The US dollar has fallen to a four-year low, but Trump is not worried: the dollar is performing well and can find a reasonable level

Trump hinted that he could manipulate the dollar exchange rate, stating, "I can make it fluctuate like a yo-yo," but he believes that doing so is not a good thing and criticized Japan for continuously devaluing its currency. After market speculation about a possible joint intervention in the foreign exchange market by the U.S. and Japan, the yen has recently appreciated over 3% in the last three trading days. In the long term, structural factors such as the independence of the Federal Reserve, the expanding budget deficit, concerns related to fiscal extravagance, and political polarization are putting downward pressure on the dollar

Investor concerns about the unpredictability of U.S. policies are deepening, causing the dollar to fall to its lowest level against major currencies in four years. At this time, U.S. President Trump is not worried. He stated on Tuesday that the dollar is performing well and is not concerned about its decline, expecting fluctuations in the exchange rate.

When asked by reporters if he was worried about the depreciation of the dollar, Trump said:

"No, I think the dollar is doing great. I think the value of the dollar—look at the trade we are doing, the dollar is performing excellently."

"I hope the dollar can—find its own reasonable level, that is the fair thing to do."

Trump hinted that he could manipulate the dollar's exchange rate, saying, "I can make it fluctuate like a yo-yo." However, he believes that this is not a good thing and compared it to hiring unnecessary employees to boost employment data, while criticizing some Asian economies that he believes are trying to devalue their currencies.

Although Trump appears unconcerned about the dollar's depreciation, commentators believe that the dollar's decline is not over. In the long term, structural factors such as the independence of the Federal Reserve, the expanding budget deficit, concerns related to fiscal profligacy, and political polarization are putting downward pressure on the dollar.

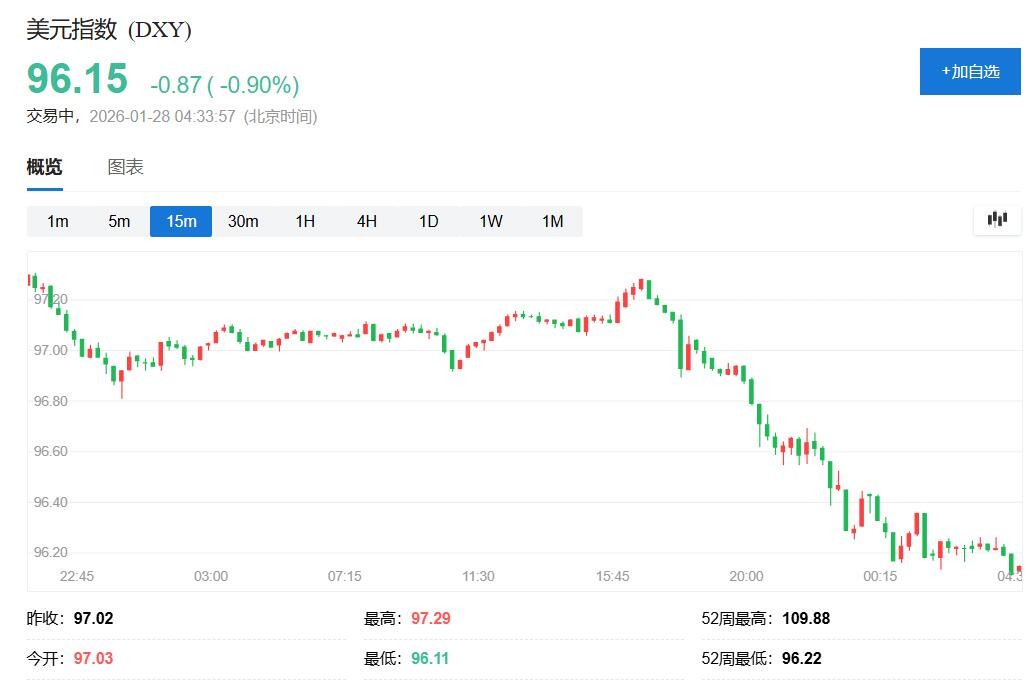

On Tuesday, Eastern Time on the 27th, during the U.S. stock market's midday session, the ICE Dollar Index (DXY), which tracks the dollar against a basket of six major currencies including the euro, fell below 96.20, hitting its lowest level since February 2022, with a daily decline of over 0.9%. The Bloomberg Dollar Spot Index also fell for the fourth consecutive day, reaching its lowest level since March 2022, marking the largest four-day decline since Trump announced reciprocal tariffs in April last year.

Elias Haddad, global market strategist at Brown Brothers Harriman & Co., commented: "The structural factors weighing on the dollar—including weakened confidence in U.S. trade and security policies, the politicization of the Federal Reserve, and deteriorating U.S. fiscal credibility—may overshadow a relatively neutral cyclical dollar environment, pushing the dollar lower."

As the dollar weakens, other major currencies around the world are rising. The yen is set to gain over 3% in the last three trading days. The euro against the dollar rose to 1.1990, reaching its highest level since June 2021, while the pound against the dollar broke above 1.3790, hitting its highest level since October of the same year. An emerging market currency index has risen for the fourth consecutive trading day, currently at record highs against the backdrop of the dollar's decline.

Trump's Policy Uncertainty Weighs on the Dollar

The dollar's weakness reflects cautious sentiment among investors amid the unpredictable direction of Washington's policies, including Trump's threat to take over Greenland. According to Bloomberg, investors are seeking hedges against further dollar weakness, with premiums for short-term options rising to the highest level since Bloomberg began compiling this data in 2011.

On Monday, trading volume through the depository and clearing company set a historical second-high record, second only to the sell-off on April 3 of last year. "We are seeing the risk premium for the dollar accumulate again," the Barclays team wrote in a report on Tuesday, noting that the dollar performed poorly after Trump's Greenland threat The uncertainty surrounding the selection of the Federal Reserve Chair is also putting pressure on the dollar. According to reports, some analysts believe that Trump may announce his candidate to replace Powell after the Fed's interest rate decision on Wednesday, especially given Trump's lack of support for the Fed's latest decision. The Trump administration's criminal investigation into Powell and its attempts to dismiss Fed Governor Lisa Cook will also be under scrutiny during this meeting.

The Trump administration's preference for a weaker dollar and the risk of a potential government shutdown further add to the uncertainty. If the Republicans do not separate the funding for the Department of Homeland Security, the Democrats vow to block the congressional spending bill.

Yen's Strong Rebound Triggers Intervention Speculation

The yen has become another driver of the dollar's weakness. Following reports last Friday that the Japanese government was set to intervene, and possibly coordinate with the U.S. government to support the yen, the yen rose for the third consecutive trading day. The dollar fell below 152.60 against the yen during Tuesday's U.S. stock market midday, approaching 152.50, with intraday losses exceeding 1%, hitting the lowest level since late October 2025.

Last Friday, the yen experienced two waves of gains in one day. The market first speculated that the Japanese Ministry of Finance had conducted a rate check, which is typically seen as a warning signal from the government to traders. Subsequently, media reports cited some traders claiming that the New York Fed had inquired about the dollar-yen exchange rate that day, which Wall Street interpreted as a sign that the Fed was preparing to assist Japanese officials in directly intervening in the market to support the yen.

Japanese Finance Minister Shunichi Suzuki warned again on Tuesday after the G7 meeting that intervention might be necessary, stating that the Japanese government is ready to coordinate closely with the U.S. if needed to take "appropriate measures" regarding the exchange rate.

The foreign exchange strategy team at Nomura Securities noted in a report that the movement of the dollar against the yen on Tuesday was similar to the interventions by the government in 2022 and 2024. The team believes that the latest round of movements "is not a one-time drop in the dollar-yen rate, but rather a series of further declines following an initial sharp drop," which resembles the trends seen during previous intervention periods.

Data on the daily current account balance released by the Bank of Japan on Wednesday will provide more information, potentially revealing whether the Ministry of Finance intervened and the scale of such intervention.

The possibility of coordinated intervention has made investors reluctant to push the yen lower. BNP Paribas emerging markets Asia foreign exchange and local market strategist Parisha Saimbi stated, "Signs from the U.S. indicate potential risks to the market, and there may be multiple parties ready to intervene, which is different from what we have seen in the past."

Although officials from both the Japanese and U.S. governments have not confirmed any rate checks, data from the Bank of Japan's money market indicates that last Friday's surge in the yen against the dollar may not have been due to Japanese intervention George Catrambone, Head of Fixed Income at DWS Americas, stated that the Federal Reserve officials' rate check last Friday "further depressed the dollar." The resilience in global growth expectations, reflected in the rise of the stock market, may prompt investors to seek higher returns outside the United States.

Karl Schamotta, Chief Market Strategist at Corpay, wrote: "The shift towards protectionism and weakened security commitments in Washington is prompting other countries to increase defense spending and strengthen competitive focus, which compresses the growth and interest rate differentials that previously favored the dollar."

Nick Rees, Head of Macro Research at Monex, stated that regardless of whether the Federal Reserve conducts coordinated intervention, "macro traders are independently deciding that the dollar is in a declining channel."

The market currently expects the Federal Reserve to maintain interest rates on Wednesday, with expectations for two 25 basis point rate cuts by the end of the year, contrasting with many other major central banks. Kit Juckes, Head of FX Strategy at Société Générale, stated: "There may now be some (U.S.) government shutdown, and dollar bulls still have many concerns. U.S. growth may still determine how much the Federal Reserve eases and whether the dollar can significantly weaken from here."