The strength of the US stock market lies only in these "Seven Sisters".

仅苹果市值就超过英国前 100 家上市公司市值之和,大摩警告:“少数巨型股” 的胜利正在掩盖市场上更广泛的痛苦。

美股顶着美联储 “鹰声嘹亮” 大涨的背后,是科技巨头的繁荣,以及其他股票的消沉。

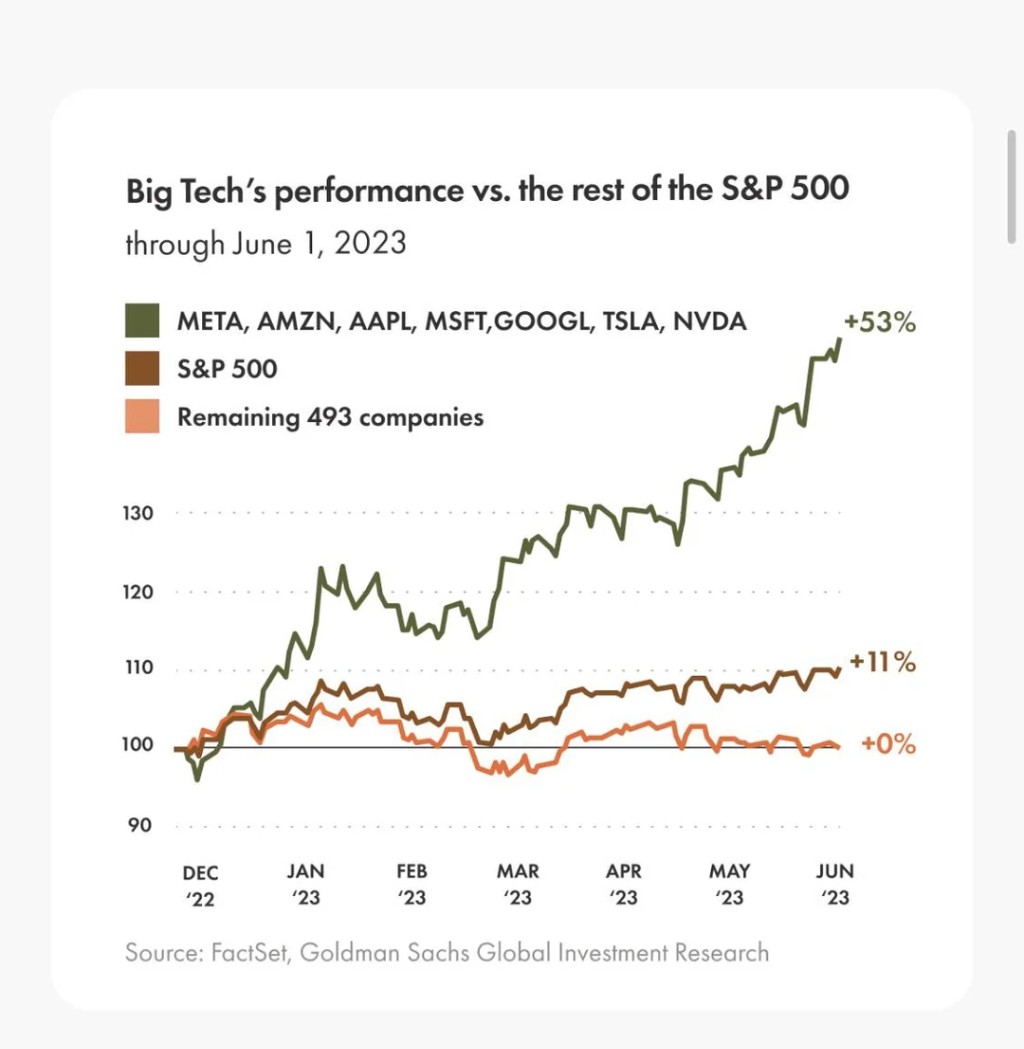

在 AI 的提振下,标普 500 指数今年已经上涨超过 14%,即将创下近二十年来该指数表现最好的半年之一,但这也是科技股主导程度最高的一次。

七个最大的成分股——苹果、微软、谷歌母公司 alphabet、亚马逊、英伟达、特斯拉和 Meta——今年的涨幅在 40%-180% 之间,而其他的 493 家公司,总体表现乏善可陈。

与此同时,这七家公司的市值已经占据了整个标普 500 指数市值的近四分之一。苹果的市值已经达到了 2.9 万亿美元,超过了英国前 100 家上市公司的总和。

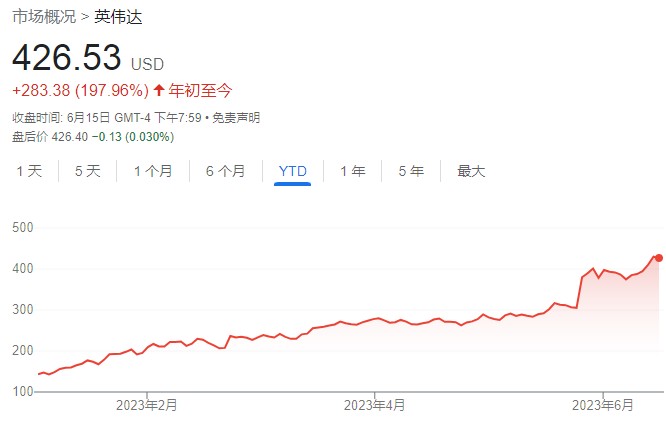

美股今年 “最靓的仔” 英伟达,今年增加的市值就已经达到了 6400 亿美元,相当于美国最大的两家银行——摩根大通和美国银行——的市值之和。

这种 “头重脚轻” 的现象并不稀奇。巴黎 Carmignac 公司跨资产团队负责人 Frédéric Leroux 表示:

现在标准普尔指数中的大型科技股与过去的石油公司或 20 世纪 60 年代的漂亮 50 指数(Nifty 50)的情况相同。

“漂亮 50 指数” 是上世纪六七十年代美股市场的 50 只备受追捧的大盘股,这些股票在被热捧后遭遇了严重的下跌。因此 Leroux 也警告:

这是一个问题,但这是一个反复出现的问题。

极端

这种愈演愈烈的现象让分析师和投资者都感到不安。

一些观点认为,美股已经达到了惊人的极端,使得大多数股票的平淡表现被掩盖,这种情况是不可持续的,同时也是未来市场环境险恶的征兆。

华尔街最大空头分析师之一,摩根士丹利首席美国股票策略师 Mike Wilson 曾警告,“少数巨型股” 的胜利正在掩盖市场上更广泛的痛苦:

重大的重新定价已经发生......由低质量、周期性和小盘股主导。

法国资产管理公司 Tobam 董事总经理 Alex Cabrol 表示,此前类似的情况都曾出现过严重的衰退:

这没有意义。

这种现象的瓦解不是 “是否” 的问题,而是 “何时” 的问题。

另一方面,对于需要遵循多样化的共同基金来说,过度的集中使得选股相当棘手。

上月,高盛对 500 多个资产总额为 26 亿美元的共同基金进行了分析,发现罗素 1000 成长指数的 “极端集中” 与要求基金保持多样化投资组合或限制对个别公司的投资的规则相冲突。这些规则意味着美国共同基金在包括苹果、微软和 Nvidia 在内的七只股票中持有的头寸比其指数头寸要小。

相对于指数而言,基金业绩因此受到影响。巨型科技股的超额表现对核心和成长型共同基金来说是一个巨大的逆风。

追涨

尽管集中度如此之高,危险信号愈发显眼,仍有投资者最终向科技股 “投降”。

汇丰银行首席多资产策略师 Max Kettner 在给客户的一份说明中写道:

美国股市广度是历史上最差的,但是这本身并没有丢掉强大、可靠的交易信号。从边际上看,它甚至可能是积极的。

如果说有什么不同的话,那就是股市广度走弱后的直接表现要好于股市广度走强时的表现。

巴克莱银行的分析师表示,他们已经发现了初步的迹象,表明投资者开始放弃忧虑了:

在近三个月的观望模式之后,谨慎但也现金充足的投资者似乎终于开始追逐涨势了。

该行表示,买盘正在蔓延,不仅仅是那些科技股,这 “实际上可能是持续突破近期交易区间的前奏”。