Brent crude oil falls below the $65 mark! IEA just warned of a "significant surplus," and the U.S. Energy Secretary calls for "doubling production."

The U.S. Secretary of Energy calls for a doubling of global crude oil production, combined with the IEA's maintenance of its severe supply surplus judgment for this year, significantly dampening market sentiment. Rising U.S. inventories, the return of supplies from Kazakhstan and Venezuela, and the recovery of Russian crude oil exports collectively amplify supply pressure; at the same time, the cooling of geopolitical risks further weakens support for oil prices

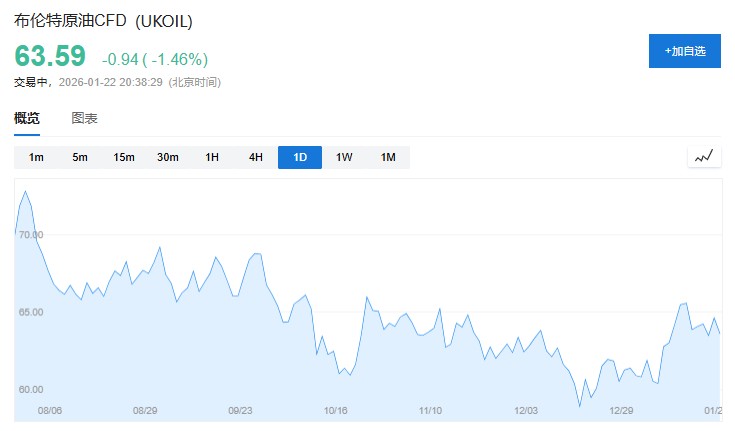

International oil prices faced downward pressure on Thursday, with Brent crude oil once again falling below the key $65 mark. Bearish factors on the supply side dominated market sentiment, as the U.S. Energy Secretary called for a doubling of global oil production, coupled with warnings from the International Energy Agency about an oversupply this year, raising traders' concerns about the outlook for supply growth.

WTI crude oil fell by 2% during the day, trading at $59.59 per barrel; Brent crude oil dropped by 1.5%, trading at $63.6 per barrel. The U.S. Energy Secretary stated that global oil production needs to be increased by double.

Multiple bearish supply factors are being concentrated and released. According to the American Petroleum Institute, U.S. crude oil inventories increased by 3 million barrels last week; the repair of Kazakhstan's key Black Sea loading facilities is nearing completion, and export restrictions are about to be lifted; Venezuelan oil is returning to the global market; Indian refiner Reliance Industries is once again purchasing Russian oil.

The International Energy Agency (IEA) raised its oil demand growth forecast on Wednesday but maintained its judgment that there will be a severe oversupply this year. Geopolitical risks have eased somewhat, as U.S. President Trump stated on Wednesday that he would postpone tariffs on Europe.

Supply-side pressures are becoming evident

The recovery of supply from multiple oil-producing countries is accelerating. The repair work on the Caspian Pipeline Consortium (CPC) Black Sea oil loading terminal in Kazakhstan is nearing completion, and the export restrictions from previous weeks are about to be lifted, allowing for the digestion of backlogged goods.

Venezuelan oil shipments are returning to the global market. Indian refiner Reliance Industries is once again purchasing Russian oil, with delivery scheduled for February and March.

According to data from the American Petroleum Institute, U.S. crude oil inventories increased by 3 million barrels last week. Official inventory data will be released later on Thursday.

IEA maintains oversupply warning

The International Energy Agency slightly raised its oil demand growth forecast on Wednesday but still maintained its judgment that there will be a severe oversupply this year. The agency provides energy policy recommendations to major economies.

Oil prices briefly rose in early 2026, mainly supported by temporary turmoil in Iran, a major member of the Organization of the Petroleum Exporting Countries (OPEC), and disruptions in Kazakhstan's shipments.

Easing geopolitical risks

Geopolitical tensions have eased somewhat. U.S. President Trump stated on Wednesday that he would postpone tariffs on Europe, claiming a potential agreement framework has been reached regarding Greenland.

Saxo Bank strategist Ole Sloth Hansen stated, "The geopolitical temperature has dropped a few degrees." However, he pointed out that given a series of unresolved supply threats, combined with cold weather boosting U.S. demand, oil prices may "remain firm."