EVERGRANDE temporarily lifts delisting crisis! Application for resumption of trading next Monday, EVERGRANDE's three listed companies will fully resume trading.

恒大称有足够的业务运作和足够资产支持运营,上半年集团总资产约 1.74 万亿元,累计销售回款约 271 亿元,但此前恒大汽车与恒大物业复盘后均股价腰斩。恒大汽车发布财报称上半年减亏 48.6%,净负债降至 328 亿元,完成地产业务剥离降债 431 亿。

8 月 25 日北京时间周五晚,中国恒大发布公告称已完成各项复牌指引,已向香港联交所申请于 8 月 28 日(即下周一)上午 9 点起正式复牌。

有分析指出,中国恒大自 2022 年 3 月 21 日停牌起已过去了 17 个月、超 500 天,根据港交所 “18 个月摘牌” 的制度安排,该公司必须在今年 9 月 20 日之前复牌,否则将从香港退市。

而复牌申请表明,昔日按合同销售额计算曾为中国最大房地产开发商的恒大暂时解除了退市危机,将令恒大系三家上市公司(中国恒大、恒大物业和恒大汽车)实现全面复牌。

恒大称有足够的业务运作和足够资产支持运营,上半年集团总资产约 1.74万亿元

恒大履行的复牌指引包括:公布上市规则规定的所有未公布的财务业绩,并解决任何审计保留意见的事项;对主要附属公司恒大物业 134 亿元的质押担保被相关银行强制执行进行独立调查,公布调查结果并采取适当的补救措施等。

恒大还称,在遵守上市规则第 13.24 条的规定方面,公司认为其有足够的业务运作,并拥有足够价值的资产支持运营。

公告显示,今年上半年,中国恒大实现合约销售额约 334.13 亿元,合约销售面积 511.5 万平方米,累计销售回款约 271 亿元。截至 2023 年 6 月 30 日的集团总资产约为 1.74 万亿元。

公司以稳经营、化风险为第一要务,以最大力度积极推进保交楼工作,实现了 732 个保交楼项目全面复工,去年累计交楼 30.1 万套。中国海南海花岛文旅项目稳步运营,累计接待游客超 760 万人次。截止 2023 年 6 月 30 日,集团拥有土地储备 1.9 亿平方米,还参与了旧改项目 78 个,其中大湾区 55 个(深圳 34 个),其他城市 23 个。

恒大透露,公司目前的营运资金来源主要为各地政府提供的抒困资金借款、项目处置收入、存量的监管资金以及日常经营销售收入等。此外,恒大计划在召开的股东周年大会上修订公司章程,以符合修订后的上市规则附录 3 的规定。

恒大汽车与恒大物业复盘后均股价腰斩,市场关注恒大表现和境外债务重组

据中国基金报等媒体总结,为了顺利复牌,中国恒大在 7 月 17 日一次性补发了 2021 年、2022 年上半年及全年的财报。尽管 2022 年亏损大幅缩减,但恒大在 2021 和 2022 年合计亏损 8120 亿元,截至去年末的负债总额 2.44 万亿元,剔除合约负债后为 1.72 万亿元,总资产约 1.84 万亿元。

就恒大财报,今年 1 月新换的核数师上会佰诚认为,恒大的持续经营存在多项不确定因素等无法发表意见,但财务报表的所有其他方面已遵照相关规定的披露要求进行编制。就上一任核数师罗兵咸永道(即普华永道)在辞任函中提出的多个事项,上会佰诚也采取了各项措施予以解决。

稍早前的 8 月 21 日本周一,中国恒大也发布了内控评估及对前任审计师提出某些问题检讨的主要结果公告,称额外复牌指引要求的内部监控已检讨并基本完善,为周五正式申请复牌铺路。

观察人士普遍担心恒大复牌后的股价表现。停牌约 16 个月的恒大汽车于 7 月 28 日复牌,当日暴跌近 70%,停牌 17 个月的恒大物业于 8 月 3 日复牌,当日跌近 50%。而在停牌前,中国恒大的港股已经跌至 1.65 港元/股,总市值约 218 亿港元。

第一财经认为,跨过复牌大关之后,恒大另一个重要关卡是境外债务重组:

在今年 3 月提出的债务重组方案,7 月时获得香港法院批准,债权人将在 8 月末对离岸债务重组计划进行表决;近期,恒大还在美国破产法院进行了破产保护,以期为离岸债务重组计划的通过创造良好的条件。而境外债权人是否接受该项重组方案,对恒大接下来的命运走向十分关键。

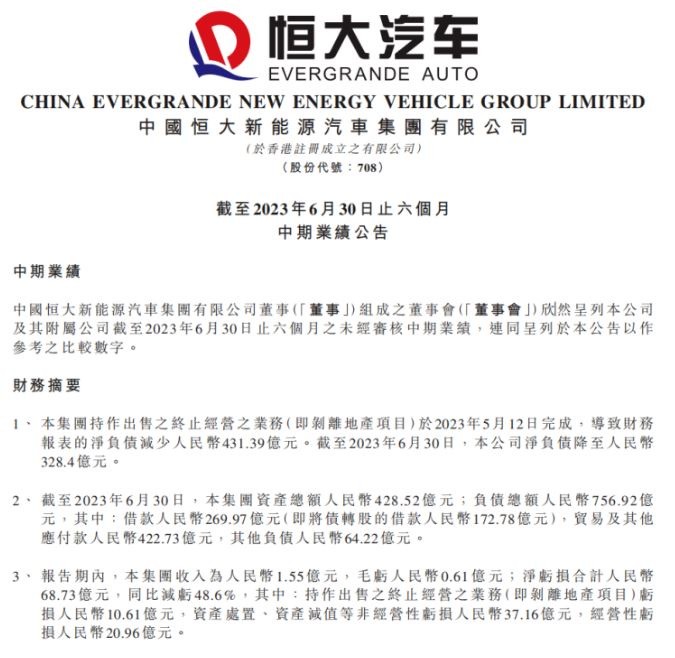

恒大汽车上半年减亏 48.6%,净负债降至 328亿元,完成地产业务剥离降债 431亿

在恒大发布申请复牌公告的同时,旗下电动汽车公司恒大汽车也公布了 2023 年上半年业绩,收入 1.55 亿元,净亏损 68.73 亿元且同比减亏 48.6%,其中属于汽车业务的经营性亏损为 20.9 亿元。截至 6 月 30 日的净负债降至 328.4 亿元,报告期内降债 431 亿元主要归功于完成地产业务剥离。

在 68.7 亿的亏损中,恒大汽车称,已于 5 月 12 日完成的剥离地产项目亏损 10.61 亿元,资产处置、资产减值等非经营性亏损 37.16 亿元,经营性亏损 20.96 亿元。

截至 6 月 30 日,恒大汽车总资产约为 428.52 亿元,负债 756.92 亿元。接下来,恒大汽车将通过债转股减债 173 亿元。在债转股完成后,恒大汽车也将完成化债工作,解决 “资不抵债” 的问题。

上海证券报·中国证券网称,恒大汽车完成了地产业务剥离,降低净负债 431 亿元,并将通过债转股减债 173 亿元。这意味着,恒大汽车不仅已成为一家纯粹的新能源汽车公司,还将减少 600 多亿元的净负债。

同时,收入增加主要由于开始销售恒驰 5,汽车及汽车零部件销售额从上年同期的 0.29 百万元增长至 113.37 百万元,另有 27.98 百万元的技术服务收入。集团继续专注于恒驰 5 的高品质生产和交付,在所有预售订单中超过 760 台于报告期交付,未来将全力推进恒驰 5 的量产及交付。

此前在 8 月 14 日,恒大汽车公告称,获得由阿联酋国家主权基金持股的美股上市公司纽顿集团首笔 5 亿美元战略投资,另有 6 亿元人民币过渡资金将自公告后 5 个工作日开始陆续到账。所有战投资金全部用于恒大汽车天津工厂,确保恒驰 5 的正常生产和恒驰 6、7 的陆续量产。