Dell soared 20% and its stock price reached a new high, as the PC giant also jumped on the AI bandwagon.

戴尔对 AI 相关业务的部署,已开始逐步在财报上体现,PC 市场或许有望在 AI 的加持下开始复苏,天风国际分析师郭明𫓹直呼,在 AI 算力成长爆发之际,戴尔将成为被低估的受惠者。

戴尔第二财季业绩、下季度指引均大超预期,傲人的业绩让市场 “切身体会” 到,把握 AI 风口后,PC 巨头会有多 “疯狂”。

9 月 1 日周五,戴尔股价暴涨超约 21%, 至 68.19 美元,刷新历史新高,今年以来戴尔股价已涨超 67%。分析师认为,无疑隔夜公布的亮眼的财报起到了一定提振作用,但更需要注意的是,过去几个月,戴尔对 AI 相关业务的部署,已开始逐步在财报上体现,PC 市场或许有望在 AI 的加持下开始复苏。

财报显示,戴尔第二财季收入下降 13%,至 229 亿美元,高于市场预期的 208 亿美元;调整后每股净利润为 1.74 美元,高于市场预期的 1.14 美元。

拆分业务来看,第二财季戴尔计算机业务的收入同比下降 16%,至 129 亿美元,超出市场预期,该部门在消费者和企业中的销售业绩也好于预期;服务器和网络业务收入下降 3%,至 42.7 亿美元,依然超出分析师预测。

戴尔预计第三财季营收将在 225 亿美元至 235 亿美元之间,高于市场预测的 216.7 亿美元。对于 2024 财年,戴尔上调全年营收指引至 895 亿美元至 915 亿美元。分。

戴尔科技集团副董事长兼首席运营官 Jeff Clarke 表示:“AI 已经表现出了长期的推动力,将助力我们的产品组合需求持续攀升。”

分析师普遍认为,AI 对戴尔业绩的加持已经开始在服务器和网络业务方面显现,随着更多 AI 功能融入 PC,预计明年 AI 业务将继续对 PC 产生积极影响。

天风国际分析师郭明錤更是直呼,长尾效应与边缘云计算将成为 AI 算力爆发式增长的两个关键因素,而在这之中,戴尔将成为被低估的受益者。

AI 或成为戴尔业绩的长期推动力

戴尔正在 AI 领域不断探索,希望为各大尝试运用 AI 的公司提供更快的基础设施硬件和解决方案。

戴尔的两个主要业务为基础设施解决方案集团(ISG)和客户解决方案集团(CSG)。其中,ISG 专注于企业级基础设施解决方案,CSG 专注于消费者和企业客户的计算设备。

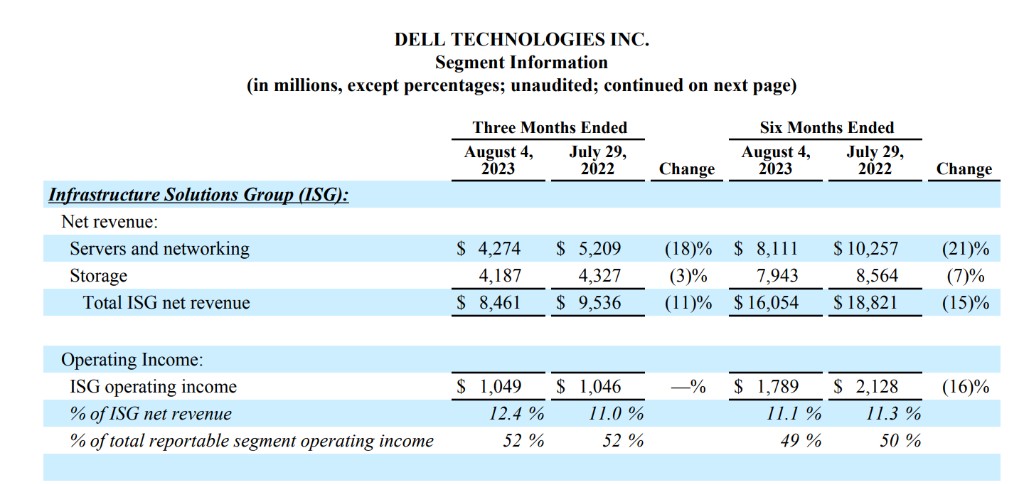

在第二财季,ISG 实现营收近 85 亿美元,同比下降 11%,但环比上涨 11%。其中,存储收入为 42 亿美元,中档存储阵列产品 PowerStore 的需求持续增长,而软件定义存储产品 PowerFlex 也已经连续八个季度实现需求增长,第二季度需求同比翻番。

服务器和网络收入为 43 亿美元,对 AI(人工智能)优化服务器的需求继续增长。营业利润为 10 亿美元,约占 ISG 营收的 12.4%。

另一方面,CSG 实现营收 129 亿美元,同比下降 16%,环比增长 8%。商业客户收入为 106 亿美元,为了帮助组织在本地运行复杂的 AI 工作负载,对工作站的需求持续增长。消费者收入为 24 亿美元。营业利润为 9.69 亿美元,约占 CSG 营收的 7.5%。

Jeff Clarke 表示,AI 已经成为了一个 “长期助推因素”,在戴尔的产品组合中对 AI 的需求持续增长。公司继续专注于市场中利润最高的几个领域,保持在这些领域中的领先地位。

今年 5 月英伟达与戴尔合作推出 Project Helix,开发集成 AI 服务,被称为戴尔生成式 AI 解决方案,该项目涉及与英伟达的深度整合,涵盖 IT 基础架构、PC 和专业服务,采用具有大型语言模型(LLM)的全栈 GenAI,旨在满足 GenAI 开发过程中的所有需求。

就在一个月前,戴尔宣布将联手英伟达,全力开发生成式 AI,作为 Project Helix 的扩展,公司与英伟达合作推出新的戴尔生成式 AI 解决方案,提供帮助企业在本地构建生成式 AI 模型的工具。

这项服务如今已经落地,另据媒体援引供应链消息称,戴尔今年 AI 服务器备货量或将高达 2 万台,明年还会继续增长。

郭明錤认为,Nvidia 与戴尔合作共同满足长尾效应和边缘计算的需求还有一个好处,那就是在向主要 PC 制造商分配更多 AI 芯片的同时,要求 PC 制造商帮助销售 PC 和笔记本电脑显卡。在 AI 芯片供应紧张而 PC/笔记本电脑显卡库存偏高的时候,这种紧密合作可以创造双赢。

Clarke 指出,PC 端的边缘 AI 应用非常重要,可以称其为 “杀手级” 应用程序,它将推动生产力的提升,每当市场看到能在 PC 端推动生产力的新应用程序时,市场都会反弹:

今年年底我们将推出带有 CoPilot 的新版 Windows,所有人都希望能拥有支持人工智能的 PC。

如果你想要求你的 PC 完成更多认为,通常意味着它需要更强大的 CPU、更多内存、更多存储空间、更好的显示器等等,这也是提高平均销售价格(ASP)的另一种方式。