US chip stocks "across the board outage": Intel just experienced the worst week in a year, AMD and Broadcom have fallen for six consecutive weeks.

AMD 最近六个交易日累跌近 14%,英特尔本周累跌 9.3%,博通本周跌逾 5%,费城半导体指数本周跌 4.5%,为 4 月 6 日以来最糟糕一周。

今年以来最热门的赛道之一——美国芯片股最近的氛围有些诡异。

隔夜美股收盘,芯片巨头 AMD 和博通公司股价连续第六个交易日下跌,英特尔股价虽然收复部分失地,但仍遭遇了一年来最糟糕的一周。

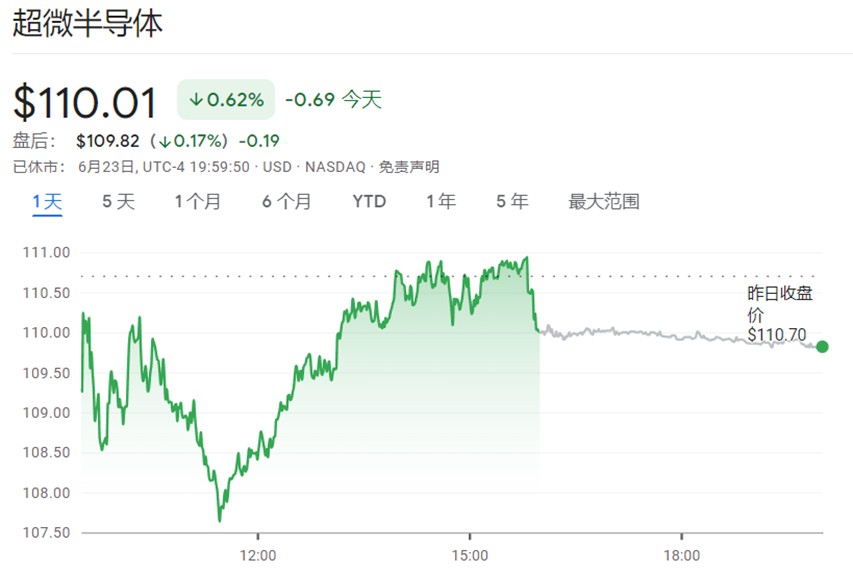

当地时间周五,AMD 股价下跌 0.6%,收于 110.01 美元,在因假期缩短的一周内下跌 8.4%,为去年 12 月 9 日以来最糟糕的一周。FactSet 数据显示,周五为 AMD 股价连续第六个交易日下跌,累计跌幅达 13.6%,为去年 10 月 14 日以来表现最差的六天走势。

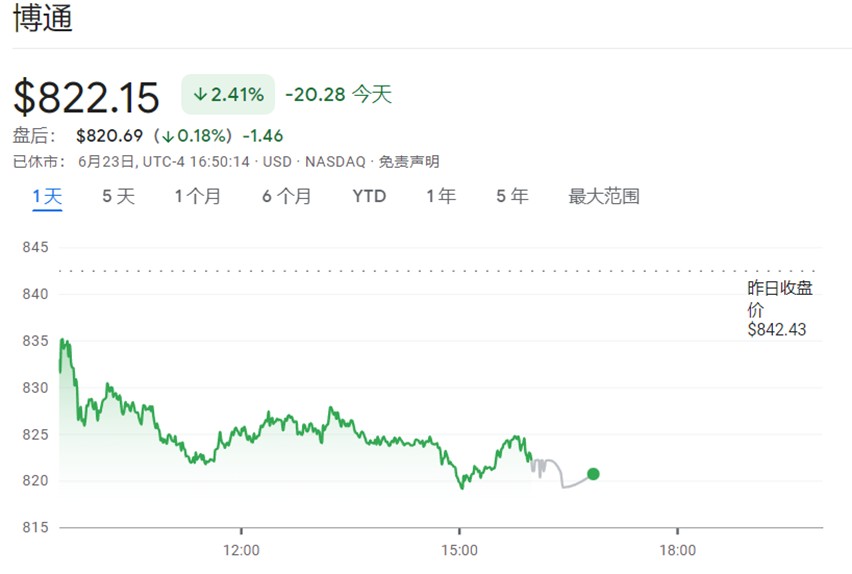

同一天,博通股价下跌 2.4%,收于 822.15 美元,连续第六天下跌,本周累跌 5.3%,这是自 10 月 14 日以来最糟糕的一周。同样,根据道琼斯数据,该股创下了去年 10 月 14 日以来最糟糕的六日涨幅。

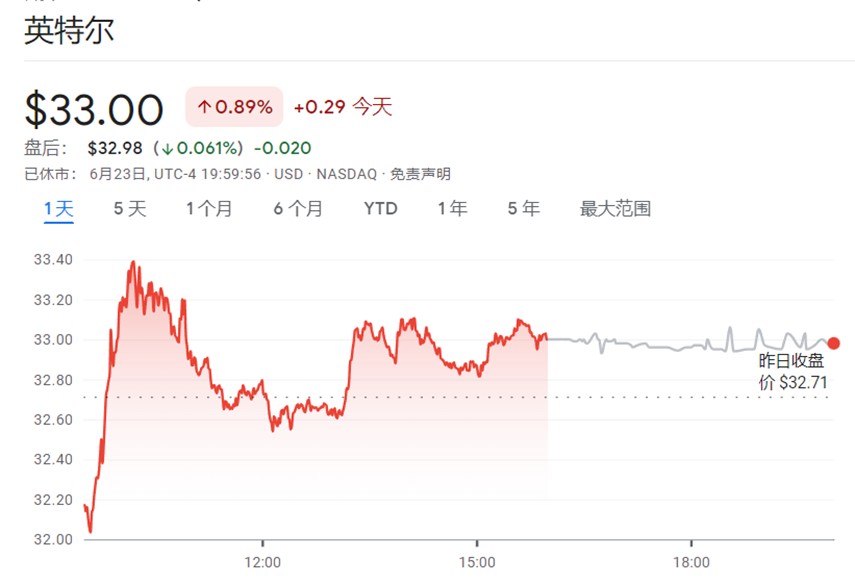

与此同时,英特尔股价直面冲击。根据道琼斯数据,周五早些时候英特尔股价一度下跌 2%,眼看就要创下 2020 年 10 月 23 日以来最糟糕的一周。稍后,英特尔股价转涨,最终收涨 0.9% 至 33 美元。

不过,英特尔本周下跌 9.3%,为 2022 年 6 月 10 日以来最糟糕的一周。周二和周三(周一美股因六月节假期休市),英特尔连续两天成为道琼斯工业平均指数中表现最差的股票。

此前,英特尔制定了与台积电竞争的计划。

当地时间 6 月 21 日,英特尔宣布重组企业架构,负责晶圆代工的 IFS 部门独立运营,明年一季度将开始提供独立的损益表,但市场对这一做法反应冷淡,英特尔当天盘中重挫 6%。

不止是以上四家巨头,全球半导体业景气主要指标之一的费城半导体指数本周下跌 4.5%,为 4 月 6 日以来最糟糕的一周。另外,该指数较近期 52 周高点 3673.14 下跌 6.4%,较 2021 年 12 月 27 日创下的收盘纪录高点 4039.51 下跌 13.2%。

此外,当下最炙手可热的英伟达隔夜收跌 1.9%,最近 5 个交易日累跌近 3%,公司遭遇董事和老牌欧洲金融世家罗斯柴尔德家族减持。

尽管如此,AI 热潮风头强劲,芯片股今年仍然跑赢了大盘。

今年迄今为止,AMD 股价今年以来累计上涨 71.8%,而博通股价上涨 48.5%,费城半导体指数指数上涨了 38.5%。

作为比较,标准普尔 500 指数上涨了 13.8%,以科技股为主的纳斯达克综合指数上涨 29.9%。

即使是最近一周表现不佳的英特尔,今年以来股价上涨了 23.5%,而道琼斯工业平均指数则上涨了 1.8%。

另外,英伟达今年以来上涨近 2 倍。