The heavyweight CPI of the United States is coming, which serves as the "trading guide" for Wall Street's major banks.

摩根大通预计,有近 50% 的概率周四的美国 CPI 数据会符合预期,美股可能出现小幅上涨。高盛的交易员则认为,如果核心 CPI 环比涨幅为 0.2% 即符合预期,那么美联储将在 9 月不加息,并可能在 11 月的会议上也不加息;但如果这一数据达到 0.3%,市场就要为美联储在 9 月加息做好准备。

近期市场最为关注的事件之一莫过于在 8 月 10 日周四公布的美国 CPI 数据。

市场普遍预期,美国 CPI 环比将增长 0.2%,核心 CPI 环比增长 0.2%,二者均和前值持平;CPI 同比增速 3.3%,高于前值的 3.0%,核心 CPI 同比增速 4.7%,略低于 4.8% 的前值。

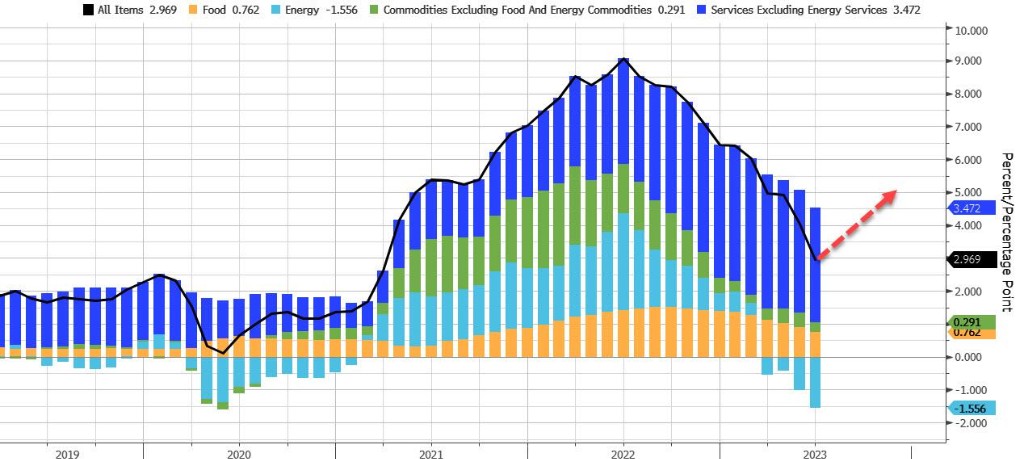

如果没有大的意外,6 月份 CPI 同比 3% 的增速可能已经是近期最低的水平,进入 7 月之后,去年这一数值的基数效应逐渐消退,加上近期能源价格飙升,CPI 可能重拾涨势。

摩根大通关于周四美国 CPI 数据的交易建议是:

如果总体 CPI 环比上涨 0.4% 或更高。尽管这种情形不太可能出现,出现的概率仅有 5%,但如果出现强于预期的核心 CPI 和汽车价格,依然有可能成为现实。市场反应将推动美债收益率走高,其中 10 年期美债收益率有望创 52 周新高至 4.24%。债券波动率的飙升可能会推高波动率指数,推高信贷利差,并引发风险资产抛售,因为市场对美联储的终端利率预期将重新定价更高。标普 500 指数将下跌 1.75% 至 2%。

如果总体 CPI 环比在增长 0.2% 至 0.4% 之间。这一结果可能会扰乱通胀正在放缓的逻辑,出现的概率约为 22.5%,可能主要是由于住房部分的通胀高于预期造成的,因为这部分通胀通常有更强的滞后性。这将导致市场对 GDP 预期的改善,但会被 CPI 走高带来的影响抵消,因此标普 500 指数会在周四下跌 1% 至 1.5%。

总体 CPI 环比上涨 0.2%,符合市场预期,出现的概率为 45%。这是市场预期,将支持通胀正在放缓的逻辑,并且不太可能改变市场对美联储将于 9 月暂停加息的看法。虽然这将是积极的,但随着市场将焦点转移到杰克逊·霍尔本月底的央行会议上,市场将进一步寻求获得美联储加息意图的确认。标普 500 指数可能会小幅上涨 0.25% 至 0.5%。

总体 CPI 环比涨幅在 0.1% 至 0.2% 之间,这一情形出现的概率约为 25%。这将巩固通胀放缓的逻辑,投资者可能会认为,美联储或许已经更接近宣布通胀 “任务完成”,因为三个月的趋势将年化通胀率压低至约 2%。“任务完成” 的结果意味着降息也可能早于预期出现。虽然这种说法可能还为时过早,但的确有可能出现。标普 500 指数可能会上涨 1% 至 1.5%。

总体 CPI 涨幅低于 0.1%。这是另一种小概率事件,概率仅有 2.5%。如果这种情况出现,甚至看到环比 CPI 增长为负值,那么市场将增强信心,可能会引发股市再次大幅走高,特别是科技股/周期性股票,标普 500 指数可能大幅上涨 1.5% 至 2%。

摩根大通首席经济学家 Mike Feroli 预计,CPI 环比上涨 0.2%,与华尔街主流预期一致;他预计核心环比 CPI 增速为 0.17%,略低于华尔街的 0.2%。具体来看:

我们团队认为 7 月美国 CPI 环比上涨 0.2%,同比上涨 3.3%。我们估计核心 CPI 环比上涨 0.17%,这与 6 月份的涨幅相似,同比增幅为 4.7%。此外,我们预计 7 月能源 CPI 将上涨环比 0.5%,食品 CPI 将环比上涨 0.1%,这将是连续第三次录得小幅上涨。

在核心 CPI 的细分项目中,我们认为住房成本将继续推高整体通胀,尽管租金通胀速度最近有所放缓。我们预测 7 月租金环比上涨 0.48%,而业主等效租金环比上涨 0.46%。我们还预测 7 月服装价格将环比上涨 0.3%。这些因素都将推高核心通胀涨幅。

其他的核心 CPI 细分项目则有望走软。近几个月来医疗保健价格几乎持平,我们预计 7 月份该项目也不会发生变化。通信价格最近一直呈下降趋势,我们预计这种情况会持续到 7 月份,环比降幅 0.3%。

酒店住宿价格最近一直波动较大,但部分基于一些相关行业数据,我们预计 7 月住宿价格将继 6 月环比下降 2.0% 后环比下降 0.8%。我们还认为 7 月机票价格再次下跌,令 7 月的公共交通价格指数下跌 4.7%。行业数据也表明近期汽车价格有所下降,我们预计 7 月份新车价格环比下跌 0.2%,二手车价格下跌 1.7%。

关于 7 月 CPI 数据,高盛预计 7 月份核心 CPI 环比增幅将为低于市场预期的 0.15%,核心 CPI 同比增速将回落至 4.66%,低于市场普遍预期的 4.8%。该行预计:

7 月份二手车价格环比下降 3.0%,新车价格环比下降 0.3%,反映出二手车价格下降以及汽车经销商促销激励措施的持续增加。

7 月的季节性因素将给服装和住宿价格带来压力。

随着新租约和长期租约租金之间的差距继续缩小,住房通胀率将大致保持在目前的水平,租金环比涨幅将为 0.44%,业主等效租金环比上涨 0.47%。

展望未来,高盛预计未来几个月核心 CPI 同比涨幅都将维持在 0.2-0.3% 的范围内,反映出随着劳动力需求持续放缓、住房通胀持续放缓、二手车价格下降以及非住房服务通胀放缓带来的影响。

高盛交易员 Brandon Brown 认为:

鉴于鲍威尔在 6 月会议后强调放慢加息步伐,我们认为恢复连续加息的门槛很高。我们认为,美联储强调是否加息将在 9 月会议上决定,是美联储倾向于鹰派的表述,即他们将维持利率不变或加息,但短期内不会降息,并且会继续依赖数据做决策。根据我们的估计,如果核心 CPI 环比上涨 0.3% 或以上,美联储会考虑在 9 月加息。如果周四的核心 CPI 环比涨幅为 0.2% 即符合市场预期,那么 9 月美联储将会维持利率不变,并可能在 11 月的会议上也跳过加息。