Global stock markets under renewed pressure: Nvidia's performance and Powell's speech are major events!

BI 统计数据显示,标普 500 指数通常在杰克逊霍尔央行年会后一周上涨;但期权交易员们近期不断增加看跌期权以对冲下跌风险。

在上周,美国经济数据持续强劲、不断扩张的赤字叠加海量的国债发售数量,以及在美联储会议纪要公布后,市场对美联储将长时间维持高利率 (即 “Higher for longer”) 的担忧情绪有所升温,推动有着 “全球资产定价之锚” 之称的 10 年期美国国债收益率升至 2008 年来的最高收盘水平,使得股票等风险资产全线受挫。

从理论层面来看,10 年期美债收益率相当于股票市场中重要估值模型——DCF 估值模型中分母端的 r 指标,分析师们一般以 10 年期美债收益率为基准设定 r 值,在其他指标未发生明显变化的情况下,分母水平越高,股票,尤其是风险较高的科技股等风险资产估值自然也不断坍塌。这一趋势已反映在美股市场,标普 500 指数连跌三周,创下 2 月以来最长连跌周。

在 “全球资产定价之锚” 痛击之下,全球股市在上周可谓经历了今年 2 月以来表现最惨烈的一周,然而交易员们预计股市所面临的重大考验仍未停息。市场在未来几天还将面临一些关键事件带来的冲击,尤其是 “AI 信仰” 的最强支撑力量——AI 芯片巨头英伟达 (NVDA.US) 第二季度业绩,以及受到密切关注的美联储主席鲍威尔 (Jerome Powell) 在杰克逊霍尔全球央行年会上所发表的讲话。

全球投资者聚焦 “AI 信仰” 的最强支撑力量——英伟达

在鲍威尔周五在怀俄明州的美联储研讨会上发表讲话之前,全球投资者们将重点关注 AI 芯片巨头英伟达周三美股盘后 (北京时间周四晨间) 发布的至关重要的业绩报告,以确定市场风险偏好。

这家芯片巨头目前是标普 500 指数 (S&P 500 Index) 的第四大成分股,该公司 5 月份公布的远超分析师预期的第二季度营收展望,彻底点燃了全球市场围绕人工智能 (AI) 的投资狂潮,进而推动标普 500 指数今年迈入技术性牛市,可谓全球 “AI 信仰” 的最核心力量。

在上周,英伟达股价逆势上涨近 6%,年初至今涨幅累计接近 200%,截止上周五收盘为每股 432.99 美元。带动美股,乃至全球股市大反弹的最强推动力——AI 狂潮能否持续,在北京时间周四将揭晓。目前,华尔街对于英伟达业绩抱有极高预期,但如果该公司未能实现预期目标,AI 狂潮之势或将暂时停歇,并给从微软 (MSFT.US)、谷歌 (GOOGL.US) 到 Meta(META.US) 和 AMD(AMD.US) 等科技巨头股价,以及全球股市带来剧烈冲击。

全球企业对于开发类似 ChatGPT 的开发生成式 AI 所需的 GPU 芯片需求大爆发,是英伟达第二季度业绩展望超预期的最重要原因,当时分析师预计 Q2 营收为 72 亿美元,但英伟达表示,该季度将实现约 110 亿美元的营收,较去年同期增长约 64%,华尔街分析师纷纷预计本周将实现这一目标,并且股价还有巨大上涨空间。

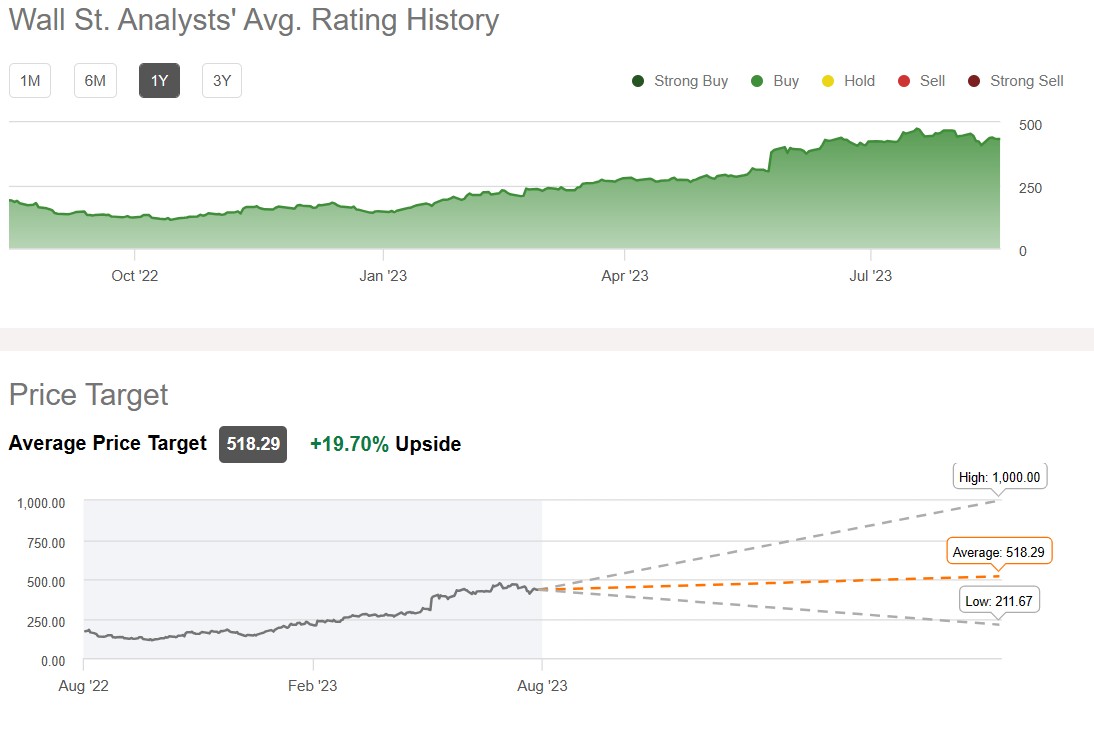

投资研究平台 Seeking Alpha 汇编的预期数据显示,华尔街分析师们予以英伟达的共识评级为 “买入”,平均目标价为 518.29 美元,意味着潜在上涨空间接近 20%。

花旗集团分析师在业绩公布前维持对英伟达的 “买入” 评级,予以 520 美元的目标价。瑞银表示,在该公司于当地时间 8 月 23 日发布第二季度业绩之前,投资者应该 “坚持到底”,瑞银将英伟达的目标股价从 475 美元上调至 540 美元,重申了对英伟达的 “买入” 评级。Baird 表示,英伟达可能会迎来 “另一个超级周期”,而这一次是由人工智能所推动,该机构重申了对英伟达的 “跑赢大盘” 评级,并将目标股价从 475 美元上调至 570 美元。

今年以来一向看好英伟达股价走势的华尔街金融巨头摩根士丹利指出:“我们认为,最近的抛售是一个很好的切入点,因为尽管供应受限,我们仍预计第二季度业绩将大幅增长,更重要的是,未来 3-4 个季度将有强劲的可见性。” 他补充称,英伟达是该机构在半导体领域的首选投资标的。大摩对英伟达的评级为 “增持”,目标价为 500 美元。

英伟达将于美东时间 8 月 23 日公布第二日历季度财报,分析师普遍预计该公司 Q2 营收将达到 110-111 亿美元,每股收益为 2.08 美元。摩根士丹利则预计该季度营收将比预期高出 5 亿至 10 亿美元,主要来自强劲的数据中心业务。展望截至 10 月份的这一季度,摩根士丹利预计英伟达季度营收可能在125 亿至 130 亿美元之间,高于目前 120 亿美元的华尔街共识预期。

“预期管理大师” 会否重设市场预期?

鲍威尔随后为本周画上句号。Bloomberg Intelligence (BI) 汇编的统计数据显示,自千禧年以来,美联储主席在会议上的讲话通常会提振股市,标普 500 指数在接下来的一周平均上涨 0.4%。但去年的情况对交易员来说仍然记忆犹新:BI 数据显示,鲍威尔发表讲话后,美股在一周内下跌了 3.2%,他当时警告称,将保持限制性政策以对抗通胀。

“这可能是他们未来最关注的政策层面:不是将联邦基金利率提高多少,而是在这个水平上维持多久。” 美联储前高级官员布莱恩·萨克 (Brian Sack) 表示。“如果他们愿意的话,以这种方式收紧金融状况仍有很大的操作空间。”

更长时间维持高利率——即 Higher for longer,正成为有着 “预期管理大师” 之称的美联储至少在今年乃至明年年初引导市场定价趋势的口头禅,而不是从自去年开始到今年初期美联储屡次强调的 “现在开始大幅加息”(Much higher rates from here)。如今市场普遍预计美联储加息完结,并且对 “Higher for longer” 的担忧情绪升温——预计高利率将至少持续至明年 3 月。

这一次的风险因素在于,美联储倾向于今年进一步收紧政策,以及高利率维持时间更长的前景。在 “软着陆” 预期全线升温之际,鲍威尔意料之外的鹰派发言可能会影响市场对经济增长的预期。这种情况也会危及华尔街分析师的盈利预期,尤其是对那些高涨的科技股。

杰克逊霍尔模式——美联储主席发表讲话后,美股在接下来一周通常上涨

然而,从长期来看,美联储的利率路径至关重要,2023 年还有三次美联储政策制定会议。在利率市场,交易员们押注下个月暂停加息,11 月加息概率小于 25%。本月公布的 CPI 数据显示,7 月通胀率持续下降,但强劲的零售销售数据也显示,美国消费者仍保持弹性,如果事实证明通胀压力持续存在,这可能促使美联储采取更激进的政策。

随着上周美国股市的抛售势头增强,标普 500 指数自 2 月份以来首次连续三周下跌,投资者对押注更多亏损的期权合约的兴趣也在增加。

根据机构汇编的数据,周四在美国股市交易了超过 2500 万份看跌期权,这是自 3 月份银行业动荡以来的最高水平,而对看涨期权的需求仍保持在平均水平。

标普 500 指数 8 月份下跌了 4.8%,是今年以来表现最差的一个月,衡量该指数预期波动的芝加哥期权交易所波动率指数 (即 VIX 指数) 接近 5 月份以来的最高水平。虽然纯粹意义上的股市疲软几乎不会引发市场恐慌,但衍生品交易员肯定会注意到这一数据升势。

花旗集团汇编的数据显示,相对于以看跌方式建仓,买入看涨期权的规模已降至今年以来的最低水平。看涨期权被视为衡量看涨头寸的重要指标。在更广泛的指标中也可以看到类似的趋势,指标包括作为上行和下行押注晴雨表的看跌和看涨期权抛售幅度。

这种仓位趋势使得杰克逊霍尔年会受到了更大的关注。来自 22V Research LLC 的总裁 Dennis Debusschere 表示,会议前的形势 “很复杂”,美国国债收益率上升给长期股票价值带来压力,而抗通胀斗争远未结束。

他在给客户的一份报告中表示:“不要指望鲍威尔会像 2022 年那样扔出铁锤重创市场。”“我们认为鲍威尔不会改变对数据依赖的态度,在收益率上升、风险资产表现不佳的情况下,鲍威尔的态度可能不会被视为 ‘鹰派作风’。”

Homrich Berg 首席投资官 Stephanie Lang 表示:“投资者正押注于这样一种说法,即通胀已得到控制,美联储可以宣布政策胜利,但这种说法尚未成为现实——这是股市面临的最大风险。”“同时,除非英伟达能够将人工智能的力量转化为强劲的盈利增长,否则今年上半年的涨势将很难持续下去。”