POP MART global buyer profile: average spending exceeds 800 yuan, rapid expansion of new customers, high repurchase rate, and second-hand proportion is only 9%

Citigroup's global survey shows that POP MART's new customer growth is strong, with 76% of users having "joined" for less than a year, and 87% planning to repurchase in the near future. The data debunks the "tide receding theory": only 9% of users participate in second-hand transactions, and the official pricing system remains solid. In addition, Twinkle Twinkle has performed better than expected in the United States, and IP diversification is breaking the reliance on a single hit product

As the market focuses on the popularity of trendy toys and fluctuations in secondary market prices, a consumer survey covering five countries provides a new data perspective on the real consumption momentum of POP MART.

According to news from the Chase Wind Trading Desk, on January 27, Citigroup Research, in collaboration with its Research Innovation Lab, released the "Global Consumer Survey," which surveyed 1,501 POP MART consumers from China, Japan, the United States, the United Kingdom, and Australia, focusing on consumption behavior, purchasing motivations, brand awareness, and IP preferences.

The survey results show that despite previous market concerns about cooling demand for trendy toys and falling secondary market prices, POP MART's user growth, repurchase stickiness, and IP appeal still demonstrate strong resilience.

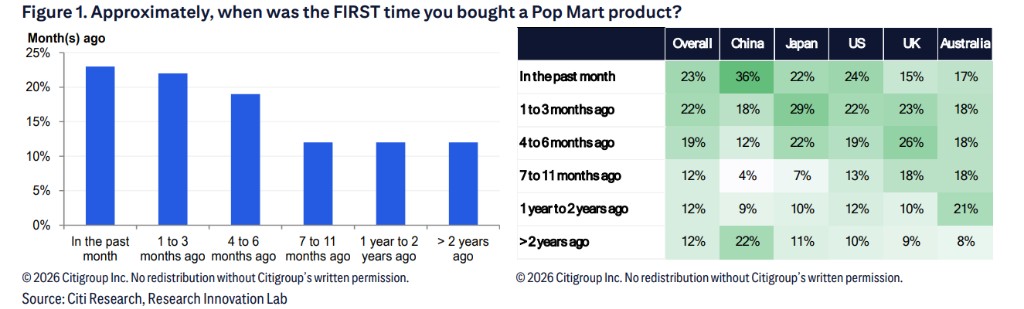

High proportion of new customers, 76% of users have been "hooked" for less than a year

The survey indicates that 76% of respondents made their first purchase of POP MART products within the past year, with 45% being new customers in the last three months. The expansion of new users is particularly evident in markets such as China and Japan.

The research report points out that this trend is closely related to "improved supply and increased product availability," rather than being driven by the short-term popularity of a single IP.

"Unlike the market's previous concerns about waning interest, with improved supply, POP MART's global user base continues to expand."

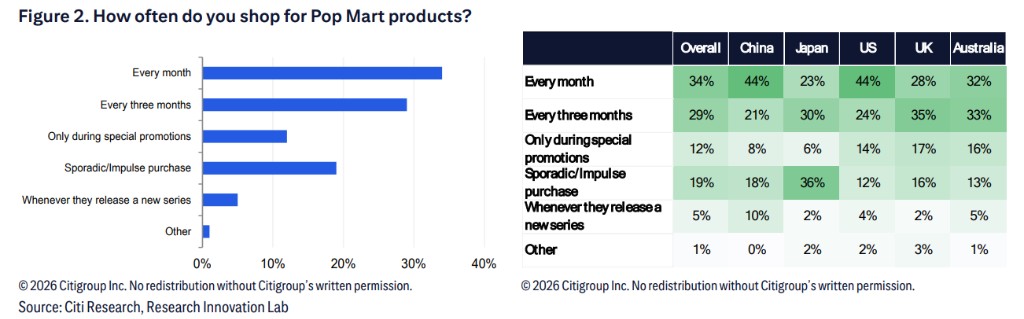

High repurchase frequency and short-term purchasing intentions remain elevated

In terms of consumption stickiness, the survey shows that POP MART's repurchase characteristics are quite prominent. 34% of respondents indicated they purchase once a month, and 29% purchase once every three months; at the same time, 87% of respondents stated they are "likely or very likely" to continue purchasing in the next three months.

Regarding future behavior expectations, 93% of respondents indicated they will continue to purchase POP MART products, with 26% planning to increase their purchase frequency.

Citigroup also provides data tracking for app downloads, official website traffic, Instagram interactions, store expansions, and foot traffic. The research report believes that the launch of new series, limited editions, and holiday (Thanksgiving, Christmas, Spring Festival, Valentine's Day) products are the core factors driving the next wave of consumption.

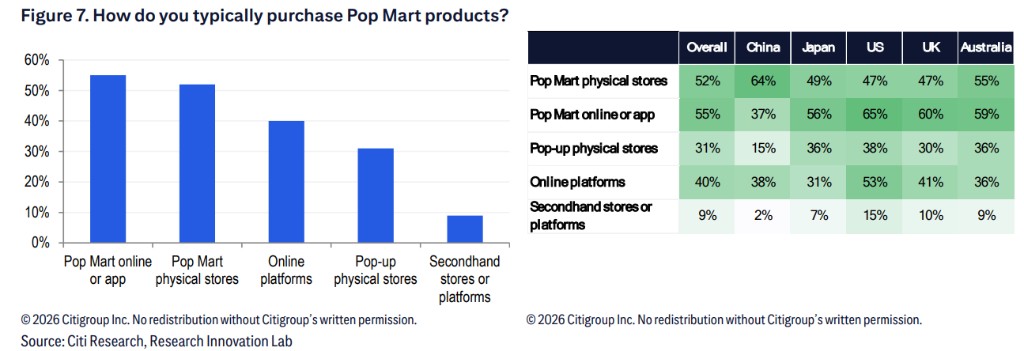

Low penetration rate in the second-hand market: only 9% of respondents participate, with official channels still dominating consumption

Regarding the market's heightened concern about fluctuations in secondary market prices, the survey results show that only 9% of respondents purchased POP MART products through second-hand platforms, with this proportion being only 2% in the Chinese market. Even in the relatively active second-hand trading market of the United States, it is only 15%.

This result indicates that the current core consumption of POP MART still relies mainly on official channels, and the secondary market has more of an emotional impact rather than dominating real consumption behavior The report believes that the current sample shows that the second-hand market is more of a "supplementary existence" rather than a systematic substitute for official sales.

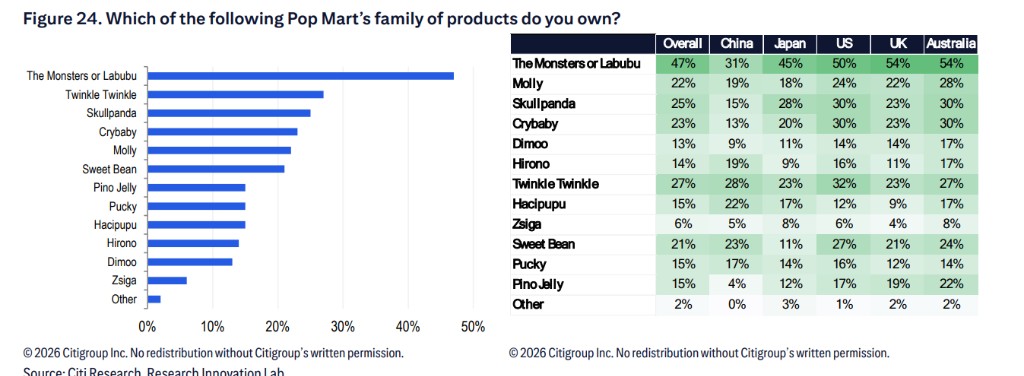

Not Just LABUBU: IP Matrix Diversification, Twinkle Twinkle Becomes a Dark Horse in the U.S. Market

From the perspective of IP structure, LABUBU remains the most attractive core IP, with 47% of respondents owning LABUBU products, and nearly half of consumers first encountered POP MART through LABUBU.

However, the survey also shows that IP such as Twinkle Twinkle, Skullpanda, and Crybaby have higher ownership rates and attractiveness in overseas markets than previously expected, with Twinkle Twinkle having the highest ownership rate in the U.S. among all countries.

Citi Research points out that this result indicates that the IP driving force of POP MART in overseas markets is not highly concentrated on a single IP, and there is still structural expansion space.

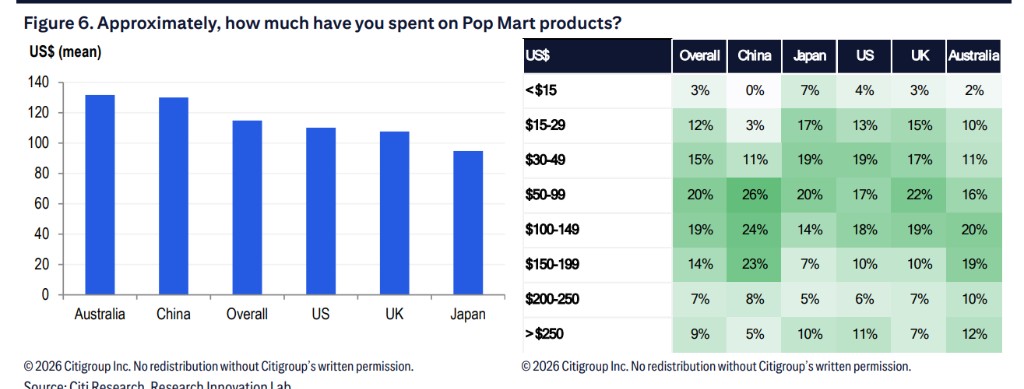

Consumer Profile: Australians Have the Highest Cumulative Per Capita Spending, U.S. Users Prefer "Buying More"

In terms of average spending, Australian respondents have the highest per capita expenditure (about $132), followed by China at about $130, the U.S. at about $110, the U.K. at about $108, and Japan at about $95.

Overall, about 90% of respondents purchased at least 2 items, with 2–5 items being the largest group (42%); Americans have the highest average ownership (close to 10 items per person).

These data suggest that, in addition to frequency, the differences in per capita spending and ownership by region will have a direct impact on single-store revenue, overseas expansion ROI, and pricing strategies.

Blind Box Mechanism Remains Core: 80% of Respondents Value "Surprise"

The report points out that 80% of respondents believe that the "blind box" element is important to the purchasing experience (about 94% in China).

In terms of the price range consumers are willing to pay, the psychological price point for a single blind box is concentrated in the $25–31 range (with variations across countries).

This has direct implications for the company's pricing strategy, premium new product launches, and the rhythm of limited editions: maintaining a "blind box + limited" combination in key markets can simultaneously sustain traffic and sales efficiency.

User Profile: 41% Aged 18–34

In terms of demographic structure, POP MART users are relatively young: 41% are aged 18–34, especially in the U.S., U.K., and Australia; the gender distribution is fairly balanced (approximately 50% male and female) In terms of consumption purposes, gifts and collectibles/hobbies account for the highest proportions (approximately 29% and 26% respectively), with emotional satisfaction and following trends also holding a place. High satisfaction (54% "very satisfied," 39% "relatively satisfied") and a low intention to abandon (only 7% indicating they will not purchase in the future) together support the long-term stickiness of the brand.

The above wonderful content comes from [Chasing Wind Trading Platform](https://mp.weixin.qq.com/s/uua05g5qk-N2J7h91pyqxQ).

For more detailed interpretations, including real-time analysis and frontline research, please join the【 [Chasing Wind Trading Platform ▪ Annual Membership](https://wallstreetcn.com/shop/item/1000309)】

[](https://wallstreetcn.com/shop/item/1000309)