Worries about the Federal Reserve raising interest rates caused the Nasdaq to drop 1%, while Apple and Nvidia both saw a 3% decline. Additionally, oil prices continued to rise, reaching their highest level in nearly ten months.

美國 8 月 ISM 服務業指數意外升至半年新高,又有美聯儲官員支持必要時進一步加息,市場對 11 月加息的預期升温。布油連續兩日收於 90 美元,通脹反彈擔憂未減,兩年期美債收益率重上 5%,歐美 10 年期基債收益率齊創兩週最高,均壓低風險資產。道指再跌 200 點,納指跌 1%,蘋果跌幅一個月最深,特斯拉跌 4.5% 後跌幅砍半。中概指數盤初逆市走高後轉跌,進一步脱離三週高位,但瑞幸咖啡再漲約 5%。美元指數一度突破 105 站穩近六個月最高,離岸人民幣最深跌 240 點並跌穿 7.32 元。現貨黃金跌穿 1920 美元至一週最低,倫銅跌 1.4% 徘徊兩週低位。

美國 8 月 ISM 服務業指數超預期升至 54.5 的半年新高,連續八個月擴張,就業指數升至 2021 年 11 月來最高,新訂單指數也創六個月新高,但反映通脹的支付指數創四個月最高。

有分析稱,該數據突顯美國消費者需求和整體經濟韌性,提升了避免衰退的概率,但服務供應商的成本壓力上升或導致通脹長期處於高位,貨幣市場對美聯儲 11 月加息的押注升温。

同時,“軟數據” 美國 8 月 Markit 服務業 PMI 終值意外下修至 50.5,創今年 1 月以來新低,其中的價格支付指數創 2 月來最低,Markit 綜合 PMI 終值下修至 50.2,也創 2 月份來最低。

反映各地區經濟狀況的美聯儲褐皮書稱,美國經濟活動在 7 至 8 月 “温和增長”,消費者的旅遊支出超預期,調查期內的就業增長受到抑制,多個地區物價上漲速度整體放緩。

美國參議院確認 Philip Jefferson 出任美聯儲 “二把手” 副主席的提名,他自加入美聯儲理事會以來對每一次利率決定都投票支持,6 月暫不加息前他曾作出可能暫停加息的暗示。

前美聯儲大鷹派、曾任聖路易斯聯儲主席的布拉德預計年內再加息一次。2025 年票委、波士頓聯儲主席柯林斯稱,可能非常接近或已達到利率峯值,但尚未能控制通脹,需耐心評估數據,可能有理由進一步收緊政策。有分析稱,柯林斯支持 9 月暫停加息,市場對後者給出 91% 的概率。

荷蘭與斯洛伐克央行行長均支持歐洲央行 9 月加息,德國和法國央行行長也稱不能排除這種可能性。但意大利央行行長呼籲已接近可以停止加息的利率水平。市場預計 9 月 14 日歐洲央行加息 25 個基點的概率約為 40%,幾乎較上週押注翻倍。

此前因數據顯示歐元區經濟惡化,投資者一直避免增加對歐央行加息的押注。週三的歐央行調查稱,消費者未來三年通脹預期從 6 月份的 2.3% 升至 7 月份的 2.4%,高於央行目標。德國 7 月工廠訂單環比驟降 11.7%,遠遜預期的降幅 4%。德國智庫警告該國今年經濟萎縮或惡化至 0.5%。

加拿大央行按兵不動,維持關鍵利率在 5% 的二十二年高位且符合預期,但決議聲明援引通脹黏性擔憂稱 “準備好再次加息”,加債收益率短線拉昇,但加元兑美元回落。

據央視,歐盟公佈最嚴行業監管《數字市場法案》,亞馬遜、蘋果、谷歌、Meta、微軟和字節跳動等被列為處於絕對壟斷地位的科技巨頭,將承擔不得濫用市場支配地位打壓或併購競爭對手、與競爭對手建立鏈接等義務,否則將面臨最高營業額 10% 的罰款。

道指再跌 200點,納指跌 1%,蘋果跌 3.6%,英特爾跌 3%,特斯拉跌 4.5%後跌幅砍半

9 月 6 日週三,美股連續兩日集體低開低走,並於午盤刷新日低。道指最深跌 350 點或跌 1%,納指開盤一小時便跌 1%,午盤時跌幅擴大至 1.6% 並領跌主要指數。標普 500 大盤也一度跌超 1%,信息技術和非必需消費品類股表現不佳,特斯拉、蘋果和英偉達等熱門科技股盤中齊跌超 3%。

有分析稱,油價連漲兩週加劇通脹擔憂,8 月美國 CPI 或更加火熱,美聯儲距離結束加息週期還有更長的一段路要走。因此,“高油價加劇美債拋售,推高了美元,還砸了美股的盤”。

尾盤時美股跌幅小幅收窄,道指創 8 月 25 日以來的近兩週低位,標普、納指、納指 100 和羅素小盤股均創 8 月 28 日以來最低,納指失守 1.4 萬點整數位,納指 100 無緣五週新高:

標普 500 指數收跌 31.35 點,跌幅 0.70%,報 4465.48 點。道指收跌 198.78 點,跌幅 0.57%,報 34443.19 點。納指收跌 148.48 點,跌幅 1.06%,報 13872.47 點。納指 100 跌 0.9%,羅素 2000 小盤股指數跌 0.3%。“恐慌指數” VIX 收漲 3.21%,報 14.46。

標普 500 指數收盤跌穿 50 日均線,美股主要指數本週累跌 標普 11 個板塊普跌,信息技術/科技板塊收跌 1.4%,可選消費跌近 1%,電信服務跌 0.5%,能源板塊則漲 0.14%。

明星科技股齊跌但尾盤跌幅收窄。元宇宙” Meta 跌 0.3% 脱離三週高位;蘋果跌 3.6% 創一個月最差表現,特斯拉跌 4.5% 後收跌 1.8%,均偏離一個月高位;被歐洲監管法案點名的亞馬遜跌 1.4%,谷歌 A 跌 1%,微軟跌 0.2% 脱離五週新高;奈飛跌 0.7% 脱離一個半月最高。

芯片股同樣尾盤跌幅收窄。費城半導體指數跌近 2% 後收跌 0.8%,脱離上週五所創的一個月高位。將參加花旗集團全球科技會議的英特爾跌近 2% 後轉漲 0.7%,創 13 個月最高,AMD 跌超 1% 脱離三週最高,英偉達跌 4% 後收跌 3%,至一週半最低,遠離上週所創的收盤歷史最高。

AI概念股多數回調。Palantir Technologies 漲 0.6%,SoundHound.ai 連續兩日均跌 2% 至一週多低位,BigBear.ai 跌超 5% 後收跌超 1%,脱離三週高位。C3.ai 公佈財報前微漲,盤後跌 8%,稱將推遲實現盈利,讓投資者質疑該公司是否抓住 AI 熱潮。

消息面上,特斯拉官微稱,上海超級工廠第 200 萬輛特斯拉整車下線,但警告由於全球計劃關閉工廠,三季度汽車產量和交付量均將下滑,觸發利潤率擔憂。高通首席執行官預言人工智能為智能手機創造新的升級週期,10 月其 Snapdragon 峯會或帶來移動技術的重大發展。

熱門中概盤初逆市走高,最終追跌美股大盤。ETF KWEB 漲 1.6% 後微跌,CQQQ 漲 0.8% 後轉跌 0.2%,納斯達克金龍中國指數(HXC)漲 1.3% 後轉跌 0.5%,失守 7100 點,進一步脱離三週高位。

納斯達克 100 成份股中,京東跌 1.4%,百度跌 0.5%,拼多多漲 0.5%。其他個股中,阿里巴巴跌 0.2%,騰訊 ADR 跌 0.4%,B 站漲近 1%,蔚來汽車跌 2%,理想汽車漲 0.2%,小鵬汽車漲 1%。法拉第未來跌超 18% 至歷史最低。瑞幸咖啡漲 4.6%,昨日收漲 5%。

地區銀行股指跌 2.3%至兩週最低。行業基準費城證交所 KBW 銀行指數(BKX)跌 1.4% 至一週半最低,5 月 4 日曾創 2020 年 10 月以來最低。KBW 納斯達克地區銀行指數(KRX)5 月11 日曾創 2020 年 11 月來最低;SPDR 標普地區銀行 ETF(KRE)5 月 4 日創 2020 年 10 月來最低。

“美國四大行” 尾盤跌幅收窄,花旗銀行轉漲,美國銀行和富國銀行跌幅砍半至 1%。重點地區銀行跌幅更深,阿萊恩斯西部銀行(Western Alliance Bancorp)跌近 5%,Zions Bancorporation 和 Keycorp 跌超 3%,西太平洋合眾銀行(PacWest Bancorp)跌超 1%。

其他變動更大的個股包括:

“散户抱團股” AMC 院線跌近 37%,跌穿 10 美元至歷史最低,並創 2021 年 2 月以來的兩年半最大單日跌幅,計劃增發最多 4000 萬股籌資。

流媒體 Roku 一度漲超 14% 至一個月高位,將裁員 10%、整合辦公空間並提升第三季度收入指引。

共享辦公巨頭 WeWork 漲近 17% 後轉跌超 4%,徘徊歷史最低,將重新談判幾乎所有辦公室租賃合約,並關閉表現不佳的空間。

美國西南航空最深跌超 3% 至三個月最低,下調第三季度收入指引,預計燃油成本高於預期。

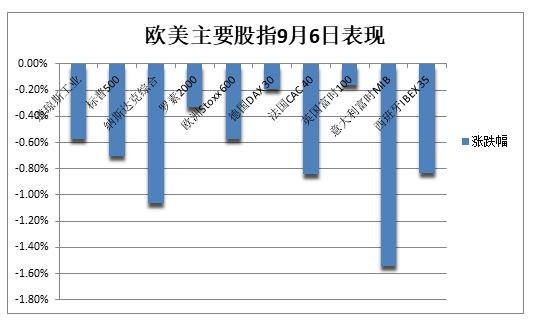

歐股普跌,昨日逆市微漲的意大利股指跌 1.5% 領跌主要國家指數。泛歐 Stoxx 600 指數收跌 0.57%,連跌六日,家居用品板塊跌超 2% 領跌大盤,銀行股跌 1.5%,意大利銀行指數則跌超 3%。

兩年期美債收益率重上 5%,歐美 10年期基債收益率齊創兩週最高

美債收益率再度集體走高。對貨幣政策更敏感的兩年期美債收益率最高上行 7 個基點,重上 5% 關口,收復上週二以來全部跌幅。10 年期基債收益率最高上行近 4 個基點並一度上破 4.30%,創 8 月 23 日以來的兩週高位。有分析稱,美債價格也受本週發行近 370 億美元公司債券的打壓。

通脹恐慌和 9 月加息可能性重燃和也令歐債收益率再創兩週高位。歐元區基準的 10 年期德債收益率尾盤升 4 個基點,連漲四日,與漲超 6 個基點的負債較深外圍國家基準 10 年期意債收益率齊創 8 月 22 日以來最高。兩年期德債收益率漲約 8 個基點,但兩年期英債收益率跌超 3 個基點。

油價刷新近十個月最高,美油 WTI期貨漲近 1%,布油連續兩日收盤站穩 90美元

油價在美股盤中轉漲,重新刷新去年 11 月中旬以來的近十個月最高。WTI 10 月原油期貨收漲 0.85 美元,漲幅 0.98%,報 87.54 美元/桶,盤中最高漲 1.3%。

布倫特 11 月期貨收漲 0.56 美元,漲幅 0.62%,報 90.60 美元/桶,連續第二個交易日收於 90 美元整數位心理關口上方,日高再度上逼 91 美元,盤中最高漲 1%。

即月布倫特原油期貨相對於六個月期貨的溢價升至每桶 4.13 美元,即月 WTI 相對於六個月期貨的溢價擴大至每桶 4.88 美元,均徘徊九個月最高,反映出近期供應擔憂。

但有分析稱,美國煉油廠進入 9 月至 10 月的維護期將令需求下降,伊朗、委內瑞拉和利比亞潛在的供應增加,以及計價貨幣美元持續走高,都會給後續油價造成壓力。

歐洲基準的 TTF 荷蘭天然氣,以及 ICE 英國天然氣期貨尾盤均跌超 10%,昨日齊漲超 4%。雪佛龍與澳大利亞工會的合同談判延長一天,澳大利亞兩個 LNG 終端的工人罷工計劃將暫停至週五。

美元轉漲站穩近六個月最高,離岸人民幣最深跌 240點並跌穿 7.32元

美國 ISM 服務業數據超預期之後,衡量兑六種主要貨幣的一籃子美元指數 DXY 在美股盤中轉漲,最高漲 0.2% 並一度升破 105 關口,連漲四日,刷新 3 月中旬以來的近六個月盤中最高。

有分析稱,除了與美聯儲在更長時間內保持更高利率的市場預期有關,美元也部分受益於擔心歐洲等全球其他經濟體增長不振的避險需求。

歐元兑美元小幅上漲並站穩 1.07 上方,英鎊兑美元最深跌 0.6% 並一度失守 1.25,均徘徊三個月最低。昨日跌超 1% 的澳元小幅轉漲,脱離十個月低位。

日元兑美元繼續下跌至十個月最低,但稍早一度上漲且上逼 147 關口,日本政府官員談及干預匯市的可能性。離岸人民幣跌穿 7.32 元,較上日收盤最深跌近 240 點,刷新兩週最低。

主流加密貨幣普跌。市值最大的龍頭比特幣跌 0.4% 並失守 2.57 萬美元,刷新 6 月中旬以來的兩個半月最低。第二大的以太坊跌 0.8% 並下逼 1620 美元,至近六個月最低。

現貨黃金跌穿 1920美元刷新一週最低,倫銅跌 1.4%徘徊兩週低位

美債收益率和美元攜手上漲再度壓低金價。COMEX 12 月黃金期貨收跌 0.43%,報 1944.20 美元/盎司,昨日跌 2.8% 的期銀再跌 1.5%,均連跌兩日。

現貨黃金最深跌近 11 美元或跌 0.6%,失守 1920 美元整數位,連跌五日並抹去上週二以來全部漲幅。現貨白銀連續兩日均跌 2%,並下逼 23 美元關口至兩週新低。

對全球經濟增長的擔憂和美元走高,打壓倫敦工業基本金屬價格。經濟風向標 “銅博士跌超 110 美元或跌 1.4%,失守 8400 美元,徘徊兩週低位,8 月中旬曾創兩個半月最低下逼 8100 美元。

倫鋁收平且持續不足 2200 美元,至近一週低位。倫鋅脱離一個月高位,倫鉛進一步脱離上週所創的七個多月新高。倫鎳跌超 2% 並失守 2.1 萬美元至月內最低,倫錫跌 0.7% 脱離四周高位。