转向追求低价心智

早在亚马逊之前,中国电商巨头阿里和京东已经感受到百亿补贴的杀伤力了。

根据媒体数据测算,拼多多与抖音电商 2022 年的订单 GMV(销售总额)合计已超过阿里国内电商业务的 50%。在收入侧,2023 年前三个月,拼多多的收入已达到阿里国内电商业务收入的 62%。

上半年马云回归之后,曾召集淘天集团高管开了一次会,会上的核心指令之一就是 “回归淘宝”,即更大的力度扶持中小商家。

多位员工判断,淘宝的流量机制也可能发生变化,从原本向天猫倾斜转回至向淘宝倾斜。

而京东创始人刘强东业直言,低价才是京东的 “大杀器”。

刘强东认为,京东要看到基层消费者的诉求,他们在消费上仍追求产品的极致性价比,千方百计地通过供应链的效率提升去把价格降下来,把服务提上去。

3 月份,京东还直接对标拼多多,上线了自己的百亿补贴计划。