Wash's nomination ignites gold and silver "bloodbath"! During trading, silver plummeted over 35% to a record low, and gold fell over 10%

The intraday decline in gold is the largest in over forty years, surpassing that during the 2008 financial crisis. The market believes that candidates for Federal Reserve Chair like Waller and Harker are more hawkish. Following the recent surge in gold and silver prices, the crowded long positions, record levels of bullish options purchases, and extreme leverage levels have put the market in a state where a "gamma squeeze" could be triggered at any moment, with just a small catalyst potentially leading to a "bloodbath" like Friday's

The nomination of Kevin Warsh by President Trump to serve as the Chairman of the Federal Reserve triggered the most severe sell-off in precious metals in decades.

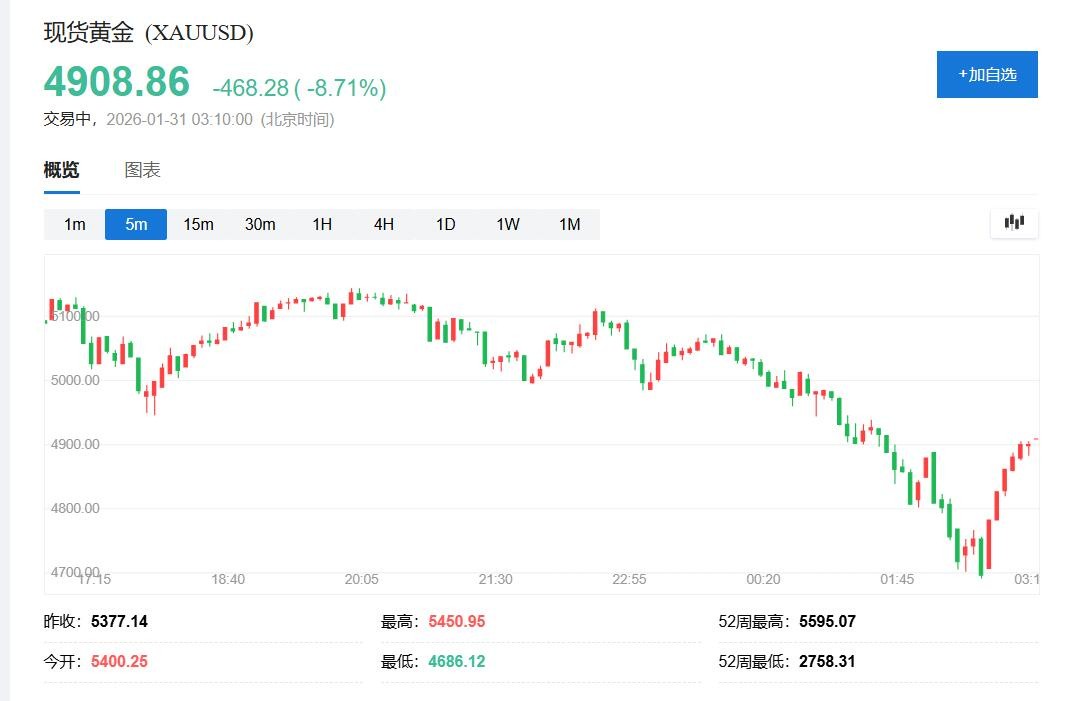

On Thursday, gold and silver, which had reached historical highs during intraday trading, plummeted. After the news of Trump's nomination of Warsh as the Federal Reserve Chairman broke on Friday morning in Asia, gold turned downward, and during European trading, it fell below the $5,000 per ounce mark. The decline in U.S. stocks expanded at midday, with spot gold experiencing an intraday drop of nearly 13%, marking the largest intraday decline in over forty years since the early 1980s, surpassing the declines seen during the 2008 financial crisis.

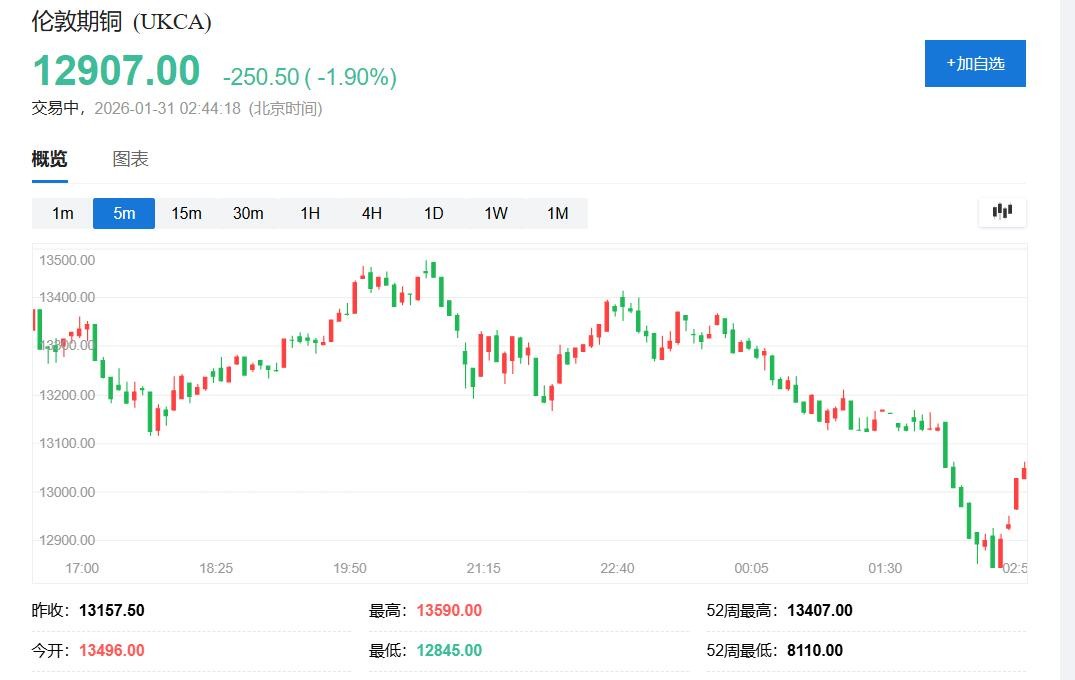

On Thursday, silver broke the $120 mark for the first time in history, but on Friday, it fell below $100 during European trading, and U.S. stocks dropped below $80 at one point. Spot silver saw a dramatic intraday plunge of over 35%, marking the largest recorded decline. This "bloodbath" affected the entire metals market, with copper, which also set a record high on Thursday, retreating nearly 6%.

The market attributed this sharp decline to a sudden shift in investor expectations regarding Federal Reserve policy. Warsh has long been known for his hawkish stance, and although he recently publicly supported interest rate cuts to align with Trump, the market still believes he is unlikely to implement aggressive rate cuts. Thu Lan Nguyen, an analyst at Commerzbank, stated, "The market sees Warsh as more hawkish than other candidates like Hassett." This expectation drove the dollar to rebound, reducing the attractiveness of dollar-denominated commodities to global buyers.

Warsh's nomination also alleviated concerns about the loss of independence of the Federal Reserve. Previously, investors flocked to precious metals as a safe haven, partly due to worries about currency devaluation and the independence of the Federal Reserve. Francesco Pesole, a foreign exchange strategist at ING, noted that Warsh's selection "is good news for the dollar and can alleviate some concerns about more dovish candidates."

This plunge also exposed the extreme vulnerability of the precious metals market. Following the recent surge in gold and silver prices, crowded long positions, record bullish options purchases, and extreme leverage levels put the market in a state that could trigger a "gamma squeeze" at any moment. Michael Brown, a senior research strategist at Pepperstone, remarked, "The market has become very frothy, and it only takes a small trigger to cause such a movement."

Gold and Silver Experience Historic Plunge

On Friday during the U.S. midday trading session, the precious metals market experienced a dramatic plunge. The main contract for silver on the New York Mercantile Exchange plummeted from the historical high of $121.785 set on Thursday to $75.44, a decline of 34%. Spot silver fell below $74.60, with an intraday drop of 35.5%, marking the largest intraday decline on record. Silver repeatedly fell below and rebounded above the psychological level of $100 during intraday trading but ultimately failed to hold above it Gold has also suffered heavy losses. New York gold futures fell from a historical high of $5,586.2 on Thursday to $4,714.5, a decline of nearly 12%. Spot gold dropped to $4,670.01, down over 12.7%. Both fell below the $5,000 mark.

By the time U.S. stocks closed at midday, COMEX February gold futures closed down 11.37% at $4,713.9 per ounce, marking the largest single-day decline since January 22, 1980. COMEX February silver futures fell 31.35% to $78.29 per ounce, the largest closing drop since March 27, 1980.

Other metals were not spared either. London copper, which had surged past $14,520 and increased by 11% to reach a historical high on Thursday, fell below $12,850 during Friday's trading, a decline of nearly 5.7%, closing down about 3.4% at $13,158 per ton. By the close, London tin was down about 5.7%, while London aluminum and London nickel fell over 2%.

Fed Chair Nomination Triggers Expectation Reversal

The catalyst for the market sell-off was the news of the nomination of Kevin Warsh. Reports emerged early Friday in Asia that Trump would nominate Warsh as the Fed Chair, causing gold, which had set intraday historical highs for nine consecutive trading days, to immediately turn downward. On Friday, before the U.S. stock market opened, Trump officially announced the nomination on his social media, stating that he has known Warsh for a long time and has no doubt that he will be among the great Fed Chairs, possibly the best one.

Warsh has long been known for his hawkish stance, but he changed his tone last year in response to Trump's calls for significant interest rate cuts, which is seen as key to his nomination. Wall Street investors and strategists indicated that Trump's choice of Warsh to lead the Fed is a relatively hawkish choice, and he may resist balance sheet expansion, which would support the dollar and steepen the U.S. Treasury yield curve.

Panmure Liberum analyst Tom Price stated:

"The market believes Kevin Warsh is rational and will not actively push for interest rate cuts. Those ordinary investors with varying goals—such as capital preservation—are taking profits."

Warsh's nomination triggered a significant rebound in the dollar, achieving its best single-day performance since July of last year on Friday. The dollar index, which tracks the dollar against a basket of currencies, rose above 97.00 during midday trading on Friday, having increased nearly 0.9% during the day. A stronger dollar reduces the appeal of dollar-denominated commodities to many global buyers and undermines the theory that precious metals could replace the dollar as the global reserve currency.

Market Crowding Triggers "Stampede"

Although Warsh's nomination became the catalyst for the sell-off, analysts generally believe that technical factors amplified the decline. Media reports suggest that soaring prices and volatility have put pressure on traders' risk models and balance sheets. Goldman Sachs research pointed out that the record surge in bullish options purchases "mechanically reinforced upward price momentum," as option sellers bought more futures to hedge their exposure The decline in gold may be accelerated by what is known as "gamma squeeze." This refers to options traders needing to buy more futures to maintain portfolio balance when prices rise, and sell when prices fall. For the SPDR Gold ETF, a large number of positions expiring on Friday are concentrated at $465 and $455, while a significant number of options positions on Comex for March and April are concentrated at $5300, $5200, and $5100.

Miller Tabak stock strategist Matt Maley stated, "This is crazy. Most of this could be 'forced selling.' Silver has recently been the hottest asset for day traders and other short-term traders, so silver has accumulated some leverage. With today's sharp decline, margin calls have been issued."

Michael Brown from Pepperstone noted, "The state of the metals market has been very bubble-like for some time, and signs that emerged earlier this week indicate that things are becoming completely chaotic." He stated that positions in the gold and silver markets are "clearly extremely crowded on the long side, and volatility has increased to frankly ridiculous levels." In a market with such high trading volume and "leveraged longs" so tight, "it doesn't take much to trigger" moves like Friday's.

Brown said, "Simply put, everyone is rushing for the exits at the same time, forcing prices lower, which in turn triggers further forced selling," reminding people that "momentum is two-way."

Christopher Wong, a strategist at Overseas-Chinese Banking Corp., stated that the movement in gold "validates the warning that what goes up quickly can come down quickly." While the reports of the nomination by Waller were the trigger, he indicated that a pullback should have happened long ago, "it's like one of those excuses the market has been waiting for to close out those parabolic moves."

Technical indicators have long issued warnings

Before the crash, several technical indicators had issued warning signals. The Relative Strength Index (RSI) has shown in recent weeks that gold and silver may be overbought and facing a correction. The RSI for gold recently hit 90, the highest level for the precious metal in decades.

Dominik Sperzel, head of trading at Heraeus Precious Metals, stated that volatility is extremely extreme, with the psychological resistance levels of $5000 and $100 being breached multiple times on Friday. "However, we need to be prepared for the roller coaster to continue."

Nevertheless, even after the significant correction, gold and silver recorded substantial gains in January, with the closing prices for the near-month contracts showing New York gold futures up nearly 10% and silver futures up over 10%.

COMEX February gold futures accumulated an 8.98% increase in January, marking the largest monthly gain since September 2025, with six consecutive months of increases, the longest streak since October 2024. COMEX February silver futures accumulated an 11.63% increase in January, marking nine consecutive months of increases, the longest monthly streak, with a total increase of 140.66% over nine months, the largest nine-month gain since April 2011 Analysts at Deutsche Bank wrote in a report on Friday that the extent of the pullback "indicates that market participants are simply waiting for an opportunity to take profits after a rapid price increase." The head of commodity research at the bank, Thu Lan Nguyen, pointed out that

"Although the market perceives candidates like Waller and Haskett as more hawkish, we still believe that the Federal Reserve is likely to yield to some extent to pressure, and the rate cuts will exceed current market expectations."

Mining Stocks Plunge

The sharp decline in precious metals dragged down the stock prices of major mining companies. During Friday's trading session, U.S.-listed gold mining giants Newmont (NEM), Barrick Mining (B), and Agnico Eagle Mines (AEM) all fell over 10%, while Coeur Mining (CDE) dropped nearly 19%.

Silver ETFs faced an even greater hit. During the session, ProShares Ultra Silver (AGQ) fell over 60%, and iShares Silver Trust ETF (SLV) dropped over 30%, with both funds recording their worst single-day performance in history. Gold ETFs also came under pressure.

Although mining stocks suffered a severe decline on Friday, some analysts believe that the pullback is beneficial for market health. Nate Miller, Vice President of Product Development at Amplify ETFs, stated that silver benefits from safe-haven and value storage demand, industrial demand, and global supply shortages, and that some consolidation after such a sharp rise "is healthy and aligns with typical behavior in commodity markets after rapid price appreciation."

Peter Grant, Vice President and Senior Metal Strategist at Zaner Metals, noted that while the rebound has indeed gone too fast and too far, it is not too late to buy metals now. He described a drop below $100 as an "opportunity," especially near the 20-day moving average of about $93. However, "you must be able to withstand volatility, which may remain elevated."

Bloomberg macro strategist Simon White pointed out:

"The rise in the silver/gold (price) ratio is almost as significant as that at the end of the 1970s, and today's dramatic movements suggest this may mark a rejection point. However, looking at gold and silver individually, they have not yet fully matched the surge of 1979. It is too early to conclude whether silver's relative performance against gold marks the end of a historic rally in precious metals. But prices are now becoming the main driving factor, with fundamentals temporarily taking a back seat."