AI drives explosive demand for storage, SanDisk's performance greatly exceeds expectations, stock price rises nearly 15% in after-hours trading | Earnings Report Insights

Memory industry player SanDisk announced its financial results after the market closed on Thursday, showing significant growth in profits and revenue for the second fiscal quarter of fiscal year 2026. The performance not only greatly exceeded Wall Street expectations but also significantly surpassed the guidance previously provided by the company, causing its stock price to surge nearly 15% in after-hours trading. Analysts noted that the expanding applications of artificial intelligence have led to a continuous rise in demand for data storage, driving the company's strong performance

Memory industry player Sandisk announced its financial results after the market closed on Thursday, showing significant growth in profits and revenue for the second quarter of fiscal year 2026. The performance not only exceeded Wall Street expectations but also significantly surpassed the company's previous guidance, causing the stock price to surge nearly 15% in after-hours trading. Analysts noted that the expanding applications of artificial intelligence (AI) have led to a continuous rise in demand for data storage, driving the company's strong performance.

Here are the key points from Sandisk's financial report:

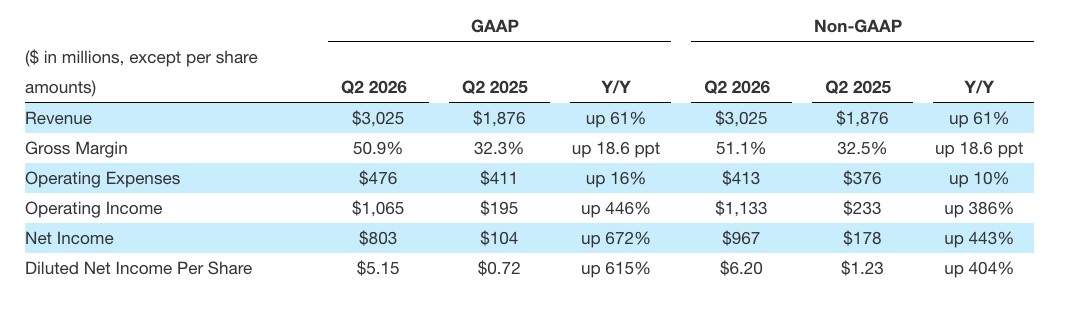

Key Financial Data:

Revenue: On a GAAP basis, revenue for the second quarter of fiscal year 2026 was $3.025 billion, higher than analysts' expectations of $2.69 billion and the company's guidance range of $2.55 billion to $2.65 billion. This compares to $1.876 billion in the same quarter of fiscal year 2025, representing a year-over-year increase of 61%. On a non-GAAP basis, revenue also grew 61% year-over-year.

Gross Margin: GAAP gross margin was 50.9%, compared to 32.3% in the same quarter of fiscal year 2025, an increase of 18.6 percentage points. Non-GAAP gross margin was 51.1%, compared to 32.5% in the same quarter of fiscal year 2025, also an increase of 18.6 percentage points.

Operating Profit: GAAP operating profit was $1.065 billion, compared to $195 million in the same quarter of fiscal year 2025, a year-over-year increase of 446%. Non-GAAP operating profit was $1.133 billion, compared to $233 million in the same quarter of fiscal year 2025, a year-over-year increase of 386%.

Net Profit: GAAP net profit was $803 million, compared to $104 million in the same quarter of fiscal year 2025, a year-over-year increase of 672%. Non-GAAP net profit was $967 million, compared to $178 million in the same quarter of fiscal year 2025, a year-over-year increase of 443%.

Earnings Per Share: GAAP diluted earnings per share were $5.15, compared to $0.72 in the same quarter of fiscal year 2025, a year-over-year increase of 615%. Non-GAAP diluted earnings per share were $6.20, exceeding analysts' expectations of $3.62 and also higher than the company's previous adjusted earnings per share guidance range of $3.00 to $3.40. This compares to $1.23 in the same quarter of fiscal year 2025, a year-over-year increase of 404%.

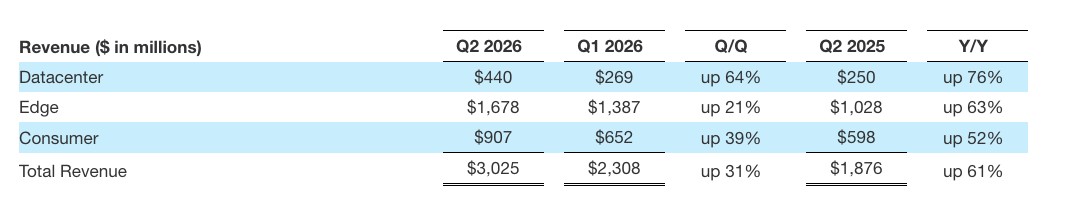

Segment Data:

Data Center Business: In the second quarter of fiscal year 2026, revenue from the data center business was $440 million, up from $269 million in the previous quarter, a quarter-over-quarter increase of 64%; compared to $250 million in the same quarter of fiscal year 2025, a year-over-year increase of 76%.

Edge Market Revenue: Edge market revenue was $1.678 billion, up from $1.387 billion in the previous quarter, a quarter-over-quarter increase of 21%; compared to $1.028 billion in the same quarter of fiscal year 2025, a year-over-year increase of 63%

Consumer Market Revenue: Consumer market revenue was $907 million, compared to $652 million in the previous fiscal quarter, a quarter-on-quarter increase of 39%; for the same period in fiscal year 2025, it was $598 million, a year-on-year increase of 52%.

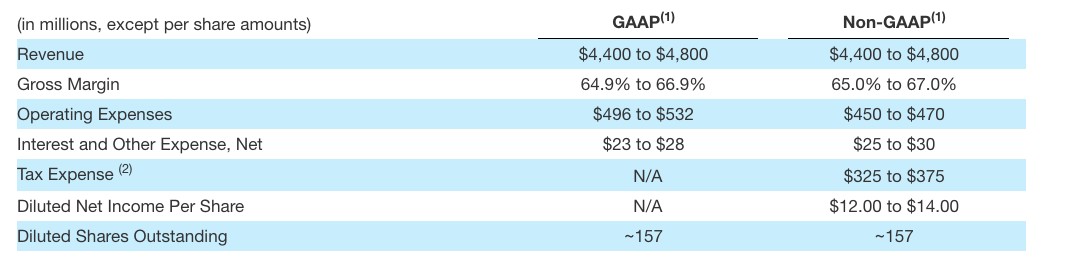

Performance Guidance:

Revenue: The company expects revenue for the third fiscal quarter of fiscal year 2026 to be between $4.4 billion and $4.8 billion. The revenue guidance range is consistent under both GAAP and non-GAAP measures.

Gross Margin: The GAAP gross margin is expected to be between 64.9% and 66.9%, while the non-GAAP gross margin is expected to be between 65.0% and 67.0%.

Earnings Per Share: No diluted earnings per share guidance is provided under GAAP; under non-GAAP, diluted earnings per share are expected to be between $12.00 and $14.00.

The company stated that as technology companies deploy artificial intelligence on a large scale, demand related to data centers has been significantly driven, with data center business revenue increasing by 64% compared to the first fiscal quarter.

SanDisk CEO David Goeckeler stated:

“This quarter's performance highlights our execution capabilities in optimizing product structure, accelerating enterprise SSD deployment, and strengthening market demand momentum. At the same time, the market is increasingly recognizing the critical role our products play in supporting artificial intelligence and the operation of the global technology ecosystem. Through structural adjustments, we have aligned supply with attractive and sustainable demand, enabling us to achieve disciplined growth and deliver industry-leading financial performance.”

Due to performance exceeding expectations, SanDisk's stock price rose nearly 15% in after-hours trading on Thursday, although the gains subsequently narrowed.