Is the rebound in Japanese bonds just a "flash in the pan"? The Bank of Japan's holdings have fallen below the 50% red line, and the selling pressure is far from over

The proportion of government bonds held by the Bank of Japan has fallen below 50% of the total outstanding amount, marking the first time in eight years. In addition to the Bank of Japan reducing its holdings, overseas investors are also cutting their exposure to Japanese bonds. The price of 40-year government bonds has dropped by as much as 8% from the mid-December peak, with analysts warning that "sustained buying demand remains difficult to emerge."

Japanese bonds continued to rebound on Thursday, but analysts warned that this may only be a temporary respite.

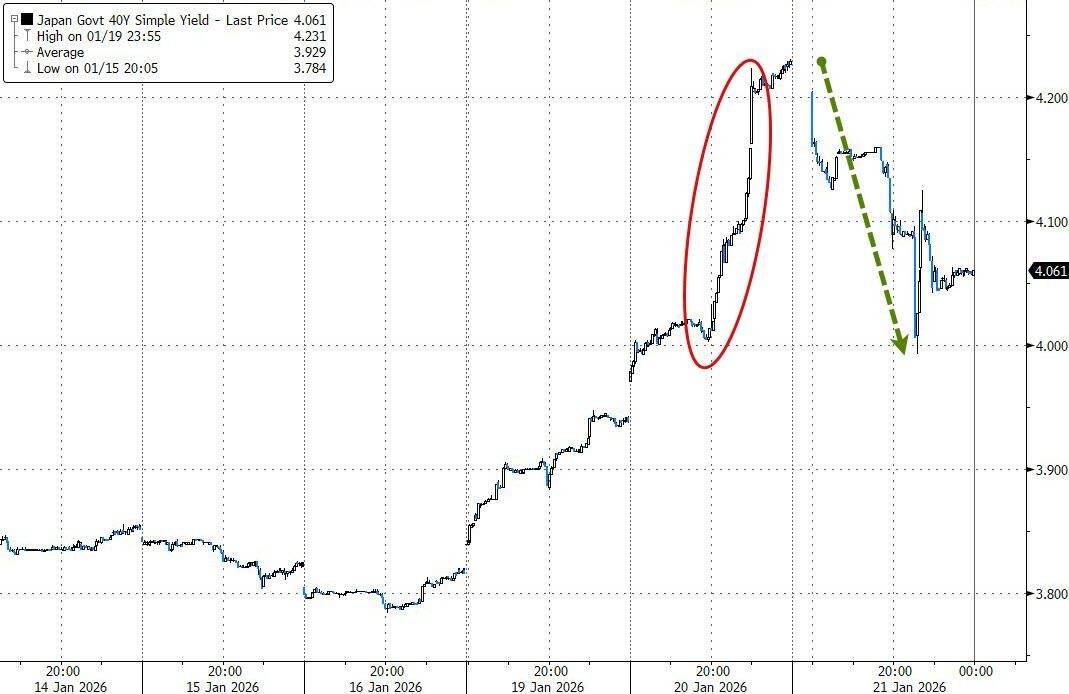

Japan's ultra-long-term government bonds rebounded for the second consecutive day on Thursday, with the 30-year bond yield falling by 10 basis points to 3.62%, and the 40-year yield dropping by 7.5 basis points to 3.980%. This followed a sharp sell-off in the market on Tuesday, where some maturities saw yields spike by more than 25 basis points in a single day.

However, according to a report by Bloomberg on Thursday, the proportion of government bonds held by the Bank of Japan has fallen below the critical level of 50% to an eight-year low. As the central bank continues to reduce its bond purchases, the market is losing its most important support, and structural selling pressure is far from dissipating.

Finance Minister Shunichi Suzuki urged the market to remain calm, with some fund managers viewing the recent spike in yields as a buying opportunity. However, there are concerns that the government and the central bank may need to take further measures to stabilize the surge in yields.

Investors are closely watching the Bank of Japan's policy decision and comments from Governor Kazuo Ueda on Friday, as well as next week's auction of 40-year government bonds.

Bank of Japan Holdings Fall Below Critical Level

The proportion of government bonds held by the Bank of Japan has dropped to its lowest level since 2018. According to Bloomberg macro strategist Simon White, the Bank of Japan's holdings now account for less than 50% of the total outstanding amount, marking the first time in eight years.

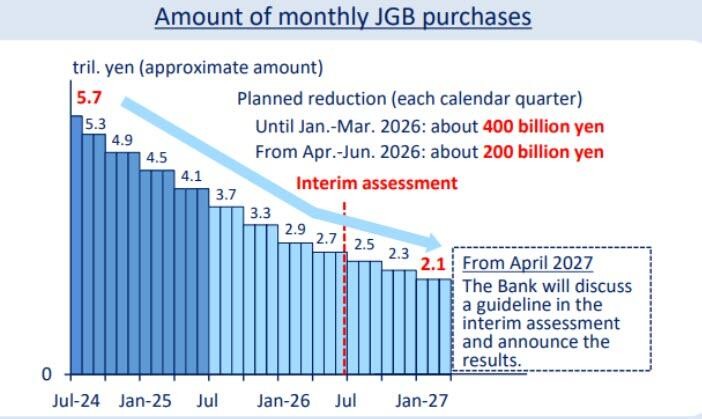

The Bank of Japan is continuing to reduce its bond purchases. By mid-2024, the central bank's monthly purchases of 5.7 trillion yen in government bonds have now decreased to 2.9 trillion yen, and it is expected to further decline to 2.1 trillion yen by early next year.

While this is a positive signal from a long-term financial stability perspective, the market is currently losing its most important support. In the context of the Bank of Japan's gradual exit, the government bond market will continue to face the risk of disorderly selling.

Multiple Selling Pressures Accumulate

In addition to the Bank of Japan's reduction in holdings, overseas investors are also cutting their exposure to Japanese bonds. Data shows that the proportion of Japanese bonds held by foreign investors relative to the total outstanding amount has been continuously declining. Although overseas buyers have never shown strong interest in Japanese bonds—they prefer the Japanese stock market—this shrinking share still poses additional resistance.

In the short term, life insurance companies may sell recently purchased bonds. Life insurance companies are typically net sellers, but more attractive yields had previously drawn them in. In December of last year, the amount of long-term government bonds purchased by life insurance companies reached a record high.

However, the price of 40-year government bonds has fallen by as much as 8% from the mid-December peak. Continued price pressure may force life insurance companies to cut losses and exit.

Market Volatility Expected to Continue

Kazuya Fujiwara, a fixed income strategist at Mitsubishi UFJ Morgan Stanley Securities, stated that the significant decline in ultra-long-term yields reflects a rebound after bonds were excessively sold earlier this week. "The volatility in the bond market remains high, leading to significant fluctuations in yields." Yamaki Yuichiro, the leader of Japan's Constitutional Democratic Party, suggested on Wednesday to consider repurchasing government debt and reducing the issuance of 40-year bonds as a possible further action.

Naoya Hasegawa, chief bond strategist at Okasan Securities, stated that discussions on consumption tax cuts have currently been digested. However, he warned that, given the uncertainties of election campaigns and parliamentary deliberations, "sustained buying demand is still difficult to emerge."

Analysts believe that the current relative calm of Japanese government bond yields may only be a temporary phenomenon. The Bank of Japan and the government face a daunting task of addressing a market that has been artificially supported for decades and is gradually losing that support