"You may never encounter this market again"! Commodities are rising one after another, and Chinese investors have "sent copper flying."

The US dollar has fallen to a four-year low, coupled with a frenzied influx of Chinese investors, leading to a single-day surge in copper prices by 11%, marking the largest increase in sixteen years and surpassing the historical high of $14,500 for the first time! However, concerns are emerging behind the celebration: weak physical demand, urgent cooling measures from regulators, and Goldman Sachs warns that a technical adjustment is imminent

Driven by strong buying from Chinese investors, copper prices have recorded the largest single-day increase in sixteen years, and the commodity market is experiencing a rare historic frenzy.

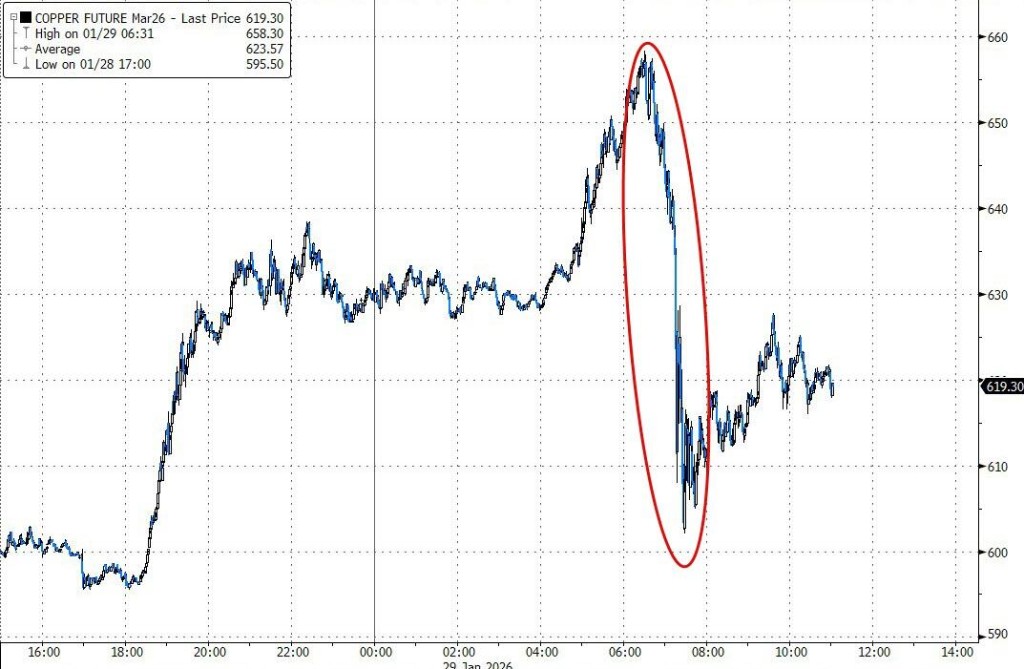

On Thursday afternoon, copper prices surged by 11%, breaking the historical high of $14,500 per ton for the first time, before sharply retreating from the peak. Since early December, copper prices have risen by approximately 21%.

This surge coincided with the dollar exchange rate falling to its lowest point in over four years, prompting Chinese investors to massively shift towards the commodity market, pushing prices of various metals, from tin to silver, to historical highs. This wave of buying led by Chinese traders ignited the market at 2:30 AM London time, with copper prices on the London Metal Exchange (LME) rising over 5% in less than an hour, and the six major base metal indices closing at record highs.

This dramatic market movement has shocked seasoned market participants. According to Bloomberg, Mark Thompson, a former trader at Trafigura Group with thirty years of experience in the copper market, stated: “Such a market condition may only happen once in a lifetime; we are just one supply disruption away from a $20,000 copper price.”

Chinese Capital Drives "Historic" Market

Chinese investors are creating waves in the commodity market, driving a surge in trading volume on the Shanghai Futures Exchange (SHFE). As of last week, January has set a record for the busiest month ever for the six major base metals on the exchange, with Thursday's single-day copper trading volume reaching the second highest level in history.

This market trend has distinct timing characteristics. The initial surge on the London Metal Exchange (LME) occurred during a period dominated by capital flows led by Chinese traders. Eric Liu, Deputy General Manager of ASK Resources, pointed out: “Commodities are rising in succession; copper prices had been hovering around $13,000 for a while, and capital has been brewing for some time.”

Despite the market retreating on Thursday afternoon, copper prices ultimately closed up 4.1% at $13,618 per ton on the LME. The intraday volatility reached the largest record since 2009. Meanwhile, futures prices on the SHFE closed up 5.8% at 109,110 yuan on Thursday, briefly touching 114,000 yuan in after-hours trading before giving back some gains.

Weak Dollar and Macroeconomic Policies Provide Dual Boost

The surge in metal prices this week is closely related to the macroeconomic environment.

The dollar index has fallen to a four-year low, making dollar-denominated commodities more attractive to many buyers. Additionally, signals from Trump indicating he is not worried about a weak dollar further encouraged investors to sell U.S. Treasury bonds in favor of commodities.

Tom Price, Senior Commodity Analyst at Panmure Liberum, noted: “Cautious investors are pulling capital back domestically due to concerns about further weakening of the dollar.” In addition, the Federal Reserve's policy expectations have also fueled the upward trend. Federal Reserve Chairman Jerome Powell maintained the borrowing costs unchanged on Wednesday while discussing the "notable improvement" in the U.S. economic outlook. The market speculates that the next Federal Reserve chairman may be more dovish than Powell, coupled with the Trump administration's tougher foreign policy leading to heightened geopolitical tensions, all of which have increased demand for physical assets.

The upward trend contradicts signs of weak physical demand

For a long time, investors have been optimistic about copper's key role in energy transition and the growth of data centers. Tesla plans to spend $20 billion this year on resource shifts in robotics and artificial intelligence (AI), further strengthening this investment outlook, with copper, aluminum, and tin seen as major beneficiaries.

Chi Kai, Chief Investment Officer of Shanghai Cosine Capital Management Partnership, stated: "The expectation for rising copper prices has not changed under the U.S. maintaining a rate cut cycle. As long as the U.S. continues to promote AI, chips, and power construction, there is no clear expectation of how high prices can rise."

Despite the price surge, the market fundamentals are not without concerns. The current upward trend contradicts signs of weak physical demand. At the same time, the LME market shows an expanded contango structure, indicating that supply remains ample.

In the face of speculative frenzy, the Shanghai Futures Exchange has taken measures to cool the market, including raising margin requirements for certain contracts and implementing trading restrictions on specific clients in the tin and silver markets. On Thursday, the exchange reported that a certain client violated abnormal trading rules and urged investors to "enhance risk awareness, invest rationally, and jointly maintain the stable operation of the market."

There have also been warning voices in the market. Trina Chen, co-head of China equities at Goldman Sachs, warned in an interview with Bloomberg Television that the astonishing rise in metal prices may have outpaced real demand, and as Chinese physical buyers retreat due to high prices, the market may experience a "technical adjustment."