Banking Race in Space Infrastructure: The Path Advancement from "Buy the Map Faction" to "Launch Faction"

In the landscape of financial technology, the sky is becoming an extension of the ground credit battlefield. In January, near the waters of Rizhao, Shandong, China Merchants Bank's "Zhaoyin Jinkui No. 1" and…

In the landscape of financial technology, the sky is becoming an extension of the ground credit battlefield. In January, in the sea near Rizhao, Shandong, China Merchants Bank's "Zhaoyin Jinkui" and Shanghai Pudong Development Bank's "Puyin Shuzhi" were launched into orbit on the same day.

Under the "space fever," it is not uncommon for large institutions to name satellites, but if we look closely, we will find that this launch has essential differences—

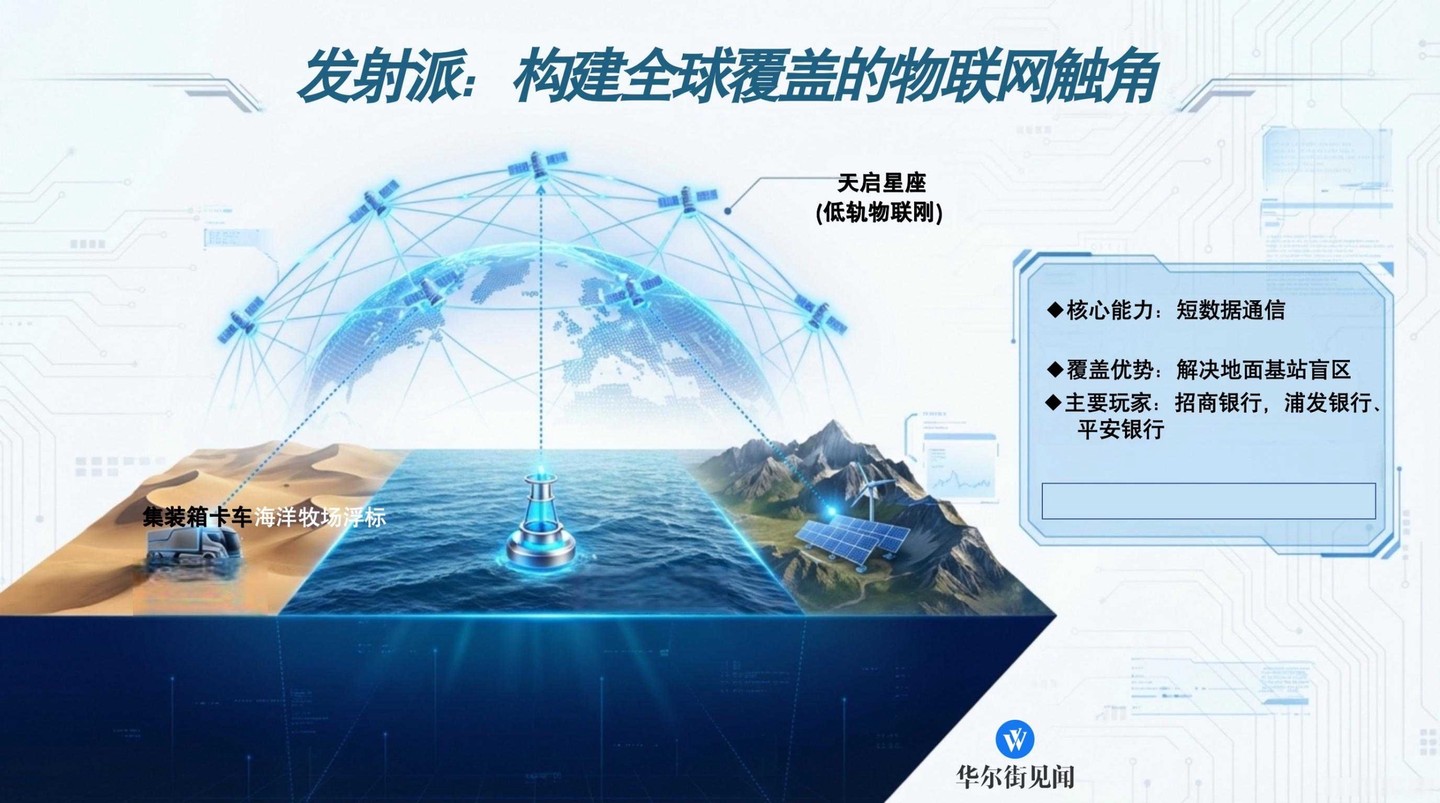

Both satellites from the two joint-stock banks are connected to the "Tianqi Constellation," becoming active nodes in the low-orbit Internet of Things constellation network. The data returned by the satellites will no longer go through third-party data vendors but will flow directly to the banks.

From Ping An Bank's early explorations to the current network establishment by China Merchants Bank and Shanghai Pudong Development Bank, the application logic of aerospace technology in China's banking industry is undergoing a profound change.

Behind this competition is a technological breakthrough for financial institutions facing supply chain risk control bottlenecks, data sovereignty anxieties, and pressures for business continuity.

Landscape Division

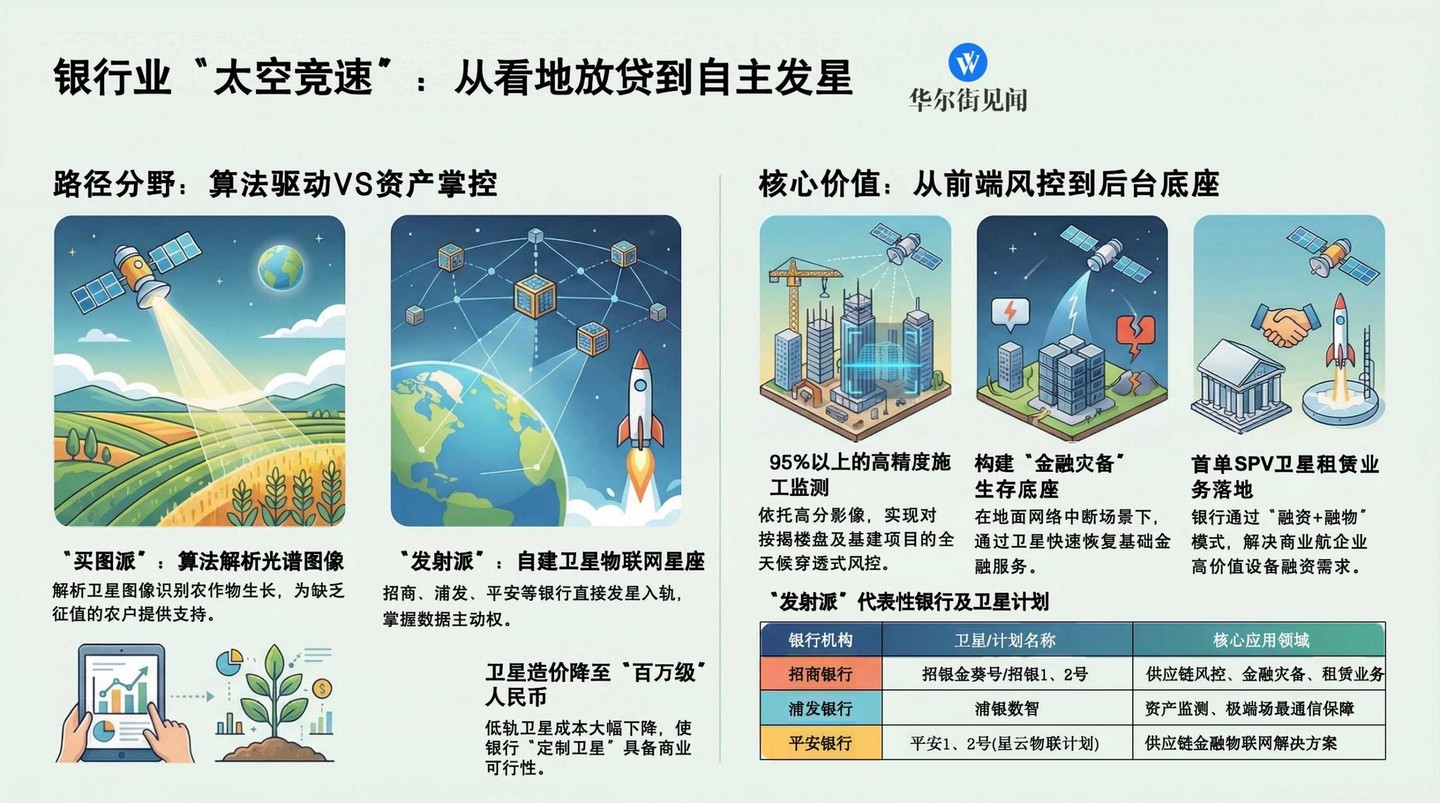

In the current financial aerospace landscape, banks are gradually diverging into two paths based on their endowments and strategic demands:

One type is the "launch faction" that controls hardware assets, while the other is the "buying map faction" that relies on algorithms and procured data services.

China Merchants Bank, Shanghai Pudong Development Bank, and Ping An Bank, which have already met in space, are the main forces in satellite launches. This time, China Merchants Bank's "Zhaoyin Jinkui" and Shanghai Pudong Development Bank's "Puyin Shuzhi" were both designed and developed by State Grid High-Tech and belong to the 37-40 batch of the "Tianqi Constellation";

Prior to this, the "Tianqi Constellation" had completed its first phase of networking, and the "Zhaoyin 1" and "Zhaoyin 2" launched by China Merchants Bank in 2024-2025 are included in this batch

Unlike high-orbit satellites that focus on broadcasting television and broadband communication, the "Apocalypse Constellation" focuses on solving short data communication for "air, land, sea" globally. It can still allow assets such as containers, buoys, and trucks to send signals in oceans, deserts, and deep mountains without ground station coverage. The key point of this launch is that it is an important enhancement launch after the first phase of the "Apocalypse Constellation" network;

The newly added satellites will increase constellation density and shorten revisit intervals, allowing satellites to pass the same location more frequently, with lower data return latency. Higher data transmission bandwidth will also support more terminal devices to connect concurrently, paving the way for large-scale commercial use.

Before China Merchants Bank and Shanghai Pudong Development Bank, Ping An Bank had already launched "Ping An No. 1" and "Ping An No. 2" from 2020 to 2022, initiating the "Nebula IoT Plan" to build IoT solutions focused on serving supply chain finance.

Zhang Shu (pseudonym), an investment and financing person from a space company, introduced that satellites are mainly divided into categories such as remote sensing, navigation, communication, and scientific experiments;

Among them, remote sensing satellites mainly capture ground photos, and institutions purchase images useful for their business, such as water conservancy departments monitoring water levels and flood conditions, and land departments focusing on illegal construction in mountainous areas;

The core of banks' efforts in satellite remote sensing is to convert images into data assets in credit.

However, banks have not been unfamiliar with the use of remote sensing technology for a long time.

Compared to the heavy asset investment of the "launch faction," more banks prefer to purchase remote sensing data from satellite companies for secondary processing. In this model, banks do not need to own satellites; they only need the ability to understand satellite images.

MyBank is a representative of this model. Its pioneering "Great Tit" system applies satellite remote sensing to rural finance. By analyzing the spectral images captured by satellites, the system can identify whether the ground is planted with rice or corn, and even analyze whether the crops are in the heading or filling stage, thus estimating yield and output value, providing loan support for farmers lacking credit records Some institutions are also focusing on corporate business.

Among them, CITIC Financial Assets has procured satellite remote sensing monitoring data services, covering scenarios such as construction projects and existing properties, which can monitor the physical status of projects through time-series satellite images;

Industrial Bank focuses on green finance, utilizing remote sensing to calculate forestry carbon sinks. By monitoring vegetation coverage and growth conditions of forest land through satellites, the bank can quantify the amount of "carbon dioxide in the air" into collateralizable financial assets.

In addition, state-owned banks such as Agricultural Bank of China, Postal Savings Bank of China, and China Everbright Bank have also embedded similar remote sensing data services in their respective supply chain finance or inclusive finance products.

From "looking at the sky to make a living" to "looking at the ground to lend," satellite remote sensing has become a mature alternative data source in bank credit risk control.

It is worth noting that these two paths are not mutually exclusive. For example, China Merchants Bank, which launched satellites this time, also stated that remote sensing technology has been deeply integrated into its risk control system;

Through self-developed systems, the bank has achieved high-precision construction monitoring of first-hand mortgage properties nationwide, relying on high-resolution images, with monitoring accuracy exceeding 95%, and simultaneously providing services to institutions such as housing provident fund and housing construction, thus building a full-chain risk control closed loop covering project management.

Why go to space?

Since "buying images" can solve many problems, why do many leading joint-stock banks still choose to invest in sending satellites into space?

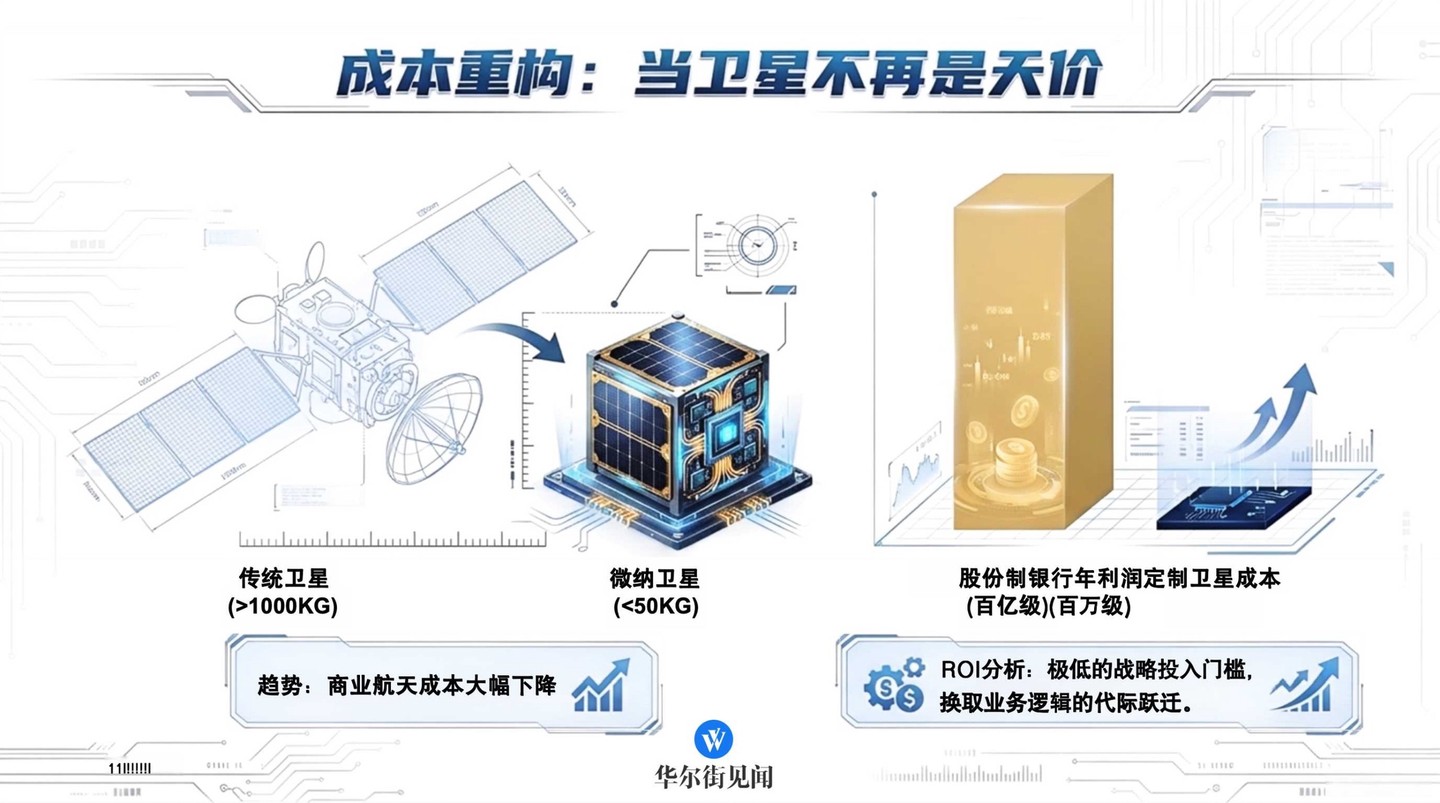

Behind this is the push of decreasing costs in commercial space and the banks' desire to upgrade their risk control capabilities.

First is the repricing of costs. With the rapid development of technology, "custom satellites" are no longer an unattainable exorbitant price.

An industry insider close to the aerospace company pointed out to Xin Feng that one of the breakthroughs of low-orbit Internet of Things satellites is the decrease in cost. Xin Feng found that the previously connected "Tiangui Constellation" batches 8-21 are all micro-nano satellites weighing under 50KG.

Zhang Shu pointed out that, based on market estimates, the cost of such customized satellites ranges from millions to tens of millions of RMB.

For a joint-stock bank with annual profits in the hundreds of billions or tens of billions, this expenditure is not particularly high.

However, the investment may lead to a generational leap in business logic.

"Buying images will always be more passive," the aforementioned insider pointed out. Remote sensing satellites have strict time windows for observing the ground and are greatly affected by weather. If there are continuous rainy days or conflicts in satellite orbit scheduling, the construction sites or ports the bank wants to observe become blind spots The practitioner stated that customized satellites equate to having the greatest degree of freedom, allowing reliable data to be processed into financial assets, serve decision-making, and even be packaged and sold.

In addition, Zhang Shu also mentioned the importance of payload customization, noting that general optical satellites can only take photos, but more satellites can be deployed to carry synthetic aperture radar (SAR) or specific sensors based on demand.

"For example, if a bank wants to penetrate cloud cover to monitor infrastructure projects during the rainy season in the south, or needs to measure the concentration of specific gases in a carbon emission demonstration area," Zhang Shu said, "these advanced requirements may need to be achieved through customized payloads."

While launching satellites, the aforementioned joint-stock banks are also continuously working on networking. The "Zhaoyin Jinkui" satellite and the "Puyin Shuzhi" satellite from Shanghai Pudong Development Bank both joined the "Tianqi Constellation" batch of satellites 37-40.

"The projection of a satellite on Earth is not a point, but a wavy quasi-sine curve," Zhang Shu stated. A single satellite is limited by orbital physical laws, passing over the same location only a very limited number of times each day, and there are time blind spots.

Zhang Shu said, "If only one satellite is launched, the bank sees a fragmented slice; forming a constellation will greatly enhance revisit frequency, expand geographical monitoring range, and shorten return time intervals."

For bank risk control, a reduction in data latency means that the "electronic fence" truly possesses practical value. When collateral assets experience abnormal displacement, banks can stop losses immediately rather than after the fact.

China Merchants Bank and Shanghai Pudong Development Bank also introduced a new concept during this launch—financial disaster recovery.

The banks have taken the lead in initiating the application verification of low Earth orbit satellite communication technology in financial disaster recovery systems. By simulating scenarios of ground network interruptions, the bank successfully completed the low Earth orbit satellite link switching test for interconnection between the head office and branches. Shanghai Pudong Development Bank also revealed similar intentions, stating that in extreme scenarios such as major natural disasters, they aim to quickly restore and provide essential basic financial services through satellite links This marks the shift of banks' positioning on satellites from a front-end customer acquisition tool to a "back-end survival base."

In the context of frequent extreme disasters, having a satellite communication link that is independent of ground fiber optic networks and is self-controllable builds a defense line for financial institutions to ensure business continuity.

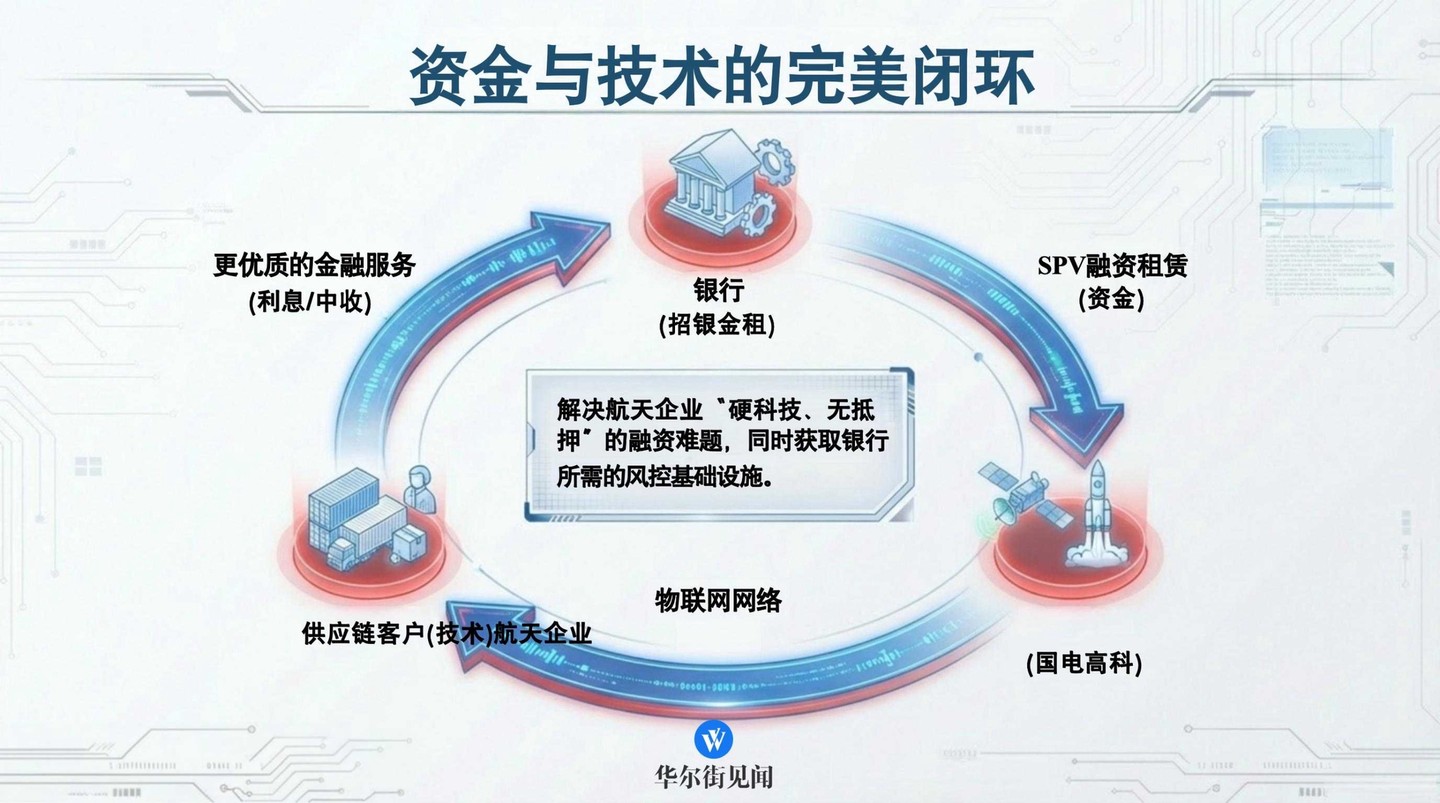

Banks are not only focused on the sky but are also laying out a larger strategy — empowering the commercial space industry.

For a long time, commercial space enterprises have been typical "hard technology, long cycle" assets. The technology for rocket research and development is complex, the cost accounting logic is unique, and there is a lack of collateral required for traditional credit, which often leads banks to shy away due to "not understanding and not daring to lend." Getting personally involved may also be a deep due diligence for banks.

"Bank funds are now paying more attention to aerospace, and our company has also interacted with banks and bank AIC institutions," said Zhang Shu. "Guodian Gaoke is still in the financing stage, and more forms of interaction are quite normal."

In addition to launching satellites, China Merchants Bank's wholly-owned subsidiary, China Merchants Jinzhong, has landed the first domestic SPV (Special Purpose Vehicle) satellite leasing business based on the funding needs of the Tianqi constellation network operation;

By establishing a project company, China Merchants Jinzhong provides equipment leasing services to Guodian Gaoke, perfectly aligning with the high-value equipment financing needs of commercial space enterprises through a "financing + asset financing" model.

This will create a more perfect closed loop: banks use satellites to enhance risk control capabilities, satellite companies receive funding support to complete networking, and the bank's customers enjoy high-quality financial services based on satellite IoT.

An ecological closed loop woven from capital, technology, and scenarios is becoming a new strategic moat for leading banks.

When the sky becomes a transmission belt for data, the competition among banks is no longer limited to counters and branches;

Whoever can weave this network in space first may gain stronger discourse power in future supply chain finance and cross-border business.

[!