Rabbit Watch HKEX: Ranked first in Southeast Asia, team from OPPO, revenue of nearly 100 billion in the past 3 years, operating losses of 3.6 billion US dollars, largest customer of PDD.

这家 “凶猛” 的快递公司要上市了。

6 月 16 日晚间,极兔速递正式提交香港 IPO 申请。联席保荐人为摩根士丹利、中金、美银。

同日稍早有消息称,极兔计划在最快几天内提交港股 IPO 申请,计划筹集 5 亿至 10 亿美元的资金。

在许多人的印象中,极兔的发展称得上 “凶猛” 二字,这家在东南亚起家,然后背靠拼多多、一路买买买的快递公司,堪称快递行业的最大黑马。

有业内人士透露,极兔预期将在 “双十一” 前后正式挂牌交易。

东南亚排名第一、中国市场增长迅猛

极兔速递是一家全球物流服务提供商,由原 OPPO 印尼分公司 CEO 李杰于 2015 年创办。

依托于 OPPO 系的资源,极兔仅用两年时间就在东南亚站稳脚跟后,并于 2020 年入局中国快递市场。

目前极兔速递的快递网络覆盖印度尼西亚、越南、马来西亚、菲律宾、泰国、柬埔寨、新加坡、中国等 13 个国家,包括全球范围内发展最快的新兴市场,并不断扩展至拉丁美洲及中东。

招股书显示,根据弗若斯特沙利文的资料,按 2022 年包裹量计,极兔为东南亚排名第一的快递运营商,市场份额为 22.5%。在中国快递市场,按包裹量计,极兔的市场份额达到 10.9%,在中国的县区地理覆盖率超过 98%。

值得注意的是,尽管极兔在 2020 年才在中国起网,但其成长速度之快让众人始料未及。

根据招股书数据,2020 年至 2022 年期间,按地理分部划分的收入数据显示,来自中国地区的收入在 2020 年仅占 31.19%,而东南亚则占据了 68.16%,但在 2022 年,来自中国地区的收入以 56.36% 占比,一跃成为极兔内部收入来源最多的市场。

有业内人士表示,对快递行业来说,日单量 2000 万是生死线,为了过这条线,中通用了 16 年,韵达用了 19 年,圆通用了 18 年,申通用了 25 年,而极兔只用了 10 个月。目前极兔在国内的日单量突破 4000 万件。

快递 “卷王”

国内快递业已经异常 “卷” 了,这从所谓的“战国七雄”以及连年的价格战就可见一斑。

但极兔速递以激进的价格策略,搅局国内快递行业,被称为快递 “卷王”。2020 年,极兔一度遭同行集体 “封杀”。2021 年 4 月 6 日,义乌邮政管理局更曾对极兔下发警示函,直指其 “低价倾销” 行为。

极兔很舍得烧钱,也有钱烧,这与创始人李杰所在的步步高系有关。

极兔快递一成立就获得了段永平的投资,李杰不仅和 OPPO 关系匪浅,还是步步高电子段永平的得力干将,有了段永平的关系,极兔快递进入国内市场曾获得步步高、vivo 以及 OPPO 大量的资金资源支持。

极兔通过快速并购也扩大了网络,2021 年 10 月,百世和极兔共同宣布达成战略合作意向,百世集团将其在国内的快递业务以约 68 亿元(合 11 亿美元)的价格转让给极兔。2023 年 5 月,顺丰控股又将旗下业务丰网控股转让给了极兔,作价 11.83 亿元。

而在日前,有市场传闻顺丰近期正与极兔就入股合作接洽,或将以 1%-2% 的比例入股投资极兔全球,具体投资金额及合作细节仍在商讨中。虽然双方都没有作出回应,但业内人士认为,双方合作并不意外,符合市场预期。

三年营收近 1000 亿,经营亏损 36 亿美元

疫情这三年,极兔收入暴增,翻了近 4 倍。

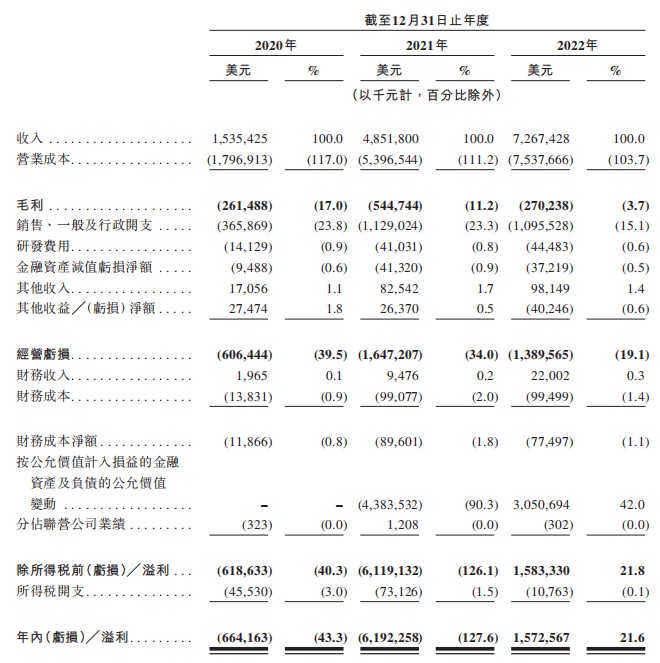

招股书数据显示,极兔 2020 年营业收入为 15.35 亿美元,2021 年为 48.52 亿美元,2022 年为 72.67 亿美元,三年营收近 1000 亿人民币。

不过从营收的同比增速看,却在下降,数据显示,公司 2020 年、2021 年和 2022 年营收的同比增速,分别为 357.7%、216% 和 49.8%。

净利润方面,极兔开始出现扭亏为盈。2020-2022 年净利润分别为-6.64 亿美元、-61.92 亿美元、15.73 亿美元。

但是,真正衡量极兔经营能力的经营利润,却不太乐观。数据显示,其 2020-2022 年数据为-6.06 亿美元、-16.47 亿美元、-13.89 亿美元,即三年亏损 36 亿美元。

亏损主要是由于极兔在中国仍处于 “烧钱” 抢份额阶段。

招股书显示,从单件包裹的平均收入及成本值来看,2021 年和 2022 年,极兔在东南亚市场单件包裹收入分别为 1.1 美元和 0.95 美元,成本分别为 0.79 美元和 0.76 美元;而在中国市场,单件包裹收入分别为 0.26 美元和 0.34 美元,成本则分别为 0.41 美元和 0.4 美元。

另一方面,多方并购尽管有助于极兔拿下中国更多市场份额,不过也要承担背后的巨额亏损。例如,顺丰丰网 2022 年营收为 32.75 亿元,净亏损为 7.47 亿元;2023 年第一季度营收为 6.91 亿元,净亏损为 1.43 亿元。

拼多多是最大客户

极兔称,公司为 Shopee、Lazada、Tokopedia、淘宝、天猫、Shein 及 Noon 等领先的电商平台,以及 TikTok、抖音、快手等短视频及直播平台上的商户及消费者提供全面的快递服务;为领先的电商平台提供快递解决方案,助力他们在进军新市场过程中的快速发展。

实际上,极兔快速崛起的背后,拼多多居功至伟。数据显示,2020 年拼多多快递所占有的市场份额为 31%,而极兔快递 90% 的快递流量都来自于拼多多。

拼多多作为极兔最大客户,2020 年和 2021 年收入占比虽然保持在 35%,但分别贡献了 5 亿美元和 17 亿美元业绩。

但有分析称,随着反垄断的出台以及新型电商势力的崛起,未来极兔可能会面临成也拼多多败也拼多多的尴尬局面。

去年为了冲上市,极兔开始把来自拼多多的收入占比减半至 17%,不过仍然贡献了 12 亿美元收入。

腾讯、高瓴、红杉均为大股东

资料显示,极兔速递 IPO 前已获多轮股权融资,投资方包括腾讯、博裕、ATM、D1、高瓴、红杉、顺丰速运、Dahlia、SAIGrowth 及招银国际。

从历史融资来看,极兔成立的 2015 年-2018 年期间,曾完成了 2 轮融资,共获得了接近 2 亿美元的 “弹药”。到了 2020 年,极兔开始进入新加坡和中国市场。仅这一年,极兔就融了两轮,合计 13 亿美元。2021 年,极兔继续融了两轮,合计 39 亿美元。

此外在递交招股书前的一个月——5 月 16 日,极兔完成 D 轮融资,以 7.64 美元/股融资 2 亿美元。如果以 16.97 亿股总股本计算,极兔这一轮估值达 130 亿美金。

股权结构中,创始人李杰为第一大股东,持股 11.54%;腾讯为第二大股东,持股 6.32%;博裕为第三大股东,持股 6.1%;ATM 为第四大股东,持股 5.49%。高瓴资本持股 2%、红杉持股 1.62%,分别名列第六、第八大股东。

核心团队

据 36 氪,在极兔目前的管理团队中,极兔的 OPPO 老人有很多,一位是最年轻的高管——执行总裁樊苏洲,一位是曾经的 OPPO 江苏公司前老板张源。

樊苏洲 2009 年大学一毕业就开始跟随创始人李杰,主要在 OPPO 江苏公司负责销售。当时李杰是江苏总经理,在工作 4 年后,李杰开始从事 OPPO 印尼代理。

樊苏洲二话不说跟着李杰去了印尼,当李杰是印尼 CEO 的时候,樊苏洲成了印尼西爪哇区域总经理。有意思的是,樊苏洲大学毕业于一个很普通的本科学校——河南师范大学。但 14 年的坚持,换来了今天的成就。

张源今年 54 岁,曾经是中山小霸王公司的南京总经理,后来创立了 OPPO 江苏公司,成为了李杰的早期领导。换句话说,是张源把李杰招进 OPPO 江苏的。如今,李杰也没有忘记老领导。

此外,董事会中还有一位 61 岁的郑玉芬,曾经的步步高原 CFO,和网易独立董事。

除了 OPPO 外,极兔的网易系也比较多。比如董事会中的杨昭烜,虽然也才 39 岁,但已经是网易 CFO。

极兔 CFO 为郑世强,普华永道出身的他于 2021 年加入。对于一家公司来说,这种高管变动就是为了上市做准备,所以极兔最迟 2021 年就确定了要 IPO。郑世强曾经是哈啰出行联席 CFO,3 年的努力最终没能帮助哈啰出行完成上市。在哈啰出行之前,郑世强还是微医 CFO,但微医至今也未能完成上市。

极兔的资本运作背后还有一位大牛——刘二飞,他曾在华尔街 “摸爬滚打” 20 年,操盘过中国电信、中国移动等上市。最近更值得关注的是,王石的那个深石 SPAC 公司(港股),联合发起方就是亚投资本创始人刘二飞,且刘二飞还担任董事兼首席执行官。

最后还是要回到创始人李杰身上:

今年 48 岁的李杰曾在 OPPO 工作了 15 年。也就是大学毕业开始在 OPPO 江苏卖电子音像产品,后面 33 岁逐步成为江苏和安徽总经理。

李杰在 OPPO 曾经深得段永平弟子陈明永喜欢,OPPO 一度还因李杰过人的销售能力成立 “李杰” 奖,以奖励全球销售机构的顶级销售人员。

即使在极兔飞奔需要钱的疫情初,OPPO 也给极兔借款 1.2 亿美金。

2013 年,也就是李杰 38 岁的时候,他开始担任 OPPO 首家海外独家销售代理公司创始人。直到 2 年后离开 OPPO,创立极兔。

比较值得称赞的是,陈明永目前通过 Team Spirit Group Limited,持有极兔 4.4% 股权。算是除李杰之外的最大个人股东了。招股书也显示,陈明永曾在疫情期间,担任过极兔董事会董事一年。

综上来看,不管是前领导还是前下属,都能比较和谐的相处。证明李杰确实有比较强的过人之处。

成功上市难料 拼多多海外版或是新的机遇

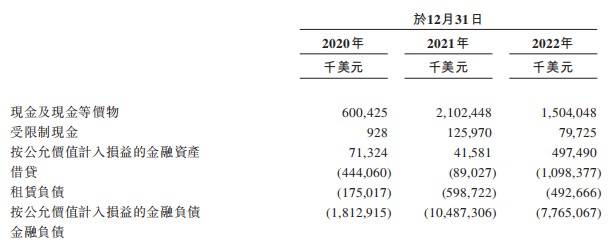

尽管极兔在此之前经历了多轮融资,但因为持续扩张亏损,账上现金仍然减少明显。

2022 年 12 月底,极兔账上现金为 15 亿美元,较上年同期减少了 6 亿美元。2023 年 4 月 30 日,其账上现金又进一步减少为 12.36 亿美元。而与此同时,2022 年,极兔调整后的亏损为近 8 亿美元。

这也意味着,极兔要想继续扩张并打价格战,还需多融资。

不过,当下的港股市场信心不足,极兔在亏损的情况下冲击 IPO,能否顺利上市难料。

与此同时,分析称,市场广阔,但极兔惯用的低价策略显然难以为继。今年 3 月,无论是同比还是环比,顺丰、韵达、圆通、申通平均单票收入均在下滑。

有券商分析师指出,快递业竞争超出预期,价格战加剧背景下,企业盈利的不确定性上升。而盈利能力强,现金流充沛,财务风险小是一家公司打新一轮价格战的底气。

值得注意的是,2022 年,极兔开始进军中东的沙特、阿联酋和埃及;也在拓展拉美的巴西和墨西哥。有分析认为,如果拼多多海外版能真正做起来,或将给极兔带来很大的帮助,极兔也能因此讲出新的故事。