With the financing issue resolved, can Oracle's AI story be repriced?

Oracle plans to raise up to $50 billion to support its AI business expansion, with a plan that balances debt and equity, aiming to optimize its balance sheet and control dilution. Barclays believes this move eliminates long-term market concerns about its funding sources, and currently, Oracle's stock price is "too cheap," not reflecting its growth prospects of over 30%, and is optimistic about a repricing of the stock

Oracle launched a comprehensive financing plan of up to $50 billion, and Barclays believes this move eliminates the market's biggest concern about the funding sources for its AI business expansion, suggesting that the company's stock price should be repriced.

On Sunday evening, Oracle announced its financing plan for the fiscal year 2026, aiming to raise $45-50 billion. According to a previous article from Wall Street Insight, the company officially launched a bond issuance on Monday, with a scale between $20 billion and $25 billion, divided into eight parts, with maturities ranging from 3 to 40 years. Oracle has committed that this will be the only debt issuance in 2026, with no additional notes issued within the year.

According to news from the Wind Trading Desk, Barclays analyst Raimo Lenschow stated in a research report on the 2nd that this news should be viewed positively and will drive the stock price higher. The firm pointed out that Oracle should be one of the few companies in the software industry this year to see significant revenue acceleration and will benefit from the emerging AI world, while the current 18 times calendar year 2027 price-to-earnings ratio (as of February 1, 2026) does not reflect its expected growth prospects of over 30% in the coming years.

Financing Structure Balancing Credit and Dilution

Oracle's financing plan reflects a balance between maintaining credit ratings and controlling equity dilution. According to Barclays' calculations, if the company raises the full $25 billion in equity, its peak leverage ratio (debt plus leases to adjusted EBITDA) will decrease by 0.4 times compared to a pure debt financing plan, at the cost of up to 4% equity dilution.

The design of the equity financing portion shows flexibility. The stock market issuance plan of up to $20 billion implies a potential scale of about $5 billion for mandatory convertible securities. This plan allows the company to flexibly adjust the issuance pace based on market conditions and actual capital needs.

For the debt portion, the issuance structure of up to 8 different maturities will diversify refinancing risks, and the distribution of maturities from 3 to 40 years also reflects a match with the long-term investment cycle in AI infrastructure.

Addressing Unresolved Financing Concerns

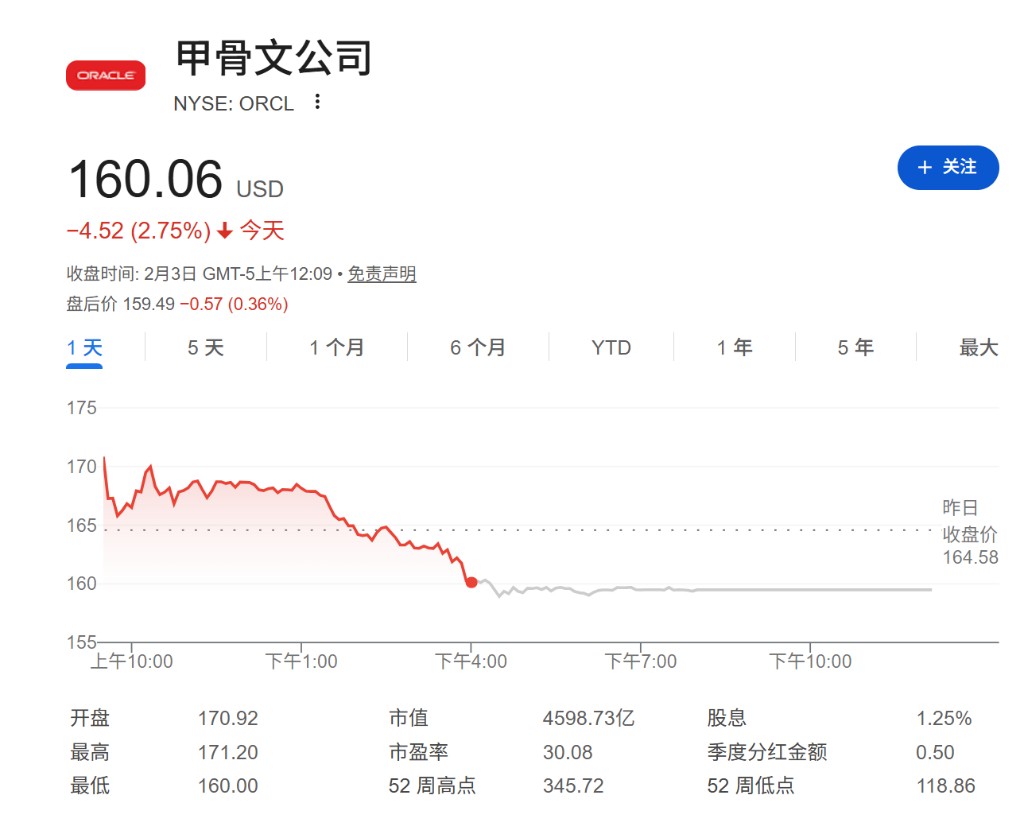

Barclays stated that in recent months, the main controversy surrounding Oracle has been how management will finance all future AI commitments and whether the company will overextend its capabilities. The company's stock price has fallen 35% over the past six months, while the software industry index IGV has dropped 19%, with credit concerns being a major drag.

This announcement provides more certainty. The market now clearly understands the scale of the annual financing needs (only this one approximately $50 billion multi-part transaction) and how the financing structure will be realized. Barclays pointed out that the combination of additional equity and mandatory convertible securities will reduce debt needs while strengthening Oracle's balance sheet, and it is expected that the debt market will be calmer after the transaction is completed.

This clear financing path eliminates market doubts about the company's financial sustainability, allowing investors to refocus on the growth potential of its AI business

Valuation and Growth Prospects Disconnected

Barclays maintains an overweight rating on Oracle, with a target price of $310, representing about 80% upside from the closing price of $160 on the 2nd. The firm believes that, considering the recent poor performance driven mainly by credit concerns, investors are expected to focus more on the improvement in leverage relative to the dilution advantage, and the stock price should respond positively.

Analysts believe that after the financing issues are resolved, the market will reassess the overall story, and Oracle's stock price is "too cheap." The company should be one of the few in the software industry that will see significant revenue acceleration this year, benefiting from the emerging AI world, and the currently depressed valuation does not match its growth prospects of over 30%.

The announcement of this financing plan provides the market with an opportunity to reassess Oracle's AI growth story, shifting the focus from concerns about financial constraints to growth potential