Samsung and SK Hynix report earnings on the same day, both sprinting towards their best performance in history, as the HBM4 competition escalates

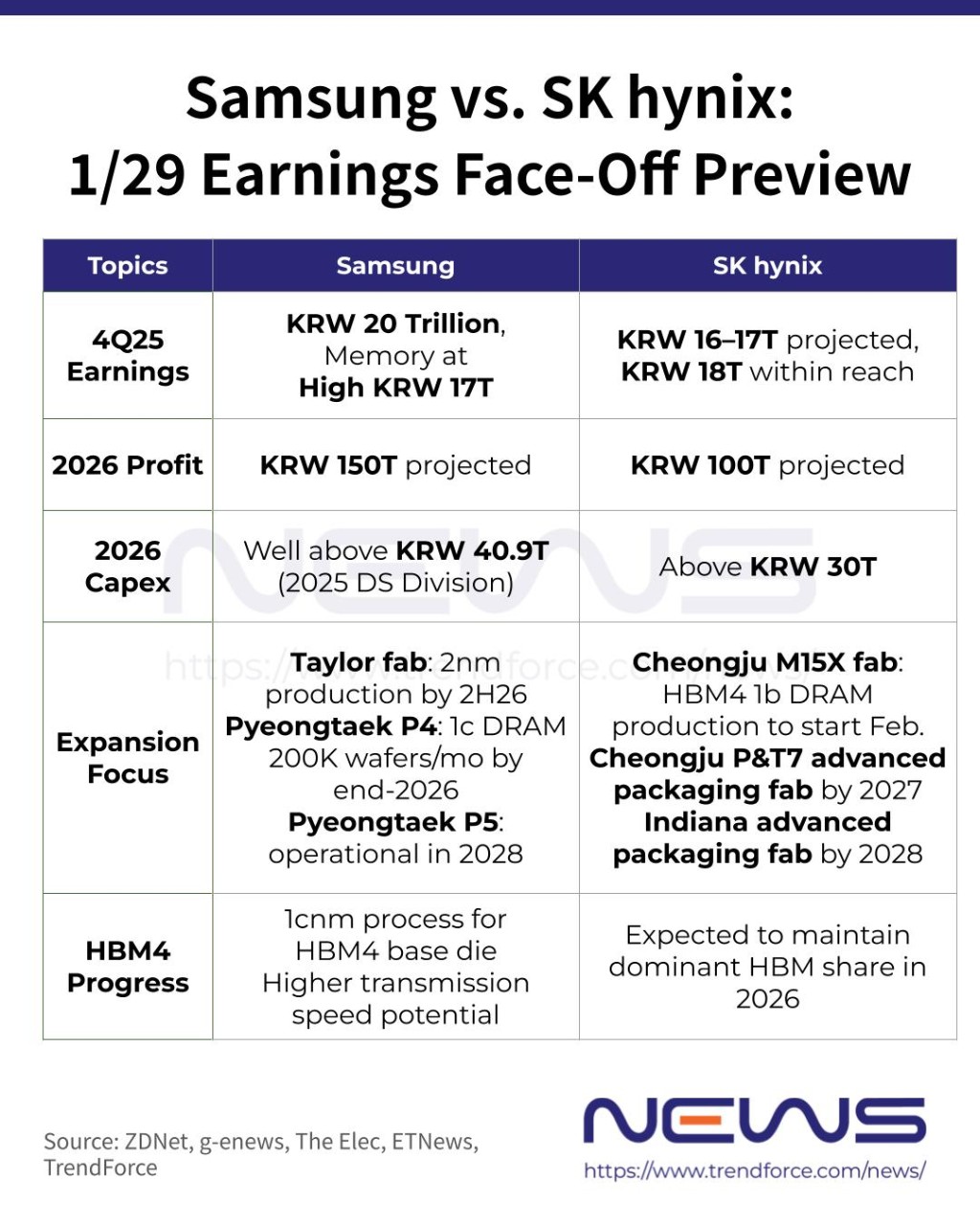

Samsung and SK Hynix will release their financial reports on January 29. Samsung's operating profit for Q4 is expected to surge by 208% due to the rebound in traditional DRAM prices, likely surpassing 20 trillion won for the first time, rapidly narrowing the profit gap with SK Hynix. Both companies are fiercely competing to reach peak performance by 2026, with massive capital expenditures and the supply competition for the next-generation HBM4 chips becoming the focal point, directly impacting the future market landscape

As the global memory chip market experiences a surge in prices due to tight supply and strong demand, Samsung Electronics and SK Hynix are set to release their Q4 2025 financial reports on January 29th. This will mark the first time the two giants announce their earnings on the same day, signifying a critical phase in the cyclical recovery of the memory industry. Investors are particularly focused on their profit performance, future capital expenditures, and the intense competition surrounding the next-generation high bandwidth memory (HBM) technology.

The latest earnings forecasts indicate that Samsung Electronics is expected to deliver a historic quarterly report, with Q4 revenue projected to exceed 90 trillion won and operating profit expected to soar by 208% year-on-year, potentially making it the first Korean company to achieve quarterly operating profit exceeding 20 trillion won. This strong performance is primarily attributed to a rapid rebound in its memory semiconductor business, significantly narrowing the profit gap with SK Hynix and potentially surpassing it in subsequent quarters. Meanwhile, although SK Hynix is limited in benefiting from the traditional DRAM price increase due to its heavy reliance on HBM, the market still anticipates its quarterly operating profit to reach at least 18 trillion won.

Another major highlight of this earnings report is the outlook for peak performance and capital expenditure plans for 2026 from both companies. With the tight memory supply expected to persist until 2027, analysts generally predict that both giants will enter the "100 trillion won operating profit club" in 2026. Additionally, the competitive landscape for the supply of the next-generation HBM4 chips will also be a focal point, especially since both companies have delivered paid final samples to NVIDIA, which directly relates to the future market share distribution in high-profit segments.

Investors are closely monitoring signals regarding capacity expansion and technology roadmaps during the earnings call. The market widely expects Samsung to significantly increase its investments in the memory sector to boost HBM production and advance the construction of its Taylor, Texas plant, while SK Hynix's capital expenditures are expected to exceed 30 trillion won in 2026, focusing on the M15X wafer fab and the Yongin semiconductor cluster.

Significant Narrowing of Profit Gap

As commodity DRAM prices rebound starting in the second half of 2025, along with an increase in mainstream DRAM shipments, Samsung Electronics' memory division is rapidly recovering its profitability. According to forecast data cited by ZDNet, Samsung Electronics' memory semiconductor business operating profit is expected to be in the high range of 17 trillion won. If the overall earnings forecast materializes, Samsung will not only achieve a remarkable revenue growth of 22.7% year-on-year but is also expected to become the first company in Korean history to reach a quarterly operating profit of 20 trillion won (approximately 13.82 billion USD).

In contrast, while SK Hynix initially expected its operating profit to be between 16 and 17 trillion won, industry sources cited by ZDNet indicate that its Q4 operating profit has now been revised upward to at least 18 trillion won. However, analysts point out that SK Hynix's business structure, which is more focused on HBM, somewhat limits its ability to benefit from the recent surge in traditional DRAM prices The market generally expects this catch-up trend to reverse in the first quarter of 2026. According to a report by ZDNet, with commodity DRAM prices expected to rise significantly again, Samsung's memory division is likely to surpass SK Hynix in operating profit during that quarter. TrendForce data indicates that the average selling price of mainstream DRAM is expected to jump by 55% to 60% quarter-on-quarter in the first quarter of 2026.

Performance Peak Expected in 2026

Against the backdrop of tight memory supply expected to continue until 2027, the two South Korean storage giants are gearing up for a performance peak in 2026. Media reports indicate that analysts predict SK Hynix's sales will exceed 165 trillion won in 2026, with operating profit surpassing 100 trillion won. Meanwhile, investment bank reports from Macquarie and KB Securities point out that Samsung Electronics' operating profit in 2026 could also reach around 150 trillion won, meaning both companies will firmly enter the "100 trillion won operating profit club."

To support this growth expectation, massive capital expenditure plans are in the works. Although no detailed plans have been officially released, The Bell previously reported that SK Hynix's capital expenditure is expected to reach the high range of 10 trillion won in 2024, increase to the mid-range of 20 trillion won in 2025, and exceed 30 trillion won in 2026. Media reports state that the company has invested billions of won into the Cheongju M15X wafer fab and the Yongin cluster project.

Samsung is also planning aggressive expansion. Media reports indicate that Samsung plans to significantly increase its investment in the storage sector in 2026, building on the 40.9 trillion won expenditure in its DS division in 2025. Key priorities include increasing HBM production, expanding the Pyeongtaek DS base, and advancing the construction of the Taylor wafer fab in Texas.

Intense Competition in HBM4 Technology

In addition to financial data, the competition between the two giants in the HBM4 field is also heating up. TrendForce notes that Nvidia modified the HBM4 specifications for its Rubin platform in the third quarter of 2025, raising the single-pin speed requirement to over 11 Gbps, forcing the three major HBM suppliers to modify their designs.

According to SeDaily, Samsung and SK Hynix began delivering paid HBM4 final samples to Nvidia by the end of 2025. The industry expects that specific supply volumes and pricing will be locked in during the first quarter of 2026, with TrendForce adding that the final results will become clear after contracts are officially finalized in the latter part of this quarter.

In this technological race, Samsung is attempting to challenge SK Hynix by manufacturing HBM4 using 1Cnm process technology and leveraging advanced in-house foundry technology to produce basic bare chips, which is expected to provide higher transmission speeds. Nevertheless, TrendForce points out that SK Hynix has already secured relevant contracts and is expected to maintain a dominant share of the total HBM supply in 2026