Morgan Stanley shouts "Super Cycle Returns"! Predicts "Oil Price of $150" and foresees "Multiple Energy Crises" in the next decade.

摩根大通预计,到 2030 年全球石油缺口将扩大到惊人的 710 万桶/日,这需要油价大幅上涨。

过去两年,华尔街最大的能源牛市旗手非高盛莫属,他们正确预判了 2022 年的油价史诗级暴涨,但在今年的油价暴跌中,高盛被啪啪打脸,其明星分析师、首席大宗商品策略师 Jeff Currie 更是黯然离职。

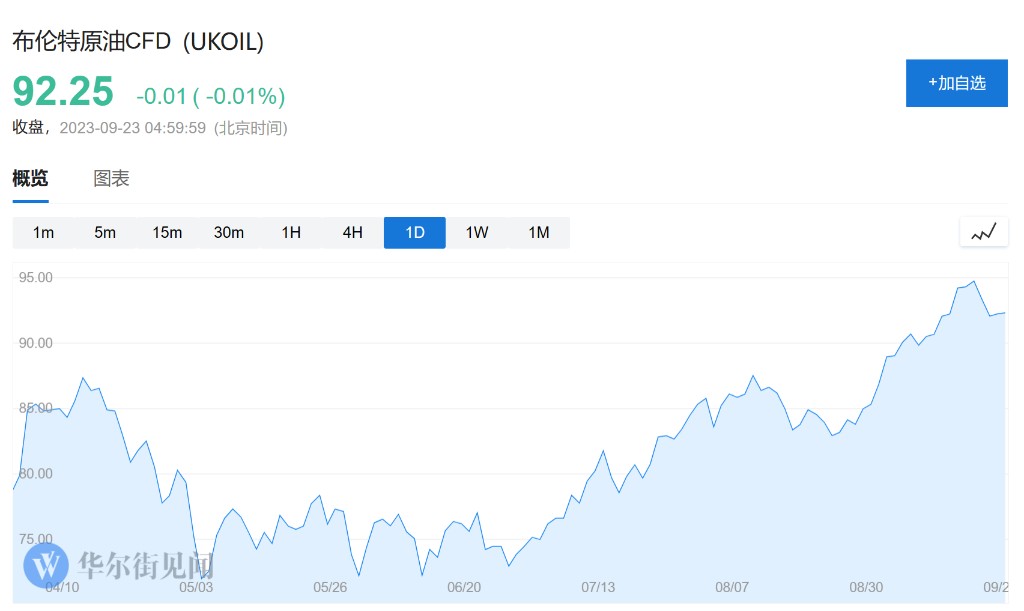

但随着油价从年中低点反弹 30%,摩根大通决定重新站出来,从高盛手中接过 “牛市旗手” 的接力棒。

摩根大通能源分析师 Christyan Malek 在隔夜发表的报告中写道,其 “超级周期” 系列报告强势归来。摩根大通在 2013-2019 年期间一直看跌油价,随后于 2020 年推出了 “超期周期” 系列报告。今年以来,这家华尔街大行一直处于观望状态。

鉴于石油行业投资逐渐枯竭,光是绿色能源难以满足全球能源需求,Malek 预计,短期或中期内,油价可能会升至 150 美元/桶,比布油当前的价格高出 62.6%,预计到 2030 年全球石油缺口扩大到 710 万桶/日。

Malek 表示:

我们去年 12 月策略性地做空,在 4 月获利了结,并从那时起保持中立。虽然自 6 月以来油价大涨 (油价上涨 30%,欧洲斯托克 600 石油和天然气指数 SXEP 上涨约 10%),但能源股票一直落后。

我们再次看好全球能源综合市场,重申 80 美元/桶的长期目标油价,并重申我们在 “超级周期 IV” 报告中的观点,即短期至中期,油价可能会升至 150 美元/桶,长期为 100 美元/桶。

Malek 解释称,支撑油价上涨的主要因素是:

更长期高息的利率前景减缓了资本流入新供应;

股权成本上升推动布伦特原油现金盈亏平衡点超过 75 美元/桶(回购后),因为公司在结构上向股东返还更多现金,反过来又推高了石油的边际成本;

体制和政策导向压力加速了向绿色能源的过渡和需求见顶恐慌。

总而言之,结论是是一个自我强化的 “更长期高息” 前景下的能源宏观展望,因为行业难以证明 2030 年之后大规模投资的合理性。

摩根大通预测,2025 年石油市场供需缺口为 110 万桶/日,到 2030 年则扩大到 710 万桶/日,这既是对需求前景的乐观预期,也是对供应的悲观预测。

而每天 700 万桶的惊人短缺,将需要油价不仅要上涨,而且要大幅上涨。

全球能源股还有上行空间?

回到报告,摩根大通接着提到全球石油市场已从风险 “折价”(需求) 转变为风险溢价 (较低超配产能/上升边际成本),即风险从需求端转向供应端。

我们的分析显示,石油市场的供需缺口只能依靠沙特的闲置产能 (以及其他海湾产油国在较小程度上) 来满足,这使其能够在 2025-2030 年期间满足创纪录的约 55% 的边际需求增长,相比之下 2005-2018 年平均为 18%。

我们估计,OPEC 增加产量和耗尽其闲置产能 (约 420-430 万桶/日;沙特 320 万桶/日) 可能会带来约 20 美元/桶的风险溢价,而我们的长期油价预期为 80 美元/桶 (相比之下,后端曲线涨幅约 18%)。

此外,公司现金收益不仅支撑着长期 80 美元/桶的价格,而且表明大型能源公司支付资本支出、股利、债务和现金回报的所需油价继续呈上升趋势。

Malek 将全球能源股的评级上调至 “增持”,主要原因如下:

更积极的宏观前景 (我们更偏好石油而非天然气,因为前者具有结构性利好特征和 OPEC 减缓的较低波动性);

企业现金实际收支平衡(与远期相比),意味着 2024 年自由现金流收益率(FCF 收益率)约为 12%,油价若达到 100 美元/桶,FCF 收益率升至 15% 左右;

每股收益(EPS)的上行风险。按 MTM 计算,我们的 2024 年预期比市场高约 10%,而在 1 月份,我们的预期约 10%;

现金回报率>30%,支撑了相对于市场而言具有吸引力的估值;

如果全球库存继续下降、油价上涨,OPEC 可能会在未来 12 个月增加产量。从历史上看,这对能源股有利,因为它通常意味着基本面 (需求) 正在改善。能源股往往跑赢大盘,并在产量增加时与油价出现正向脱钩。

我们注意到,尽管自 6 月沙特启动 100 万桶/日的减产计划以来,油价上涨 30%,但股票只上涨约 10%,即负向脱钩。

系好安全带,未来十年或出现 “多次能源危机”

尽管看好油价,Malek 仍向基本面投资者发出了一个重要信号——“系好安全带”。

虽然我们认为该行业处于结构性牛市,油价应该正常化走高,但我们预计油价和能源股票将在更宽的价格范围内交易,较高 “加权平均资本成本”(WACC)以及围绕 ESG/需求见顶的担忧可能加剧油价的波动性。

我们建议,未来几年采用绝对价格修正( absolute price corrections),利用这些时机在综合能源市场中建立方向性多头头寸,尤其是石油贝塔系数较高的股票。我们承认与全球衰退等因素相关的下行风险。然而,在这种情况下,供需基本面仍然紧张,能源板块应该跑赢股市大盘。

重要的是,如果出现需求冲击,我们认为 OPEC 可以进一步削减产量以帮助稳定油价。此外,由于股票估值面临 “更长期高息” 带来的风险,我们认为,当整体股市下跌时,能源行业通常表现优于大盘,因为该行业可作为宏观对冲通胀、利率和地缘政治风险的工具。

最后,我们认为全球经济能够承受三位数的名义油价,因为按实际价格计算,油价仍低于 2008 年和 2011 年的峰值,也低于 “需求破坏区”(即石油在全球 GDP 中的比重>5%,而目前仅约为 2.5%)。

针对电动汽车兴起对化石燃料的威胁反复引发的石油需求见顶问题,摩根大通嗤之以鼻:

我们认为,我们的投资期限(2030 年)内,石油需求不会出现见顶,因为需要大量燃料来补充我们全球能源展望中提到的 11EJ 能源赤字。

由于供应链、基础设施和关键材料瓶颈,清洁能源系统在接下来的十年中还无法走向足够成熟,捕获技术不够完美,也无法向最终客户输送足够多的 “清洁” 电力。因此,这对传统燃料施加了更大的压力,以填补缺口并满足新兴市场带动的不断增长的需求。

Malek 警告称,如果不增加石油和天然气资本支出,全球仍将面临能源短缺和整个大宗商品大幅涨价的风险。这可能会在未来十年内,多次引发石油为主导的能源危机,可能比去年欧洲爆发的天然气危机严重得多。

此外,它还有助于使 OPEC 牢牢掌握全球石油市场的方向盘,在需求增长中占据更大份额,同时有助于缓解油价急剧波动。