Amid the severe decline in the cryptocurrency market, Coinbase's revenue in the fourth quarter fell by 20%, with a net loss exceeding $600 million | Financial Report Insights

Affected by the cooling of the cryptocurrency market, Coinbase's revenue in the fourth quarter fell by 20% to $1.8 billion, with a net loss of $667 million. Although consumer trading revenue plummeted by 13%, institutional business and derivatives performed strongly, with subscription service revenue reaching a record high of $2.8 billion, and USDC becoming a key growth point. Analysts are divided on whether this is a "cyclical adjustment" or a "crypto winter," with after-hours stock prices fluctuating slightly up by 1%

Affected by the cooling of the cryptocurrency market, cryptocurrency exchange Coinbase reported a staggering loss of $667 million in the fourth quarter.

On February 12, after the U.S. stock market closed, Coinbase released its fourth-quarter financial report, with revenue declining 20% to $1.8 billion, a drop that exceeded market expectations. The company recorded a net loss of $667 million for the quarter, compared to a net profit of $1.3 billion in the same period last year.

The financial report indicated that the losses were primarily due to impairment losses on cryptocurrency holdings and investments. In contrast to the weak quarterly financial performance, Coinbase still emphasized the narrative of "scale and diversification" in its operational indicators for 2025.

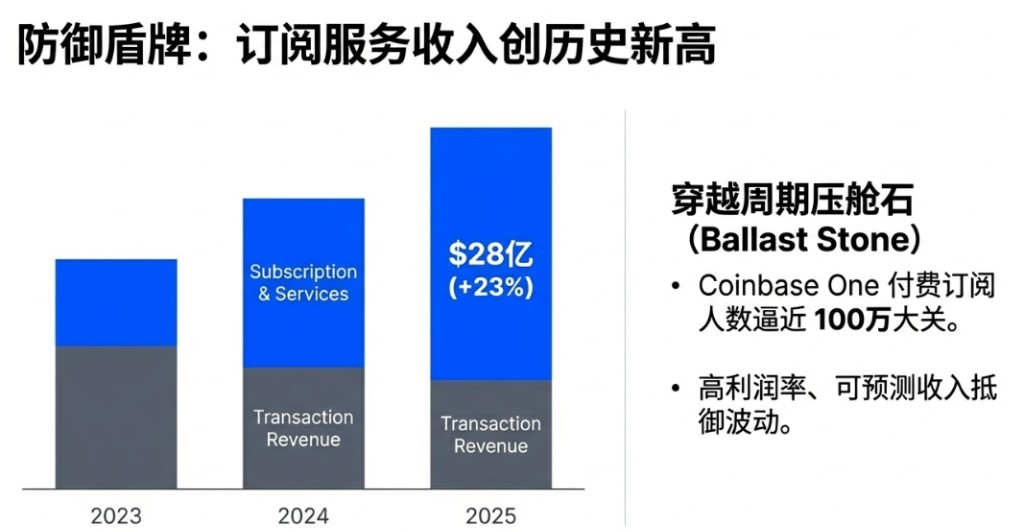

The total trading volume for the year reached $5.2 trillion (up 156% year-on-year), with the market share of cryptocurrency trading rising to 6.4% (doubling year-on-year). The subscription and service revenue, viewed by management as a "counter-cyclical ballast," reached a record high of $2.8 billion, with USDC-related earnings and membership subscriptions becoming key support points.

Mizuho analyst Dan Dolev pointed out that Coinbase's institutional business performed strongly, but the consumer side was weak, with first-quarter revenue expectations falling below consensus and EBITDA missing expectations. The market is closely watching whether this is a "mid-cycle correction" or the beginning of a new "crypto winter."

Despite the disappointing financial report, the company's stock price rose slightly in after-hours trading, but the cumulative decline this year still exceeds 40%.

This decline in performance reflects the common difficulties faced by the entire cryptocurrency exchange industry. Competitor Gemini Space Station announced last week plans to cut up to 25% of its workforce and reduce international operations, while Robinhood also stated this week that its cryptocurrency trading revenue fell by 38%.

Trading Revenue Under Pressure, Derivatives Business Becomes New Growth Engine

Affected by the overall softening of the cryptocurrency market in the fourth quarter, Coinbase's core trading revenue declined.

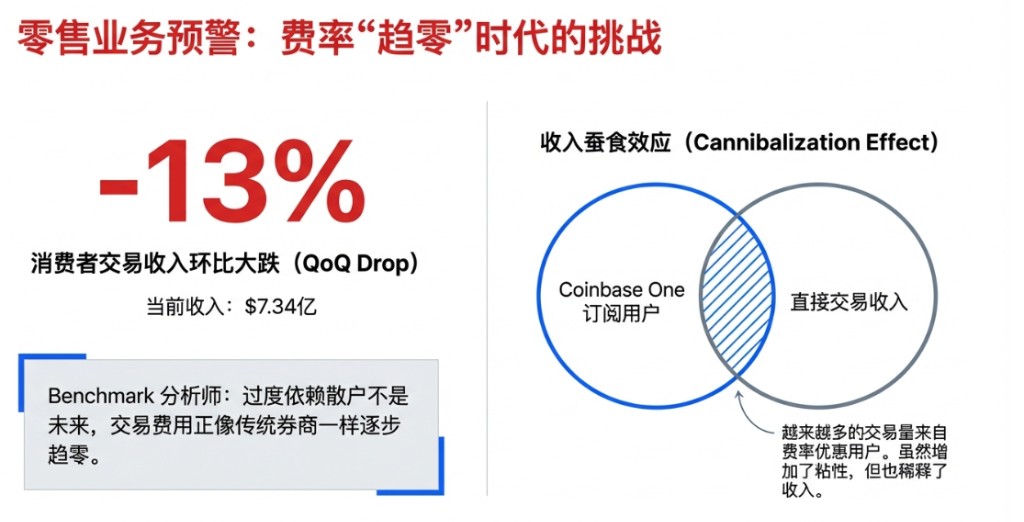

The company's Q4 trading revenue was $983 million, a decrease of 6% quarter-on-quarter. Among this, consumer trading revenue plummeted 13% quarter-on-quarter to $734 million. The financial report showed that an increasing amount of trading volume came from Coinbase One paid subscription users who enjoy fee discounts.

Benchmark analyst Mark Palmer stated:

Over-reliance on retail trading is not the future Coinbase wants, especially as trading fees may gradually approach zero like traditional brokers Nevertheless, CFO Haas remains optimistic about the retail outlook:

Retail investors are buying on dips, and importantly, retail investor sentiment is strong.

In contrast, institutional business performed brilliantly. Although institutional spot trading volume decreased by 13% quarter-on-quarter, thanks to optimized fee structures and strong growth in derivatives business, institutional trading revenue increased by 37% quarter-on-quarter to $185 million.

In particular, after completing the acquisition of Deribit, Coinbase further solidified its leadership position in the global crypto derivatives market. Data shows that Coinbase's market share in the U.S. derivatives market surged fourfold year-on-year, with Q4 derivatives trading volume reaching an all-time high.

Subscription services become a ballast, stablecoin USDC ecosystem growth

If trading business is Coinbase's "offensive spear," then subscription and service revenue is its "defensive shield."

By 2025, subscription and service revenue is expected to reach $2.8 billion, a year-on-year increase of 23%. Among them, stablecoin revenue became the biggest highlight, contributing $364 million in Q4 alone. This is mainly due to the average USDC holdings on the platform surging by 18% quarter-on-quarter to a historic high of $17.8 billion.

Coinbase is working to establish USDC as the "hard currency" of the on-chain economy through deepening cooperation with Circle and promoting the Base chain. The financial report indicates that Coinbase holds approximately 12% of the world's crypto assets, and platform assets have tripled over the past three years.

Additionally, the number of subscribers for the paid membership service Coinbase One is approaching 1 million, and these highly engaged users not only contribute stable subscription fees but also increase fund retention on the platform through products like Coinbase Card.

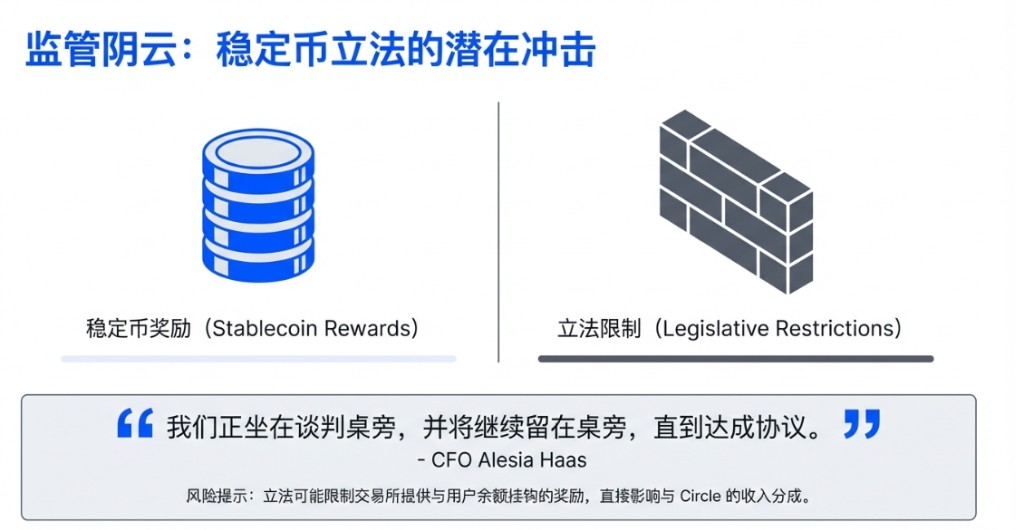

It is worth noting that the stablecoin legislation being advanced in the U.S. may restrict exchanges from offering rewards tied to users' stablecoin balances, which will directly impact Coinbase's revenue-sharing arrangements with Circle. CFO Haas stated:

We are sitting at the negotiating table and will continue to stay at the table until an agreement is reached.

Analysts generally believe that this portion of revenue has higher profit margins and is more predictable, serving as an important buffer against trading volume fluctuations. If legislation restricts this revenue source, it will weaken one of the core pillars of the company's diversification strategy.

Layout for the Future: Rigid Growth in Expenses

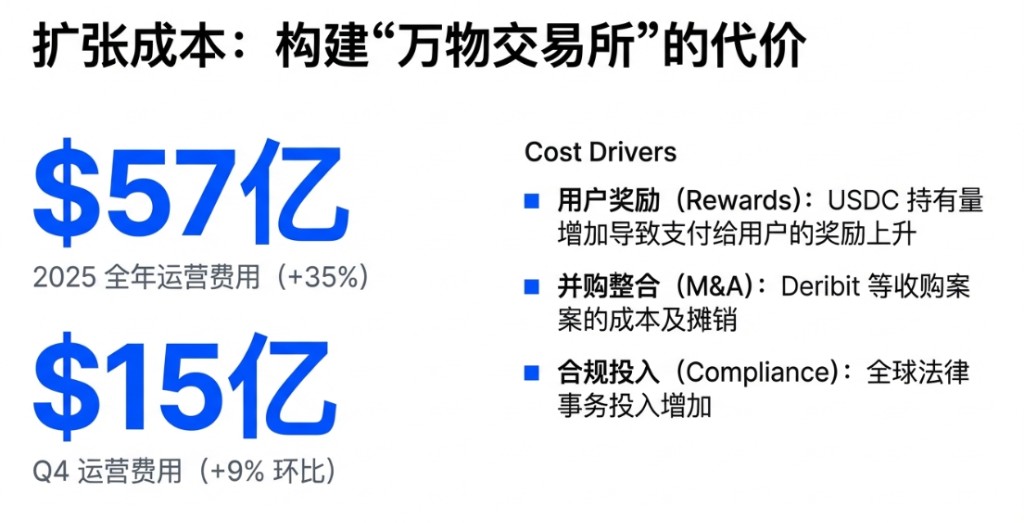

To support the ambition of becoming a "Universal Exchange," Coinbase has not been frugal with its spending.

Operating expenses for the entire year of 2025 surged 35% to $5.7 billion. Specifically, in the fourth quarter, total operating expenses increased by 9% quarter-on-quarter to $1.5 billion. Among these, technology research and development, administrative, and marketing expenses collectively grew by 14%.

The increase in spending mainly comes from three aspects:

- First, with the increase in USDC holdings, the rewards paid to users have risen significantly;

- Second, acquisition-related costs and amortization from acquiring companies like Deribit;

- Third, investments in global compliance and legal affairs.

Despite high expenses, Coinbase emphasizes that this is to capture market dividends after regulatory clarity. The company increased its full-time employee count by 3% quarter-on-quarter to 4,951 in the fourth quarter, mainly concentrated in customer service and product teams, indicating an expansion trend.

Outlook for Q1: Cautiously Optimistic

For the first quarter of 2026, Coinbase provided a relatively cautious performance guidance.

As of February 10, 2026, the company has generated approximately $420 million in trading revenue. However, in terms of subscription services, Q1 revenue is expected to be between $550 million and $630 million, lower than Q4 levels, primarily due to decreased interest income from falling interest rates and a decline in staking rewards due to the drop in cryptocurrency asset prices.

To hedge against potential performance fluctuations and return value to shareholders, Coinbase has launched a substantial buyback plan.

Following the buyback of $850 million in stock in Q4, the company repurchased another $895 million in stock from the beginning of 2026 to February 10. With the new $2 billion buyback authorization approved by the board, Coinbase currently has about $2.3 billion in buyback "ammunition."

Analysts believe this aggressive capital allocation strategy provides support for the stock price in a turbulent market. In response to the recent contraction in the cryptocurrency market, research firm Kaiko stated that we are currently at the "midpoint of a bear market." However, Clear Street analyst Owen Lau believes:

Price trends and trading volumes resemble a mid-cycle correction rather than a complete collapse.

For Coinbase, the short-term slump in the cryptocurrency market will prove the effectiveness of its diversification strategy, but a prolonged bear market will once again expose the reality that exchange revenues are difficult to completely escape from market cycles