NVIDIA gave its "favorite child" $2 billion, CoreWeave's stock price surged

NVIDIA will subscribe to CoreWeave common stock at a price of $87.20 per share, with an investment amount reaching $2 billion. Evercore ISI analysts stated that although this news may exacerbate market concerns about AI cycle financing, this move is expected to improve CoreWeave's balance sheet. Additionally, by securing NVIDIA's Rubin products in advance, CoreWeave may gain an advantage in the competition with rivals

NVIDIA and CoreWeave announced on Monday the expansion of their partnership to accelerate the construction of artificial intelligence data centers.

NVIDIA will subscribe to CoreWeave's common stock at a price of $87.20 per share, with an investment amount reaching $2 billion. NVIDIA is already a major shareholder of CoreWeave, holding approximately 6.6% of the company's outstanding shares as of the end of September. This increase further solidifies the strategic alliance between the two parties.

According to the agreement, CoreWeave plans to build over 5 gigawatts of AI data centers by 2030, which will run NVIDIA's future generations of AI systems, including the upcoming Rubin AI chip platform and Vera central processing unit. NVIDIA CEO Jensen Huang told Bloomberg that this investment reflects confidence in CoreWeave's growth prospects, management team, and business model.

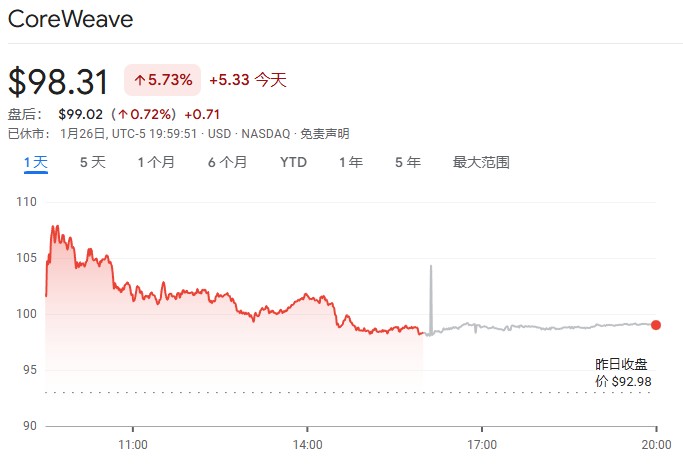

CoreWeave CEO Michael Intrator stated in a statement that this arrangement "highlights the strong demand we see in our customer base and broader market signals as AI systems enter a phase of large-scale production." Following the announcement, CoreWeave's stock price rose 5.7% on the same day.

Locking in Next-Generation Chip Advantages

The core of this collaboration is that CoreWeave has gained priority access to NVIDIA's future products. These data centers will deploy NVIDIA's upcoming Rubin AI chip platform, Vera central processing unit, and Bluefield storage systems.

Evercore ISI analyst Amit Daryanani pointed out that while this news may intensify market concerns about the cyclical financing of the AI ecosystem, he holds a more positive view, believing that this move is expected to improve CoreWeave's balance sheet. He also stated that by gaining early access to NVIDIA's Rubin products, CoreWeave may gain an advantage in the competition with emerging cloud computing rivals.

The collaboration also includes testing and validating AI software and reference architectures, with CoreWeave hoping to offer its products alongside NVIDIA's solutions to cloud partners and enterprise customers in the chip manufacturing sector.

Deeply Bound Business Relationship

The partnership between NVIDIA and CoreWeave has continued to deepen. The two parties previously signed an agreement requiring NVIDIA to purchase underutilized computing capacity from CoreWeave's customers, which is effective until April 2032. In September of last year, the two companies also signed a cloud services agreement worth $6.3 billion.

Intrator revealed to Bloomberg that NVIDIA's investment accounts for only 2% of the company's planned expenditures for building more data centers. He stated, "This year we will deliver a significant amount of infrastructure, and this will only accelerate over the next three years."NVIDIA's stock price fell slightly by less than 1% on Monday, indicating a relatively calm market reaction to the deal.

Analysts Optimistic About Long-Term Prospects

D.A. Davidson analyst Alex Platt upgraded CoreWeave's stock rating to Buy on Monday, becoming another catalyst for the stock price increase. He is optimistic about the demand for computing power and believes that at the current price, CoreWeave's stock has fully reflected risks such as financing reviews and data center delays.

Platt stated that without a catalyst to "significantly reduce" counterparty risk and debt concerns, CoreWeave's valuation is unlikely to rise further, but he believes that more such opportunities may arise in 2026.

He pointed out that if OpenAI can raise enough funds to fulfill its data center commitments with CoreWeave, it would not only reduce the risk of backlog orders for the company but also improve its financial agreements. Additionally, a lower interest rate environment would benefit CoreWeave, as declining borrowing costs would lower the "required rate of return perceived by investors, thus being seen as a value-creating business."