BHP's profits soared by 30%, with copper business surpassing iron ore for the first time as the largest source of profit

The world's largest mining company BHP has been rewarded for betting on a surge in copper demand, with net profit in the first half of the fiscal year increasing by nearly 30% year-on-year. The copper business contributed 51% of the company's EBITDA, surpassing other businesses for the first time to become the largest source of profit. Strong demand from the energy and automotive sectors continues to drive up copper prices, validating the strategic value of this transformation

The world's largest mining company, BHP, has reaped rewards from its bet on soaring copper demand, with net profit for the first half of the fiscal year increasing by nearly 30% year-on-year, making copper business the company's largest source of profit for the first time.

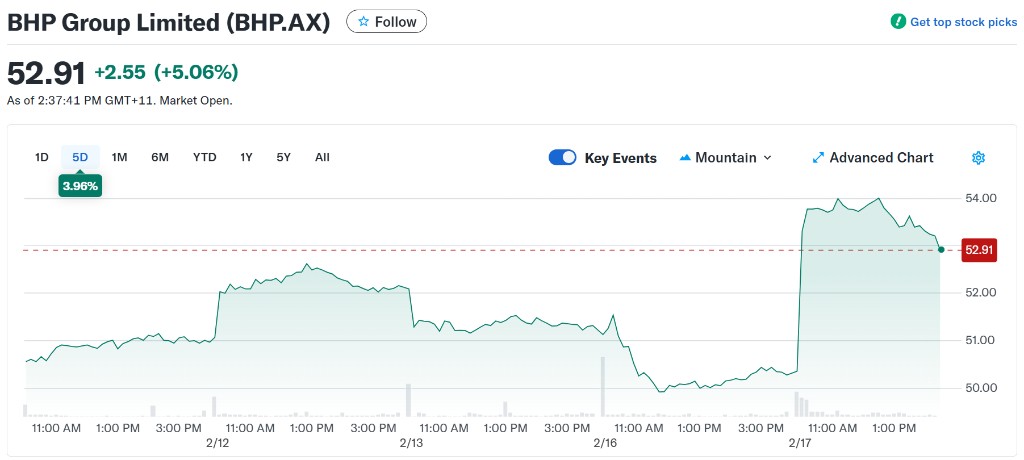

The Australian mining giant announced on Tuesday that for the six months ending December 31 last year, revenue rose 11% year-on-year to $27.9 billion, and profit attributable to shareholders increased by 28% to $5.6 billion. The performance exceeded analysts' expectations, and the company's stock price opened up 5.3%.

CEO Mike Henry stated that this performance is a "milestone" for BHP, with the copper business contributing 51% of the company's underlying earnings before interest, taxes, depreciation, and amortization (EBITDA), surpassing other businesses for the first time as the largest source of profit. Strong demand from the energy and automotive sectors continues to drive up copper prices, validating the strategic value of this transformation.

BHP will distribute an interim dividend of 73 cents per share, equivalent to a 60% payout ratio.

Copper Business Becomes Profit Pillar

Copper has become the core driver of growth in the global mining sector. BHP's performance this time marks the success of the company's strategic transformation, with the copper business contributing 51% to underlying EBITDA, making it the largest source of profit for the first time.

Saranga Ranasinghe from Moody's stated that copper has now become a "strong profit pillar" for BHP. She pointed out that BHP has raised its copper production guidance amid a reduction in market supply, which will support stronger future cash flows as higher production coincides with tighter market conditions.

Last month, BHP raised its copper production growth expectations, aiming for an annual output of 2.5 million tons by the mid-2030s. Henry stated that multiple projects have "added substantial content" to this goal.

Abandoning Large Acquisitions for Smaller Deals

Increasing exposure to copper business was once at the core of BHP's strategy. The company attempted to merge with Anglo American at the end of last year but was unsuccessful. A similar logic also drove the recent conclusion of negotiations between Rio Tinto and Glencore.

However, Henry stated during a media conference call that BHP currently "does not feel any urgent need" to pursue further acquisition opportunities. He noted that transactions aligned with the company's growth strategy are only "very limited in scope."

In the absence of large mergers and acquisitions, BHP has relied on smaller deals to maintain its position as the world's largest copper producer, including the acquisition of Australian company OZ Minerals and the Chilean Vicuña project. Canadian Lundin Mining stated this week that its joint venture with BHP on the Chilean Vicuña project is progressing rapidly, with plans to invest $7.1 billion in the initial development phase.

BHP has also benefited from soaring prices of by-products from copper mining, including gold, silver, and uranium. These non-core products contributed approximately $2 billion in revenue in the first half of the year The company has signed a $4.3 billion agreement with Canada's Wheaton Precious Metals to supply silver from the Antamina mine in Peru, taking advantage of the significant rise in the price of this metal.

This transaction is part of BHP's asset optimization plan. In December last year, the company sold a stake in the Western Australia power network to Global Infrastructure Partners for $2 billion, which is part of its plan to unlock $10 billion of undervalued assets in its business