The US economy remains overheated, triggering bets on interest rate hikes and putting Wall Street traders in a predicament.

强劲的美国 6 月 ADP 就业人数引发了交易员们对美联储将需要进一步紧缩的押注。

在各大央行开启激进的货币紧缩政策一年多之后,最新的迹象表明,美国经济仍然过热。这让交易员们措手不及,因为这可能预示着股市和债市将再度暴跌,就像 2022 年的那段糟糕日子一样。

智通财经 APP 获悉,强劲的美国 6 月 ADP 就业人数引发了交易员们对美联储将需要进一步紧缩的押注。周四,两年期美债收益率飙升至 2007 年以来的最高水平;十年期美债收益率跃升至 4% 以上,再度测试去年高点。

尽管一系列好于预期的美国经济数据打消了人们对经济衰退迫在眉睫的担忧,但华尔街尚未准备好利率在更长时间内维持在高位。在忽略了过去几个月稳步上升的美债收益率之后,股市的平静开始出现动摇,芝加哥期权交易所波动率指数 (Cboe Volatility Index) 一度飙升至 3 月地区银行动荡以来的最高水平。

最糟糕的是,十年期美债收益率与标普 500 指数之间的一个月相关性变为负值,为过去 3 个月以来的首次,这意味着美债和美股往往同时遭到抛售。如果这种通胀时代的交易模式持续下去,对几乎所有人来说都是坏消息,尤其是那些价值数万亿美元的 60/40 投资组合和所谓的风险平价量化分析师。

Macro Intelligence 2 Partners 的顾问 Harry Melandri 表示:“问题在于,不管出于什么原因,经济降温的速度还不够快。”“美联储似乎还有更多事情要做,如果是这样的话,很多市场就有点越位了。我不认为这些头寸很大,但他们没有为进一步加息做好准备。”

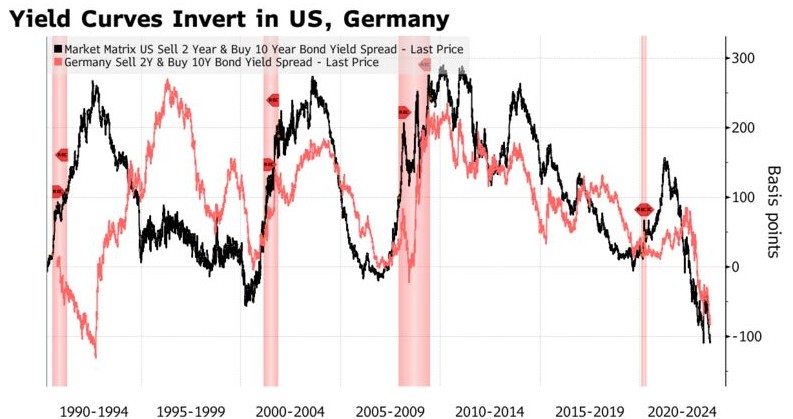

市场再度紧张凸显出投资者的不安,即政策制定者不得不提高利率以遏制通胀,而这有可能导致经济陷入混乱。从美国到德国,收益率曲线都深陷倒挂,从历史上看,这往往预示着经济衰退。

与去年的波动相比,本周市场的波动还是微不足道的。去年的波动导致资产损失达到两位数,投资者们对对冲策略的信心崩溃。标普 500 指数在过去 7 周有 6 周上涨,但在过去两天下跌了 1%。此外,在信贷市场,垃圾级债券与美债之间的利差仍接近年内低点,表明危机尚未波及更广泛的市场。

然而,华尔街对本周数据反应的转变引发了一些投资者的担忧。美股因强劲的经济数据而下跌,标志着股市与上周的走势有所不同。上周,强劲的消费者信心、新屋销售、初请失业金人数和国内生产总值 (GDP) 数据是推动股市上涨的动力。

支撑这一转变的是对美联储加息行动押注的重新调整。达拉斯联储主席洛根 (Lorie Logan) 周四表示,可能需要进一步加息来刺激有意义的反通胀,这与周三公布的美联储 6 月会议纪要中的态度一致。目前,利率市场预计 7 月份还会有一次加息。

法国兴业银行的美国利率策略师主管 Subadra Rajappa 表示,美联储加息越多,经济衰退可能就越严重,这最终将导致利率下调。她建议客户押注于更陡峭的收益率曲线,这样短期利率相对于长期收益率可能会下降。但她承认,由于市场波动,这一交易并不容易,“不幸的是,对交易双方的投资者来说,这是一个令人沮丧的环境”。