Credit Suisse's First Earnings Report After Finalizing the Acquisition: Net Profit in the Second Quarter Reaches the Highest in Banking History | Earnings Report Insights

得益於收購瑞信帶來的 289 億美元負商譽 “會計增厚”,瑞銀二季度淨利潤 288.8 億美元,創下歐美銀行業的同期利潤紀錄。在 “歷史性” 財報的提振下,瑞銀歐股最高漲超 7% 至 2008 年金融危機以來的十五年最高。瑞銀旗艦業務全球財富管理繼續大力 “吸金”,瑞信淨資產流出改善,華爾街叫好聲一片。

8 月 31 日週四,瑞士最大的銀行瑞銀 UBS 公佈了收購競爭對手瑞士信貸以來的首份財報。為了制定對瑞信的整合計劃,財報被推遲五週發佈,瑞銀近期也在情理遺留的法律和監管糾紛。

得益於 289億美元負商譽的 “會計增厚”,瑞銀二季度淨利潤打破歐美銀行業史上紀錄

財報顯示,截至 6 月的今年二季度,由於收購瑞信產生了 289.3 億美元的負商譽,瑞銀的淨利潤高達 288.8 億美元,超越美國資產值最大銀行摩根大通在 2021 年一季度 143 億美元的利潤數據,成為歐美銀行業有史以來最高的季度利潤紀錄。

負商譽實際起到了會計收益增厚的效果,反映出被收購方瑞士信貸的資產賬面公允價值,與瑞銀花費 30 億瑞士法郎(約合 34 億美元)折扣收購價之間的差額。在扣除負商譽的收益增厚、業務整合相關費用和收購成本後,瑞銀二季度的基本税前利潤為 11 億美元。

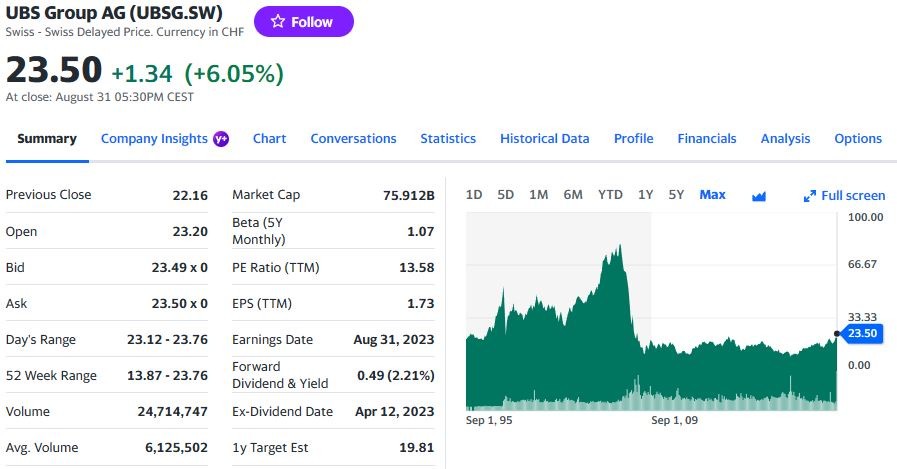

有分析指出,華爾街原本預期負商譽為瑞銀帶來的收益會更高至 330 億美元,但瑞信今年出現了虧損,瑞銀還對瑞信部分不符合前者發展戰略的資產進行了減記。但瑞銀淨利潤已較市場預期的 128 億美元翻倍,其歐股最高漲超 7% 至 2008 年金融危機以來最高,今年累漲近 40%。

在瑞銀髮布二季報的同時,成為瑞銀子公司的瑞士信貸也發佈了其作為獨立實體的最後一份財報,今年二季度税前虧損 93 億瑞郎,淨資產流出 392 億瑞郎但速度放緩,管理資產規模因客户和員工的大規模外流而下降了 3%,這表明在 3 月危機之前幾近崩潰的信心喪失尚未得到扭轉。

瑞銀明年起全面整合瑞信的瑞士銀行業務,而非坊間猜測的分拆後獨立上市,或引發爭議

瑞銀表示,將於 2024 年整合曾為瑞士信貸核心利潤來源的瑞士銀行業務,由於國內業務部分重合將在瑞士裁員 1000 人,預計 2026 年基本完成對瑞信所有業務的 “全面整合”,目標是節省至少 100 億美元總成本,並涉及在瑞士進一步裁員 2000 人,國際其他裁員人數未知。

此前有報道稱,收購瑞信令瑞銀的員工人數增加至約 12 萬,該銀行計劃最終裁員約 30%。有分析師認為,瑞銀將利用不同的裁員方式,儘量不引起瑞士民眾反感,但顯然對投資者來説是積極的。瑞銀 CEO 埃爾莫蒂稱,3000 人中的大部分裁員將由員工退休或離開組成,而不是被替換。

還有分析稱,瑞信的旗艦瑞士銀行業務是 2022 年唯一一個仍能產生正收益的部門,也成為本次收購的政治與民眾輿論焦點,畢竟這是首次有兩傢俱有全球系統重要性的金融機構合併,且瑞信擁有 167 年曆史的品牌形象可能會被逐步取消。

曾有人猜測瑞銀會將瑞信的瑞士銀行業務分拆並獨立 IPO 上市,但瑞銀在本月初選擇主動終止超過 1000 億瑞郎的瑞士政府與央行流動性和損失保護支持,便是為整合、而非拆分瑞信的國內銀行業務鋪路。瑞銀 CEO 也稱,這是對瑞銀、利益相關者和瑞士經濟來説最好的結果。

瑞銀二季度 CET1比率改善,全球財富管理吸引資金 160億美元,瑞信的淨資產流出改善

財報還顯示,瑞銀二季度衡量銀行流動性與償付能力的指標——普通股一級資本(CET1)比率從上年同期的 14.2% 增至 14.4%,也高於今年一季度的 13.9%。不包括負商譽、整合相關費用和收購成本的有形股本回報率為 4.3%,CET1 槓桿率為 4.8%,而一年前為 4.4%。

當季合併後的集團存款淨流入 230 億美元,其中 180 億美元來自瑞信的財富管理和瑞士銀行部門。瑞銀的旗艦業務全球財富管理部門吸納了 160 億美元的淨新資金,創十多年來第二季度淨流入的最高水平,但低於今年一季度的 280 億美元淨新資金流入。

瑞銀強調,瑞士信貸去年出現的大規模淨資產和存款外流終於開始扭轉,淨資產流出在二季度有所放緩,並在 6 月份完成收購後轉為正數。該行看到客户活動有所回升,預計新資產流入將繼續。瑞銀將致力於保留儘可能多的瑞士信貸客户,以便令大規模合併能夠長期發揮作用。

瑞銀 CEO 表示,瑞銀和瑞信在二季度和三季度迄今的存款流入均有所增加,這證明客户 “保持忠誠度”:

“瑞士信貸在 2022 年和 2023 年的困難時期流失了約 2000 億美元,現在我們看到其中一些資金正在重返,我們的目標是盡力挽回儘可能多的資金,當然這並不容易。”

最新業績還顯示,瑞銀的財富管理利潤在二季度同比下降 4%,零售和企業銀行利潤增長 54%,資產管理利潤下降 91%,主要由於去年出售一個基金經理的股份所致,投資銀行利潤下降了 66%。

瑞銀稱,將關閉瑞士信貸三分之二的投資銀行業務,包括幾乎全部交易業務,以便退出不符合其現有戰略的業務,瑞信境況不佳的財富管理和資產管理部門非核心業務也將被進一步削減。

瑞信 CEO 在接受多方媒體採訪時表示:

“現在沒有懷舊的餘地了,我們正在執行全面整合瑞信業務的戰略,並取得了非常好的進展。”

整合瑞信的瑞士銀行業務時,客户將繼續獲得他們期望的優質服務,並受益於合併後集團增強的產品、專家能力和全球影響力。我們更強大的資本基礎將保持合併後的貸款敞口不變,同時保持風險紀律。

龐大的負商譽是維持 2400 億美元風險加權資產所需的股本,也是瑞信進行深度重組所需的財務資源。瑞信擁有優秀的人才、客户和產品能力,但其商業模式已不再可持續,需要進行重組。”

華爾街看好瑞銀收購瑞信後的業務穩定速度更快,但警惕全面整合歷程複雜且不平坦

分析師普遍看好瑞銀收購瑞信後的 “業務穩定速度比預期要快”。資管機構 Lakefield Partners 的合夥人 Bruno Verstraete 稱瑞銀二季度淨利潤為 “千載難逢的歷史性數字”,並稱好消息是 “(業績)企穩正在到來,情況似乎已得到控制,市場降低了對現有及潛在風險的擔憂。”

彭博 BI 高級行業分析師 Alison Williams 認為,瑞銀財報有兩個關鍵數據點表明其成功收購了瑞信:日趨穩定的財富管理部門,以及保留和整合瑞信本土銀行業務的決定,都將令瑞銀能夠利用其在瑞士國內市場不斷擴大的規模和競爭領導地位。

德銀樂觀表示,瑞銀的基礎業務似乎並未受到收購瑞信的影響,處理瑞信的非核心業務也取得了紮實進展,令今年二季度的 CET1 比率強勁且超出預期:

“儘管該集團在短期內仍處於(整合瑞信業務過程中龐雜且忙亂的)建築工地狀態,但一系列利好的財報和公告應該能給中期看漲的場景帶來信心,我們對瑞銀持有買入評級。”

目前,摩根大通、花旗等主流投行也對瑞銀持有增持/買入評級,RBC Capital Markets、Jefferies 等券商評級為 “持有”,意大利投行 Mediobanca 等則評級 “賣出”。

持有買入評級的瑞士私人銀行和投資管理集團 Vontobel Holding AG 強調,瑞銀顯然面臨着重組瑞士信貸、整合關鍵員工、保留客户並將其遷移到自身內部系統,以及解決瑞士信貸的歷史訴訟問題等多方面的艱鉅任務,“這將需要大量的時間和管理層的關注。”