US stocks "first surge then crash"? US Treasury yields break 5%, technology lags behind pharmaceuticals... The "top ten surprises" in 2026 may disrupt the market

UBS released its top 10 "surprise" warnings for 2026: U.S. stocks may experience a roller coaster of "rising first and then crashing," with the probability of being in a bubble possibly exceeding 80%; the yield on 10-year U.S. Treasuries may break 5%; overvalued tech stocks may underperform, while pharmaceuticals may outperform; the U.S. dollar continues to weaken, and assets in the Eurozone and India are expected to break through against the trend; copper mining stocks with a "consensus leaning bullish" may underperform

U.S. stocks may surge more than 20% initially, followed by a bubble burst and a sharp decline; the yield on the U.S. 10-year Treasury may break the previous high of 5%; technology stocks may significantly underperform, while pharmaceutical stocks may rise unexpectedly.

According to the Wind Trading Desk, UBS's Global Equity Strategy team released a report on February 2, 2026, outlining "Ten Surprises," which are not their baseline predictions but a reminder that market consensus may underestimate tail risks and the speed of style shifts. For investors, the most critical impacts focus on three main lines:

-

The stock market may "rise" before "crashing": The team believes the market currently only accounts for about a 20% probability of a bubble, but the probability of being in a bubble may exceed 80%, implying that the stock market could still rise by 20% before the bubble bursts, leading to a "real bear market";

-

Rising tail risks in interest rates: If the yield on the U.S. 10-year Treasury rises above 5% (the recent high was 5.04%), the traditional asset allocation of "bond hedging" may continue to be weakened;

-

Sector and regional pricing may be rewritten: In a risk scenario, pharmaceuticals may outperform, while technology stocks may underperform; at the same time, the U.S. dollar may weaken throughout 2026, and U.S. assets may continue to lag when measured in dollars; the Eurozone, India, and others may have upside potential; while "consensus bullish" copper mining stocks may underperform.

Surprise One: U.S. Stock "Frenzy-Crash" Cycle

UBS's Core View: MSCI Global Index year-end target of 1130 points, about 8% upside potential

Risk Scenario: Surge to form a bubble, followed by a sharp decline

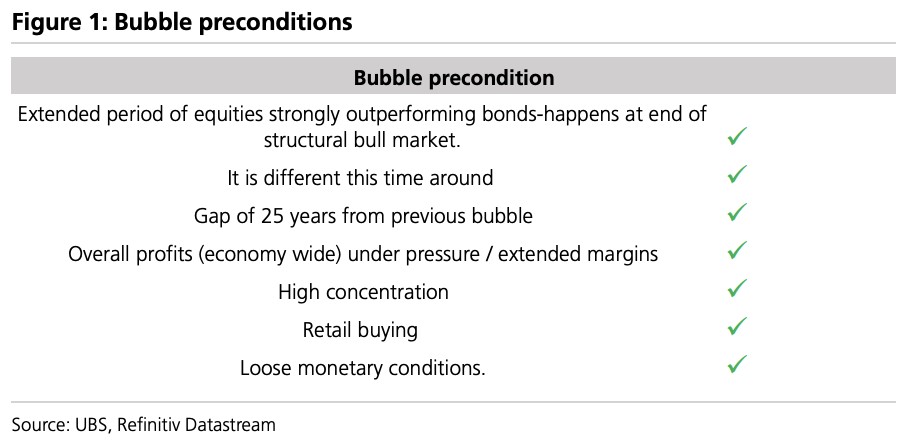

UBS points out that the market currently assigns only about a 20% probability to bubble pricing, but this probability may rise to over 80% (which would imply that the stock market has about 20% upside potential left). Since December of last year, all seven prerequisites for bubble formation have been met: stocks have significantly outperformed bonds over the long term, the narrative of "this time is different," 25 years since the last bubble, overall profit margins under pressure, high concentration, retail buying, and loose monetary conditions.

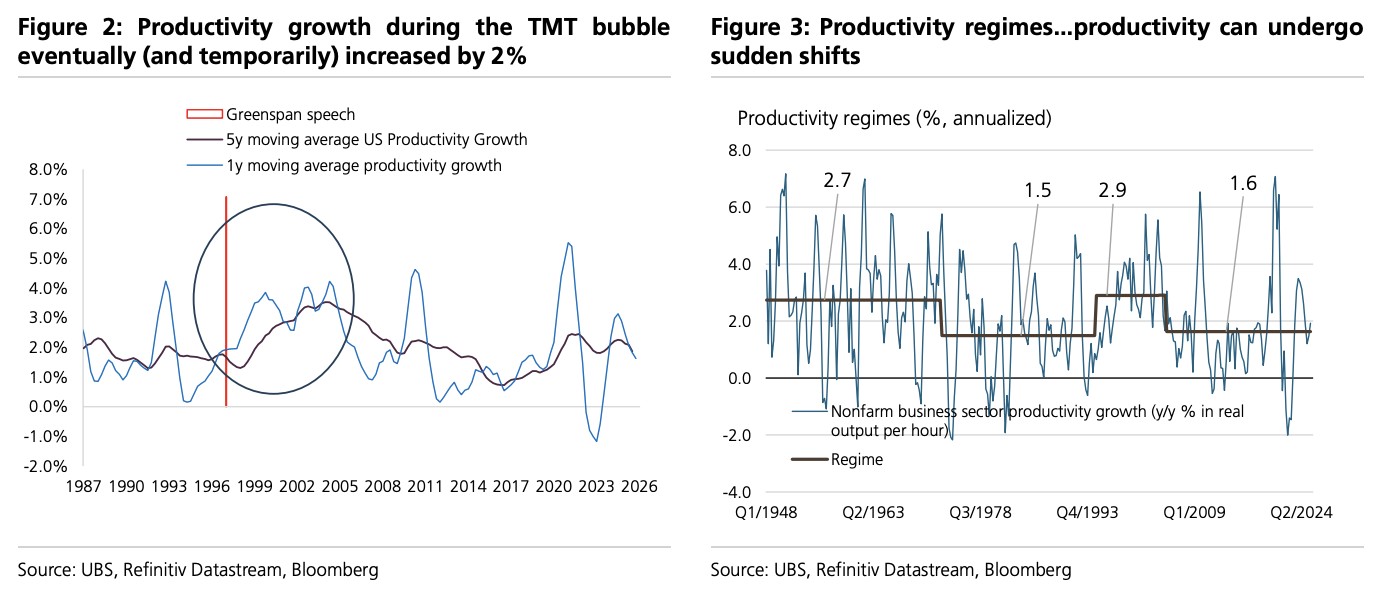

More critically, the rationale for this round of bubbles is more compelling than ever. First, generative AI may break the "Amara's Law"—we typically overestimate the short-term impact of technology while underestimating its long-term effects, but this time both may be underestimated. The U.S. quarterly productivity growth has soared to 4.9%. If productivity improves by 2% starting in 2028, the fair value of the S&P 500 index could reach 8600 points.

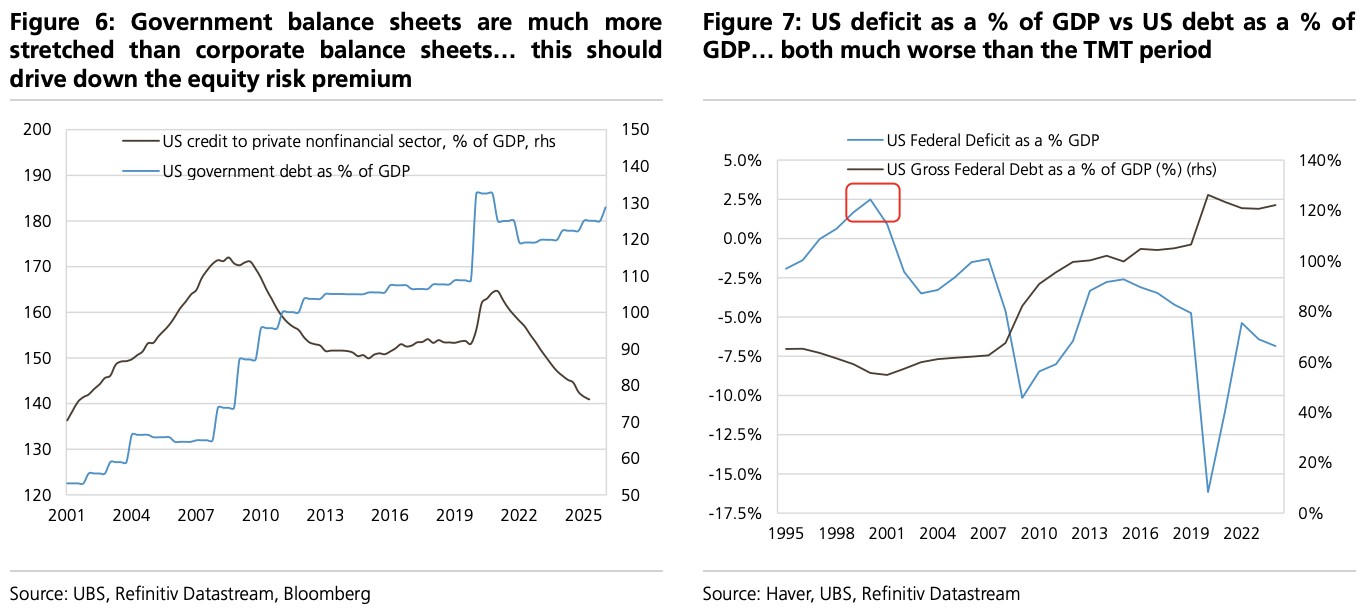

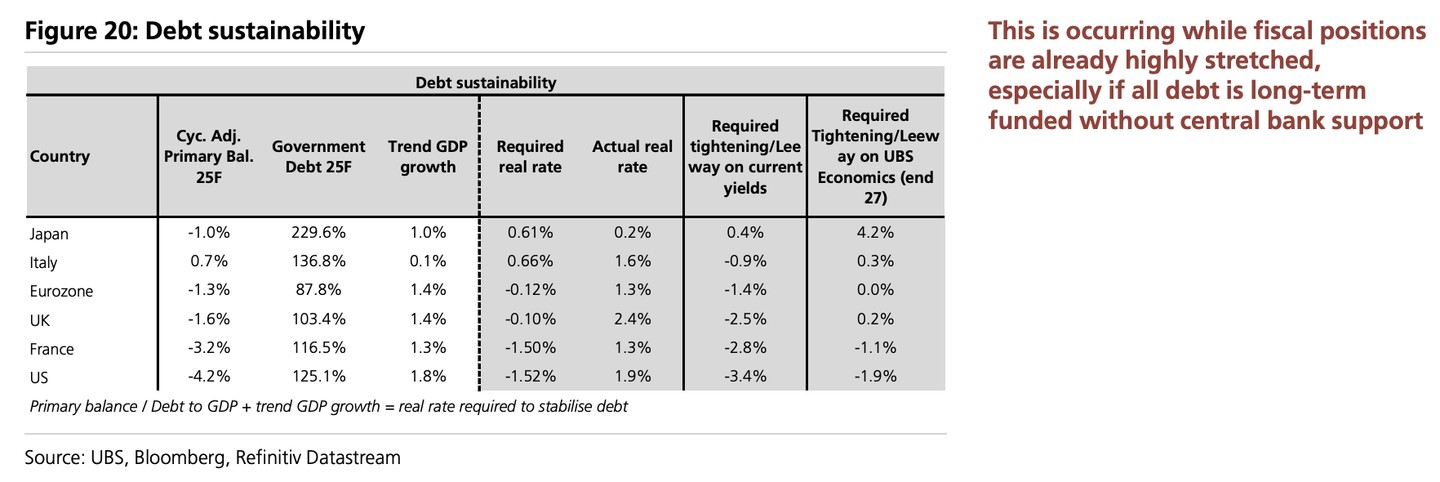

Second, the risk of government debt monetization. The U.S. federal deficit accounts for 4.2% of GDP, and government debt accounts for 125.1% of GDP, far exceeding the TMT bubble period. UBS believes that governments face three options: default (very low probability), forced fiscal tightening (50% probability), or central banks printing money to buy bonds (at least 30% probability).

Second, the risk of government debt monetization. The U.S. federal deficit accounts for 4.2% of GDP, and government debt accounts for 125.1% of GDP, far exceeding the TMT bubble period. UBS believes that governments face three options: default (very low probability), forced fiscal tightening (50% probability), or central banks printing money to buy bonds (at least 30% probability).

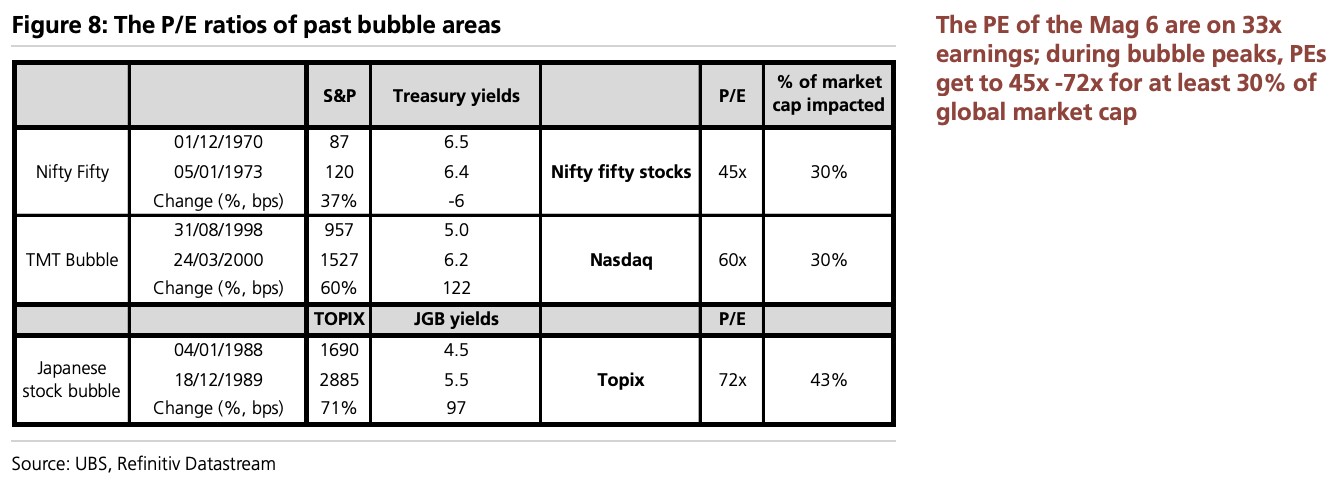

However, UBS emphasizes that we are far from the peak of the bubble. None of the seven warning signals of a bubble peak have appeared: the Mag 6 price-to-earnings ratio is only 33 times (typically reaches 45-72 times at the bubble peak), the equity risk premium remains at 2.6% (drops to 1% at the bubble peak), credit spreads are close to historical lows rather than rising, volatility has not increased (the S&P 500's maximum drawdown since April 8 is only 5%), the Federal Reserve is cutting rates rather than significantly raising them, ISM new orders have not plummeted, and there have been no extreme merger and acquisition transactions.

Once the bubble eventually bursts, possible triggering factors include: excessive investment in the technology sector leading to a collapse in profit margins, bond yields soaring due to concerns over fiscal discipline, a sharp decline in immigration and strong growth driving accelerated wage growth, industry devaluation caused by AI exceeding revaluation, and the lagging effects of higher interest rates and higher corporate tax rates.

Surprise Two: Sovereign Debt Crisis Drives U.S. Treasury Yields Above 5%

UBS Core View: U.S. 10-Year Treasury Yield Will Fall Back to 4% by Year-End

Risk Scenario: U.S. Treasury Yields Break Above Previous High of 5.04%

UBS warns that the government may "spend until collapse." In the vast majority of developed market elections over the past two years, the incumbent government has lost elections or majority seats. Many commentators attribute this to stagnation in per capita GDP growth since 2018. A short-term expedient may be for the government to spend heavily.

In the U.S., President Trump’s approval rating is 38%, and as the midterm elections approach, he has proposed a series of spending plans: a 50% increase in defense spending by fiscal year 2027 (costing about 1.2% of GDP), and a $2,000 tax cut per person (costing 2% of GDP).

More concerning is that this occurs at a time when fiscal conditions are already very tight. The U.S. needs an initial budget surplus of 1.52% to stabilize debt, but the actual deficit is -4.2%, with a gap of 3.4%. If all debt is financed long-term without central bank support, the situation will be even more severe.

Other factors driving yields higher include: 5-year forward inflation expectations imply a core PCE of 2%, but the Federal Reserve has exceeded its inflation target for nearly five years; the U.S. yield curve is only at neutral levels; Upward pressure on yields in Japan and Germany; global and U.S. growth continues to be revised upward; foreign holdings of U.S. Treasuries may face risks due to worsening geopolitical conditions; pension funds shifting from defined benefit (DB) to defined contribution (DC) plans lead to bond sell-offs.

Investment advice: Avoid stocks with high leverage and low free cash flow; focus on domestic stocks in regions with excellent fiscal conditions such as Switzerland and Taiwan; financial stocks and companies with unhedged pension deficits may benefit; continue to overweight gold to hedge against debt monetization risks.

Surprise Three: U.S. GDP growth exceeds 3%, Fed forced to reverse policy

UBS Core View: U.S. GDP growth at 2.6% in 2026, Fed to cut rates twice more

Risk Scenario: GDP growth exceeds 3%, Fed forced to raise rates

Upward risks include: A 10% rise in the stock market adds nearly $6 trillion to household wealth, if 3-5% of that is consumed, it could contribute 0.7-1% to GDP; tech investment contributed 85 basis points to GDP growth over the past four quarters, and ultra-large cloud computing companies are expected to increase capital expenditures by 30% in 2026, with Oracle just raising its 2026 capital expenditure budget from $35 billion by 42% to $50 billion; reduced policy uncertainty; rebound in non-AI capital expenditures; global monetary stimulus; Japan may ease by another 0.8% of GDP, and China may exceed the expected 1-1.5%.

The real risk is: Unexpectedly strong economic performance could lead to accelerated wage growth, especially with the current labor force growth rate at zero. If wage growth rises and inflation rebounds (UBS forecasts core PCE to rise to 3.1%), the Fed may be forced to pivot quickly. In this scenario, the market may see rates at 4% by the end of 2026, rather than the market's expected 3.15%.

Investment impact: Financial stocks may outperform; the dollar strengthens; a potential overall shift to defensive sectors.

Surprise Four: Pharmaceutical stocks unexpectedly outperform

UBS Core View: Benchmark allocation to pharmaceutical stocks

Risk Scenario: Pharmaceutical stocks outperform the market

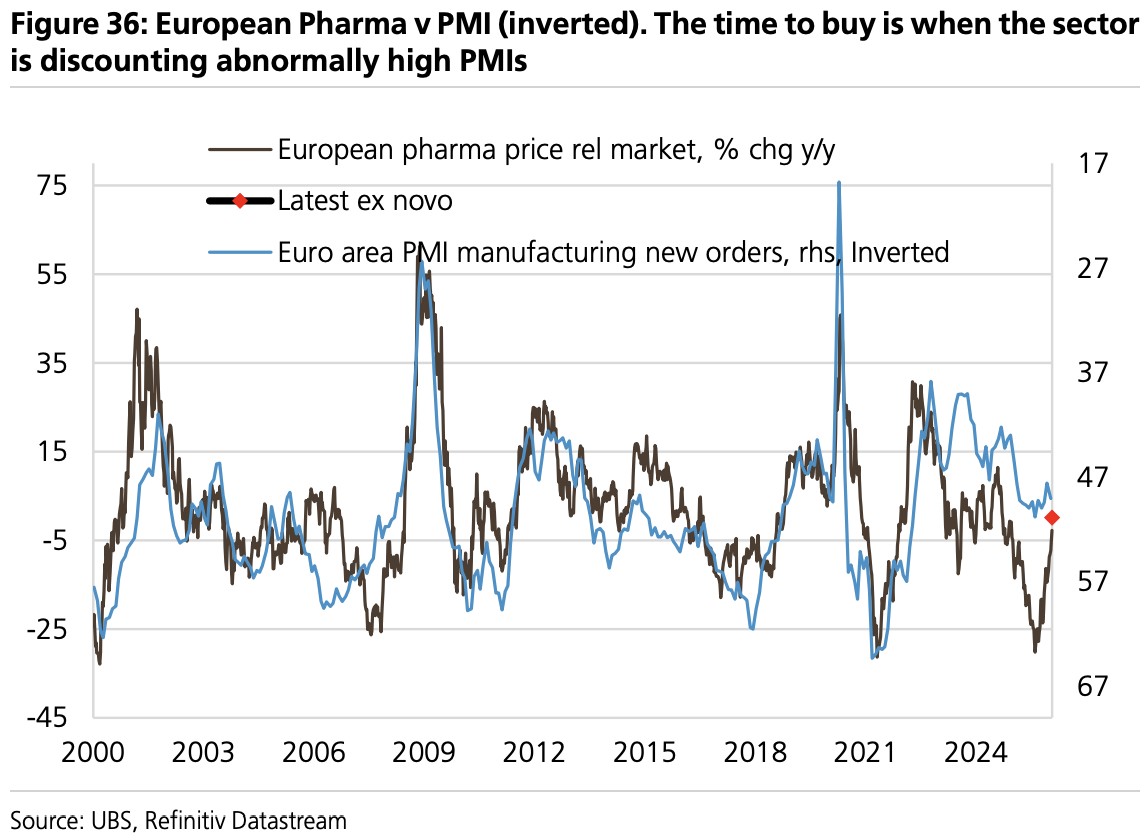

UBS lists reasons why pharmaceutical stocks may outperform: The sector currently implies a Eurozone PMI new orders of 55 (equivalent to 2.5% GDP growth), which is unlikely to be achieved.

Pharmaceutical stocks are one of the lowest-leverage defensive sectors and perform well when credit spreads widen, while current credit spreads are at historical lows; earnings revisions are in line with the market, and pricing relative to CPI is at a moderate level; valuations are cheap.

Positive catalysts include: a significant strengthening of the US dollar (pharmaceutical stocks are the largest dollar revenue sector in Europe); if US wage growth accelerates, the market may shift towards defensive sectors; drug pricing pressures continue to ease after November; the application of AI in drug discovery—generative AI could reduce preclinical trial times from 5 years to 2 years and halve the cost of bringing drugs to market (typically $2.9 billion).

Positive catalysts include: a significant strengthening of the US dollar (pharmaceutical stocks are the largest dollar revenue sector in Europe); if US wage growth accelerates, the market may shift towards defensive sectors; drug pricing pressures continue to ease after November; the application of AI in drug discovery—generative AI could reduce preclinical trial times from 5 years to 2 years and halve the cost of bringing drugs to market (typically $2.9 billion).

Surprise Five: Tech Stocks Underperform Significantly

UBS Core View: Tech stocks moderately outperform, but with high selectivity (focus on TSMC, ASML, Microsoft, Chinese platform companies, Amazon, and Samsung Electronics, but cautious on Apple and Tesla)

Risk Scenario: Tech stocks underperform the market

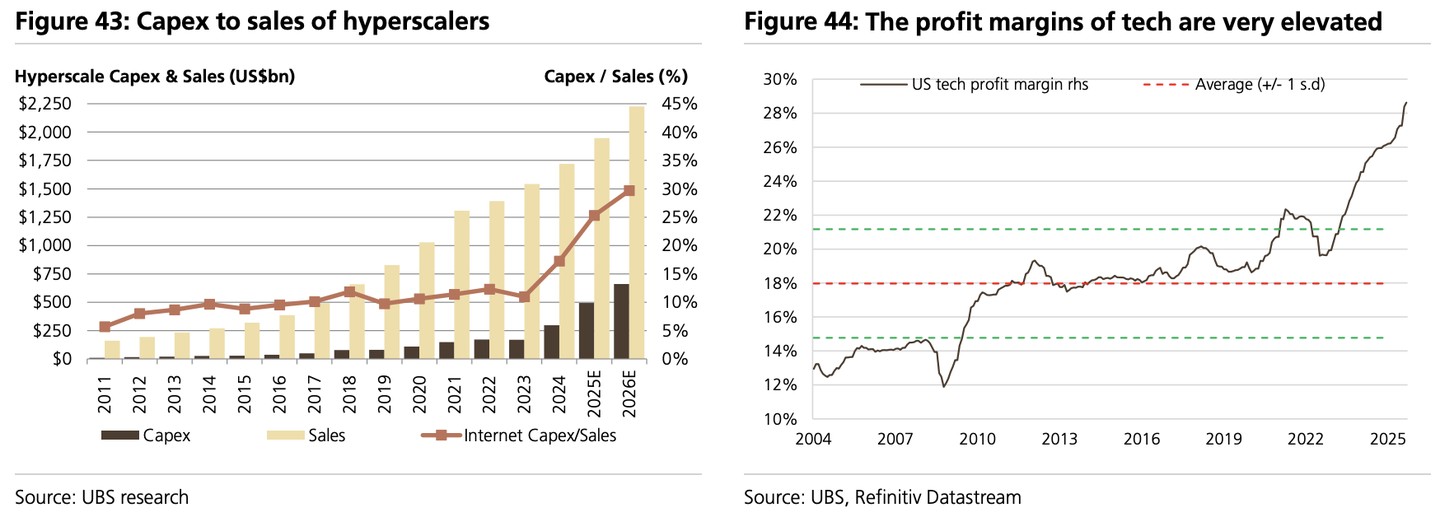

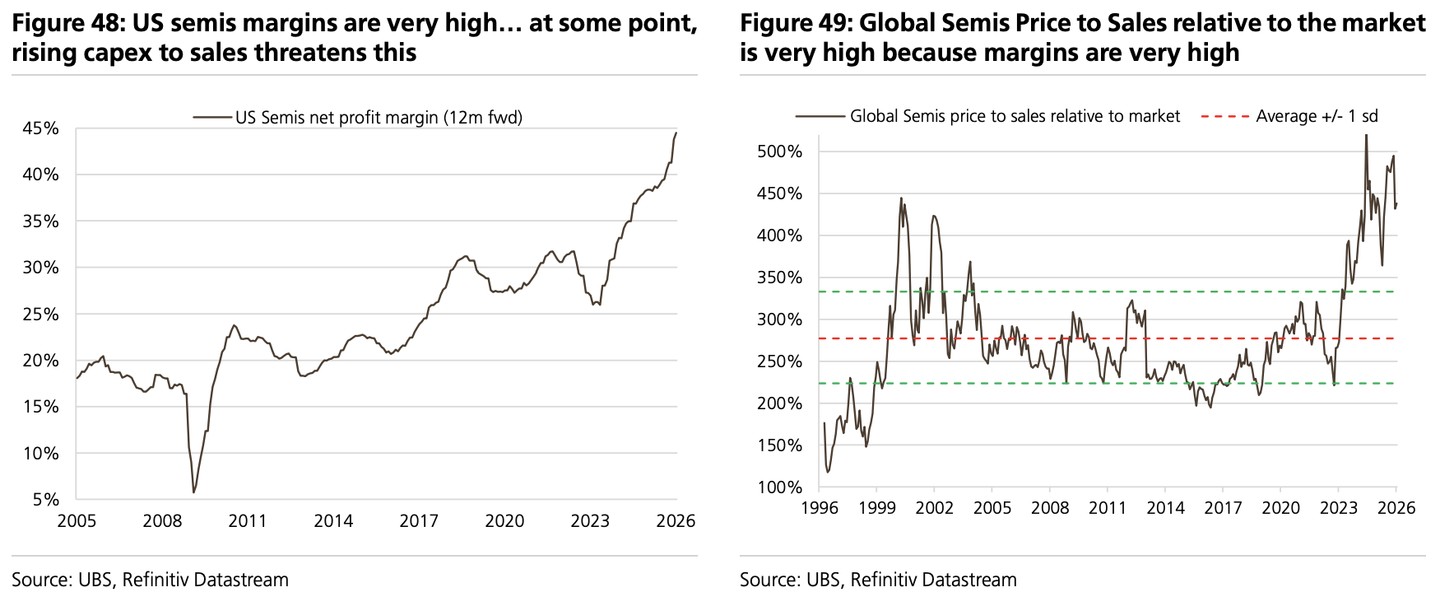

UBS warns that the rising ratio of capital expenditures to sales may ultimately harm profit margins. The capital expenditure to sales ratio for hyperscale cloud companies has surpassed the 26% peak reached by telecom companies in 2000. Oracle's stock reacted negatively after announcing a 42% increase in capital expenditures, with a free cash flow yield of -5.2% for 2026 and a net debt/EBITDA ratio of 3 times—this is highly unusual for software companies.

Semiconductor profit margins are at historical highs, which is why the price-to-sales ratio for semiconductors is also close to previous peaks. UBS questions whether Nvidia's 53% net profit margin can be sustained permanently—only one large company in the UBS HOLT database has maintained such a high net profit margin for over 5 years. Google's TPU chips and Amazon's Trainium 3 chips are creating more competition.

Online advertising faces threats: 73% of advertising is already online, which is a mature industry; if OpenAI focuses on advertising, competition will intensify; internet inventor Tim Berners-Lee warns that when large language models read content while humans do not, ad-based business models will collapse; social media usage time fell by 7% last year.

Software may be disrupted: "from 'software eating the world' to 'AI eating software'." Generative AI means fewer white-collar jobs, leading to a decrease in subscriptions and licenses for software companies; Klarna mentioned it will no longer use Salesforce and Workday; Coca-Cola recently used OpenAI to create advertisements at a cost that is only a fraction of traditional methods.

A surprise may be that software starts to outperform semiconductors from here: software is exceptionally oversold; earnings revisions are better than performance, which is the most extreme gap among all sectors; this is one of the least favored sectors by sell-side relative to normal; it has already depreciated significantly.

Surprises Six to Ten: Other Key Risks

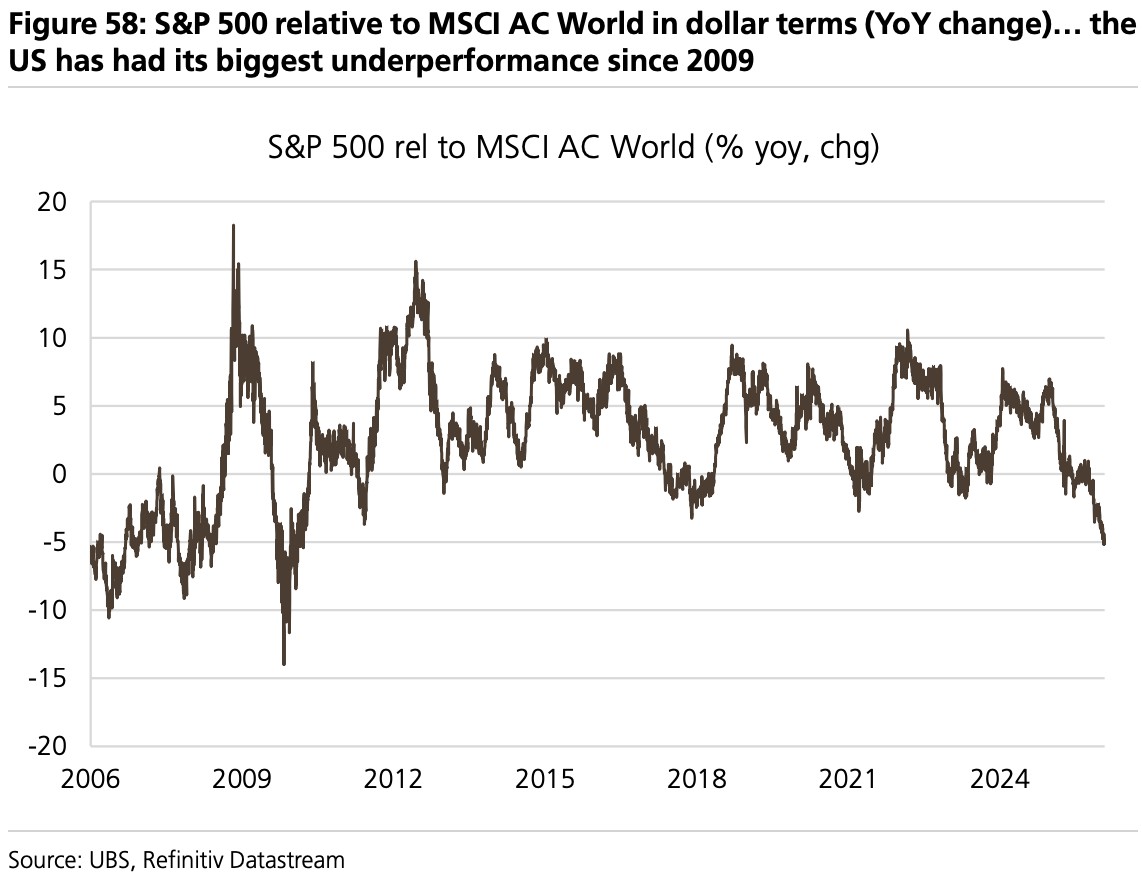

Surprise Six: The U.S. market continues to underperform. In dollar terms, U.S. stocks have experienced the largest pullback relative to global markets in nearly 15 years. If global growth accelerates to over 3.5%, the U.S. typically underperforms because it has the lowest operating leverage. A weaker dollar, repurchase yields no longer being outstanding (having fallen to be on par with global markets), and the adjusted price-to-earnings ratio for sectors excluding technology stocks still being relatively high mean that if technology stocks underperform, the U.S. will underperform 80% of the time.

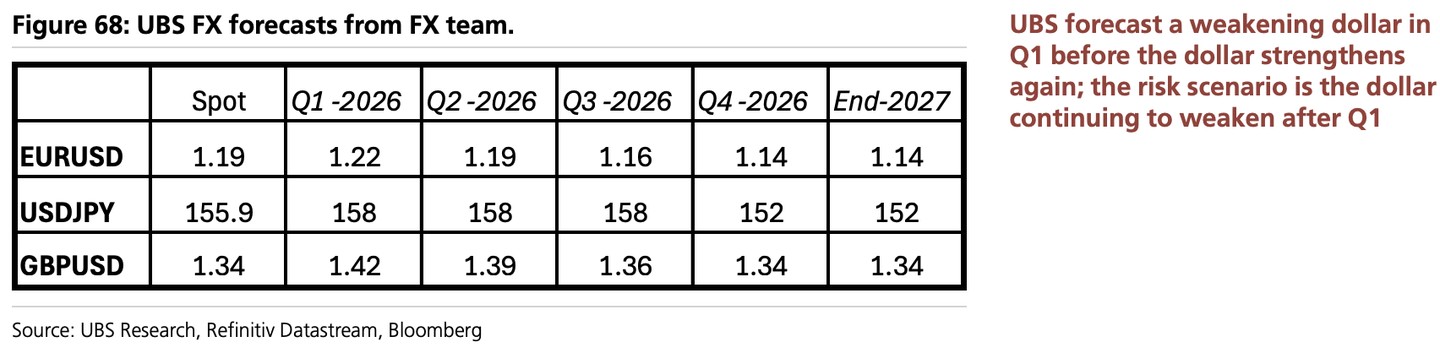

Surprise Seven: The dollar continues to weaken throughout the year. UBS's foreign exchange team predicts that the euro/dollar will reach 1.22 in Q1 but fall back to 1.14 by the end of 2027. The risk is that the dollar continues to weaken because: net external debt remains about 80% of GDP, the dollar is still overvalued, excessive dollar holdings (accounting for 57% of global foreign exchange reserves but only 16% of global trade), dollar bull and bear markets typically last 9.5-10 years, erosion of the Federal Reserve's credibility, the dollar no longer diversifies risk, and President Trump has repeatedly stated he does not want a strong dollar.

Surprise Eight: Eurozone GDP growth significantly exceeds expectations. The composite PMI is consistent with about 1.5% GDP growth; the savings rate is still 3% higher than before the pandemic, with excess savings stock at 10% of GDP; energy and food prices are falling (UBS predicts a 25% drop in natural gas prices); a ceasefire in Ukraine could contribute 0.3% to European GDP growth within 12-18 months, according to UBS analysts; the impact of fiscal easing may be greater than expected.

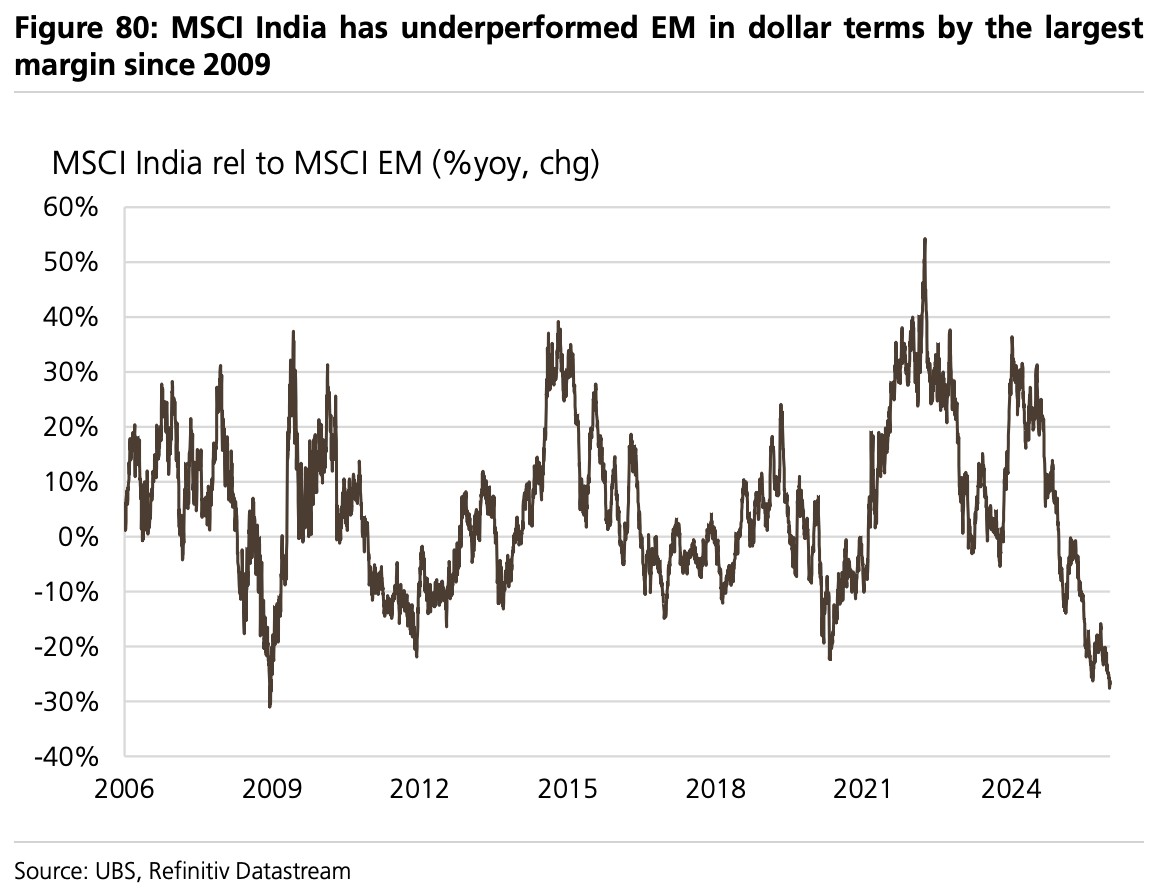

Surprise Nine: The Indian market outperforms. India has experienced the largest pullback relative to emerging markets since 2009. Supporting factors include: one of the best structural growth stories, nominal GDP growth of 8.7% is still double that of China; the price-to-earnings ratio relative to global stock markets has returned to historical averages; India's performance is re-coupling with PMI; if oil prices fall by 10%, it could contribute 40 basis points to GDP growth; the Reserve Bank of India may be more dovish than expected; the rupee appears cheap; and the possibility of tariff reversals.

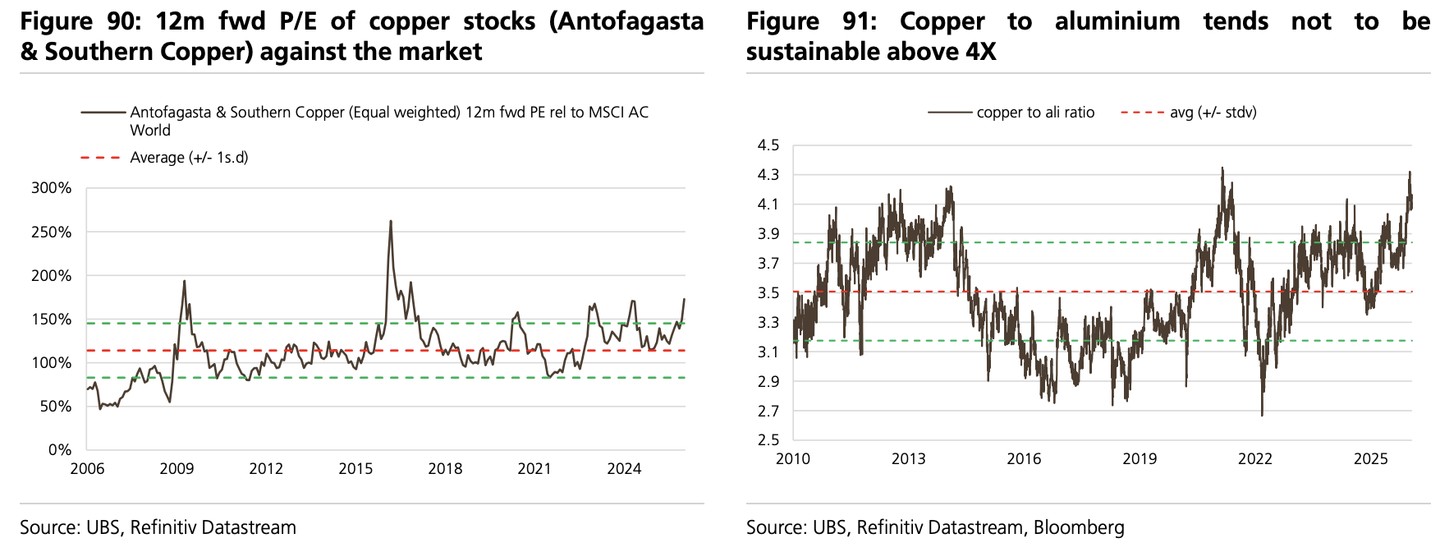

Surprise Ten: Copper mining stocks underperform. The price-to-earnings ratio of copper mining stocks relative to the market has reached extreme levels, with Southern Copper's expected P/E ratio for 2029 at 36.4 times and Antofagasta at 23.4 times; the copper-aluminum price ratio is at a level where a 20% substitution could occur; copper mining stocks are merely following copper prices upward, which means the market assumes that price increases are permanent and that there will be no demand destruction or economic recession China must shift from investment-led to consumption-led growth, with 58% of copper demand coming from China and 70% related to investment; copper mining stocks are very overbought.

Investor Insights

UBS's "Top Ten Surprises" framework reminds investors that market consensus is not set in stone, and there may be significant volatility in 2026. For investors seeking stable returns, the key is to prepare for these "tail risks" based on core allocations: moderately allocate to gold to hedge against debt monetization risks, focus on defensive sectors such as pharmaceuticals, be wary of the correction risks of overvalued tech stocks, and be more selective in stock picking within the tech sector. Historical experience shows that when all the prerequisites for market bubbles are in place, it is often a time of both opportunity and risk—there could be a further 20% increase, or it could ultimately plummet by 80%. This requires investors to remain highly vigilant and ready to adjust their strategies at any time