Bank of America Hartnett: Only "a bigger event" can end the "gold bull market"

Epic fluctuations led to a sharp decline in silver, but Bank of America’s Hartnett stated: currency devaluation remains the fundamental basis! A weak dollar is crucial for Trump's political survival; unless a "catastrophic" event occurs, the gold bull market is unlikely to end

On the trading day just past Friday, the market experienced a dramatic volatility that is enough to be recorded in history. From the sudden plunge of stocks to the fierce rebound of the dollar, and the heavyweight rumor that former Federal Reserve "super hawk" Kevin Warsh might replace Powell, this series of events ultimately triggered a record single-day plunge in silver.

However, despite the roller-coaster market on Friday, Bank of America Chief Investment Strategist Michael Hartnett reiterated: "Debasement is Da Base Case."

For investors, this means that despite the severe short-term fluctuations, the macro logic driving the rise of gold and physical assets remains solid. Unless a "greater event" occurs that is more destructive than the current macro narrative, this bull market driven by currency debasement is unlikely to end easily. However, investors must be wary of the liquidity deleveraging risks that may arise in the first half of the year, which will be a severe cleansing of "greed" sentiment.

Weak Dollar and the Political Economy of the "Rust Belt"

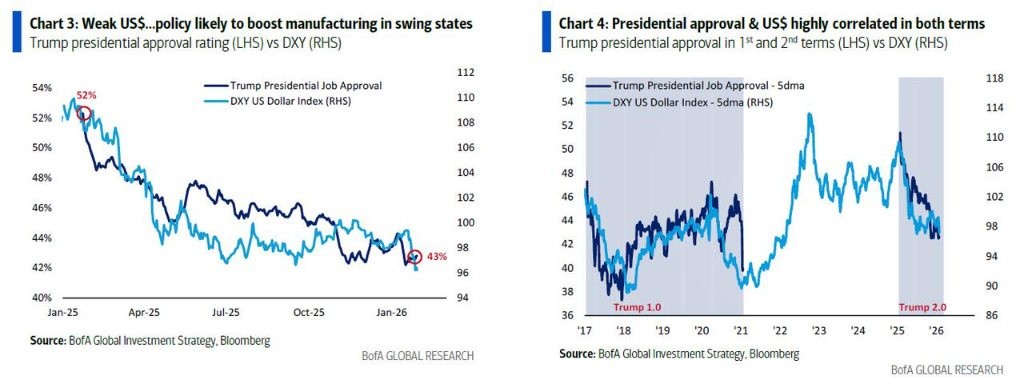

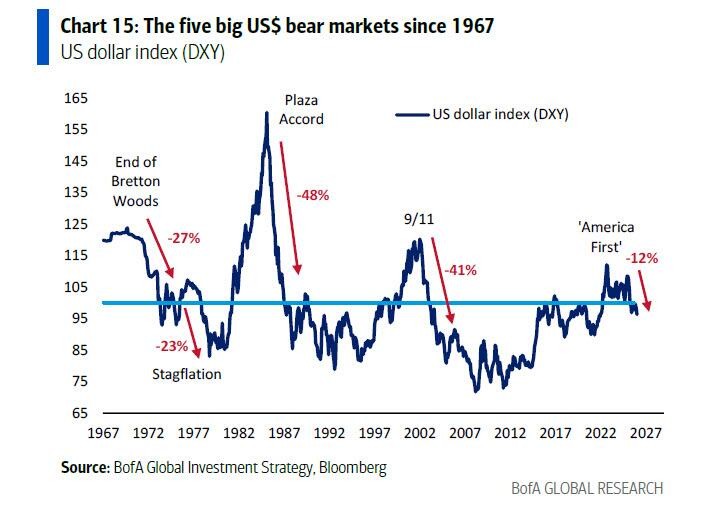

Although the dollar exchange rate rebounded on Friday, Hartnett pointed out that the dollar has actually fallen by 12% since Trump's inauguration. This weakness is not accidental but a policy direction. A weak dollar is seen as a key means to boost manufacturing in swing states like Pennsylvania, Michigan, and Wisconsin in the "Rust Belt."

This is not just an economic issue but a matter of political survival. Hartnett's data shows a high correlation between the president's approval ratings and the dollar's performance during Trump's first and second terms.

From a historical cycle perspective, the average decline of the dollar in bear markets since 1970 has reached 30%. In this macro context, gold and emerging market (EM) stocks are typically the best-performing asset classes. As long as the attribute of "currency debasement" as a policy tool remains unchanged, the long-term downward pressure on the dollar will continue to support physical assets.

The Glorious Return of the "Permanent Portfolio"

Hartnett emphasized that the traditional 60/40 stock-bond strategy is no longer suitable for the current environment, replaced by a "permanent portfolio" consisting of 25% stocks, 25% bonds, 25% gold, and 25% cash (25/25/25/25).

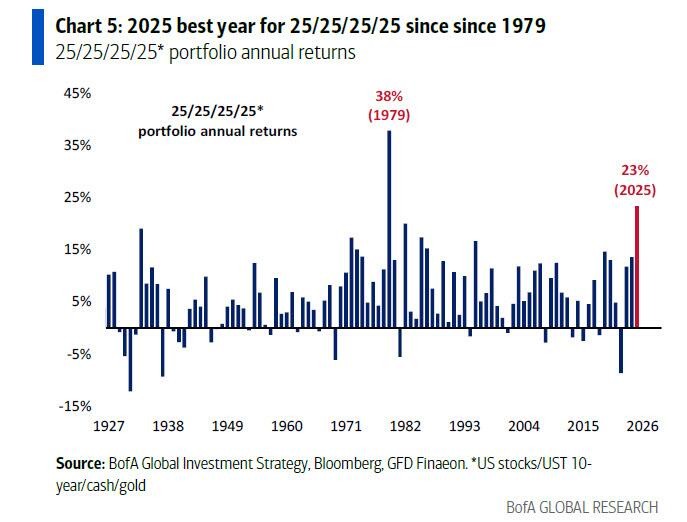

Data shows that the performance of this strategy is astonishing:

Its 10-year return rate has reached 8.7%, marking the best performance since 1992.

Even more remarkable is that the portfolio recorded a massive return of up to 23% in 2025, the best year since 1979

This data strongly proves the importance of incorporating gold and cash into core asset allocation in an era of currency depreciation and inflation fluctuations. Regarding future asset rotation, Hartnett, as a well-known contrarian investor, pointed out that the "pain trade" of 2020 was to go long on gold, while by 2026, the contrarian trade may shift to "going long on bonds." However, against the backdrop of global debt proliferation, it remains to be seen whether this contrarian thinking will be effective this time.

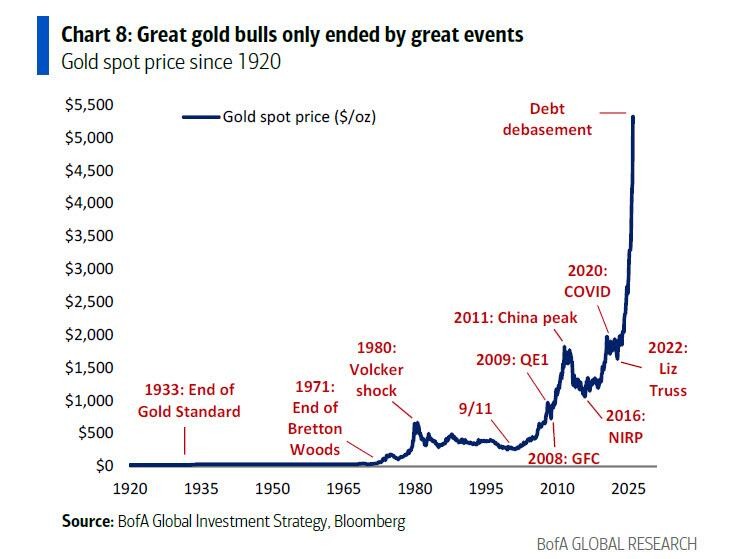

Only "a bigger event" can end the "gold bull market"

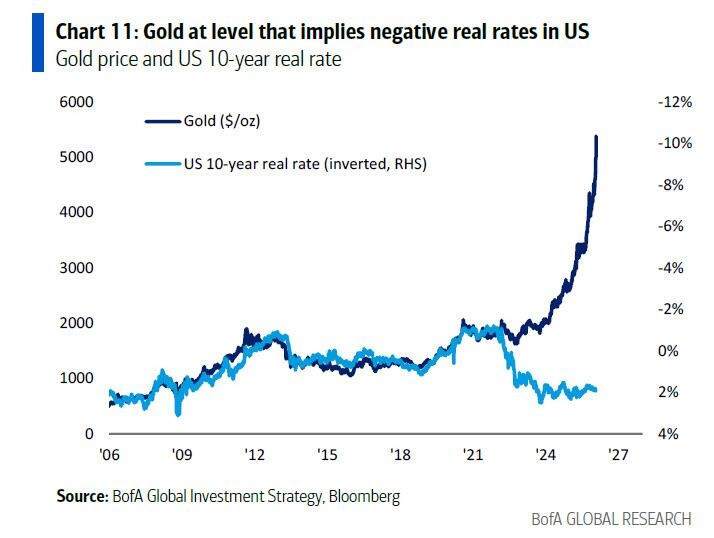

Although gold prices have recently shown "bubble-like" characteristics and even experienced a significant pullback last Friday, Hartnett believes this does not change the overall situation. The investment trends of the 2020s are dominated by war, inflation, protectionism, and wealth redistribution. Currently, the price level of gold implies that U.S. real interest rates are negative, which aligns with the market's general expectations of excess liquidity, dollar depreciation, and the basic scenario of a booming U.S. economy before the elections.

However, risks still exist. Hartnett warns that non-U.S. asset allocators currently hold 64% of the market value of U.S. stocks, 55% of the global corporate bond market, and 50% of the global government bond market.

In this highly concentrated holding structure, if non-U.S. investors merely reduce their stock and government bond holdings by 5%, it would lead to a capital outflow of $1.5 trillion. Considering that the U.S. currently faces a $1.4 trillion current account deficit and a $1.7 trillion budget deficit, the impact of such capital outflow would be enormous.

Hartnett emphasizes that great gold bull markets can usually only be ended by "a bigger event." In the current overly bullish sentiment, the triggers for deleveraging, a reversal of currency depreciation trends, and a correction of prosperity winners in the first half of the year will inevitably be some significant macro event that can break the existing liquidity logic. Until then, the currency depreciation trade remains ahead of the risk.

2026 Trading Strategy Outlook: BIG + MID

Looking ahead, Hartnett continues to maintain his signature contrarian thinking.

While going long on gold was the "pain trade" for asset allocators in 2020, he believes that the contrarian trade in 2026 may be to go long on bonds. However, he also acknowledges that, against the backdrop of global debt proliferation, this contrarian thinking may go wrong For the specific trading strategy for 2026, Hartnett strongly recommends the "BIG + MID" combination. This is also a theme he has repeatedly mentioned in recent reports, which is optimistic about Bitcoin, international stocks, gold, and mid-cap stocks. As we reach the halfway point of the 2020s, this strategy aims to capture asset classes that may outperform the market under a new macro paradigm