Tokyo CPI in Japan has declined for two consecutive months, with lower energy and food prices

Tokyo's CPI has fallen for two consecutive months, with the core CPI dropping to 2.0%, below expectations. The decline in energy prices has widened, the increase in food prices has narrowed, and service prices continue to rise moderately. The slowdown in inflation has weakened expectations for a rate hike by the Bank of Japan, leading to a plunge in the yen after the data release

Tokyo's CPI in Japan has fallen for two consecutive months. The decline in energy prices has widened, the increase in food prices has narrowed, and service prices continue to rise moderately. The core CPI at 2.0% is exactly at the central bank's target level of 2%, and the cooling trend over the past two months may prompt the central bank to adopt a more cautious stance on interest rate hikes.

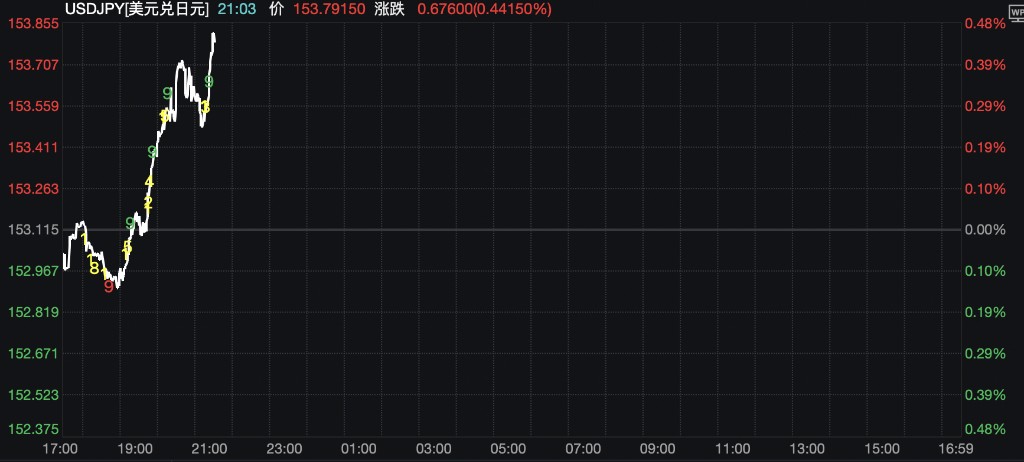

After the data was released, the US dollar rose against the Japanese yen, with the dollar/yen up 0.44% as of the time of writing.

According to data released by Japan's Ministry of Internal Affairs and Communications on Friday, Tokyo's core CPI (excluding fresh food) rose 2.0% year-on-year in January, lower than the expected 2.2% and down from the previous value of 2.3%. Tokyo's CPI (excluding fresh food and energy) rose 2.4% year-on-year, lower than the expected 2.6% and down from the previous value of 2.6%. Tokyo's CPI was 1.5%, lower than the expected 1.7% and down from the previous value of 2%.

The slowdown in Tokyo's CPI, a leading indicator, suggests that nationwide inflationary pressures in Japan are weakening.

The decline in energy prices is the main factor dragging down inflation. Gasoline prices fell 14.8% year-on-year, a significant increase from last month's decline of 6.4%, and overall energy prices fell 4.2%, dragging down overall inflation by 0.22 percentage points.

The increase in food prices continues to narrow. The increase in food prices excluding fresh food fell from 6.2% to 5.6%, contributing 0.13 percentage points less to inflation.

The widening decline in energy prices drags down inflation

Energy prices have become the biggest drag on inflation in January. Gasoline prices fell 14.8% year-on-year, a significant increase from December's decline of 6.4%, dragging down overall inflation by 0.09 percentage points.

Electricity prices fell 2.0%, and city gas prices fell 4.2%, with the overall negative contribution of energy to inflation widening from last month's 0.19 percentage points to 0.22 percentage points.

Month-on-month data shows that gasoline prices fell 4.8%, electricity prices fell 0.1%, and city gas prices fell 0.6%. The continued decline in energy prices reflects the weak trend in the international crude oil market and the continued effects of the Japanese government's energy subsidy policy.

The increase in food prices continues to narrow

The increase in food prices has further slowed. Food prices excluding fresh food rose 5.6% year-on-year in January, a decrease of 0.6 percentage points from last month's 6.2%, with the contribution to overall inflation falling from 1.43 percentage points to 1.30 percentage points.

Fresh vegetable prices fell 13.2% year-on-year, with cabbage prices plummeting 64.4% and fresh fruit prices falling 10.8%.

In terms of specific categories, rice prices rose 25.5% year-on-year, dining out prices rose 4.1%, chocolate prices rose 24.4%, and coffee bean prices soared 66.6%. Although some food prices remain at high increases, the overall inflationary pressure on food is gradually easing.

Service prices continue to rise moderately

Service prices continue to support inflation. Residential rents rose 1.5% year-on-year, with private rents rising 2.1%, contributing 0.08 percentage points to overall inflation Communication costs rose by 6.4% year-on-year, mainly driven by an 11.0% increase in mobile communication fees, contributing 0.15 percentage points to inflation.

Prices for education and entertainment services increased by 2.2%, with accommodation fees rising by 6.0%, although the growth rate slowed from 7.8% last month, reducing its contribution to inflation from 0.11 percentage points to 0.08 percentage points. Childcare fees fell by 60.4% year-on-year, reflecting the ongoing impact of the government's free early childhood education policy.

Inflation slowdown weakens expectations for Bank of Japan rate cuts

The comprehensive slowdown in Tokyo's January inflation data may influence the Bank of Japan's policy stance. The core inflation rate of 2.0% is exactly at the central bank's target level of 2%, but the cooling trend over the past two months may prompt the central bank to adopt a more cautious approach regarding interest rate hikes.

Seasonally adjusted month-on-month data shows that the CPI excluding fresh food remained flat compared to last month, and the CPI excluding fresh food and energy also remained flat, indicating a weakening of short-term inflation momentum.

The CPI for the Tokyo metropolitan area is regarded as a leading indicator of national inflation, typically leading national data by about two weeks. The inflation slowdown trend indicated by January's data is expected to be confirmed in the upcoming national data, providing important evidence for investors to assess the Bank of Japan's next monetary policy direction