Reports indicate that software stocks have significant exposure, and U.S. private equity firms are facing a new round of sell-offs

Hedge funds are fleeing software stocks in droves, and the private equity sector is facing a wave of sell-offs, with leaders like Blue Owl leading the decline. Barclays warns that private equity BDC companies holding $100 billion in software debt are facing valuation shrinkage, but due to the lack of public quotes, it creates an "invisible bottomless pit." UBS further predicts that if AI triggers radical disruption, the default rate in private credit could soar to 13%. Apollo has already taken the lead in reducing software exposure and shorting bonds of several software companies

The panic over AI's disruption of traditional software business models is spreading from the stock market to the opaque private equity market.

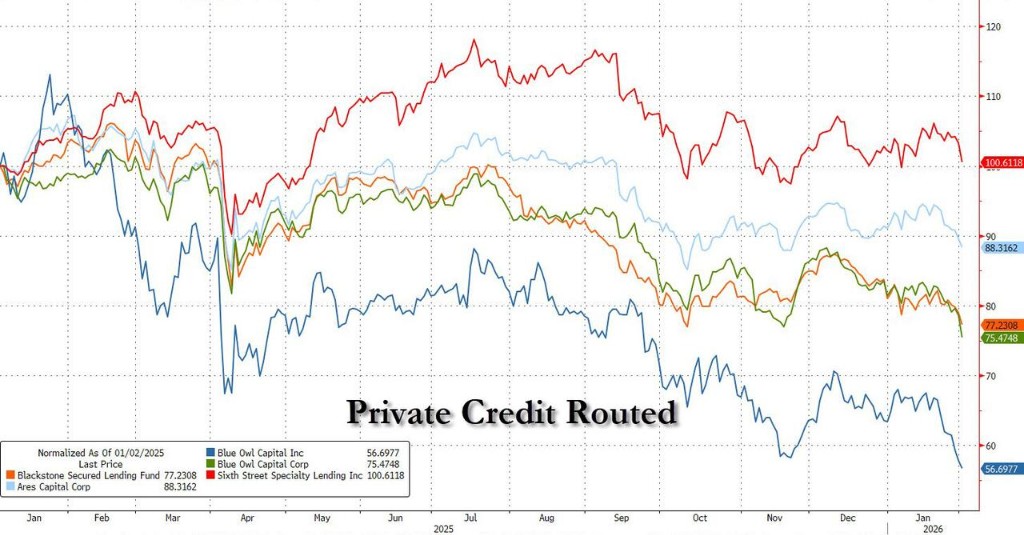

On February 3rd local time, following reports from Goldman Sachs and Barclays revealing significant risks in the software industry, U.S. publicly listed private equity (PE) and business development companies (BDC) faced a new wave of sell-offs. Investors are concerned that the hundreds of billions of dollars in private software debt held by these institutions may be facing severe valuation shrinkage risks.

The market reacted on Monday, with Blue Owl Capital's stock price dropping by about 5%, and industry leaders such as Ares Capital, Sixth Street Specialty Lending, and Trinity Capital seeing declines of over 3%.

Capital Flight: Selling Software, Embracing Chips

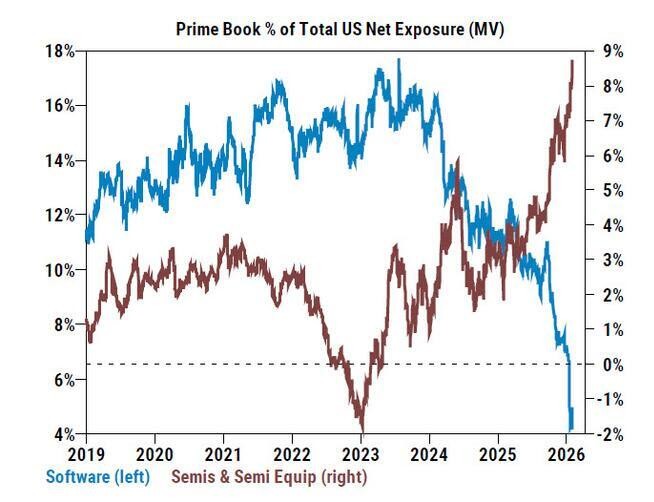

The trigger for this round of sell-offs was a capital flow report from Goldman Sachs' Prime Brokerage.

The report indicated that hedge funds are rotating industries at a record pace: frenzied selling of software stocks while aggressively buying semiconductor stocks.

Goldman Sachs stated in the report:

“Last Thursday, the net selling in the technology sector reached its highest level since September 2024, with all sub-sectors showing net selling, led by the software sector. On the other hand, the semiconductor and equipment sector saw the highest net buying of funds this week... its net exposure reached a historic high of 8.7% by the end of the week.”

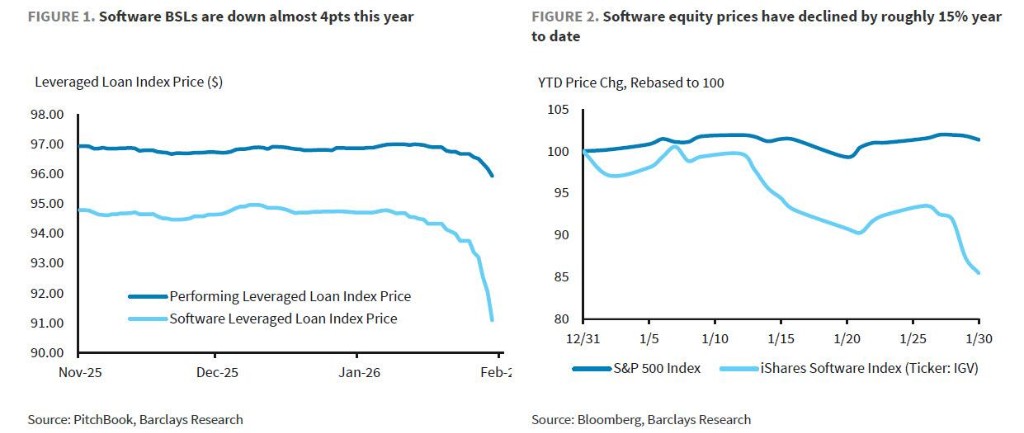

This extreme sentiment is transmitting downstream. According to Bloomberg, an index tracking software stocks plummeted by 15% in January, marking the largest monthly decline since October 2008. This panic sentiment directly impacts private credit institutions that provide financing to software companies.

Unlike the widespread concerns about subprime risks in November last year, today's sell-off reflects deep anxiety over the "software industry being crushed by AI." Last week, the prices of software loans in the broadly syndicated loan market dropped by about 4 points.

Barclays: 20% "Invisible" Risk Exposure

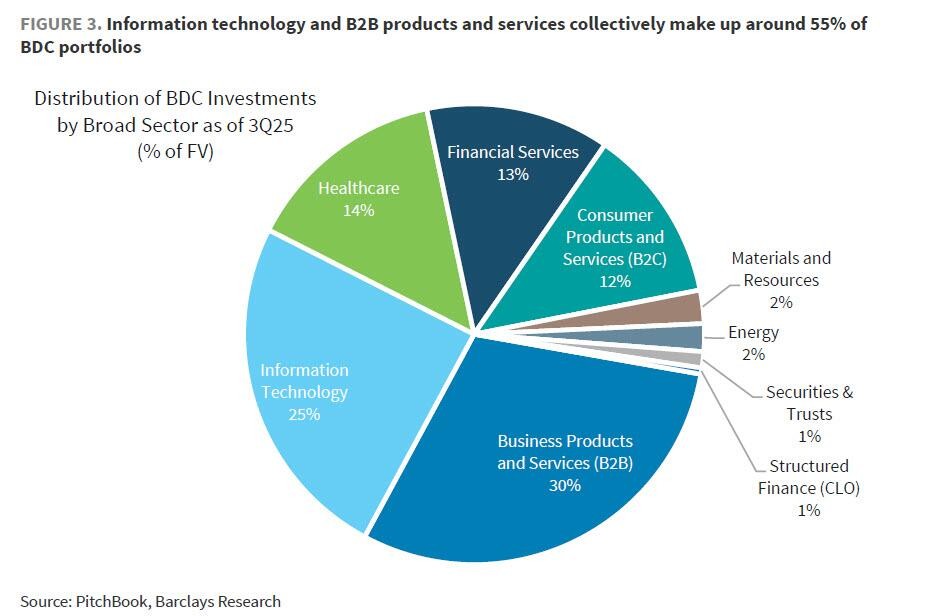

The market's biggest concern is that the massive software debt held in BDC portfolios may be facing the risk of valuation going to zero.

Barclays analyst Peter Troisi pointed out in a recent research report:

“Software is the largest industry exposure for BDCs, accounting for about 20% of their portfolios, making this sector particularly sensitive to recent declines in software equity and credit valuations.”

According to PitchBook data, as of the third quarter of last year, this total exposure was approximately $100 billion. If business products and services are included, the related exposure could be as high as 30% Barclays warned that although publicly traded software stocks have fallen 15% this year, BDCs primarily hold private credit loans that are not publicly quoted. This means that the plunge in the public market will not immediately reflect in the BDC's net asset value (NAV).

“Most BDCs will not release their Q4 financial reports until late February or March. Even then, the fair value marks as of December 31, 2025, will not reflect the recent sharp decline in valuations.”

This valuation "lag" has made investors more anxious—because it is an unseen bottomless pit.

UBS Warns: Default Rates May Soar to 13%

If AI truly leads to the mass elimination of traditional software companies, the consequences will be catastrophic.

UBS strategists provided a shocking forecast in a report on Monday: if artificial intelligence triggers "radical" disruption among corporate borrowers, the default rate in U.S. private credit could soar as high as 13%.

This view is not unfounded. As early as the end of 2025, private equity giant Apollo Global Management had begun to take action. According to a previous report by the Financial Times, Apollo CEO Marc Rowan explicitly stated that he aims to reduce the total exposure to software in the company's credit funds from 20% to below 10%.

Apollo even shorted bonds of several software companies, including Internet Brands under KKR. Rowan stated at the time:

“I don’t know whether the enterprise software industry will benefit or be destroyed as a result. But as a lender, I’m not sure I want to be in there to validate the outcome.”

Market View: Overreaction or Crisis Precursor?

Despite the spreading panic, some analysts believe the market may be overreacting.

Mitchel Penn, a senior analyst responsible for BDCs at Oppenheimer, stated that aside from speculation and emotional outbursts, there is currently no new fundamental information to explain this decline:

“Typically on days like this, we would tell clients to buy because there is no new information to help you understand why it’s falling.”

However, a series of recent negative news has put investors on edge. Just last week, a technology fund from Blue Owl had to loosen withdrawal restrictions due to a surge in investor redemption requests, resulting in about 15.4% net asset outflow. Meanwhile, TCP Capital Corp., a private debt fund under BlackRock, saw its stock price hit the largest drop in nearly six years after disclosing a series of investment write-downs Before the official unveiling of the true value of these "black box" assets during the earnings season, the market seems to have decided to decline as a form of respect