Since the Fed is going to raise interest rates, why doesn't it do it all at once? Reporters are confused, and Powell made a crucial analogy.

鲍威尔表示,“这就像开汽车一样”,速度问题与最终的水平问题是两个不同的问题。对于去年来说,“速度” 非常重要,但随着我们越来越接近目的地,放慢速度是常识。

美联储如期暂停加息但 “鹰声连连”,鲍威尔借用了一个比喻试图打消市场疑虑。

虽然美联储终于停下了加息的脚步,但点阵图和经济展望都显示美联储今年可能还要有两次加息;鲍威尔的讲话也相对鹰派,称今年降息是不合适的。这就令人们十分困惑,美联储为何中途要停下来?鲍威尔解释道,这就好像开车一样,越接近终点,越应该放慢速度。

美东时间 6 月 14 日周三,美联储货币政策委员会 FOMC 会后宣布,将联邦基金利率的目标区间维持在 5.0% 至 5.25% 不变,让这一政策利率保持在十六年来最高水平。本次利率决策得到了 FOMC 投票委员全票赞成。

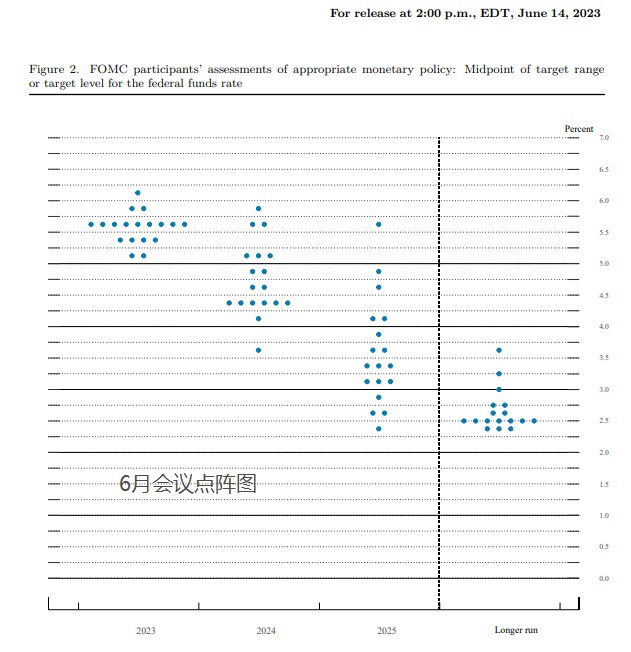

此次会议更新的点阵图还显示,18 名联储官员中有 16 名预计到今年末利率将高于 5.25%,3 月时这一数量还只有 7 名。这就意味着他们希望未来能够进一步提高利率。

那么令人困惑的问题就来了——评论家、经济学家和记者们都好奇,如果需要继续加息,为什么美联储不一步到位呢?在新闻发布会上,被视为 “美联储喉舌”、有 “新美联储通讯社” 之称的华尔街日报记者 Nick Timiraos 率先提出了这一问题。

鲍威尔对此做出了一个神奇的比喻。他回答道:

这就像开汽车一样。

速度问题与最终的水平问题是两个不同的问题。对于去年来说,“速度” 非常重要,但随着我们越来越接近目的地,放慢速度是常识。

但英国金融时报认为,将经济比喻成汽车已经是美联储的 “老生常谈”,并无任何新意且并不恰当。这本质上不是一场比赛、一次自驾游或者一次通勤,鲍威尔口中带有象征意义的 “汽车” 并不需要拼命追赶什么,因为理论上来说,这会冒着撞上前方障碍物的风险。所以从这个角度看,鲍威尔可能在表达对不会发生经济衰退的信心。