One of America's largest truck companies, Yellow, announced bankruptcy, resulting in 30,000 job losses.

从失业人数和收入损失方面而言,拥有近百年历史的 Yellow 倒闭是美国卡车运输业历史上最大的一次。Yellow 还欠美国联邦政府大约 7 亿美元的贷款,能否还上这笔钱,可能取决于 Yellow 通过出售房地产和其他资产筹集了多少资金。Yellow 的股价在周一大幅低开并一度持续走低,盘中跌幅一度超 40%,午后该公司股价跌幅收窄至 20% 以内。

受累于包括一笔政府贷款在内的庞大债务以及与工会之间的僵局,8 月 6 日周日晚间,拥有 99 年历史的美国卡车运输公司 Yellow 已申请破产并将关闭业务。

该公司近期都在努力解决其在新冠疫情期间因一系列合并交易和 7 亿美元联邦救济贷款而积累起来的债务。在上周的 7 月 30 日,该公司就关闭了业务,并解雇了大量工人。

公司倒闭意味着失去 3 万个工作岗位,其中包括北美运输业工会 International Brotherhood of Teamsters 的 2.2 万名工人。

从失业人数和收入损失方面而言,这次倒闭是美国卡车运输业历史上最大的一次。

该公司表示,将寻求破产法院授权,以支付包括工人薪资和福利在内的款项。

该公司首席执行官 Darren Hawkins 周日在申请该公司破产保护时表示:

Yellow 在营业近 100 年后宣布关闭,令人深感失望。

Hawkins 表示,该公司打算全额偿还 2020 年获得的联邦政府贷款。当时联邦政府批准这笔贷款是因为特朗普政府认为 Yellow 作为美国政府的运输服务提供商之一,在国家安全中发挥着至关重要的作用。

美国联邦政府能否收回这部分贷款,可能取决于 Yellow 通过出售房地产和其他资产筹集了多少资金。但一些美国国会议员和分析人士表示,在这件破产案上,Yellow 可能最终无力偿还这部分贷款,不得不由美国纳税人为其支付。作为当时援助计划的一部分,美国财政部持有 Yellow 30% 的股份,而这部分股份也可能会被清空。

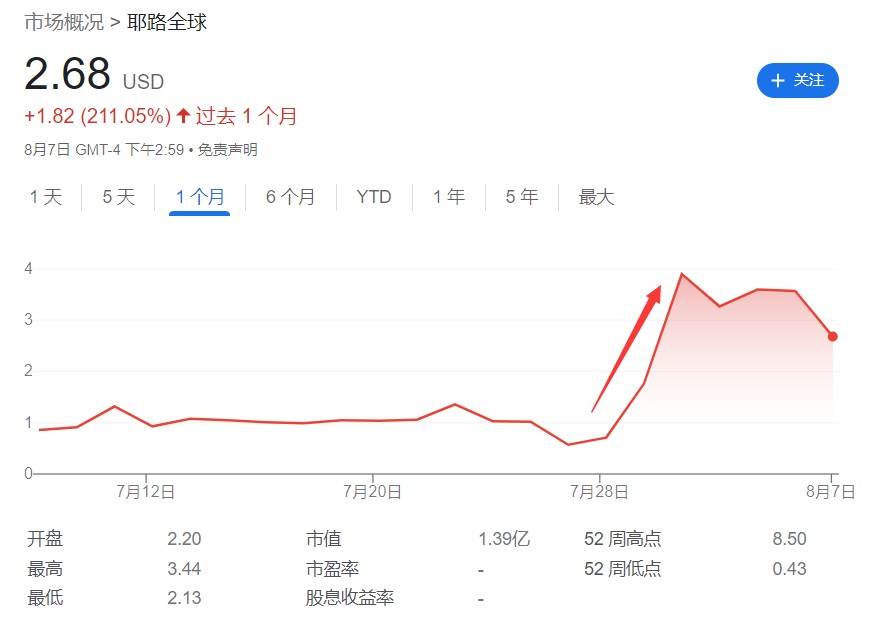

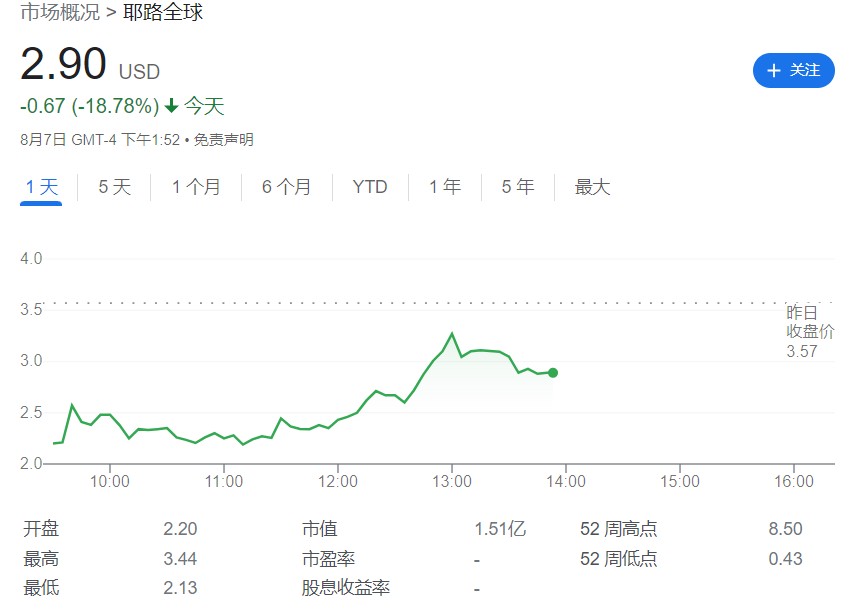

Yellow 的股价在 2020 年 7 月获得联邦政府的贷款时,股价约为每股 2.7 美元,但随着该公司开始关闭业务,上周其股价出人意料地飙升至近 4 美元。

申请破产保护后,Yellow 的股价在周一大幅低开并一度持续走低,跌幅一度超 40%,午后该公司股价跌幅收窄至 20% 以内。

Yellow Roadway 集团成立于 1924 年,总部位于田纳西州纳什维尔,年销售额一度高达 95 亿美元,拥有超过 1.2 万辆卡车,为全球超过 80 万客户提供运输和物流服务。《财富》杂志曾连续三年将 Yellow 集团评选为运输业排名第一、最受敬仰的企业。

Yellow 在其破产申请中列出了 30 个无担保债权人,其中包括巴菲特旗下的 BNSF 铁路、电商巨头亚马逊和美国家装巨头家得宝。

Yellow 以其低廉的价格以及为沃尔玛、家得宝和许多其他小型企业在全国范围内运输货物而闻名。过去二十年来,该公司数次面临破产风险。2010 年,卡车司机同意削减工资和福利后,该公司避免了破产。

在疫情前的几年,该公司吞并了不少竞争对手大幅扩张,并且在过去十五年中工会一直对其让步,并在 2020 年新冠疫情带来最多困难之际获得联邦政府救助。但如今,随着运输需求下降以及工会态度强硬,该公司在今年陷入困境。

工会今年春天阻止了该公司拟议的运营改革,导致客户和业务流失,此外,公司为 2024 年到期的约 13 亿美元债务进行再融资遇到困难。截至第一季度末,该公司欠联邦政府约 7 亿美元,欠私募股权公司阿波罗全球管理公司 5 亿多美元。

本月早些时候,Yellow 公司避免了 2.2 万名由工会代表的工人举行罢工的威胁,称公司将支付拖欠的 5000 多万美元工人福利和养老金。

Hawkins 则把公司的破产归咎于工会:

我们面临着工会长达九个月的顽固态度、欺凌行为和故意破坏性的策略。

工会则表示,该公司破产令人遗憾,对工人和美国货运业来说,这是悲伤的一天。