The Japanese stock market frenzy cannot hide the turmoil in bonds and currencies. Is "high market trading" an opportunity or a trap?

The Japanese stock market reached a historic high driven by "high market trading" (Nikkei 225 rose 5% this week), but the calm in the bond and currency markets hides a "high market trap": if the high market early rice significantly increases spending to fulfill promises, it may weaken the yen, exacerbate inflation, and ultimately backfire on the stock market. Although she promised that tax cuts would not involve new debt, analysts question the ability to deliver

With the victory of high city early rice in last Sunday’s election, the Japanese stock market has continuously set historical highs this week, with the Nikkei 225 index rising a cumulative 5%. However, behind this market frenzy, referred to as "high city trading," some investors are beginning to worry whether it is evolving into a trap, with some traders warning that the current market calm may just be "the calm before the storm."

Despite the stock market's exuberance, the Japanese bond and foreign exchange markets have shown a relative calm that is starkly different from before the election. Previously, the market had fluctuated significantly due to concerns over high city early rice's aggressive fiscal spending plans. The current disconnection between the stock and bond markets suggests that some investors seem to believe that although the new prime minister has gained greater power, she will show restraint in implementing her fiscal plans.

However, core risks remain. Analysts warn that the Japanese market faces a potential "high city trap": If the new prime minister significantly increases public spending to fulfill her promise to address the cost of living, it could further weaken the yen, exacerbating inflation by driving up the costs of imports such as energy, ultimately backfiring on stock market performance.

Currently, high city early rice is trying to reassure the market, claiming that her comments about the yen during the campaign were "misunderstood," and promising that the plan to cut the consumption tax will not involve issuing new debt. However, Wall Street strategists are skeptical, questioning how she can fulfill fiscal commitments without disturbing the market given her significant public mandate.

The Calm Before the Storm

According to media reports, although the Nikkei 225 index rose 5% this week, a Tokyo trader pointed out that the reaction of the Japanese government bond and yen markets has been much calmer than expected before the election. The trader warned: "We may need to view this as a temporary phenomenon, as the core issue is how she will pay for it. This is not a honeymoon period; it feels more like the calm before the storm."

Since high city early rice announced a $135 billion fiscal spending plan last November, her relationship with the bond and currency markets has been tense. To leverage her popularity in the election, she previously promised to suspend the collection of the food consumption tax for two years, which is expected to cost 5 trillion yen (approximately $32 billion). Under this expectation, the yield on Japan's 40-year government bonds once broke 4%, and the yen subsequently weakened.

Now, her absolute majority in the House of Representatives provides a solid political foundation for her to fulfill these spending commitments, but this is precisely the source of market anxiety.

Exchange Rate Trap and Central Bank Dilemma

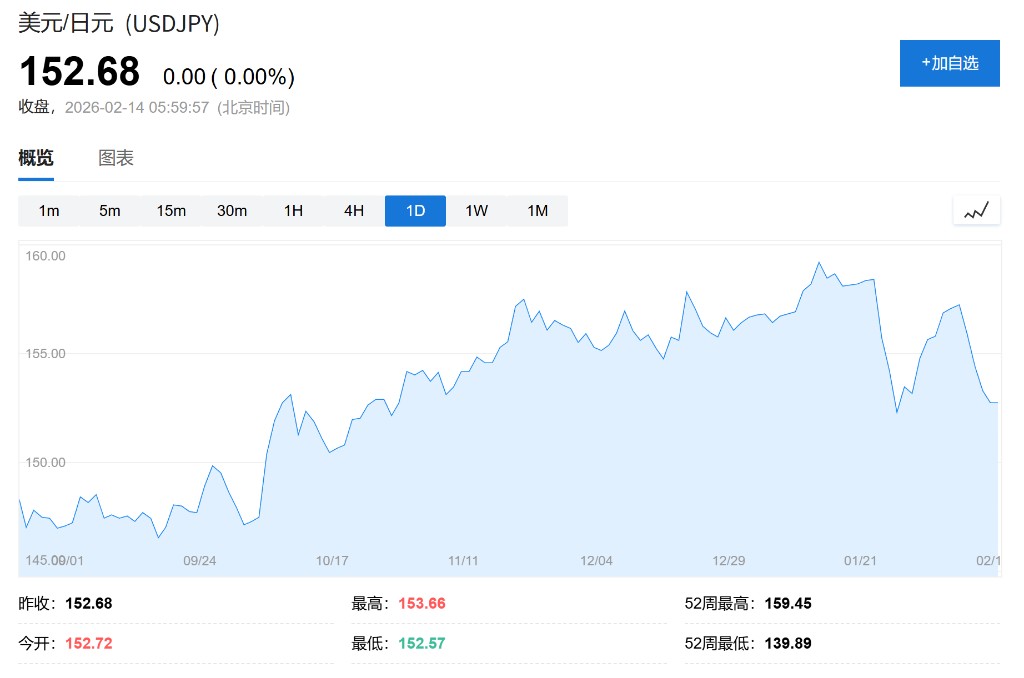

Darren Tay, head of country risk for BMI Asia-Pacific, pointed out that the yen is currently facing the risk of a "high city trap." The higher the government spending, the greater the risk of currency depreciation. Currently, the yen is hovering around 153 against the dollar, and high city early rice has been relying on her finance minister, Katayama Satsuki, to reassure the market, while officials have also issued verbal warnings, hinting at possible intervention

Citigroup foreign exchange strategist Osamu Takashima stated that if the yen exchange rate rebounds to 160, the government will intervene in the market. This puts the Bank of Japan in a dilemma. Although the market expects the Bank of Japan to raise interest rates at least twice by 2026, some traders are concerned that the central bank may face pressure to delay rate hikes in order to provide more fiscal maneuvering space for Prime Minister Sanna Marin.

If the central bank maintains its accommodative stance while the Ministry of Finance intervenes, one trader bluntly stated that any intervention in this case would amount to a "temporary subsidy for short sellers."

Feasibility of Fiscal Commitment in Doubt

To ease tensions with the financial markets, Prime Minister Sanna Marin stated at her first press conference after the election that her consumption tax cut plan would not involve issuing new debt. However, analysts are skeptical about this.

J.P. Morgan senior economist Benjamin Shatil pointed out, "Given the scale of the mandate she received, how can she realistically withdraw such a commitment? Unlike other prime ministers, she cannot use parliamentary resistance as an excuse."

Moreover, Bank of America Japan foreign exchange and interest rate strategy head Shusuke Yamada believes that the election did not change the structural drivers of yen weakness. He noted that companies and investors will continue to seek returns outside of aging, slow-growing Japan, and yen carry trades are unlikely to reverse in the short term. He emphasized, "They need to see concrete evidence that Japan is a better long-term investment... This will take years."

Debt Concerns and Market Divergence

Market concerns about Japan's fiscal situation stem from its massive public debt. According to data from the International Monetary Fund (IMF), Japan's total public debt amounts to 237% of GDP.

There is significant divergence in the market regarding this risk. CLSA analyst Nicholas Smith believes that these concerns mainly reflect the views of foreign investors, who hold only 6.6% of Japanese government bonds but account for 71% of futures trading volume. Smith stated that foreign investors "have no vested interest, and various signs indicate they do not truly understand this market," pointing out that Japan's net debt situation is significantly lower than its total debt and is expected to continue to decline in the coming years.

However, others argue that the government should be more vigilant. BMI's Darren Tay warned that the market may underestimate the populist pressures released by Sanna Marin, and the belief that Japan's debt is primarily held domestically may give the government a "dangerous sense of insulation," causing it to ignore warning signals from the global bond market.

Nomura Research Institute economist Takahide Kiuchi also stated that while the debt level itself may not be an issue, he has "never experienced such a sharp rise in long-term yields as seen before the election." He warned that the Japanese government should respond to these warning signals, or Japan may face a crisis