Intensive official announcements on all-solid-state batteries, the last shortcoming of pure electric vehicles is about to be addressed

Recently, the new energy vehicle industry has made significant progress, especially with CATL's release of the "Tianxing II" low-temperature version battery, which can maintain high efficiency in extremely cold environments, addressing battery endurance and charging issues in high-latitude regions. At the same time, there are reports that Huawei's solid-state battery is about to be released, attracting attention for its endurance and charging speed. These technological breakthroughs could change the market landscape for new energy vehicles

For the new energy vehicle industry, there has recently been a feeling of "destiny is on our side."

First, there was a sudden shift in geopolitical relations. Previously, there were tariff and policy barriers for new energy vehicles going abroad. In some foreign markets with strong consumer purchasing power, in order to protect the local automotive industry, heavy taxes were often imposed on domestic new energy vehicles, or they were outright banned.

However, recently, places like Europe and Canada have begun to frequently show goodwill and sincerity, opening their doors to domestic new energy vehicles, especially the European Union even proactively requested price increases for sales. This has allowed new energy vehicle brands, which were struggling in the domestic market, to almost instantly remove the noose from their necks.

Of course, some have raised objections, arguing that high-latitude regions like Canada often have long and cold winters, making it difficult for domestic new energy vehicle batteries to reach ideal levels, so one should not be overly optimistic.

But hold on, let's look at the second piece of news—on January 22, CATL officially announced the release of the "Tianxing II" light commercial low-temperature version battery.

In addition to being the world's first sodium-ion battery to achieve mass production in the light commercial vehicle sector, the biggest feature of the "Tianxing II" is that this battery can maintain 90% usable power in extreme cold environments at -40°C, can be plugged in and charged at -30°C, and can complete fast charging from 20% to 80% in 30 minutes at -15°C.

With these targeted features, the "Tianxing II" is practically a killer solution to the problems of range degradation and charging difficulties in extreme winter environments in high-latitude regions.

It is reasonable to speculate that CATL's new product launch is timed with the shift in foreign policies, as if to say: regardless of whether in the northeastern provinces or in Northern Europe and Canada, the last shortcoming of new energy vehicles affected by regional environmental factors has been conquered by us.

To be honest, this is a significant technological breakthrough in the new energy vehicle field, but the market reaction has not been as enthusiastic as expected. The core issue is that around a week before and after the release of the "Tianxing II," rumors began circulating in the market that Huawei's solid-state battery was about to be launched, with related data exploding:

Full charge range of 3000 kilometers. Charging for five minutes can add 800 kilometers of range, and ten minutes can charge to 80%.

A

Regardless of its truth, once this news came out, everyone began to envision the ultimate form of new energy vehicles.

Looking back at the development path of batteries, one can understand why the market is so sensitive to such news.

In the early stages of the new energy vehicle industry, the battery technology was primarily dominated by Tesla's "ternary lithium" as the main technical route. Compared to early lead-acid batteries, ternary lithium has a higher energy density, with stronger range under the same volume, generally exceeding 700 kilometers. The extreme even exceeds 1000 kilometers. But as everyone knows, it also has disadvantages: it has strict thermal management requirements, is costly, and is prone to catching fire, with news reports in recent years frequently highlighting these issues Later, when domestic new energy vehicle brands experienced a major explosion, BYD and CATL chose another technical route: "lithium iron phosphate." Compared to ternary lithium, the biggest advantages of lithium iron phosphate are low cost, high safety, and long lifespan. However, its energy density is limited by technological and material constraints, and the range of lithium iron phosphate batteries used in small pure electric commercial vehicles is almost at the limit of 800 kilometers under normal conditions.

However, this technical direction of lithium iron phosphate, with its low cost that easily leads to price wars, key raw materials that are controllable, core technologies without patent barriers, and a range limit that sufficiently meets daily needs, is indeed very suitable for our national conditions. Therefore, in recent years, we have frequently seen leading companies such as BYD, CATL, EVE Energy, Guoxuan High-Tech, and Xinwangda continuously chasing after lithium iron phosphate, turning a rather mediocre technical route into a dominant force.

In particular, CATL announced three months ago that the fifth-generation lithium iron phosphate battery has been fully mass-produced, with a range already approaching 1200 kilometers. Compared to the ternary lithium technology commonly used abroad, domestic new energy vehicles have lower costs, no brand premium, better intelligent vehicle-machine interaction, and their range is not inferior, even slightly leading. So how can foreign new energy vehicles compete?

This is also the fundamental reason why many established imported car brands have been overwhelmed by domestic brands in the new energy sector.

B

However, no matter how competitive lithium iron phosphate becomes, it still has its limits. The most direct issue is that at low temperatures of minus 20 degrees Celsius, the battery capacity retention rate is generally below 70%, and the charging speed is extremely slow. Therefore, in high-latitude and cold regions, gasoline vehicles still firmly hold their ground. Moreover, the range and charging of pure electric vehicles still cannot match the convenience of gasoline vehicles, leaving consumers with a lingering "mental block."

More critically, as the world bets on lithium batteries, lithium mines have naturally become an important strategic resource. From 2020 to 2024, the price of lithium carbonate surged from $6,000 per ton to $83,000 per ton, creating a clear seller's market. The entire upstream and downstream of the new energy vehicle industry urgently needs a completely new technical route; even an alternative is better than tying one's life and fortune to just one element, lithium.

Sodium batteries, such as the previously mentioned "Tianxing II," were born in this context. At the press conference on the 22nd, CATL's CTO confidently stated: the development pattern of sodium batteries will similarly follow the lithium battery route, but based on the accumulated experience and technology, the development curve and slope of sodium batteries will be faster. In the next three years, CATL's sodium batteries can achieve energy densities similar to today's lithium iron phosphate, and sodium batteries will be more economical than lithium batteries.

However, sodium batteries can only solve problems in extreme environments and still cannot provide consumers with complete energy freedom. The entire industry urgently needs a new technical route that offers high range, high safety, controllable costs, stable properties, and supports fast charging.

Solid-state batteries.

All practitioners have long reached a consensus: the next jewel in the crown of the industry in the next decade can only be solid-state batteries. It will be the "smartphone moment" in the energy field, a revolution that completely disrupts the status quo. More critically, all solid-state batteries worldwide are still in the laboratory stage, and the technological gap has not yet widened This is the last opportunity for all industry players—either break through first and reap the rewards, or be left behind and rely on others.

C

How powerful are solid-state batteries? Let's first look at a simple data comparison.

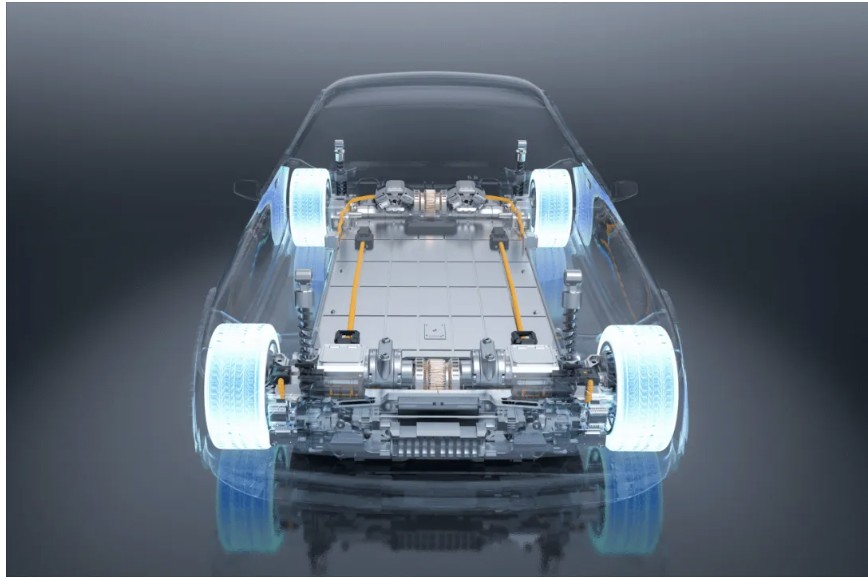

Taking the higher-performance ternary lithium battery as an example, its energy density is 300Wh per kilogram. However, the simplest sulfide solid-state battery, which is still in the laboratory stage, has already achieved an energy density of 720Wh per kilogram, more than doubling the figure. This means that under the same specifications, a small commercial vehicle equipped with a solid-state battery could easily exceed a range of 2000 kilometers.

In terms of charging, due to the limitations of lithium batteries, even the fastest supercharging can only charge from 5% to 80% in 15 minutes. However, sulfide solid-state batteries have now achieved the ultimate effect of being fully charged in 5 minutes, making the waiting time comparable to refueling. Moreover, sulfide solid-state batteries eliminate the risks of fire, leakage, and thermal runaway, making them safer than fuel tanks.

In terms of lifespan, ternary lithium batteries typically show significant energy degradation after about 1500 cycles. In contrast, solid-state batteries can achieve around 3000 cycles, meaning consumers no longer need to worry about battery replacement.

A range exceeding 2000 kilometers, charging completed in 5 minutes, no risks, and a lifespan of around fifteen years is the ultimate form of pure electric vehicles. Additionally, the powerful energy density can also power various smart devices, truly realizing the dream of domestic new energy vehicle brands for a "fully mobile home."

Furthermore, if solid-state batteries can be miniaturized and integrated into smartphones, laptops, or other appliances, the product experience will increase exponentially. With a bit more imagination, if power-hungry humanoid robots, drones, and pure electric aircraft can all be equipped with more mature and powerful solid-state batteries in the future, many scenes from science fiction movies will become a reality.

D

With huge market potential and profits, everyone is going crazy, whether they are vehicle manufacturers or battery companies, whether domestic or foreign.

For car manufacturers, battery costs account for about 40% of the total vehicle cost. This means that for a pure electric vehicle priced at 200,000, the manufacturer has to pay 80,000 for the battery, which not only caps the product's upper limit but also compresses profit margins. Once they develop solid-state batteries first, they can recklessly initiate a price war, completely wiping out competitors. It’s worth noting that BYD's willingness to start a price war in 2024 stems from the fact that their own batteries can reduce costs by about 15%.

For battery companies, the solid-state route is an indispensable "holy grail." Currently, Chinese companies dominate the global market for liquid batteries, with CATL and BYD alone accounting for 70% of the global power battery share. Losing the market would not only be unacceptable for the companies but would also pose a serious threat to the entire country's strategy, security, and economic lifeline For those traditional foreign car manufacturers and battery companies that have been pushed to the brink by domestic enterprises, solid-state batteries will be the last glimmer of hope for a turnaround. Currently, Japanese and South Korean car manufacturers and battery companies are visibly going crazy: Toyota holds over 2,100 solid-state battery patents and plans to launch its first model equipped with a solid-state battery in 2027, while Samsung SDI is also targeting mass production in 2027. Mercedes-Benz and BMW have already begun road testing their solid-state battery prototypes.

As for whether this is just talk or a serious commitment, it remains to be seen.

E

So the question arises, how far are we from large-scale mass production and commercialization of such a powerful product as solid-state batteries?

According to current industry statements, although solid-state batteries perform perfectly in the laboratory, there are still three issues that need to be resolved for mass production.

The first is the cost issue. The raw materials for solid-state batteries, especially those using the sulfide route, such as germanium, phosphorus, and sulfur, have consistently high prices, and the preparation process is complex with stringent manufacturing environment requirements. The initial cost may be about ten times that of existing batteries, which is hard for consumers who have been "spoiled" by lithium batteries to accept.

The second is the fast charging issue. In the laboratory, a single cell can be charged in 5 minutes, but when multiple cells are connected in series, there will be significant transmission losses. This means that the currently tested solid-state battery packs still take about the same time to charge as lithium iron phosphate batteries, failing to create a significant advantage.

The third is that the manufacturing process for solid-state batteries is completely different from that of previous liquid lithium batteries, meaning that the production lines and industrial chains that have previously invested trillions will be unusable and completely scrapped. These severe losses are not something companies can bear.

It is unlikely to overcome these issues in the short term, and many companies have begun to take a detour by choosing a "semi-solid" route—essentially continuing to push liquid batteries, which may yield better results but are unlikely to bring substantial improvements. Currently, many car manufacturers and battery companies have already backed out and no longer promote their products as "solid-state batteries."

According to the China Society of Automotive Engineers, full solid-state batteries are expected to be realized by 2030. Moreover, Academician Ouyang Minggao from the Chinese Academy of Sciences emphasized that 2030 is still about technology realization, not commercial realization. The large-scale commercial rollout of high-density solid-state batteries is expected to take until 2035.

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk.