金银 “史诗级暴跌”,可以抄底了吗?

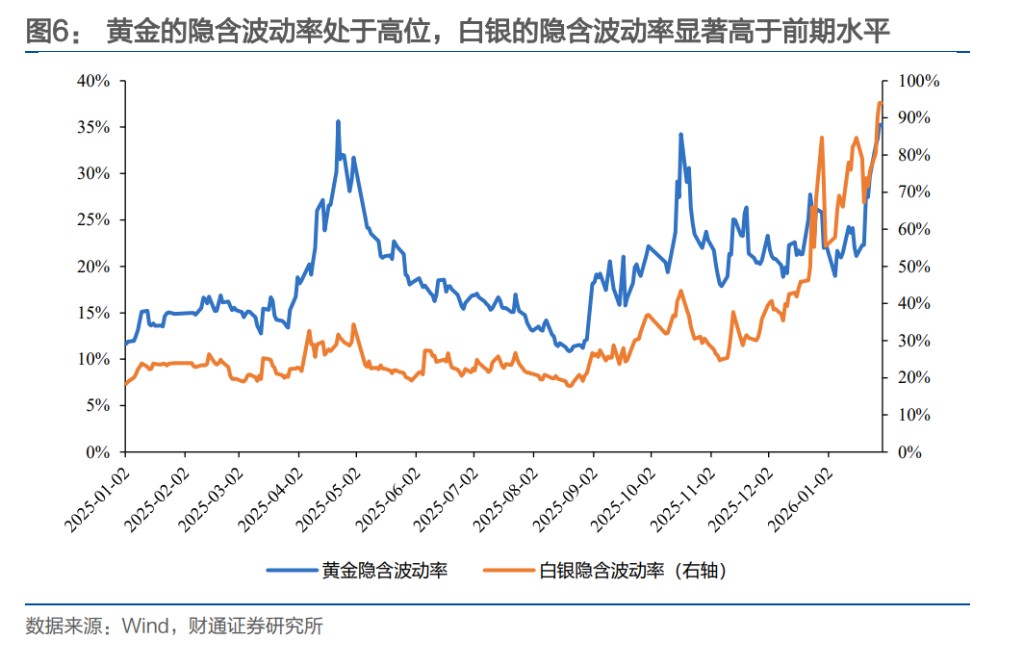

共识是:此刻不宜盲目抄底。虽长期牛市逻辑未变,但短期抛压未尽、波动巨大。华泰证券等多家机构分析师建议保持耐心,等待市场波动率从极端高位(如黄金 IV35%)显著回落,并观察关键支撑位(如黄金 4700 美元/盎司)的企稳信号,避免在 “雪崩” 中伸手接刀。

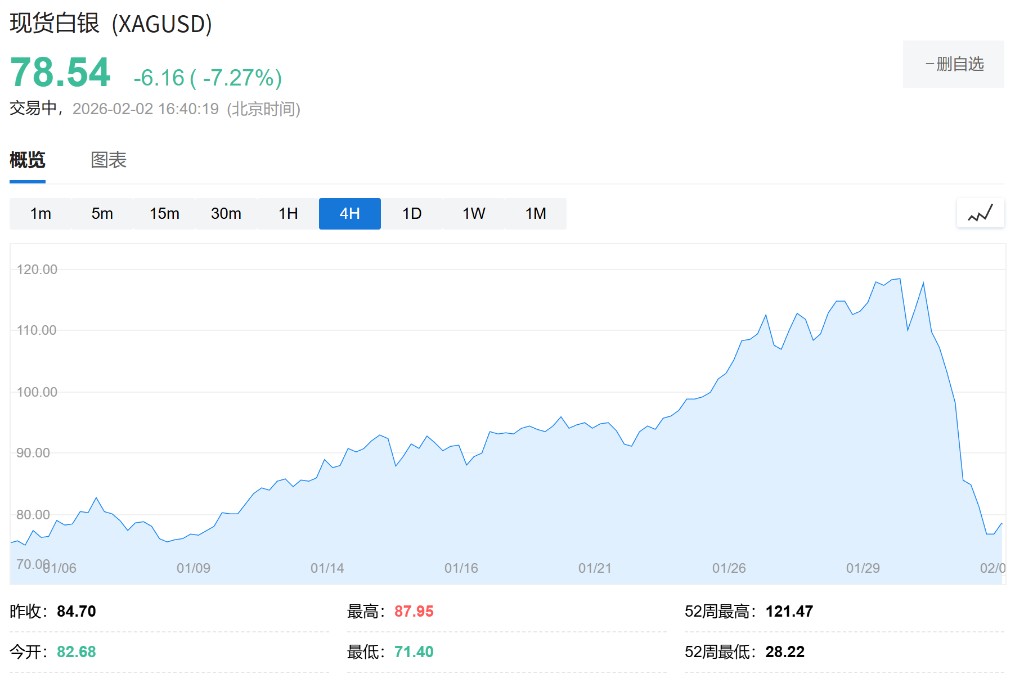

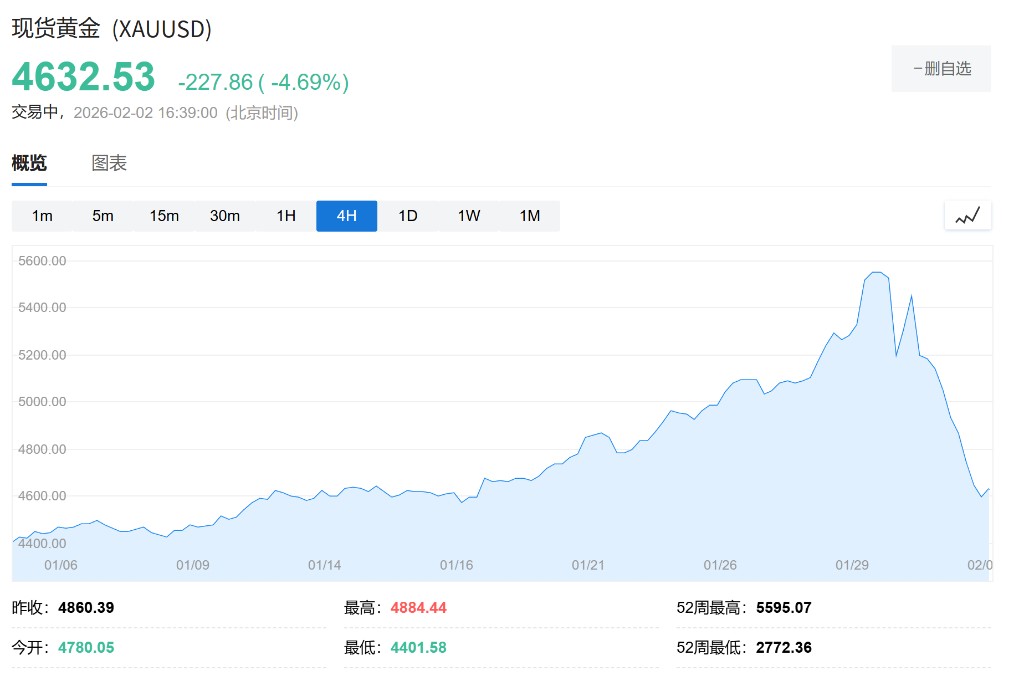

On Monday, the precious metals market continued the downward trend from Friday, with spot silver plummeting 7% in a single day and spot gold crashing 4.7%, briefly falling below the $4,500 mark.

The current situation is very clear: capital is taking profits, and leveraged funds are being forcibly liquidated. Several research institutions believe that although the long-term geopolitical game and debt logic remain unchanged, in the short term, do not attempt to catch "bloody chips" during an avalanche. The current decline is the market testing the bottom line of the new Federal Reserve Chairman and a violent correction of the previous speculative frenzy.

Gold and Silver Crash: Not Just Warsh, But a Chain Reaction of Deleveraging

This crash is not caused by a single factor, but rather a resonance of policy expectations, trading crowding, and exchange intervention.

1. Trigger: Warsh's Nomination, Hawkish Expectations Rise. Huatai Securities and Tianfeng Securities both pointed out that Trump's nomination of Kevin Warsh as the new Federal Reserve Chairman is a direct trigger. Warsh is seen as a "hawk," with core propositions including "rate cuts + balance sheet reduction." Tianfeng Securities added that Warsh was known as an "inflation hawk" during his tenure from 2006 to 2011, and the market is concerned that his appointment may lead to a crisis in the independence of the Federal Reserve, resulting in a rebound of the dollar and tightening liquidity expectations that suppress precious metals.

2. Mechanistic Sell-off: Exchanges Collaborate to "Cool Down." Huatai Securities and Caitong Securities emphasized the impact of exchange intervention. CME (Chicago Mercantile Exchange) and the Shanghai Futures Exchange almost simultaneously raised margin ratios. CME raised gold and silver margins twice in late January, with silver increasing from 11% to 15%; the Shanghai Futures Exchange also followed suit.

Caitong Securities added the factors of forced liquidation and options gamma squeeze. As of January 29, the ratio of virtual to real positions in the main silver contract on the Shanghai Futures Exchange reached 8.75, significantly higher than historical levels; at the same time, a large number of retail investors bought call options, forcing market makers to buy futures for hedging, driving up prices. Once the exchanges intensified their intervention (such as CME raising gold and silver margins six times), capital flowed out, and this positive feedback loop instantly reversed into a collapse. Additionally, the significant decline in silver ETF holdings is also an important adjustment signal.

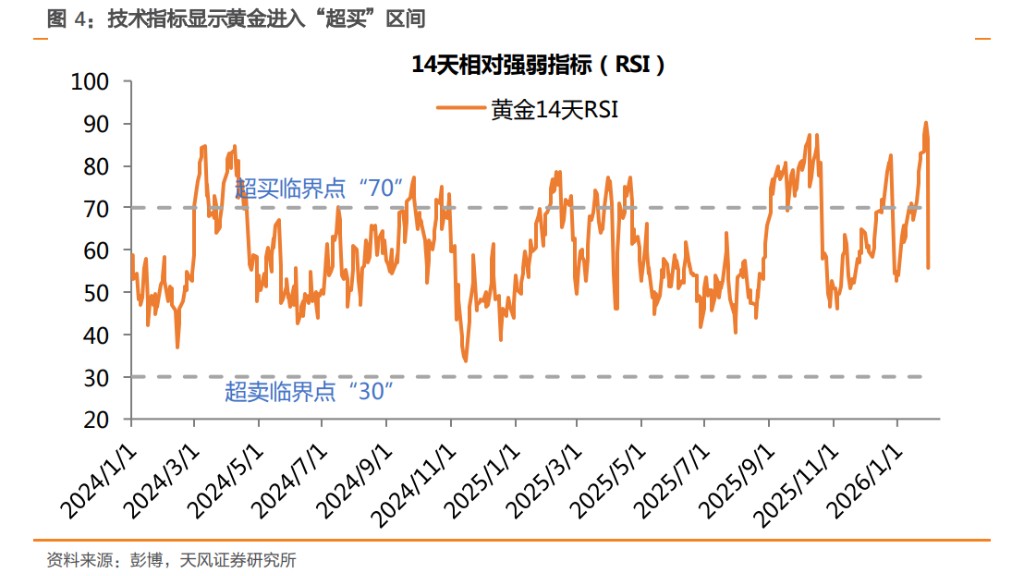

3. Root Cause: Extremely Crowded Speculative Positions and Profit Taking. Huatai Securities pointed out that before the crash, non-ferrous metals (especially silver) were the most crowded long positions globally. According to Tianfeng Securities, the 14-day RSI indicator for gold broke 90 on January 28, marking the first time this century, indicating extreme "overbought" conditions.

3. Root Cause: Extremely Crowded Speculative Positions and Profit Taking. Huatai Securities pointed out that before the crash, non-ferrous metals (especially silver) were the most crowded long positions globally. According to Tianfeng Securities, the 14-day RSI indicator for gold broke 90 on January 28, marking the first time this century, indicating extreme "overbought" conditions.

Fangzheng Securities monitored that the silver volatility index rose to 111 on January 29, setting a new historical high. Caitong Securities believes that the rapid price increase was driven by a combination of forced liquidation and options gamma squeeze effects, and once sentiment reverses, the deleveraging process will be exceptionally brutal.

4. Macro Disturbance: Concerns Over AI Tech Stock Earnings. Huatai Securities also mentioned that earnings reports from tech giants like Microsoft and Tesla have raised market concerns about AI investment returns, leading to a risk-off sentiment in the U.S. stock market, with some funds selling precious metals to remedy stock market liquidity.

Market Outlook: Long-term Logic Unchanged, Short-term Volatility Inevitable

Despite suffering a heavy blow in the short term, institutions generally believe that the long-term bull market logic for precious metals has not fundamentally reversed.

1. Long-term Logic Unchanged, Short-term Entering Volatility. Tianfeng Securities believes that gold will enter a wide-ranging volatility period in the short term, with buying sentiment being cautious. However, at a critical juncture in the global competitive landscape, the long-term allocation demand for gold by global central banks will continue to serve as a fundamental price support, and "the story of gold" will not end here. Caitong Securities also stated that the long-term logic has not reversed. Concerns about the sustainability of U.S. debt and the independence of the Federal Reserve in the international market will continue to drive central banks and the private sector to increase their gold reserves.

2. Policy Uncertainty Remains. Huatai Securities maintains a long-term bullish view, believing that non-ferrous metals are still the most obvious varieties driven by the global manufacturing cycle, geopolitical order reconstruction, and AI technology.

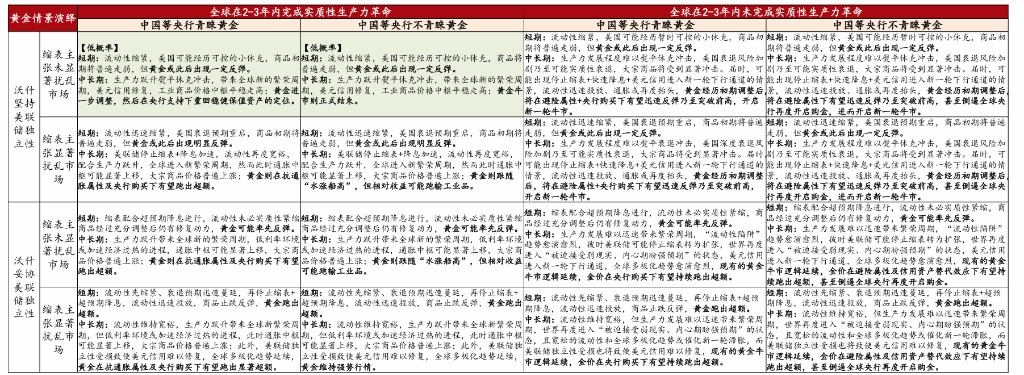

Fangzheng Securities analyzes that the subsequent market trend depends on the scenario interpretation of multiple factors. The key variables are: First, the long-term nature of great power competition and the possible short-term easing window; Second, the actual process of AI technology driving a leap in total factor productivity; Third, whether the new Federal Reserve Chairman Waller can adhere to his policy stance (such as independence and balance sheet reduction) amid internal political resistance (such as opposition nominations, internal divisions, and pressure from the previous administration).

Fangzheng Securities comprehensively deduces that for the bull market logic of precious metals to completely reverse, multiple stringent conditions must be met simultaneously (such as a rapid revolution in global productivity, Waller strongly implementing tightening without disturbing the market, and a decline in central bank gold purchasing demand), the probability of this scenario occurring is extremely low. Therefore, after fully adjusting and releasing risks, the long-term allocation value of precious metals remains prominent, and it is recommended to focus on core companies with stable performance, excellent quality, clear growth potential, and reasonable valuations.

Bottom-Fishing Timing: Do Not Rush to Catch Falling Knives, Wait for Volatility to Return

Regarding the most concerning question for investors, "When to enter the market," institutions generally advise maintaining patience and waiting for volatility to return.

1. Pay attention to the decline in volatility. Huatai Securities clearly warns that short-term "bottom-fishing" requires caution. As market volatility remains high, deleveraging and bubble-popping are still ongoing. Caitong Securities provides specific quantitative indicators: it is recommended to wait for implied volatility to pull back below 20%, which may be the time to go long again.

2. Refer to historical pullback cycles. Caitong Securities reviews historical data and points out that in recent years, after gold reaches a temporary peak, the average pullback time is about 18 days, with an average pullback magnitude of about 8%. This provides investors with a reference for the time window. Huatai Securities suggests waiting for market volatility to significantly decline from extreme high levels (e.g., gold IV > 35%) and to observe stabilization signals at key support levels (e.g., gold at $4,700/ounce) to avoid reaching out to catch knives during an "avalanche."

3. Be wary of the risk of spot and futures price differentials. Huatai Securities specifically reminds domestic investors that there is room for a correction in Shanghai silver. When the crash occurred, the closing price for Shanghai silver on the night of January 30 corresponded to $111/ounce, while London silver had fallen to $85/ounce, indicating that Shanghai silver still has about a 30% premium over the foreign market, necessitating caution regarding the risk of a correction in Shanghai silver.

4. Pay attention to delivery month squeeze risks. Huatai Securities mentions that March is a major delivery month for silver, and currently, the total open interest in CME futures is far higher than the deliverable inventory, so it is necessary to monitor whether a squeeze will occur in the delivery month, which poses both risks and potential points of speculation