Under the metal frenzy, the top 50 global mining giants surged 20% at the beginning of the year

Affected by the geopolitical tensions triggered by Trump and the weakening of the US dollar, the market value of the world's top 50 listed mining companies increased by USD 476 billion in the past month, with a rise of about 20%. Gold has surpassed USD 5,300, and silver has broken USD 100. Although analysts believe that mining stock valuations still lag behind metal prices, they also warn that the rapid inflow and outflow of speculative funds could trigger a "massive correction" in the market

Geopolitical tensions and a weakening dollar have triggered a rush to safe havens, driving the global mining sector to achieve remarkable gains at the start of the new year.

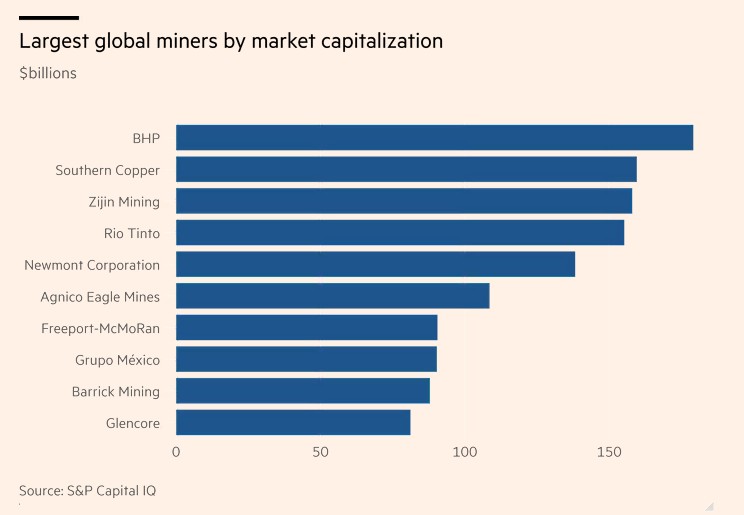

According to the latest data from S&P Capital IQ, propelled by escalating geopolitical tensions, the prices of precious and base metals have surged, with the market capitalization of the world's 50 largest publicly listed mining companies increasing by $476 billion over the past month, a rise of approximately 20%.

At the same time, since January, the stock prices of over 100 independent metal and mining companies have more than doubled. Among the 156 industry stock indices tracked by MSCI, the top three performers this year all belong to the metals sector. Industry giants such as BHP, Zijin Mining, Rio Tinto, and Glencore have emerged as the biggest winners.

This round of "metal frenzy" is gaining momentum. Gold prices surpassed $5,300 per troy ounce on Wednesday, silver broke the $100 mark for the first time last week, and copper and tin also reached historic highs this month.

The main driver of the influx of funds into mining stocks and physical metals comes from safe-haven demand. As U.S. President Trump issued military and tariff threats and took action against Federal Reserve Chairman Powell, global turmoil intensified, causing the dollar to fall to its lowest level against a basket of currencies in four years.

Panmure Liberum analyst Tom Price candidly stated: "People are very scared." He pointed out that investors are "replacing dollar exposure with commodity exposure" and noted that "we have never seen such a scale of market movement." Additionally, the AI boom has also driven up copper prices due to increased demand for grid infrastructure and data centers.

Valuation Recovery and Upside Potential for Mining Stocks

This surge continues the strong performance of mining stocks seen in 2025. According to S&P Global Market Intelligence, the total market capitalization of a group of mining stocks composed of nearly 2,400 companies rose by over 80% year-on-year in December last year. Nevertheless, investment institutions believe that there is still room for growth in this sector.

James Hayter, Chief Investment Officer of Orion Resource Equities, stated that investors are increasingly expecting metal prices to continue rising in the medium to long term, which is driving "excellent stock performance." He added that even if precious and base metal prices retreat from their recent historical highs, this dynamic may persist.

Hayter pointed out that given that mining has been "unfavored and underinvested for years," "a small amount of capital rotation into our industry by global asset management companies could have a huge impact."

John Meyer, an analyst at SP Angel, believes that the performance of mining stocks still "lags behind" the "extraordinary and unprecedented" increases in gold, silver, copper, and other metals this month. He added that many miners' valuations have not been "particularly well reflected," indicating that there is still much room for catch-up

Speculative Capital Influx Triggers Concerns of a Pullback

Despite the buoyant market sentiment, analysts have issued warning signals, pointing out that the industry still requires substantial capital, and geopolitical turmoil has introduced uncertainties regarding mining companies' ability to establish and operate mines, which will affect stock performance.

Enrique Dans, a researcher at the Center for European Policy Analysis, stated that global tensions have increased the "volatility premium across the entire industry," with some mining stocks that are years away from production experiencing "very sharp fluctuations."

Price from Panmure Liberum warned that speculators are entering the industry, and if spooked, these speculators "have the incentive to exit quickly." He added that such moves could trigger a significant pullback "after this massive rebound." Even seasoned commodity investors are now inquiring about "exit plans" and "life after [price] surges."