The "Danger Signals" of the US Stock Market

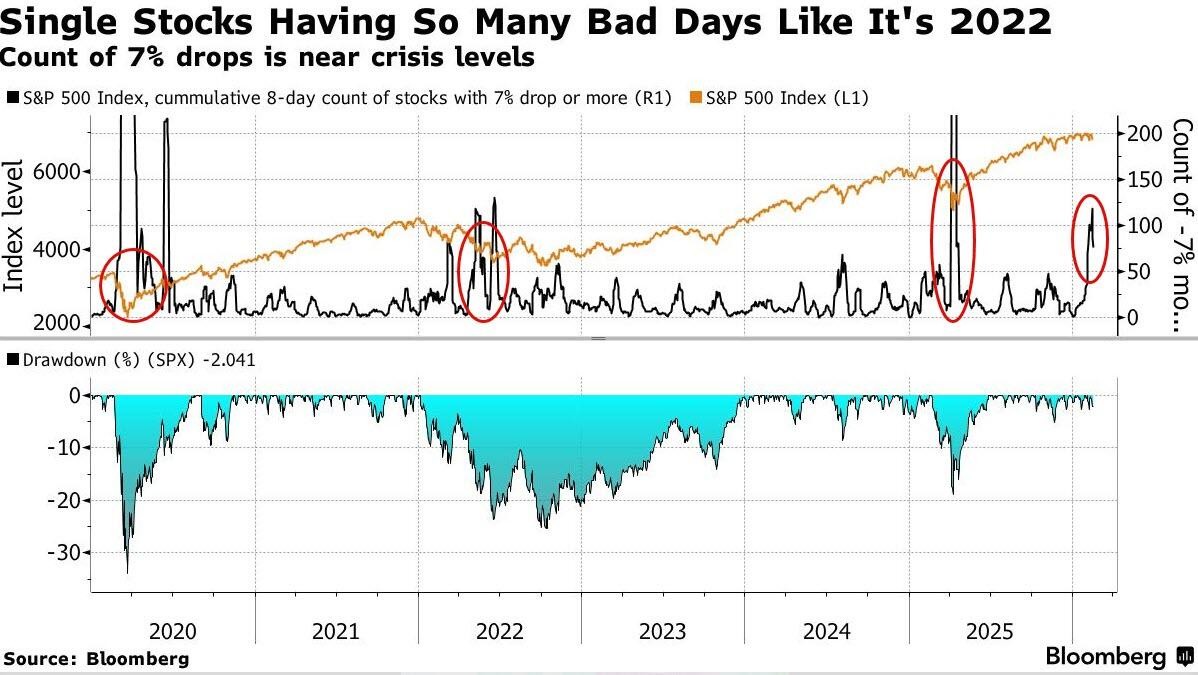

This month, the number of S&P 500 constituent stocks that have fallen 7% or more within eight trading days has exceeded 100, approaching the levels seen during the 2022 U.S. stock market bear market. Although this is not as extreme as during the COVID-19 pandemic or tariff crisis, the indicator exceeding 100 typically signifies a broader decline, which has not yet occurred

This month, the number of S&P 500 constituent stocks that have fallen 7% or more within eight trading days has exceeded 100, approaching the levels seen during the 2022 U.S. stock market bear market.

Although this is not as extreme as during the COVID-19 pandemic or the tariff crisis, the indicator exceeding 100 typically signifies a broader decline, which has not yet occurred.